|

市场调查报告书

商品编码

1755291

汽车故障电路控制器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Fault Circuit Controller Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

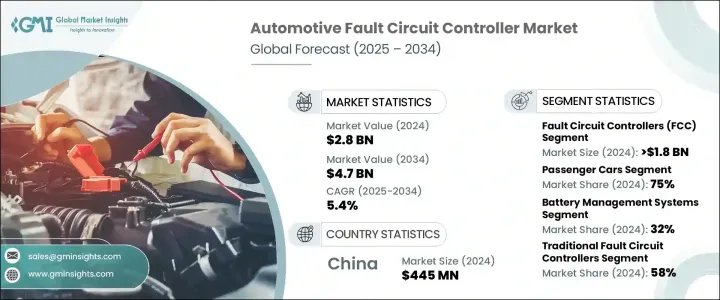

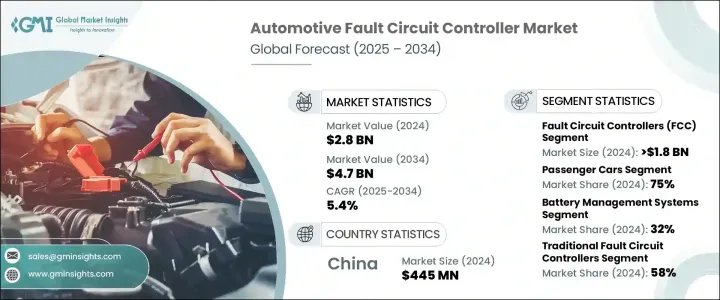

2024年,全球汽车故障电路控制器市场规模达28亿美元,预计2034年将以5.4%的复合年增长率成长,达到47亿美元。这一增长主要源于电动车(EV)和混合动力汽车的日益普及,这些汽车由于其复杂的电力电子设备和高压电池,需要更先进的电气安全系统。故障电路控制器对于这些车辆的安全运作至关重要,因为它们能够快速识别和隔离故障,保护关键零件免受损坏。

随着电动车的普及率持续上升,尤其是在排放法规和政府激励措施日益严格的情况下,对催化裂解装置(FCC)的需求也日益增长。这些设备有助于确保车辆安全,最大限度地减少停机时间,并维持电气系统的可靠性。随着车辆越来越依赖先进的电子设备来提升性能、导航和驾驶辅助,这一点至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 28亿美元 |

| 预测值 | 47亿美元 |

| 复合年增长率 | 5.4% |

连网自动驾驶汽车 (AV) 的兴起为汽车系统带来了新的复杂性。这些车辆高度依赖先进的感测器、通讯网路和人工智慧 (AI) 演算法来做出即时决策并导航。随着这些技术的发展,对高可靠性和高安全性电气系统的需求也日益增长。故障电路控制器 (FCC) 在确保这些复杂系统即使在电力中断的情况下也能保持运作方面发挥关键作用。在自动驾驶汽车中,即使是动力传动系统或通讯系统的轻微故障也可能导致灾难性的后果,因此这些保护装置对于维护车辆的安全和性能至关重要。

2024年,故障电路控制器 (FCC) 细分市场产值达18亿美元。 FCC在电动车动力系统中尤其关键,因为如果故障未能快速检测到,高压系统可能会导致严重故障。由于电动车的运行电压范围为400V至800V,FCC在早期隔离故障以防止潜在灾难方面发挥着至关重要的作用。它们能够侦测异常电流并断开故障电路,对于维护车辆安全至关重要。因此,随着电动车製造商越来越多地将这些安全装置整合到汽车中,这个细分市场也随之快速成长。

电池管理系统细分市场在2024年占据了32%的市场份额,预计到2034年将显着成长。这些系统中的电池监控单元在确保电动车的安全性和可靠性方面发挥关键作用。这些单元追踪电压、温度和电流等关键参数,从而能够及早发现故障电池或电路。与故障电路控制器搭配使用时,这些系统有助于防止电源故障和过热问题,从而延长电池寿命并提升车辆整体性能。电池断开装置可作为安全开关,进一步确保车辆电气系统在故障或维护期间的安全。

亚太地区汽车故障电路控制器市场占43%的市场份额,2024年市场规模达4.45亿美元。中国作为全球最大电动车市场的地位,是推动FCC需求的关键因素,因为本土製造商正在迅速扩大其电动车产品线。随着车辆安全监管要求日益严格,中国汽车製造商越来越多地采用先进的FCC,用于电池管理系统、电力电子设备和电力驱动单元的过流保护。中国致力于提高车辆安全性和可靠性,这使得FCC成为电动传动系统的重要组成部分,进一步加速了市场成长。

全球汽车故障电路控制器市场的主要参与者包括西门子、三菱电机、霍尼韦尔国际、英飞凌科技、ABB、松下公司、伊顿、博世汽车电子、通用电气 (GE) 和施耐德电气。为了巩固其在汽车故障电路控制器市场的地位,各公司正专注于开发尖端、可靠和高效的解决方案,以满足汽车行业不断发展的安全标准。他们正在大力投资研发,以创新故障保护技术,确保其产品针对高压电动车和连网汽车进行了最佳化。此外,这些公司正在扩大与汽车製造商的合作伙伴关係,以将 FCC 无缝整合到现代动力系统和电池管理系统中。提供满足不同车型和类型特定需求的客製化解决方案也已成为优先事项。公司透过扩大生产能力和增加在电动车采用率不断上升的新兴市场的份额来巩固其市场地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 汽车电气化和高压架构采用率激增

- 越来越重视乘客安全和法规遵循性

- 连网和自动驾驶汽车技术的扩展

- 高级驾驶辅助系统 (ADAS) 中故障检测系统的集成

- 产业陷阱与挑战

- 复杂性高,整合成本高

- 恶劣汽车环境中的可靠性问题

- 市场机会

- 电动车(EV)製造扩张

- 与先进驾驶辅助系统(ADAS) 集成

- 监理推动电气安全合规

- 新兴汽车市场的成长

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 故障电路控制器(FCC)

- 电路保护装置

- 感测器和监控单元

- 控制模组

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 越野车

- 掀背车

- 商用车

- LCV(轻型商用车)

- MCV(中型商用车)

- HCV(重型商用车)

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 引擎管理系统

- 电池管理系统

- 照明系统

- 资讯娱乐和连接系统

- 安全系统

- HVAC(暖气、通风、空调)

第八章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 传统故障电路控制器

- 智慧型故障电路控制器

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- OEM (原始设备製造商)

- 售后市场

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- ABB

- Alstom

- American Superconductor

- Autoliv

- Bosch Automotive Electronics

- Continental

- Denso

- Eaton

- General Electric (GE)

- Honeywell International

- Infineon Technologies

- Liaoning Rongxin Electric Power Electronic Co.

- Mitsubishi Electric

- Nexans

- Panasonic

- Schneider Electric

- Siemens

- Superconductor Technologies

- TE Connectivity

- Valeo

The Global Automotive Fault Circuit Controller Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 4.7 billion by 2034. This growth is largely driven by the increasing shift towards electric vehicles (EVs) and hybrid models, which require more sophisticated electrical safety systems due to their complex power electronics and high-voltage batteries. Fault circuit controllers are integral to the safe operation of these vehicles, as they identify and isolate faults quickly, protecting essential components from damage.

As the adoption of EVs continues to rise, especially with stricter emission regulations and government incentives, the demand for FCCs is growing. These devices help ensure vehicle safety, minimize downtime, and maintain the reliability of electrical systems, which is crucial as vehicles become increasingly dependent on advanced electronics for performance, navigation, and driver assistance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 5.4% |

The rise of connected and autonomous vehicles (AVs) introduces a new layer of complexity to automotive systems. These vehicles rely heavily on advanced sensors, communication networks, and artificial intelligence (AI) algorithms to make real-time decisions and navigate environments. As these technologies evolve, so does the demand for highly reliable and secure electrical systems. Fault circuit controllers (FCCs) play a pivotal role in ensuring that these intricate systems remain operational, even in the face of electrical disruptions. In autonomous vehicles, even a minor fault in the powertrain or communication system leads to catastrophic outcomes, making these protective devices critical for maintaining vehicle safety and performance.

In 2024, the fault circuit controller (FCC) segment generated USD 1.8 billion. FCCs are particularly critical in electric vehicle powertrains, where high-voltage systems can cause significant failures if faults are not detected quickly. With electric vehicles operating within voltage ranges of 400V to 800V, the role of FCCs in preventing potential disasters by isolating faults at the earliest stages cannot be overstated. Their ability to detect abnormal current flow and disconnect faulty circuits is essential for maintaining the safety of these vehicles. Consequently, this market segment has grown rapidly as EV manufacturers increasingly incorporate these safety devices into their automobiles.

The battery management systems segment captured a 32% share in 2024 and is expected to see notable expansion through 2034. Battery monitoring units within these systems play a pivotal role in ensuring the safety and reliability of electric vehicles. These units track key parameters like voltage, temperature, and current, allowing early identification of faulty cells or circuits. When paired with fault circuit controllers, these systems help prevent power failures and thermal issues, thus enhancing battery longevity and overall vehicle performance. Battery disconnects units, which act as safety switches, further contribute to ensuring the safety of the vehicle's electrical system during faults or maintenance.

Asia Pacific Automotive Fault Circuit Controller Market held a 43% share and generated USD 445 million in 2024. China's status as the largest EV market globally is a key factor in the demand for FCCs, as local manufacturers are rapidly expanding their electric vehicle offerings. As regulatory requirements for vehicle safety become stricter, Chinese automakers are increasingly adopting advanced FCCs for overcurrent protection in battery management systems, power electronics, and e-drive units. The country's push toward enhancing vehicle safety and reliability has made FCCs a vital component in electric drivetrains, further accelerating market growth.

Key players in the Global Automotive Fault Circuit Controller Market include Siemens, Mitsubishi Electric, Honeywell International, Infineon Technologies, ABB, Panasonic Corporation, Eaton, Bosch Automotive Electronics, General Electric (GE), and Schneider Electric. To strengthen their position in the automotive fault circuit controller market, companies are focusing on developing cutting-edge, reliable, and efficient solutions that meet the evolving safety standards of the automotive industry. They are investing heavily in research and development to innovate fault protection technologies, ensuring their products are optimized for high-voltage electric vehicles and connected cars. Additionally, these companies are expanding their partnerships with automotive manufacturers to integrate FCCs seamlessly into modern powertrains and battery management systems. Offering customized solutions that cater to the specific needs of different vehicle models and types has also become a priority. Companies enhance their market foothold by expanding their production capabilities and increasing their presence in emerging markets, where the adoption of electric vehicles rises.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Application

- 2.2.5 Technology

- 2.2.6 End use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in vehicle electrification and high-voltage architecture adoption

- 3.2.1.2 Growing emphasis on passenger safety and regulatory compliance

- 3.2.1.3 Expansion of connected and autonomous vehicle technologies

- 3.2.1.4 Integration of fault detection systems in advanced driver-assistance systems (ADAS)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High complexity and cost of integration

- 3.2.2.2 Reliability issues in harsh automotive environments

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in electric vehicle (EV) manufacturing

- 3.2.3.2 Integration with advanced driver assistance systems (ADAS)

- 3.2.3.3 Regulatory push for electrical safety compliance

- 3.2.3.4 Growth in emerging automotive markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD, Million, Units)

- 5.1 Key trends

- 5.2 Fault circuit controllers (FCC)

- 5.3 Circuit protection devices

- 5.4 Sensors & monitoring units

- 5.5 Control modules

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD, Million, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedan

- 6.2.2 SUV

- 6.2.3 Hatchback

- 6.3 Commercial vehicles

- 6.3.1 LCVs (light commercial vehicles)

- 6.3.2 MCVs (medium commercial vehicles)

- 6.3.3 HCVs (heavy commercial vehicles)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD, Million, Units)

- 7.1 Key trends

- 7.2 Engine management systems

- 7.3 Battery management systems

- 7.4 Lighting systems

- 7.5 Infotainment and connectivity systems

- 7.6 Safety systems

- 7.7 HVAC (heating, ventilation, air conditioning)

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD, Million, Units)

- 8.1 Key trends

- 8.2 Traditional fault circuit controllers

- 8.3 Smart/intelligent fault circuit controllers

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD, Million, Units)

- 9.1 Key trends

- 9.2 OEM (original equipment manufacturers)

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Alstom

- 11.3 American Superconductor

- 11.4 Autoliv

- 11.5 Bosch Automotive Electronics

- 11.6 Continental

- 11.7 Denso

- 11.8 Eaton

- 11.9 General Electric (GE)

- 11.10 Honeywell International

- 11.11 Infineon Technologies

- 11.12 Liaoning Rongxin Electric Power Electronic Co.

- 11.13 Mitsubishi Electric

- 11.14 Nexans

- 11.15 Panasonic

- 11.16 Schneider Electric

- 11.17 Siemens

- 11.18 Superconductor Technologies

- 11.19 TE Connectivity

- 11.20 Valeo