|

市场调查报告书

商品编码

1755295

血液透析血管移植市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Hemodialysis Vascular Grafts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

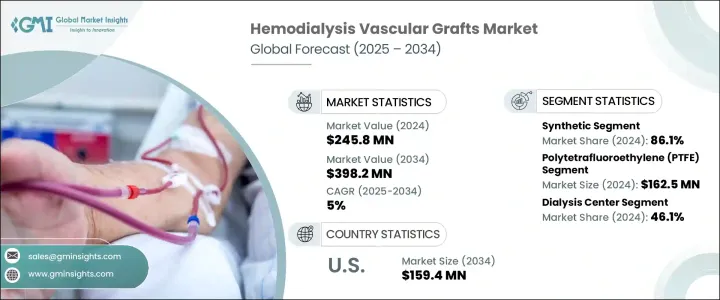

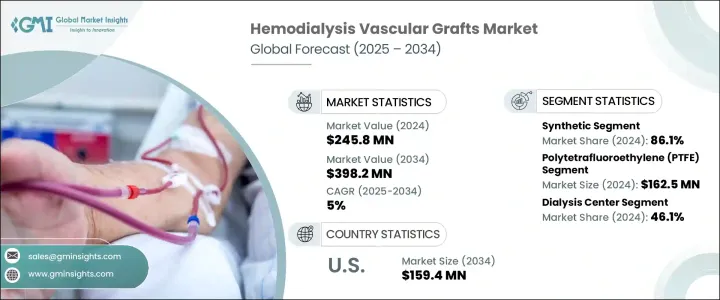

2024年全球血液透析血管移植物市场规模达2.458亿美元,预计2034年将以5%的复合年增长率成长至3.982亿美元。这些医疗器材在为接受血液透析的患者,尤其是不适合动静脉瘻管的末期肾病变 (ESRD) 患者提供血管通路方面发挥着至关重要的作用。由于糖尿病、高血压和人口老化,全球ESRD负担日益加重,导致血液透析治疗的需求不断增长。此外,移植物技术的创新,例如生物工程和混合材料的开发,正在提高这些移植物耐久性、柔韧性和生物相容性,从而减少併发症,延长移植物通畅时间,并在已开发市场和新兴市场得到更广泛的临床应用。

慢性肾病 (CKD) 和末期肾病 (ESRD) 的发生率上升与全球人口老化息息相关。老年患者通常血管通路有限,更依赖合成或生物血管移植物,这进一步推动了对基于移植物透析的需求。发展中国家透析中心的成长,以及医疗服务可近性的提高,正在提高血管移植物的应用率。政府的倡议和对肾臟护理的持续投入,也有助于使先进的移植技术更加经济实惠、更容易获得,从而支持全球肾臟医疗基础设施的成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.458亿美元 |

| 预测值 | 3.982亿美元 |

| 复合年增长率 | 5% |

2024年,合成移植物市场占据主导地位,占据86.1%的显着份额。合成血液透析移植物可立即使用,而动静脉瘻管则需要数週才能成熟。这种即时可用性使其成为急性或紧急透析情况下的必需品。此外,膨体聚四氟乙烯(ePTFE)和聚氨酯等合成材料提高了这些移植物的性能、柔韧性和耐用性。表面处理和肝素涂层降低了血栓形成和感染的风险,使合成移植物在长期透析治疗中更有效。随着紧急血液透析需求的不断增长,尤其是在医院和急诊环境中,合成移植物的应用也随之增加,因为它们成熟时间更短,通常比生物移植物更受欢迎。

透析中心细分市场在2024年的市占率为46.1%。全球慢性肾臟病和末期肾病病例的增加刺激了透析中心的快速发展。随着这些设施的扩建以容纳更多患者,对血液透析移植物等血管通路解决方案的需求也在增加。高容量透析中心需要提供患者可靠、有效的血管通路选择。合成血液透析移植物与动静脉瘻管相比,成熟时间较短,在这些情况下尤其有益,使其成为首选方案。因此,透析中心经常储备合成移植物,促进了该细分市场的成长。

2034年,美国血液透析血管移植市场规模将达到1.594亿美元。美国糖尿病和高血压的盛行率很高,而这两种疾病是导致慢性肾臟病和末期肾病的主要原因。这些疾病的发生率不断上升意味着更多患者需要长期透析,从而推动了对血管通路解决方案的需求。联邦医疗保险(Medicare)和其他联邦医疗保健计划为透析治疗和血管通路手术提供全面的覆盖,这使得患者更容易获得血液透析血管移植。这些报销政策激励医疗保健提供者采用先进的移植技术,进一步推动市场成长。

全球血液透析血管移植物产业的主要市场参与者包括 Artivion、Becton Dickinson and Company、BIOVIC、Cook Medical、CryoLife、Getinge、Laminate Medical Technologies、LeMaitre、Merit Medical Systems、ParaGen Technologies、Proteon Therapeutics、Terumo & Medical、Vascudyne、Vascular Geneore、Vascular Genesis 和 WL Gam & Medicalore、Vascudyne、Vascular Geneore、Vascular Geneore 和 WL Gam & Medicalore, Vascular。血液透析血管移植物市场的公司正在采用多种关键策略来提升其市场地位。这些策略包括大力投资研发,以提高移植物的性能、生物相容性和使用寿命。製造商也致力于透过引入先进材料和混合移植物来扩展其产品组合,以满足患者的多样化需求。与医疗保健提供者、医院和透析中心的合作正在帮助公司渗透新市场并提高产品的可及性。为了进一步巩固立足点,公司正在透过进入透析服务需求不断增长的新兴市场来扩大其地域覆盖范围。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 末期肾病(ESRD)盛行率上升

- 移植材料和技术的进步

- 老年人口不断增加

- 扩大医疗基础设施和透析中心

- 产业陷阱与挑战

- 血管移植手术和设备成本高昂

- 感染、血栓形成和移植失败等併发症的风险

- 成长动力

- 成长潜力分析

- 技术格局

- 未来市场趋势

- 监管格局

- 差距分析

- 专利分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 竞争市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 合成的

- 生物

第六章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 聚四氟乙烯(PTFE)

- 聚氨酯

- 聚酯纤维

- 生物

- 杂交种

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 透析中心

- 其他最终用途

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Artivion

- Becton Dickinson and Company

- BIOVIC

- Cook Medical

- CryoLife

- Getinge

- Laminate Medical Technologies

- LeMaitre

- Merit Medical Systems

- ParaGen Technologies

- Proteon Therapeutics

- Terumo Medical

- Vascudyne

- Vascular Genesis

- WL Gore & Associates

The Global Hemodialysis Vascular Grafts Market was valued at USD 245.8 million in 2024 and is estimated to grow at a CAGR of 5% to reach USD 398.2 million by 2034. These medical devices play a vital role in providing vascular access for patients undergoing hemodialysis, particularly those with end-stage renal disease (ESRD) who are not suitable candidates for arteriovenous fistulas. The increasing global burden of ESRD, driven by diabetes, hypertension, and aging populations, is contributing to a growing need for hemodialysis treatments. Moreover, innovations in graft technology, such as the development of bioengineered and hybrid materials, are enhancing the durability, flexibility, and biocompatibility of these grafts, which results in fewer complications, prolonged graft patency, and broader clinical adoption in both developed and emerging markets.

The rise in chronic kidney disease (CKD) and ESRD correlates with an aging global population. Elderly patients, who often have limited vascular access, rely more on synthetic or biological vascular grafts, further boosting the demand for graft-based dialysis access. The growth of dialysis centers in developing countries, along with enhanced healthcare service access, is increasing the utilization of vascular grafts. Government initiatives and rising investments in renal care also contribute to making advanced graft technologies more affordable and accessible, supporting global growth in renal healthcare infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $245.8 Million |

| Forecast Value | $398.2 Million |

| CAGR | 5% |

In 2024, the synthetic graft segment led the market with a significant share of 86.1%. Synthetic hemodialysis grafts offer immediate use, unlike arteriovenous fistulas, which require weeks for maturation. This immediate availability makes synthetic grafts essential for acute or emergency dialysis situations. Furthermore, synthetic materials such as expanded polytetrafluoroethylene (ePTFE) and polyurethane have improved the performance, flexibility, and durability of these grafts. Surface treatments and heparin-bonded coatings reduce the risk of thrombosis and infection, making synthetic grafts more effective for long-term dialysis therapies. The growing demand for emergency hemodialysis access, especially in hospitals and emergency settings, is increasing the adoption of synthetic grafts, which have shorter maturation times and are often preferred over their biological counterparts.

The dialysis centers segment held a 46.1% share in 2024. The rise in chronic kidney disease and end-stage renal disease cases worldwide has spurred the rapid growth of dialysis centers. As these facilities expand to accommodate more patients, the demand for vascular access solutions such as hemodialysis grafts increases. High-volume dialysis centers require reliable, effective vascular access options for their patients. Synthetic hemodialysis grafts, with their shorter maturation times compared to arteriovenous fistulas, are particularly beneficial in these settings, making them a preferred option. As a result, dialysis centers are frequently stocking synthetic grafts, contributing to the segment's growth.

U.S. Hemodialysis Vascular Grafts Market will reach USD 159.4 million by 2034. The U.S. faces a high prevalence of diabetes and hypertension, which are leading causes of chronic kidney disease and end-stage renal disease. The increasing incidence of these conditions means more patients require long-term dialysis, thereby driving demand for vascular access solutions. Medicare and other federal healthcare programs offer comprehensive coverage for dialysis treatments and vascular access procedures, which makes hemodialysis grafts more accessible to patients. These reimbursement policies incentivize healthcare providers to adopt advanced graft technologies, further fueling the market's growth.

Key market players in the Global Hemodialysis Vascular Grafts Industry include Artivion, Becton Dickinson and Company, BIOVIC, Cook Medical, CryoLife, Getinge, Laminate Medical Technologies, LeMaitre, Merit Medical Systems, ParaGen Technologies, Proteon Therapeutics, Terumo Medical, Vascudyne, Vascular Genesis, and W.L. Gore & Associates. Companies in the hemodialysis vascular grafts market are employing several key strategies to enhance their market position. These strategies include significant investments in research and development to improve graft performance, biocompatibility, and longevity. Manufacturers are also focusing on expanding their product portfolios by introducing advanced materials and hybrid grafts to meet the diverse needs of patients. Collaborations with healthcare providers, hospitals, and dialysis centers are helping companies penetrate new markets and improve product accessibility. To further strengthen their foothold, companies are increasing their geographic reach by entering emerging markets with growing demand for dialysis services.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of end-stage renal disease (ESRD)

- 3.2.1.2 Advancements in graft materials and technology

- 3.2.1.3 Growing geriatric population

- 3.2.1.4 Expanding healthcare infrastructure and dialysis centers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of vascular graft procedures and devices

- 3.2.2.2 Risk of complications such as infections, thrombosis, and graft failure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.7 Gap analysis

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Synthetic

- 5.3 Biological

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Polytetrafluoroethylene (PTFE)

- 6.3 Polyurethane

- 6.4 Polyester

- 6.5 Biological

- 6.6 Hybrid

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Dialysis centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Artivion

- 9.2 Becton Dickinson and Company

- 9.3 BIOVIC

- 9.4 Cook Medical

- 9.5 CryoLife

- 9.6 Getinge

- 9.7 Laminate Medical Technologies

- 9.8 LeMaitre

- 9.9 Merit Medical Systems

- 9.10 ParaGen Technologies

- 9.11 Proteon Therapeutics

- 9.12 Terumo Medical

- 9.13 Vascudyne

- 9.14 Vascular Genesis

- 9.15 W L Gore & Associates