|

市场调查报告书

商品编码

1755329

金融云市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Finance Cloud Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

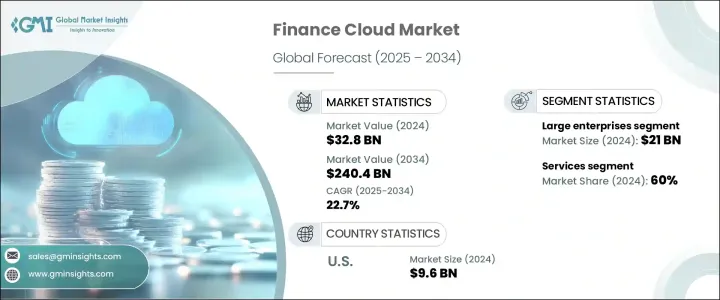

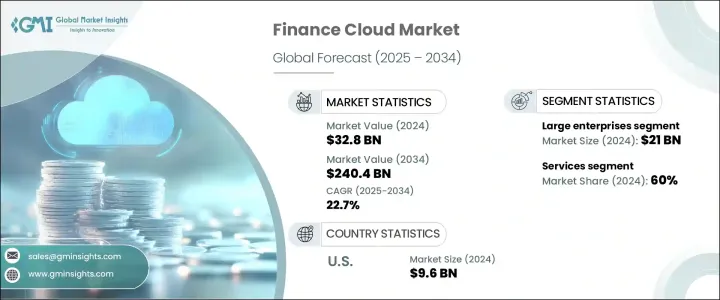

2024年,全球金融云市场规模达328亿美元,预计2034年将以22.7%的复合年增长率成长,达到2,404亿美元。银行、保险、投资管理和其他金融领域对数位转型的需求日益增长,推动了这一成长。企业纷纷转向基于云端的金融解决方案,以提高营运效率、确保合规性并提升客户体验。自动化、人工智慧 (AI) 和高级分析技术的集成,透过实现即时决策和主动风险管理,彻底改变了财务工作流程。

财务云端平台为优化财务营运奠定了基础,包括自动化会计、即时财务报告以及与企业资源规划 (ERP) 和客户关係管理 (CRM) 系统的顺畅连接。加密、多因素身份验证和基于区块链的交易验证等增强的安全协议可保护敏感的财务讯息,并有助于满足严格的监管要求。用于现金流预测的预测分析、用于交易处理的机器人流程自动化 (RPA) 以及用于互动式仪表板的扩增实境 (AR) 等创新技术正在加速市场应用。这些技术进步使企业能够在竞争激烈的环境中提供差异化的金融产品,提高准确性并增强业务敏捷性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 328亿美元 |

| 预测值 | 2404亿美元 |

| 复合年增长率 | 22.7% |

2024年,大型企业市场规模达210亿美元。这些企业凭藉着雄厚的IT预算和部署可扩展、全面云端基础架构的能力,占据领先地位。这些企业使用财务云端系统来简化全球财务流程,确保合规性,并整合不同业务部门的服务。集中式云端平台能够统一执行策略,并在部门之间有效协调,从而实现跨区域的标准化流程和强大的安全性。

2024年,服务业占据了60%的市场份额,这得益于咨询、实施、支援和託管服务需求的不断增长。随着金融机构向云端原生系统迁移,它们严重依赖专业服务提供者来确保平稳过渡、整合并遵守监管标准。这些服务透过帮助机构客製化平台、管理工作负载、维护正常运作时间并保障安全,从而优化云端效能。持续的支援和託管服务使组织能够专注于核心功能,而将基础设施管理交由外部处理。金融法规的复杂性、网路安全风险以及持续的数位转型,提升了专业云端服务对大型企业和中小企业的策略重要性。

2024年,美国金融云市场规模达96亿美元,预计2034年将以24%的复合年增长率成长。美国强大的IT基础设施、大型金融机构的布局以及对云端技术的早期采用推动了这一成长。强大的监管环境和充满活力的金融科技生态系统加速了银行、保险和投资领域对云端技术的采用。美国的金融公司利用云端平台对遗留系统进行现代化改造,加强网路安全,并提供无缝的数位体验。与Google、微软和亚马逊等领先云端服务供应商的合作也为此转型提供了支持。

全球金融云端产业的主要参与者包括 Salesforce、IBM、戴尔、甲骨文、凯捷、Acumatica、印孚瑟斯、亚马逊、微软和谷歌。为了巩固市场地位,金融云领域的公司专注于持续创新并扩展其技术产品。他们投资开发人工智慧和自动化驱动的解决方案,以提高效率和合规性。与金融机构和云端服务供应商建立策略联盟和合作伙伴关係有助于加速采用并扩大其覆盖范围。公司优先考虑增强安全功能和监管合规能力,以满足行业标准。此外,许多公司正在透过在地化服务和资料中心扩展其全球业务,以符合区域法规并降低延迟。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 配销通路分析

- 最终用途

- 利润率分析

- 供应商格局

- 技术与创新格局

- 专利分析

- 监管格局

- 成本細項分析

- 重要新闻和倡议

- 衝击力

- 成长动力

- 管理客户资料和财务

- 对诈欺检测和预防的需求增加

- 增强商业智慧和策略规划的需求日益增长

- 增强财务规划与分析

- 产业陷阱与挑战

- 资料隐私和安全问题

- 与现有遗留系统的整合可能很复杂

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 服务

- 解决方案

第六章:市场估计与预测:依企业规模,2021 - 2034 年

- 主要趋势

- 大型企业

- 中小企业

第七章:市场估计与预测:依部署模型,2021 - 2034 年

- 主要趋势

- 民众

- 杂交种

- 私人的

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 银行业

- 保险

- 投资管理

- 其他的

第九章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 客户关係管理

- 财富管理

- 资产管理

- 帐号管理

- 收益管理

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Acumatica

- Amazon

- Aryaka

- Capgemini

- Cisco

- Dell

- Google LLC

- Hewlett Packard

- IBM

- Infosys

- Microsoft

- Oracle

- Rapidscale

- Sage

- Salesforce

- ServiceNow

- Tata Consultancy

- Unit4

- Wipro

- Workday

- Yardi

The Global Finance Cloud Market was valued at USD 32.8 billion in 2024 and is estimated to grow at a CAGR of 22.7% to reach USD 240.4 billion by 2034. The growth is driven by the rising demand for digital transformation within banking, insurance, investment management, and other financial sectors. Companies shift to cloud-based finance solutions to boost operational efficiency, maintain compliance with regulations, and enhance customer experience. Integrating automation, artificial intelligence (AI), and advanced analytics transform financial workflows by enabling real-time decision-making and proactive risk management.

Finance cloud platforms provide a foundation for optimized financial operations, including automated accounting, real-time financial reporting, and smooth connectivity with enterprise resource planning (ERP) and customer relationship management (CRM) systems. Enhanced security protocols such as encryption, multi-factor authentication, and blockchain-enabled transaction verification protect sensitive financial information and help meet stringent regulatory requirements. Innovations like predictive analytics for cash flow forecasting, robotic process automation (RPA) for transaction handling, and augmented reality (AR) for interactive dashboards accelerate market adoption. These technological advancements allow organizations to differentiate their financial offerings, improve accuracy, and increase business agility in a highly competitive environment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $32.8 Billion |

| Forecast Value | $240.4 Billion |

| CAGR | 22.7% |

The large enterprises segment was valued at USD 21 billion in 2024. Their leadership stems from substantial IT budgets and the ability to deploy scalable, comprehensive cloud infrastructures. These organizations use finance cloud systems to streamline global financial processes, ensure regulatory compliance, and integrate services across diverse business units. Centralized cloud platforms enable consistent enforcement of policies and efficient coordination between departments, delivering standardized processes and robust security across regions.

The services segment held a 60% share in 2024, driven by the increasing need for consulting, implementation, support, and managed services. As financial institutions migrate to cloud-native systems, they depend heavily on specialized service providers to ensure smooth transitions, integration, and adherence to regulatory standards. These services optimize cloud performance by helping institutions customize platforms, manage workloads, and maintain uptime while upholding security. Continuous support and managed services free organizations to focus on core functions while infrastructure management is handled externally. The complexity of financial regulations, cybersecurity risks, and ongoing digital transformation has elevated the strategic importance of specialized cloud services for large corporations and SMEs.

U.S. Finance Cloud Market was valued at USD 9.6 billion in 2024 and is expected to grow at a CAGR of 24% through 2034. The country's robust IT infrastructure, presence of major financial institutions, and early adoption of cloud technologies fuel this growth. A strong regulatory environment along with a dynamic fintech ecosystem accelerates cloud adoption across banking, insurance, and investment sectors. Financial firms in the U.S. leverage cloud platforms to modernize legacy systems, strengthen cybersecurity, and deliver seamless digital experiences. Partnerships with leading cloud service providers like Google LLC, Microsoft, and Amazon support this transition.

Key players in the Global Finance Cloud Industry include Salesforce, IBM, Dell, Oracle, Capgemini, Acumatica, Infosys, Amazon, Microsoft, and Google LLC. To strengthen their market presence, companies in the finance cloud sector focus on continuous innovation and expanding their technology offerings. They invest in developing AI-driven and automation-powered solutions to enhance efficiency and compliance. Strategic alliances and partnerships with financial institutions and cloud providers help accelerate adoption and broaden their reach. Firms prioritize enhancing security features and regulatory compliance capabilities to meet industry standards. Additionally, many are scaling their global footprint through localized services and data centers to cater to regional regulations and reduce latency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Cost breakdown analysis

- 3.6 Key news & initiatives

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Managing customer data and financials

- 3.7.1.2 Increased demand for fraud detection and prevention

- 3.7.1.3 Rising need to enhance business intelligence and strategic planning

- 3.7.1.4 Enhanced financial planning and analysis

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Data privacy and security concerns

- 3.7.2.2 Integration with the existing legacy systems can be complex

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Services

- 5.3 Solution

Chapter 6 Market Estimates & Forecast, By Enterprise size, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Large enterprises

- 6.3 SME

Chapter 7 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Public

- 7.3 Hybrid

- 7.4 Private

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Banking

- 8.3 Insurance

- 8.4 Investment management

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Customer relationship management

- 9.3 Wealth management

- 9.4 Asset management

- 9.5 Account management

- 9.6 Revenue management

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 France

- 10.3.3 UK

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Acumatica

- 11.2 Amazon

- 11.3 Aryaka

- 11.4 Capgemini

- 11.5 Cisco

- 11.6 Dell

- 11.7 Google LLC

- 11.8 Hewlett Packard

- 11.9 IBM

- 11.10 Infosys

- 11.11 Microsoft

- 11.12 Oracle

- 11.13 Rapidscale

- 11.14 Sage

- 11.15 Salesforce

- 11.16 ServiceNow

- 11.17 Tata Consultancy

- 11.18 Unit4

- 11.19 Wipro

- 11.20 Workday

- 11.21 Yardi