|

市场调查报告书

商品编码

1849809

金融云:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Finance Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

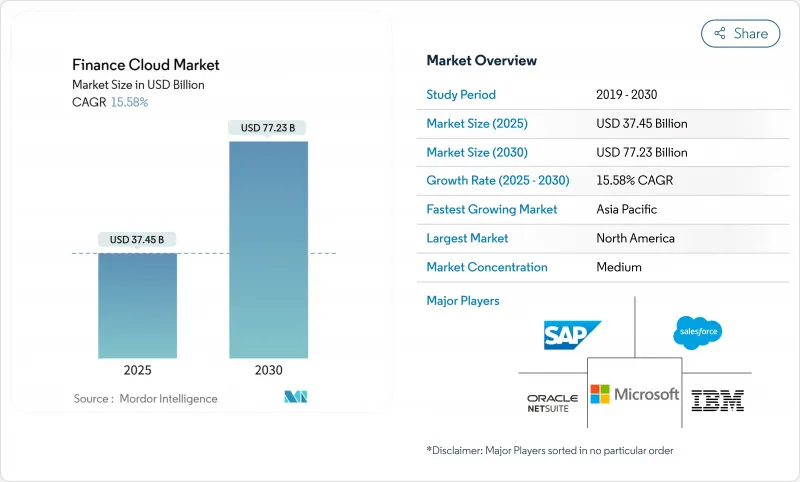

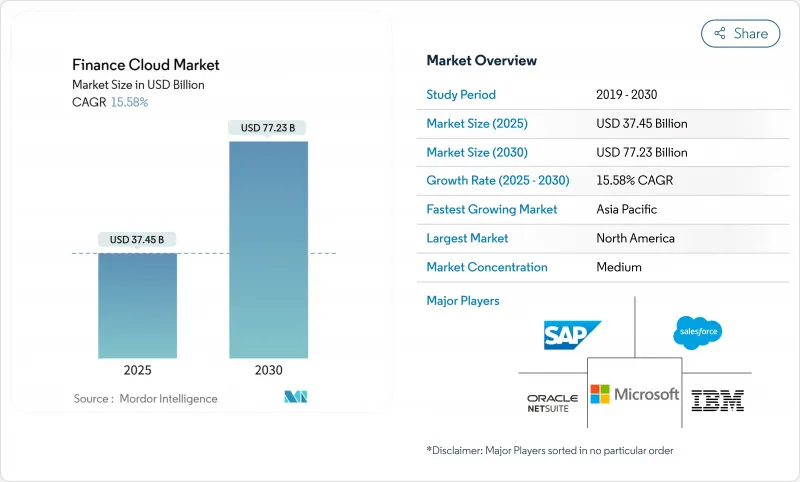

预计2025年金融云市场规模将达374.5亿美元,2030年将达772.3亿美元,复合年增长率为15.6%。

消费者对数位优先世界的期望不断提高、法律规范加大以及云端安全框架日趋成熟,推动公共云端云和混合云端。仅欧盟的数位和营运弹性法案 (DORA) 就要求约 22,000 家金融机构及其技术合作伙伴升级 ICT 风险管理,从而加速整个全部区域的平台现代化。同时,98% 的全球金融机构已经使用至少一种云端服务,高于 2020 年的 91%,证实了金融云市场已经达到临界规模。现在,在云端基础架构上部署生成性人工智慧支撑着从自动对帐到预测现金流建模的一切,使云端供应商成为策略合作伙伴以获得竞争优势。北美银行正在投资数十亿美元的技术预算来迁移数千个应用程序,而亚太金融机构正在扩展其云端原生核心以服务其庞大的数位客户群。

全球金融云市场趋势与洞察

需要改进客户关係管理

云端基础的CRM 套件使金融机构能够即时洞察行为模式,从而提供高度个人化的服务,并在竞争激烈的市场中提高客户留存率。亚太地区的银行正在运行能够支援数千万并发会话的云端平台,例如 AIBank 的微服务核心,它服务超过 1 亿客户。同时,北美金融机构正在整合云端分析和忠诚度引擎,以减少客户流失,而客户流失问题仍影响着超过 60% 的传统金融机构。由于金融数据受到严格监管,供应商正在透过平台内加密、审核追踪和资料居住管理来脱颖而出,这些技术既能实现跨通路编配,又能满足监管机构的要求。随着客户生命週期价值成为关键的 KPI,随着银行寻求以弹性、支援人工智慧的替代方案取代老旧的 CRM 工具,金融云市场正在获得进一步的发展动能。

金融领域对营运效率的需求

将财务工作负载迁移到消费云可将资本支出转化为可变营运成本,从而释放资金用于产品创新。已完全迁移到云端的金融机构报告称,其月末结帐週期缩短了 20-30%,监管报告速度也有类似的提升。云端 ERP 内建的自动化功能消除了手动会计分录的需要,而无伺服器运算则使它们能够处理不可预测的支付量激增,而不会降低效能。例如,Discover Financial Services 依靠混合资产在季节性支出高峰期间灵活调配资源。随着利润率收紧,成本收入比现在与收益一起出现在董事会仪表板上,这强化了持续推动金融云市场发展的效率概念。

云端基础的网路威胁的兴起

金融服务仍然是高阶攻击的首要目标,而云端环境的威胁面正在不断扩大。美国监管机构报告称,勒索软体攻击不断升级,破坏了关键的支付基础设施,迫使银行加倍投资于零信任架构和增强型检测平台。如果金融机构迁移敏感资料时没有进行相应的安全改进,则可能面临超过其年度IT预算的监管罚款。云端供应商正在製定机密运算、硬体加密和主权云端的蓝图来应对这项挑战,但实施这些控制措施的成本和复杂性将限制金融云端市场近期的成长。

細項分析

2024年,财务预测与规划部门的收益将达到38.3%,反映出在持续的经济波动中,情境建模的普遍需求。云端基础的EPM套件使财务团队能够跨数千个成本中心创建滚动预测,从而增强数据主导的决策能力。整合的基于驱动因素的模型可在利率或外汇衝击后即时更新利润预测,进一步凸显了转型的紧迫性。同时,在DORA和类似法规的推动下,风险、合规和监管科技是成长最快的解决方案领域,到2030年,其复合年增长率将达到15.9%。供应商正在整合支援API的监管库,使金融机构只需点击即可向监管机构报告详细的交易资料。持续的管理监控功能减轻了审核准备的负担,直接影响合规预算,并推动了金融云端市场的需求。

核心会计和总分类帐平台仍然至关重要,它们是所有其他云端财务模组的记录系统基石。资金筹措。例如,花旗集团扩展了其云端财务工作区,以提供全球现金部位的逐分钟总结。 Workday 的最新版本捆绑了劳动力规划和支出分析,清楚地展示了整合套件如何改善企业协调。随着供应商将这些功能打包到统一的资料架构下,它将扩大提升销售管道,并推动财务云端市场永续的收益源。

受超大规模云端运算供应商的全球企业发展、先进的安全认证和持续创新蓝图的推动,公有云将占2024年总收入的57.6%。银行通常采用託管的PaaS资料库来加速新产品的推出,而无需配置硬体。然而,对单一供应商的依赖引发了对弹性的担忧,推动混合云和多重云端的采用,复合年增长率达到17.0%。欧洲金融机构意识到监管机构提到的集中风险,越来越多地将工作负载分散到至少两家供应商,同时将超低延迟交易引擎保留在私有云端中。 Form3的支付平台就体现了这个策略,它抽象化了路由逻辑,使银行能够在发生故障时在云端之间切换端点。

对于对效能和资料完整性要求极高的用例来说,私有云端仍然至关重要。摩根大通斥资20亿美元新建四个私有云端资料中心,以支援对延迟敏感的风险运算。统一的可观察性堆迭和策略即程式码减少了混合设施之间的运作摩擦,使混合云真正无缝衔接。随着监管机构对「退出计画」的明确规定,金融机构更倾向于容器化工作负载和开放API,以避免锁定。

区域分析

2024年,北美将占到全球金融云收入的41.0%,这得益于强劲的技术预算和清晰的监管环境,这些因素加速了金融云的迁移。光是在美国,摩根大通每年就投入170亿美元用于技术开发,并将6,000个应用程式迁移到云端平台。加拿大的开放银行指南鼓励建立安全的API生态系统,墨西哥银行也正在采用云端技术以满足跨国报告标准。在网路安全和数位身分框架方面的公私合作进一步降低了采用风险,并增强了该地区的金融云端市场。供应商正在提高资料中心密度,以满足高频交易者低于10毫秒的延迟需求。

亚太地区是成长最快的地区,到2030年的复合年增长率将达到16.2%。政府驱动的数位经济蓝图将云端运算置于金融包容性计画的核心位置,以支持该地区的数位经济价值,预计2030年将达到1兆美元。中国的AIBank透过容器化平台为超过1亿客户提供服务,展现了云端运算的可扩展性。印度的公共云端政策允许监管和政策制定者在严格的加密金钥下将核心资料託管在海外,从而刺激了超大规模企业的采用。日本和澳洲已经核准了行业云模型,这些模型可为当地监管机构提供预先认证的合规交付成果。亚太地区的银行预计,到2030年,数位相关服务将贡献其40%的利润。再加上不断增长的收费收益目标,这些趋势确保了金融云市场的持续成长。

在欧洲,根据 DORA 营运恢復指令,云端现代化正在加速,影响到约 22,000 家金融机构。德国、法国和英国正在推出网路事件模拟的共用测试框架,并鼓励采用可自动收集证据的平台。由领先供应商营运的主权云端区域符合资料主权规定,多供应商策略可降低系统性风险。南美洲正在呈现强劲成长,巴西的无分行挑战者分店(例如 Nubank)累计,在完全依靠云端基础设施营运的情况下,2024 年的利润将达到 20 亿美元。中东和非洲的云端采用正在加速,该地区 83% 的金融机构使用云端工作负载,预计两年内每年可节省 2,114 万美元的成本。海湾合作委员会的银行正在将国家云端授权与雄心勃勃的数位转型蓝图相结合,巩固金融云端市场的新需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 需要改进客户关係管理

- 金融领域对营运效率的需求

- 监管推动即时透明度和报告

- 支持 GenAI 的自助财务分析

- 采用 FinOps 优化云端支出

- 面向 BFSI 产业的产业云平台

- 市场限制

- 云端基础的网路威胁的兴起

- 遗留核心整合的复杂性

- 云端金融营运与数据工程人才缺口

- 供应商锁定和 GenAI 成本超支

- 价值链分析

- 监管格局

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估宏观经济趋势对市场的影响

第五章市场规模及成长预测

- 按解决方案

- 核心会计和总帐

- 财务预测与规划

- 风险、合规和监管科技

- 财务和现金管理

- 薪资核算和劳动力财务

- 按部署模型

- 公共云端

- 私有云端

- 混合/多重云端

- 按最终用户

- 银行业

- 保险

- 资本市场

- 金融科技/新银行

- 按公司规模

- 大公司

- 小型企业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Oracle Corporation(Netsuite)

- SAP

- Microsoft

- Salesforce

- IBM

- Workday

- Sage Intacct

- Unit4/FinancialForce

- Intuit

- Anaplan

- Workiva

- BlackLine

- Coupa

- Xero

- FIS

- Fiserv

- Temenos

- Finastra

- Acumatica

- AWS

- Google Cloud

- Huawei

第七章 市场机会与未来展望

The finance cloud market size is valued at USD 37.45 billion in 2025 and is set to reach USD 77.23 billion by 2030, advancing at a 15.6% CAGR.

Rising digital-first consumer expectations, tighter regulatory oversight, and the maturation of cloud security frameworks are driving widespread migration of core finance workloads to public and hybrid clouds. The European Union's Digital Operational Resilience Act (DORA) alone mandates upgraded ICT risk controls for about 22,000 financial entities and their technology partners, accelerating platform modernization across the region. At the same time, 98% of financial institutions globally already use at least one cloud service, up from 91% in 2020, confirming that the finance cloud market has reached critical mass. Generative AI roll-outs on cloud infrastructure now underpin everything from automated reconciliation to predictive cash-flow modelling, turning cloud providers into strategic partners for competitive differentiation. North American banks fund multibillion-dollar tech budgets to migrate thousands of applications, while Asia-Pacific institutions scale cloud-native cores to serve massive digital customer bases-all of which keeps the finance cloud market on a steep growth trajectory.

Global Finance Cloud Market Trends and Insights

Need for Improved Customer Relationship Management

Cloud-based CRM suites give financial institutions real-time insight into behavioural patterns, enabling hyper-personalised offers that improve retention in crowded markets. Asia-Pacific banks run cloud platforms capable of supporting tens of millions of concurrent sessions, as illustrated by AIBank's micro-services core that serves more than 100 million customers. In parallel, North American lenders integrate cloud analytics with loyalty engines to cut churn that still affects over 60% of legacy institutions. Because finance data is highly regulated, vendors differentiate through in-platform encryption, audit trails, and data-residency controls that satisfy regulators while still allowing cross-channel orchestration. As customer lifetime value becomes a pivotal KPI, the finance cloud market gains further momentum from banks' willingness to replace ageing CRM tools with elastic, AI-ready alternatives.

Demand for Operational Efficiency in Financial Sector

Moving finance workloads to consumption-based clouds converts capital expenditure into variable operating cost, releasing cash for product innovation. Institutions that completed full cloud migrations report 20-30% reductions in month-end close cycles and similar gains in regulatory reporting speed. Automation natively embedded in cloud ERPs eliminates manual journals, while serverless compute handles unpredictable spikes in payment volumes without performance degradation. Discover Financial Services, for example, relies on a hybrid estate to flex resources during seasonal spending peaks. As margins tighten, cost-to-income ratios now appear on board dashboards alongside revenue, reinforcing the efficiency narrative that will continue to propel the finance cloud market.

Rise of Cloud-based Cyber Threats

Financial services remain the top target for sophisticated attacks, and cloud environments enlarge the threat surface. US regulators report escalating ransom incidents that disrupt critical payment infrastructures, prompting banks to double investments in zero-trust architectures and extended detection platforms. Migrating sensitive data without commensurate security uplift exposes institutions to regulatory fines that can exceed annual IT budgets. Cloud providers answer with confidential computing, hardware-rooted encryption, and sovereign-cloud blueprints, yet implementing these controls adds cost and complexity, muting short-term acceleration in the finance cloud market.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for Real-Time Transparency and Reporting

- GenAI-enabled Self-service Finance Analytics

- Legacy-core Integration Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Financial Forecasting and Planning segment retained 38.3% revenue in 2024, reflecting the universal need for scenario modelling when economic volatility remains high. Cloud-based EPM suites let finance teams generate rolling forecasts across thousands of cost centres, elevating data-driven decision-making. Integrated driver-based models update profit outlooks instantly after rate or FX shocks, reinforcing migration urgency. Concurrently, Risk, Compliance, and RegTech is the fastest-growing solution line, advancing at 15.9% CAGR through 2030 on the back of DORA and comparable regimes. Vendors embed API-ready regulatory libraries so institutions can push granular transaction data to supervisors with one-click reporting. Continuous control monitoring features lower audit-prep workloads, translating compliance budgets directly into demand for the finance cloud market.

Core Accounting and General Ledger platforms remain indispensable, acting as system-of-record anchors for all other cloud finance modules. Treasury and Cash-Management tools gain new momentum as volatile funding markets prioritise real-time liquidity insight. Citigroup, for instance, expanded its cloud treasury workspace to aggregate global cash positions minute-by-minute. Payroll and Workforce Finance applications benefit from tight finance-HR convergence; Workday's latest release bundles headcount planning with spend analytics, underscoring how integrated suites improve enterprise alignment. As vendors package these capabilities under unified data fabrics, upsell pipelines expand, driving sustainable revenue streams within the finance cloud market.

Public clouds controlled 57.6% of 2024 revenue due to hyperscalers' global footprints, advanced security certifications, and continuous innovation roadmaps. Banks routinely adopt managed PaaS databases to accelerate new product rollouts without provisioning hardware. Yet dependence on a single provider raises resilience concerns, propelling Hybrid and Multi-Cloud uptake at 17.0% CAGR. European lenders, mindful of concentration risk outlined by regulators, increasingly split workloads across at least two vendors, while retaining ultra-low-latency trading engines on private clouds. Form3's payment platform exemplifies this strategy, abstracting routing logic so banks can toggle endpoints among clouds during outages.

Private clouds remain vital for use cases with stringent performance or data-sovereignty requirements. JPMorgan Chase is spending USD 2 billion on four new private cloud data centres that anchor latency-sensitive risk computations. Unified observability stacks and policy-as-code reduce operational friction across mixed estates, making hybrid truly seamless. Because regulatory discourse now explicitly references "exit plans," institutions favour containerised workloads and open APIs to avoid lock-in, a development that further broadens addressable opportunity for the finance cloud market.

The Finance Cloud Market Report is Segmented by Solution (Core Accounting and GL, Financial Forecasting and Planning, and More), Deployment Model (Public Cloud, Private Cloud, and Hybrid / Multi-Cloud), End-User (Banking, Insurance, Capital Markets, and More), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 41.0% of 2024 revenue thanks to deep technology budgets and regulatory clarity that fosters accelerated migration. The United States anchors the region, with JPMorgan Chase alone allocating USD 17 billion annually to tech and moving 6,000 applications to cloud platforms. Canada follows with open-banking guidelines that encourage secure API ecosystems, while Mexican banks adopt cloud to meet cross-border reporting standards. Public-private collaboration on cybersecurity and digital-identity frameworks further de-risks adoption, strengthening the finance cloud market in the region. Providers leverage dense data-centre footprints to meet sub-10-millisecond latency thresholds demanded by high-frequency traders.

Asia-Pacific is the fastest-growing territory at 16.2% CAGR through 2030. Government-backed digital-economy blueprints place cloud at the centre of financial-inclusion agendas, underpinning a regional digital-economy value expected to reach USD 1 trillion by 2030. China's AIBank demonstrates cloud scalability by serving over 100 million customers on a containerised platform. India's public-cloud policy now allows regulated entities to host core data offshore under strict encryption keys, unlocking broader hyperscaler adoption. Japan and Australia endorse Industry-Cloud models that deliver pre-certified compliance artefacts for local supervisory bodies. Coupled with rising fee-based revenue targets-APAC banks expect digital adjacencies to supply 40% of profit pools by 2030-these trends ensure sustained upside for the finance cloud market.

Europe accelerates cloud modernisation under DORA's operational-resilience mandate, affecting roughly 22,000 financial organisations. Germany, France, and the United Kingdom roll out shared testing frameworks for cyber-incident simulations, incentivising the adoption of platforms that automate evidence collection. Sovereign-cloud regions operated by large providers satisfy data-sovereignty clauses, while multi-vendor strategies mitigate systemic risk. South America charts high growth, powered by Brazil's branchless challenger banks such as Nubank, which posted USD 2 billion profit in 2024 while operating entirely on cloud infrastructure. Middle East and Africa adoption climbs swiftly; 83% of MENA financial firms now run cloud workloads and expect USD 21.14 million in annual savings within two years. Gulf Cooperation Council banks align national cloud mandates with ambitious digital transformation roadmaps, solidifying new demand pockets for the finance cloud market.

- Oracle Corporation(Netsuite)

- SAP

- Microsoft

- Salesforce

- IBM

- Workday

- Sage Intacct

- Unit4 / FinancialForce

- Intuit

- Anaplan

- Workiva

- BlackLine

- Coupa

- Xero

- FIS

- Fiserv

- Temenos

- Finastra

- Acumatica

- AWS

- Google Cloud

- Huawei

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Need for improved customer relationship management

- 4.2.2 Demand for operational efficiency in financial sector

- 4.2.3 Regulatory push for real-time transparency and reporting

- 4.2.4 GenAI-enabled self-service finance analytics

- 4.2.5 FinOps adoption to optimise cloud spending

- 4.2.6 Industry-cloud platforms for BFSI verticals

- 4.3 Market Restraints

- 4.3.1 Rise of cloud-based cyber threats

- 4.3.2 Legacy-core integration complexity

- 4.3.3 Talent gap in cloud-FinOps and data engineering

- 4.3.4 Vendor lock-in and GenAI cost overruns

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution

- 5.1.1 Core Accounting and GL

- 5.1.2 Financial Forecasting and Planning

- 5.1.3 Risk, Compliance and Reg-Tech

- 5.1.4 Treasury and Cash-Management

- 5.1.5 Payroll and Workforce Finance

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid / Multi-Cloud

- 5.3 By End-User

- 5.3.1 Banking

- 5.3.2 Insurance

- 5.3.3 Capital Markets

- 5.3.4 FinTech / Neo-banks

- 5.4 By Organisation Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Oracle Corporation(Netsuite)

- 6.4.2 SAP

- 6.4.3 Microsoft

- 6.4.4 Salesforce

- 6.4.5 IBM

- 6.4.6 Workday

- 6.4.7 Sage Intacct

- 6.4.8 Unit4 / FinancialForce

- 6.4.9 Intuit

- 6.4.10 Anaplan

- 6.4.11 Workiva

- 6.4.12 BlackLine

- 6.4.13 Coupa

- 6.4.14 Xero

- 6.4.15 FIS

- 6.4.16 Fiserv

- 6.4.17 Temenos

- 6.4.18 Finastra

- 6.4.19 Acumatica

- 6.4.20 AWS

- 6.4.21 Google Cloud

- 6.4.22 Huawei

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment