|

市场调查报告书

商品编码

1755335

调味料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Seasoning Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

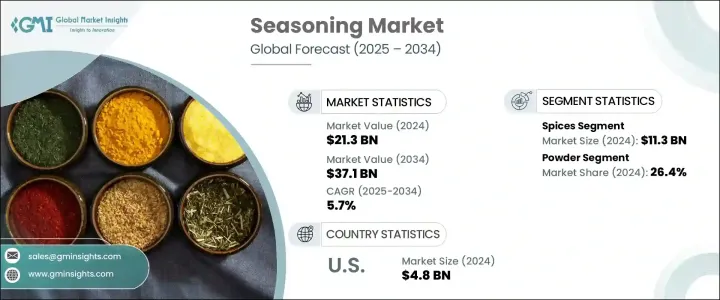

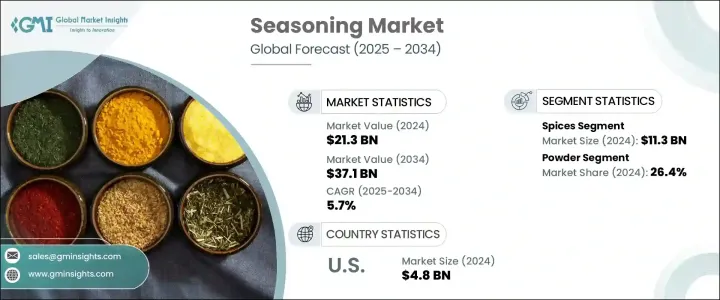

2024年,全球调味料市场规模达213亿美元,预计到2034年将以5.7%的复合年增长率成长,达到371亿美元。这主要得益于饮食习惯的改变、方便食品的日益普及以及人们对提升食品风味日益增长的兴趣。儘管全球经济波动,但调味料的需求仍然强劲,因为它在已开发经济体和新兴经济体的家庭厨房和商业食品行业中都扮演着不可或缺的角色。调味料不仅对风味至关重要,也对保持全球美食的原汁原味至关重要。

技术进步和全球化的不断发展,拓宽了世界各地各种香草和香料的供应,催生了更复杂、更客製化的香料混合物。这些发展使得调味料能够无缝融入包装食品和即食食品领域。随着城市化和国际美食的普及,调味料市场蓬勃发展。消费者对清洁标籤、天然和非基因改造产品表现出明显的偏好,这促使企业在成分透明度和永续性方面不断创新。除了烹饪用途外,对功能性食品日益增长的需求也进一步推动了富含健康益处的调味料产品的使用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 213亿美元 |

| 预测值 | 371亿美元 |

| 复合年增长率 | 5.7% |

2024年,以香料为基础的调味品市场价值达113亿美元,预计到2034年将以5.6%的复合年增长率成长。香料在食品製备中依然至关重要,因为它们能够提升口感和营养价值。人们的健康意识不断增强,全球各地对当地风味的热爱也推动了香料在传统菜餚和现代食谱中的广泛应用。消费者对姜黄、辣椒、孜然和辣椒粉等香料的需求持续成长,不仅源自于其美味,也源自于其健康功效。香料的灵活使用方式——无论是整粒、研磨还是萃取物——也增强了其持久的吸引力。此外,电子商务和零售通路的蓬勃发展也使得香料的供应更加便利。

2024年,粉状调味料市场规模达181亿美元,占市占率的26.4%。由于其便利性和与各种食谱的兼容性,预计2025年至2034年期间的复合年增长率将达到5.5%。粉状调味料质地均匀、易于储存,使其在加工和包装食品中具有显着优势,尤其在口味均匀和保质期较长的加工和包装食品中。消费者和製造商更青睐粉状调味料,用于製作调味酱、汤品、酱汁、零食和餐盒。此外,这些调味料运输和储存成本低廉,也使其日益受欢迎。

美国调味料市场在2024年创收48亿美元,预计2025年至2034年期间的复合年增长率将达到6%。该市场受益于国内消费旺盛、食品加工能力强劲以及向有机和天然食材的广泛转变。多元文化美食(尤其是亚洲、地中海和拉丁美洲的美食)日益流行,引发了人们对混合香料和民族风味组合的需求。同时,家庭烹饪、社群媒体影响力以及人们对美食烹饪的兴趣也随之激增。低钠和无过敏原混合香料等注重健康的创新产品正成为关键卖点。这些发展势头使美国成为全球调味料行业的领导者。

活跃于全球调味料市场的公司包括:奇华顿公司 (Givaudan SA)、奥兰国际 (Olam International)、味好美公司 (McCormick & Company, Inc.)、嘉里集团 (Kerry Group plc) 和味之素株式会社 (Ajinomoto Co., Inc.)。为了巩固和扩大市场份额,调味料行业的公司正在实施有针对性的策略。许多公司正在推出文化多元化的混合香料和更健康的替代品,以满足清洁标籤的需求。产品创新是核心-各大品牌正在推出兼顾风味和健康的香料配方,例如低钠和无防腐剂的选择。进军电商领域使公司能够触及更广泛的消费者群体,同时提供可客製化的包装和基于订阅的香料套装。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 对民族和异国美食的需求不断增长

- 消费者对美食烹饪的兴趣日益浓厚

- 消费者对清洁标籤产品的偏好日益增加

- 食品服务业的成长

- 产业陷阱与挑战

- 原物料价格波动

- 食品添加物的严格监管

- 市场机会

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- Pestel 分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)

(註:仅提供重点国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 草药

- 罗勒

- 牛至

- 百里香

- 迷迭香

- 香菜

- 其他的

- 香料

- 胡椒

- 肉桂

- 孜然

- 姜黄

- 小荳蔻

- 丁香

- 其他的

- 盐和盐替代品

- 食盐

- 海盐

- 喜马拉雅盐

- 低钠盐

- 其他的

- 调味料混合物

- 义大利调味料

- 卡真调味料

- 咖哩粉

- 塔可调味料

- 咖哩粉

- 其他的

- 其他的

第六章:市场估计与预测:依形式,2021-2034

- 主要趋势

- 粉末

- 完整/完好

- 粉碎/研磨

- 液体

- 贴上

- 其他的

第七章:市场估计与预测:依性质,2021-2034

- 主要趋势

- 传统的

- 有机的

- 非基因改造

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 肉类和家禽

- 零食和方便食品

- 汤、酱汁和调味品

- 烘焙和糖果

- 海鲜

- 冷冻食品

- 饮料

- 其他的

第九章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 食品加工业

- 食品服务业

- 餐厅

- 饭店

- 咖啡厅

- 速食连锁店

- 其他的

- 零售/家居

第 10 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- B2B

- B2C

- 超市/大卖场

- 便利商店

- 专卖店

- 网路零售

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- Ajinomoto Co., Inc.

- Ariake Japan Co., Ltd.

- Baria Pepper

- British Pepper & Spice Co Ltd

- Dohler GmbH

- DS Group

- Everest Spices

- Firmenich SA

- Frontier Co-op

- Fuchs Gewurze GmbH

- Givaudan SA

- Kerry Group plc

- McCormick & Company, Inc.

- MDH Spices

- Nestle SA

- Olam International

- Sensient Technologies Corporation

- Symrise AG

- The Kraft Heinz Company

- Unilever PLC

The Global Seasoning Market was valued at USD 21.3 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 37.1 billion by 2034, fueled by changing dietary habits, the rising popularity of convenient food products, and a heightened interest in enhancing food flavor. Despite fluctuations in the global economy, the demand for seasoning remains strong due to its indispensable role in household kitchens and the commercial food industry across developed and emerging economies. Seasonings have become integral not just for flavor but also for preserving authenticity in global cuisines.

Technological improvements and increasing globalization have broadened the availability of diverse herbs and spices worldwide, giving rise to more complex and tailored spice blends. These developments have enabled the seamless incorporation of seasonings into packaged and ready-to-eat food segments. As urbanization and exposure to international cuisines rise, the market thrives. Consumers are showing a clear preference for clean-label, natural, and non-GMO products, which is encouraging companies to innovate in ingredient transparency and sustainability. In addition to culinary uses, the increasing demand for functional foods further boosts the use of seasoning products enriched with health benefits.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.3 Billion |

| Forecast Value | $37.1 Billion |

| CAGR | 5.7% |

The seasoning segment based on spices was valued at USD 11.3 billion in 2024 and is projected to grow at a CAGR of 5.6% through 2034. Spices remain vital in food preparation thanks to their role in enhancing both taste and nutritional value. Their widespread use in traditional dishes and contemporary recipes alike is driven by rising health consciousness and the global appreciation for regional flavors. Consumers continue to demand spices like turmeric, chili, cumin, and paprika not only for taste but for their wellness properties. The flexibility of using spices in different formats-whether whole, ground or as extracts-adds to their sustained appeal. Moreover, growing e-commerce and retail availability have made spices more accessible.

The powdered seasoning segment generated USD 18.1 billion in 2024, holding a 26.4% share, and is set to grow at a CAGR of 5.5% from 2025 to 2034 driven by the convenience and compatibility with a wide range of recipes. The consistent texture and ease of storage give powdered seasonings a significant edge, particularly in processed and packaged foods where uniform taste and longer shelf life are key. Consumers and manufacturers prefer powdered formats for applications in rubs, soups, sauces, snacks, and meal kits. Additionally, these seasonings are cost-effective to transport and store, contributing to their growing popularity.

U.S. Seasoning Market generated USD 4.8 billion in 2024 and is expected to grow at a CAGR of 6% from 2025 to 2034. The market benefits from high domestic consumption, strong food processing capabilities, and a widespread shift toward organic and natural ingredients. The growing popularity of multicultural cuisines-particularly those from Asia, the Mediterranean, and Latin America-has sparked increased demand for blended and ethnic spice combinations. Simultaneously, home cooking, social media influence, and interest in gourmet meal preparation have surged. Health-focused innovations, such as low-sodium and allergen-free spice blends, are becoming key selling points. These dynamics position the U.S. as a leader in the global seasoning industry.

Companies active in the Global Seasoning Market include: Givaudan SA, Olam International, McCormick & Company, Inc., Kerry Group plc, and Ajinomoto Co., Inc. To secure and expand their market footprint, companies in the seasoning industry are implementing targeted strategies. Many are introducing culturally diverse blends and healthier alternatives that cater to clean-label demands. Product innovation is central-brands are rolling out spice formulations that balance flavor and health, such as low-sodium and preservative-free options. Expansion into e-commerce has enabled companies to reach broader consumer segments while offering customizable packaging and subscription-based spice kits.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1.1 Regional

- 2.2.1.2 Product type

- 2.2.1.3 Form

- 2.2.1.4 Nature

- 2.2.1.5 Application

- 2.2.1.6 End use

- 2.2.1.7 Distribution channel

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical success factors

- 2.7 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for ethnic and exotic cuisines

- 3.2.1.2 Rising consumer interest in gourmet cooking

- 3.2.1.3 Increasing preference for clean label products

- 3.2.1.4 Growth in the food service industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fluctuating raw material prices

- 3.2.2.2 Stringent regulations on food additives

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Herbs

- 5.2.1 Basil

- 5.2.2 Oregano

- 5.2.3 Thyme

- 5.2.4 Rosemary

- 5.2.5 Parsley

- 5.2.6 Others

- 5.3 Spices

- 5.3.1 Pepper

- 5.3.2 Cinnamon

- 5.3.3 Cumin

- 5.3.4 Turmeric

- 5.3.5 Cardamom

- 5.3.6 Cloves

- 5.3.7 Others

- 5.4 Salt & salt substitutes

- 5.4.1 Table salt

- 5.4.2 Sea salt

- 5.4.3 Himalayan salt

- 5.4.4 Low-sodium salt

- 5.4.5 Others

- 5.5 Seasoning blends

- 5.5.1 Italian seasoning

- 5.5.2 Cajun seasoning

- 5.5.3 Curry powder

- 5.5.4 Taco seasoning

- 5.5.5 Garam masala

- 5.5.6 Others

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Whole/intact

- 6.4 Crushed/ground

- 6.5 Liquid

- 6.6 Paste

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Nature, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Conventional

- 7.3 Organic

- 7.4 Non-GMO

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Meat & Poultry

- 8.3 Snacks & convenience food

- 8.4 Soups, sauces & dressings

- 8.5 Bakery & confectionery

- 8.6 Seafood

- 8.7 Frozen foods

- 8.8 Beverages

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Food processing industry

- 9.3 Food service industry

- 9.3.1 Restaurants

- 9.3.2 Hotels

- 9.3.3 Cafes

- 9.3.4 Fast food chains

- 9.3.5 Others

- 9.4 Retail/household

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 B2B

- 10.3 B2C

- 10.3.1 Supermarkets/hypermarkets

- 10.3.2 Convenience stores

- 10.3.3 Specialty stores

- 10.3.4 Online retail

- 10.3.5 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Ajinomoto Co., Inc.

- 12.2 Ariake Japan Co., Ltd.

- 12.3 Baria Pepper

- 12.4 British Pepper & Spice Co Ltd

- 12.5 Dohler GmbH

- 12.6 DS Group

- 12.7 Everest Spices

- 12.8 Firmenich SA

- 12.9 Frontier Co-op

- 12.10 Fuchs Gewurze GmbH

- 12.11 Givaudan SA

- 12.12 Kerry Group plc

- 12.13 McCormick & Company, Inc.

- 12.14 MDH Spices

- 12.15 Nestle S.A.

- 12.16 Olam International

- 12.17 Sensient Technologies Corporation

- 12.18 Symrise AG

- 12.19 The Kraft Heinz Company

- 12.20 Unilever PLC