|

市场调查报告书

商品编码

1755338

电动三轮车市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electric Three-Wheeler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

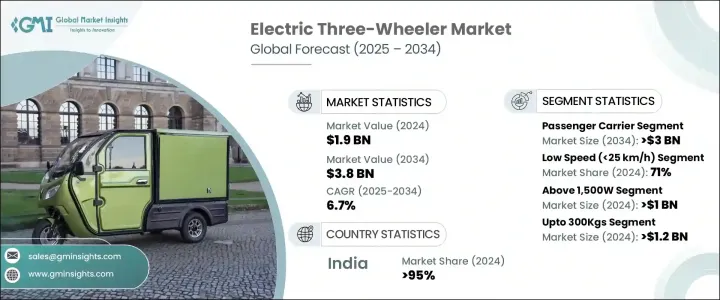

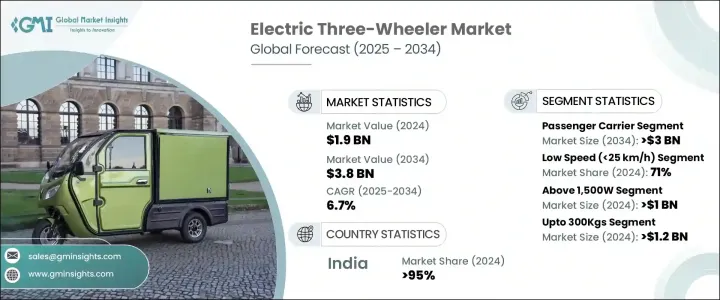

2024年,全球电动三轮车市场规模达19亿美元,预计2034年将以6.7%的复合年增长率成长,达到38亿美元。这一快速增长的动力源于燃油价格上涨、电动车普及激励措施的不断扩大以及人们对经济实惠的城市交通日益关注。电动三轮车是人口密集城市短途旅行和最后一英里出行的理想解决方案。电动车充电基础设施的扩张和电池技术的进步也提升了这些车辆的续航里程和性能。加之各地区推出的支持性政策和对永续交通的投资,电动三轮车市场正受到寻求经济高效、清洁出行解决方案的私人用户和商业车队营运商的强烈关注。

与内燃机汽车相比,电动三轮车拥有显着的营运优势。由于维护需求极低且燃料成本显着降低,它们的总拥有成本极具吸引力。这使得它们尤其适合日常商业应用。非洲、亚洲和欧洲等地区的许多政府正在透过提供补贴、免税和费用减免的计划来鼓励电动车的购买。这些措施,加上各国针对电动车的推广项目,正帮助缩小价格差距,并加速向电动车的转变。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 19亿美元 |

| 预测值 | 38亿美元 |

| 复合年增长率 | 6.7% |

2024年,客运运输板块的产值达到13亿美元,预计2034年将达到30亿美元。电动三轮车作为城市和半城市地区公共交通的广泛使用,推动了这一成长。对于难以获得传统公共交通的人来说,这些车辆提供了可靠且低成本的通勤解决方案。它们与叫车和共享出行平台的整合进一步提高了利用率。此外,低拥有成本、快速回报和易于驾驶等优势,正在激励企业家和车队运输供应商大规模采用电动模式。

2024年,最高时速25公里/小时的电动三轮车占了71%的市场。这些低速车辆越来越多地被用于垃圾管理、本地配送和机构运输等特殊公用事业任务,尤其是在以短途低速出行为主的发展中国家。宽鬆的牌照审批标准、较低的成本以及环保的运作方式,进一步提升了电动三轮车的普及率。政府旨在推动农村电气化和清洁旅行的政策,也进一步鼓励了轻型电动车在本地交通中的应用。

2024年,亚太地区电动三轮车市场占了95%的市场。印度在客运和货运方面对三轮车的依赖程度很高,尤其是在二、三线城市,这持续推动了三轮车的普及。印度扶持性的电动车生态系统,包括国家和邦级政策、报废汽车计画以及宣传活动,正在加速城市中心和农村地区向电动出行的转型。电动三轮车在微出行和最后一哩物流领域的需求强劲,反映了该产业的适应性和成本效益。

电动三轮车市场的主要公司包括 Hotage India、Mahindra Last Mile Mobility、Dilli Electric Auto、YC Electric、Energy Electric Vehicles、Piaggio Vehicles、Unique International、Saera Electric Auto、Bajaj Auto 和 Mini Metro EV。为了巩固其在电动三轮车市场的地位,各公司正致力于透过针对货运和客运应用量身定制的车型来扩展其产品组合。许多参与者正在投资研发,以提高电池效率、增加续航里程并缩短充电时间。与电池供应商、车队营运商和充电基础设施提供商的策略合作伙伴关係正在帮助他们扩大营运规模。製造商也优先透过在地化生产和精益製造来优化成本,以满足价格敏感型市场的需求。品牌建立、经销商扩张和售后服务改进正在进一步实现更深层的市场渗透。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 地区

- 国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 低营运和维护成本

- 政府激励和补贴

- 电池技术的进步和电池价格的降低

- 严格的排放标准和环境法规

- 智慧技术集成

- 产业陷阱与挑战

- 充电基础设施有限

- 初始购买成本高

- 市场机会

- 充电基础设施建设

- 轻型商用车更换

- 最后一哩配送扩展

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按国家

- 乘车

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 消费者行为分析

- 使用趋势:乘客通勤与货物运输

- 购买决策因素(价格、品牌、范围)

- 保险和售后市场趋势分析

- 商业 E3 Ws 的保险采用

- 电池更换和本地化售后服务

- 维修成本比较:电动三轮车与内燃机三轮车

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

- 产品基准测试

- 范围

- 电池寿命

- 建造和设计

- 连接和技术功能

- 售后服务

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 客运公司

- 载运装置

第六章:市场估计与预测:按电池,2021 - 2034 年

- 主要趋势

- 锂离子

- 铅酸

第七章:市场估计与预测:依发电容量,2021 - 2034 年

- 主要趋势

- 低于1,000W

- 1,000瓦-1,500瓦

- 1,500W以上

第八章:市场估计与预测:按电池容量,2021 - 2034 年

- 主要趋势

- 3度以下

- 3-6千瓦时

- 6度以上

第九章:市场估计与预测:按速度,2021 - 2034 年

- 主要趋势

- 低速(<25公里/小时)

- 高速(≥25公里/小时)

第十章:市场估计与预测:依酬载容量,2021 - 2034 年

- 主要趋势

- 最多300公斤

- 300公斤以上

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 江苏

- 河南

- 河北

- 山东

- 粤

- 浙江

- 其他的

- 印度

- 北方邦

- 比哈尔邦

- 阿萨姆

- 拉贾斯坦邦

- 其他的

- 其他的

- 日本

- 韩国

- 澳洲

- 东南亚

- 中国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十二章:公司简介

- Altigreen Propulsion Labs

- Atul Auto

- Avon EV

- Bajaj Auto

- Dilli Electric Auto

- Energy Electric Vehicles

- Euler Motors

- Greaves Electric Mobility

- Hotage India

- JS Auto

- Mahindra Last Mile Mobility

- Mini Metro EV

- Montra Electric

- Omega Seiki Mobility

- Piaggio Vehicles

- Saera Electric Auto

- TVS Motor Company

- Unique International

- VeeEss Eelectric

- YC Electric

The Global Electric Three-Wheeler Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 3.8 billion by 2034. This rapid growth is driven by rising fuel prices, expanding EV adoption incentives, and an increasing focus on affordable urban transportation. Electric three-wheelers offer an ideal solution for short-distance and last-mile connectivity in densely populated urban settings. The expansion of EV charging infrastructure and advances in battery technology are also improving the range and performance of these vehicles. Coupled with supportive policies and investment in sustainable transport across regions, the market is witnessing significant traction among both private users and commercial fleet operators seeking cost-efficient, clean mobility solutions.

Electric three-wheelers offer compelling operational advantages over internal combustion engine alternatives. With minimal maintenance needs and significantly lower fuel costs, they present an attractive total cost of ownership. This makes them especially viable for daily-use commercial applications. Many governments across regions like Africa, Asia, and Europe are incentivizing EV purchases through schemes offering subsidies, tax exemptions, and fee waivers. These measures, along with country-specific programs to promote electric mobility, are helping bridge the price gap and accelerate the shift to electric fleets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 6.7% |

The passenger carrier segment generated USD 1.3 billion in 2024 and is expected to generate USD 3 billion by 2034. The widespread use of electric three-wheelers as public transport alternatives in urban and semi-urban areas is fueling this growth. For populations with limited access to conventional public transit, these vehicles offer a reliable and low-cost commuting solution. Their integration with ride-hailing and shared mobility platforms is further increasing utilization rates. Additionally, benefits such as low ownership costs, quick returns, and ease of driving are motivating entrepreneurs and fleet-based transport providers to adopt electric models at scale.

Electric three-wheelers with a top speed of 25 km/h segment captured a 71% share in 2024. These low-speed vehicles are increasingly being deployed for specialized utility tasks such as waste management, local delivery, and institutional transport, particularly in developing countries where short-distance, low-speed travel is the norm. Their popularity is bolstered by lenient licensing norms, lower costs, and eco-friendly operation. Government support aimed at rural electrification and clean mobility is further encouraging the use of light-duty EVs for local transport applications.

Asia Pacific Electric Three-Wheeler Market held a 95% share in 2024. India's strong reliance on three-wheeled vehicles for both passenger and cargo transport-especially in Tier II and Tier III cities-continues to drive adoption. The country's supportive EV ecosystem, including national and state-level policies, scrappage schemes, and awareness campaigns, is accelerating the transition to electric mobility in both urban centers and rural corridors. Demand for electric three-wheelers is strong in micro-mobility and last-mile logistics, reflecting the sector's adaptability and cost-effectiveness.

Major companies operating in the Electric Three-Wheeler Market include Hotage India, Mahindra Last Mile Mobility, Dilli Electric Auto, YC Electric, Energy Electric Vehicles, Piaggio Vehicles, Unique International, Saera Electric Auto, Bajaj Auto, and Mini Metro EV. To strengthen their position in the electric three-wheeler market, companies are focusing on expanding their product portfolios with models tailored to both cargo and passenger applications. Many players are investing in R&D to improve battery efficiency, enhance range, and reduce charging time. Strategic partnerships with battery suppliers, fleet operators, and charging infrastructure providers are helping them scale operations. Manufacturers are also prioritizing cost optimization through localized production and lean manufacturing to meet the needs of price-sensitive markets. Branding efforts, dealer expansion, and after-sales service improvements are further enabling deeper market penetration.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Region

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Battery

- 2.2.4 Power capacity

- 2.2.5 Battery capacity

- 2.2.6 Speed

- 2.2.7 Payload capacity

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Low operating and maintenance costs

- 3.2.1.2 Government incentives and subsidies

- 3.2.1.3 Advancements in battery technology and reducing battery prices

- 3.2.1.4 Stringent emission norms and environmental regulations

- 3.2.1.5 Integration of smart technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited charging infrastructure

- 3.2.2.2 High initial purchase cost

- 3.2.3 Market opportunities

- 3.2.3.1 Charging infrastructure development

- 3.2.3.2 Light commercial vehicle replacement

- 3.2.3.3 Last-mile delivery expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By country

- 3.8.2 By vehicle

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Consumer behavior analysis

- 3.13.1 Usage trends: passenger commute vs. goods transport

- 3.13.2 Purchase decision factors (price, brand, range)

- 3.14 Analysis of insurance and aftermarket trends

- 3.14.1. Insurance adoption for commercial E3 Ws

- 3.14.2 Battery replacement & localized aftermarket services

- 3.14.3 Comparative maintenance costs: Electric vs. ICE 3-wheelers

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Product benchmarking

- 4.7.1 Range

- 4.7.2 Battery life

- 4.7.3 Build and design

- 4.7.4 Connectivity & tech features

- 4.7.5 Aftermarket service

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Passenger carrier

- 5.3 Load carrier

Chapter 6 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Lithium-ion

- 6.3 Lead acid

Chapter 7 Market Estimates & Forecast, By Power Capacity, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Below 1,000W

- 7.3 1,000W-1,500W

- 7.4 Above 1,500W

Chapter 8 Market Estimates & Forecast, By Battery Capacity, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Below 3kWh

- 8.3 3-6kWh

- 8.4 Above 6kWh

Chapter 9 Market Estimates & Forecast, By Speed, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Low speed (<25 km/h)

- 9.3 High speed (≥25 km/h)

Chapter 10 Market Estimates & Forecast, By Payload Capacity, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 Upto 300Kgs

- 10.3 Above 300Kgs

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.1.1 Jiangsu

- 11.4.1.2 Henan

- 11.4.1.3 Hebei

- 11.4.1.4 Shandong

- 11.4.1.5 Guangdong

- 11.4.1.6 Zhejiang

- 11.4.1.7 Others

- 11.4.2 India

- 11.4.2.1 Uttar Pradesh

- 11.4.2.2 Bihar

- 11.4.2.3 Assam

- 11.4.2.4 Rajasthan

- 11.4.2.5 Others

- 11.4.2.6 Others

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Southeast Asia

- 11.4.1 China

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Altigreen Propulsion Labs

- 12.2 Atul Auto

- 12.3 Avon EV

- 12.4 Bajaj Auto

- 12.5 Dilli Electric Auto

- 12.6 Energy Electric Vehicles

- 12.7 Euler Motors

- 12.8 Greaves Electric Mobility

- 12.9 Hotage India

- 12.10 J.S. Auto

- 12.11 Mahindra Last Mile Mobility

- 12.12 Mini Metro EV

- 12.13 Montra Electric

- 12.14 Omega Seiki Mobility

- 12.15 Piaggio Vehicles

- 12.16 Saera Electric Auto

- 12.17 TVS Motor Company

- 12.18 Unique International

- 12.19 VeeEss Eelectric

- 12.20 YC Electric