|

市场调查报告书

商品编码

1755345

氢气市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Hydrogen Generation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球氢气生产市场规模达1,658亿美元,预计到2034年将以7.2%的复合年增长率成长,达到3,280亿美元。这主要得益于低碳工业燃料需求的不断增长,以及从传统化石燃料转向更清洁替代品的转变。此外,氨生产、炼油和合成燃料製造等产业持续专注于脱碳,将显着推动低碳氢化合物的普及。氢燃料电池汽车(FCV),包括公车、卡车和船舶,以及加氢站的扩张,将进一步刺激市场成长。

氢气在钢铁生产、化学製造和炼油等行业日益广泛的应用,旨在减少碳排放,也将在推动市场发展方面发挥关键作用。针对发展氢能基础设施和技术的财政诱因、拨款和补贴增强了市场前景。然而,对进口氢气设备和零件征收的关税可能会影响成长,增加开发商的资本支出,并可能推迟专案进度。氢气生产市场分为蒸汽重整、电解等多个领域,其中蒸汽重整因其成本效益高且基础设施完善而占据最大份额。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1658亿美元 |

| 预测值 | 3280亿美元 |

| 复合年增长率 | 7.2% |

2024年,蒸汽重整在氢气生产市场中的份额达到88.3%。这主要归功于其经济高效的生产能力以及支持其广泛应用的完善基础设施。蒸汽重整长期以来一直是氢气生产的首选方法,尤其是在炼油和石化等行业,它在生产各种工艺所需的氢气方面发挥着至关重要的作用。

预计到2034年,自备氢能市场规模将达到2,680亿美元,并将受益于工业和商业用现场氢气投资的增加。这项转变旨在降低供应链风险并提高能源安全。绿色氢能技术在内部消费的应用日益增多,尤其是在炼油和化学产业,将进一步刺激市场扩张。此外,鼓励清洁能源整合的政策激励措施将支持氢能技术在各领域的持续应用。

2024年,美国氢能发电市场规模达150亿美元,这得益于氢能在发电和运输领域日益增长的作用。提高电网灵活性、减少对化石燃料的依赖以及支持向清洁能源转型的需求推动了对氢能解决方案的需求。氢能正日益成为重工业和交通运输(包括货运和公车)脱碳的关键因素。公共和私营部门为实现经济脱碳而采取的措施正在进一步推动氢能技术的普及,预计未来几年将带来显着的市场成长。

全球氢气生产市场的主要参与者包括林德、空气化学产品公司、液化空气集团、麦克菲能源和普拉格能源等。这些公司正在采取各种策略来巩固其市场地位,包括投资研发以提高氢气生产技术的效率和永续性。许多公司正在透过整合再生氢能解决方案并与其他产业参与者建立策略合作伙伴关係来建立氢能基础设施,从而扩大其产品供应。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率

- 策略倡议

- 竞争基准测试

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依交付方式,2021 - 2034 年

- 主要趋势

- 俘虏

- 商人

第六章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 石油炼油厂

- 化学

- 金属

- 其他的

第七章:市场规模及预测:依工艺,2021 - 2034

- 主要趋势

- 蒸气重整器

- 电解

- 其他的

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 荷兰

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 中东和非洲

- 沙乌地阿拉伯

- 伊朗

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第九章:公司简介

- Air Liquide

- Air Products and Chemicals

- Ballard Power Systems

- Ally Hi-Tech

- Claind

- Engie

- Caloric

- HyGear

- Iwatani Corporation

- Linde

- Mahler

- Messer

- McPhy Energy

- Nel ASA

- Nuvera Fuel Cells

- Plug Power

- Resonac Holdings Corporation

- Taiyo Nippon Sanso Corporation

- Teledyne Technologies Incorporated

- Xebec Adsorption

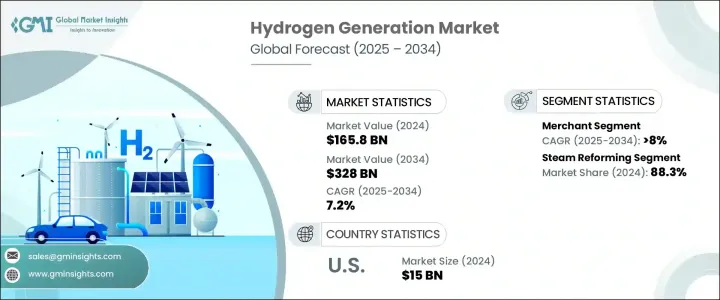

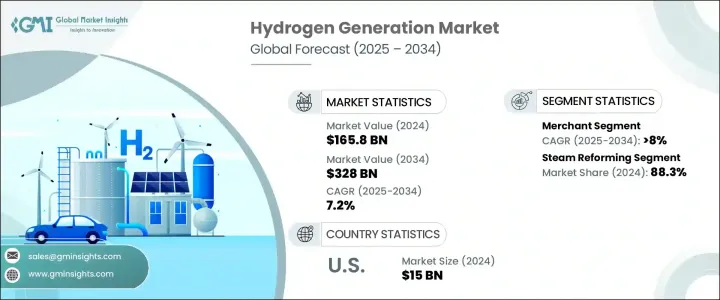

The Global Hydrogen Generation Market was valued at USD 165.8 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 328 billion by 2034, driven by the increasing demand for low-carbon industrial fuels and a shift from traditional fossil-based feedstocks to cleaner alternatives. Additionally, the ongoing focus on decarbonizing sectors like ammonia production, refining, and synthetic fuel manufacturing will significantly boost the adoption of low-carbon hydrogen. The growing popularity of hydrogen fuel cell vehicles (FCVs), including buses, trucks, and ships, alongside the expansion of hydrogen refueling stations, will further stimulate market growth.

The rising application of hydrogen in industries such as steel production, chemical manufacturing, and refining, aimed at reducing carbon emissions, will also play a crucial role in driving the market. Financial incentives, grants, and subsidies for developing hydrogen infrastructure and technologies enhance the market outlook. However, tariffs imposed on imported hydrogen production equipment and components may affect growth, raising capital expenditures for developers and potentially delaying project timelines. The hydrogen generation market is divided into segments such as steam reforming, electrolysis, and others, with steam reforming holding the largest share due to its cost-effectiveness and established infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $165.8 Billion |

| Forecast Value | $328 Billion |

| CAGR | 7.2% |

The steam reforming segment in the hydrogen generation market held 88.3% share in 2024. This is largely due to its cost-effective production capabilities and the well-established infrastructure that supports its widespread use. Steam reforming has long been the preferred method for hydrogen production, especially within industries like refining and petrochemicals, where it plays a crucial role in generating the hydrogen needed for various processes.

The captive segment is expected to reach USD 268 billion by 2034 and will benefit from increasing investments in on-site hydrogen generation for industrial and commercial use. This shift is aimed at mitigating supply chain risks and improving energy security. The growing use of green hydrogen technologies for in-house consumption, particularly in the refining and chemical industries, will further stimulate market expansion. Additionally, policy incentives encouraging the integration of clean energy will support the ongoing adoption of hydrogen across various sectors.

United States Hydrogen Generation Market was valued at USD 15 billion in 2024, driven by the increasing role of hydrogen in both power generation and the transportation sector. The demand for hydrogen-based solutions is driven by the desire to improve grid flexibility, reduce dependence on fossil fuels, and support the transition to clean energy. Hydrogen is increasingly a key player in decarbonizing heavy industries and transportation, including freight and buses. Public and private sector initiatives to decarbonize the economy are further propelling the adoption of hydrogen technologies, which is expected to lead to significant market growth in the years ahead.

Key players in the Global Hydrogen Generation Market include Linde, Air Products and Chemicals, Air Liquide, McPhy Energy, and Plug Power, among others. These companies are employing various strategies to strengthen their market position, including investments in research and development to enhance the efficiency and sustainability of hydrogen production technologies. Many companies are expanding their product offerings by integrating renewable hydrogen solutions and forming strategic partnerships with other industry players to build hydrogen infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Delivery Mode, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Captive

- 5.3 Merchant

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Petroleum refinery

- 6.3 Chemical

- 6.4 Metal

- 6.5 Others

Chapter 7 Market Size and Forecast, By Process, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Steam reformer

- 7.3 Electrolysis

- 7.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 UK

- 8.3.4 Italy

- 8.3.5 Netherlands

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 Iran

- 8.5.3 UAE

- 8.5.4 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 Air Liquide

- 9.2 Air Products and Chemicals

- 9.3 Ballard Power Systems

- 9.4 Ally Hi-Tech

- 9.5 Claind

- 9.6 Engie

- 9.7 Caloric

- 9.8 HyGear

- 9.9 Iwatani Corporation

- 9.10 Linde

- 9.11 Mahler

- 9.12 Messer

- 9.13 McPhy Energy

- 9.14 Nel ASA

- 9.15 Nuvera Fuel Cells

- 9.16 Plug Power

- 9.17 Resonac Holdings Corporation

- 9.18 Taiyo Nippon Sanso Corporation

- 9.19 Teledyne Technologies Incorporated

- 9.20 Xebec Adsorption