|

市场调查报告书

商品编码

1755354

小米市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Millets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

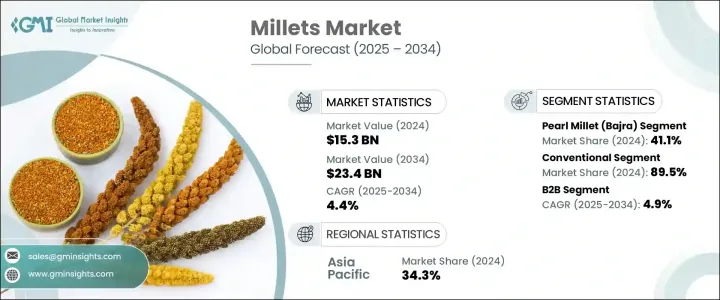

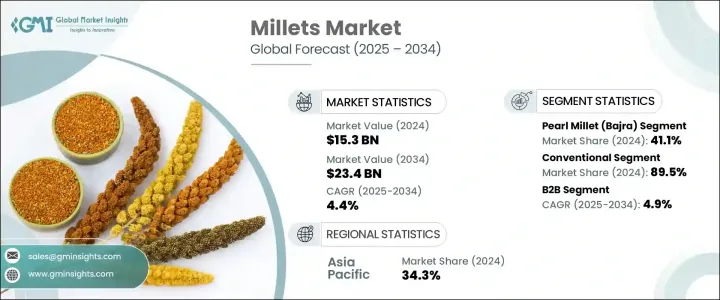

2024年,全球小米市场规模达153亿美元,预计到2034年将以4.4%的复合年增长率成长,达到234亿美元。这一增长主要源于消费者对富含纤维和蛋白质的健康无麸质食品日益增长的兴趣。随着人们对小米营养价值的认识不断提高,小米在现代饮食中的应用也越来越普遍。消费者选择小米不仅是为了传统消费,也是为了其在功能性食品、健康饮食和永续饮食实践中的作用。近年来,小米在许多新应用中占据了一席之地,尤其是在烘焙食品、零食和饮料领域,它们不仅具有健康益处,还能改善口感和口感。

小米能够抵御恶劣的气候条件,也使其成为水资源匮乏地区的可靠食物来源,这进一步凸显了其对粮食安全的重要性。加工和产品开发的创新持续推动全球小米消费。随着永续性在整个粮食体系中日益受到重视,小米正被视为气候智慧型谷物,是环保饮食的理想选择。城市市场对永续植物性食品的需求不断增长,进一步支撑了小米市场的长期发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 153亿美元 |

| 预测值 | 234亿美元 |

| 复合年增长率 | 4.4% |

支持性政策框架和製度激励措施持续推动小米市场发展。全球范围内的多项小米推广倡议,大大提升了人们对小米食品产业的认知度,并推动了相关投资。各国政府和农业机构正在透过提供财政支持、打造价值链基础设施以及培育小米产品开发领域的创业精神来鼓励小米种植。这些措施不仅支持了农民,也有助于简化分销流程,拓宽小米产品在国内外市场的准入管道。

依品种划分,珍珠粟在2024年占据市场主导地位,占41.1%,市场规模达63亿美元。每种小米品种都因其营养成分和对不同饮食的适应性而拥有独特的价值。有些品种因其高蛋白或高钙含量而备受青睐,而有些品种则因其在无麸质和纯素饮食中的应用而日益受到关注。随着全球需求持续转向清洁标籤和防过敏食品,这些谷物在各地区都有强劲的成长机会。

基于自然属性,到2024年,传统小米将占据主导地位,市占率达89.5%,预计在预测期内将以5.8%的复合年增长率成长。由于价格实惠且易于获取,此细分市场将继续吸引更广泛的消费者群体。然而,有机小米市场也正受到越来越多的关注,尤其是在城市市场,消费者正在寻求无化学成分和环保的食品选择。政府推广永续农业的计画也增强了有机小米的吸引力。儘管有机小米目前的市场份额较小,但对清洁营养的需求不断增长预计将推动其渗透,尤其是在高端零售场所和注重健康的人群中。

按形态细分,全谷物在2024年占据了39.7%的市场份额,由于其营养丰富且加工程度低,依然保持着强劲的市场相关性。小米粉作为无麸质烘焙产品(包括饼干、麵包和健康零食)的多功能配料,在全球范围内持续受到欢迎。小米片在早餐谷物和零食棒中越来越受欢迎,反映出市场正与现代便捷消费模式保持一致。随着饮食习惯的不断变化,对以小米为基础的即食和即食产品的需求也在不断增长,这为製造商提供了在零售货架上推出多样化产品线的机会。

B2B 市场正在快速扩张,预计到 2034 年复合年增长率将达到 4.9%。这一增长主要源于食品製造商、机构买家和动物饲料生产商日益增长的需求,他们正将小米作为一种功能性和可持续性的原料,广泛应用于各种应用领域。小米被广泛应用于包装食品、学校膳食计划和自有品牌健康食品中,这为大规模采购创造了机会。随着越来越多的产业利用小米的健康和永续优势,B2B 市场预计将迎来强劲成长动能。

从区域来看,亚太地区在2024年占据了最大的收入份额,达到34.3%,这得益于高产量和不断增长的国内消费。由于传统的种植模式和日益增强的健康意识,该地区仍然是小米的主要产地。城镇化、收入成长和农业扶持政策不仅推动了小米在传统饮食中的使用,也推动了其在当代食品创新中的应用。

小米市场的主要参与者正在积极实施策略性倡议,以扩大市场覆盖范围并强化品牌定位。领先的公司正在投资产品创新,推出以小米为基础的即食食品、零食、早餐谷物和无麸质烘焙食品,以满足不断变化的消费者偏好。许多公司正在与食品科技新创公司和研究机构合作,开发营养丰富的配方,以延长保质期并提升口感,同时保留小米的天然益处。与零售连锁店和电商平台建立策略合作伙伴关係也日益普遍,从而扩大了产品的知名度和消费者覆盖范围。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)

(註:仅提供重点国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 珍珠粟(Bajra)

- 小米(Ragi)

- 谷子

- 黍

- 高粱(Jowar)

- 稷

- 科多小米

- 小小米

- 其他的

第六章:市场估计与预测:依性质,2021 - 2034 年

- 主要趋势

- 有机的

- 传统的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 食物

- 烘焙产品

- 早餐麦片和粥

- 小吃和咸味产品

- 婴儿食品

- 传统食物

- 其他的

- 饮料

- 酒精饮料

- 非酒精饮料

- 动物饲料

- 家禽饲料

- 牛饲料

- 其他的

- 营养保健品和膳食补充剂

- 其他的

第八章:市场估计与预测:依形式,2021 - 2034 年

- 主要趋势

- 全谷物

- 麵粉

- 薄片

- 即食

- 即食

- 其他的

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- B2B

- 食品製造商

- 动物饲料业

- HoReCa (饭店、餐厅、咖啡馆)

- 其他的

- B2C

- 超市和大卖场

- 专卖店

- 便利商店

- 网路零售

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第 11 章:公司简介

- Nestle SA

- Archer Daniels Midland Company

- Cargill, Incorporated

- Bunge Limited

- Kellogg Company

- PepsiCo, Inc. (Quaker Oats)

- General Mills, Inc.

- Britannia Industries Ltd.

- ITC Limited

- Patanjali Ayurved Limited

- Organic India Pvt. Ltd.

- 24 Mantra Organic (Sresta Natural Bioproducts)

- Nature's Path Foods

- Bob's Red Mill Natural Foods

- Arrowhead Mills (Hain Celestial Group)

The Global Millets Market was valued at USD 15.3 billion in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 23.4 billion by 2034. This growth is largely driven by rising consumer interest in healthy, gluten-free foods rich in fiber and protein. With increasing awareness about the nutritional benefits of millets, their inclusion in modern diets is becoming more common. Consumers are turning to millets not just for traditional consumption but also for their role in functional foods, wellness diets, and sustainable food practices. In recent years, millets have found a place in a wide range of new applications, especially in baked goods, snacks, and beverages, where they offer not just health benefits but also improved texture and taste.

Their ability to withstand harsh climatic conditions also makes them a reliable food source in regions with limited water availability, reinforcing their importance for food security. Innovations in processing and product development continue to drive millet consumption globally. As sustainability becomes a stronger focus across food systems, millets are being recognized as climate-smart grains, ideal for environmentally-conscious diets. Growing demand in urban markets for sustainable and plant-based food products further supports the market's long-term trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.3 Billion |

| Forecast Value | $23.4 Billion |

| CAGR | 4.4% |

Supportive policy frameworks and institutional incentives continue to fuel this market. Several global efforts to promote millet have significantly contributed to building awareness and driving investment in millet-based food industries. Governments and agricultural bodies are encouraging millet cultivation by offering financial support, creating value-chain infrastructure, and fostering entrepreneurship in millet product development. Such measures not only support farmers but also help streamline distribution and widen accessibility for both domestic and international markets.

By type, pearl millet led the market in 2024, holding a share of 41.1%, which equates to a market size of USD 6.3 billion. Each millet variety holds unique value based on its nutrient profile and suitability for different diets. While some are favored for their high protein or calcium content, others are gaining interest for their use in gluten-free and vegan diets. As global demand continues to shift towards clean-label and allergen-friendly foods, these grains are securing strong growth opportunities across regions.

Based on nature, in 2024, conventional millets dominated with an 89.5% share and are expected to grow at a higher CAGR of 5.8% during the forecast period. This segment continues to appeal to a broader consumer base due to affordability and easy availability. However, the organic millet segment is also witnessing increased interest, especially in urban markets where consumers are seeking chemical-free and eco-friendly food options. Government programs that promote sustainable agriculture are also enhancing the appeal of organically produced millets. Although organic millets currently occupy a smaller share, rising demand for clean nutrition is expected to boost their penetration, particularly in premium retail spaces and health-conscious demographics.

When segmented by form, the whole grain accounted for 39.7% of the total market share in 2024, maintaining strong relevance due to its nutritional richness and minimal processing. Millet flour continues to gain popularity globally as a versatile ingredient in gluten-free bakery products, including cookies, breads, and health snacks. Flakes are increasingly favored for breakfast cereals and snack bars, reflecting the market's alignment with modern, convenience-driven consumption patterns. With evolving dietary habits, the demand for millet-based ready-to-cook and ready-to-eat offerings is also rising, providing manufacturers the opportunity to introduce diverse product lines across retail shelves.

The B2B segment is expanding rapidly, with a projected CAGR of 4.9% through 2034. This growth is driven by increased demand from food manufacturers, institutional buyers, and animal feed producers who are integrating millet as a functional and sustainable ingredient in a wide variety of applications. The integration of millets into packaged foods, school meal programs, and private-label health foods is opening up large-scale procurement opportunities. As more industries tap into the health and sustainability benefits of millets, the B2B segment is expected to witness strong momentum.

Regionally, Asia Pacific held the largest revenue share in 2024 at 34.3%, fueled by high production and rising domestic consumption. The region continues to be a stronghold for millets due to historical cultivation patterns and increasing health awareness. Urbanization, rising incomes, and supportive agriculture policies are boosting millet usage not only in traditional diets but also in contemporary food innovations.

Key players in the millets market are actively implementing strategic initiatives to expand their market footprint and strengthen brand positioning. Leading companies are investing in product innovation by launching millet-based ready-to-eat meals, snacks, breakfast cereals, and gluten-free bakery items to cater to evolving consumer preferences. Many are collaborating with food tech startups and research institutions to develop nutrient-dense formulations that enhance shelf life and taste while retaining the grains' natural benefits. Strategic partnerships with retail chains and e-commerce platforms are also becoming common, allowing broader product visibility and consumer reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Pearl millet (Bajra)

- 5.3 Finger millet (Ragi)

- 5.4 Foxtail millet

- 5.5 Proso millet

- 5.6 Sorghum (Jowar)

- 5.7 Barnyard millet

- 5.8 Kodo millet

- 5.9 Little millet

- 5.10 Others

Chapter 6 Market Estimates and Forecast, By Nature, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Organic

- 6.3 Conventional

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food

- 7.2.1 Bakery products

- 7.2.2 Breakfast cereals & porridges

- 7.2.3 Snacks & savory products

- 7.2.4 Infant food

- 7.2.5 Traditional foods

- 7.2.6 Others

- 7.3 Beverages

- 7.3.1 Alcoholic beverages

- 7.3.2 Non-alcoholic beverages

- 7.4 Animal feed

- 7.4.1 Poultry feed

- 7.4.2 Cattle feed

- 7.4.3 Others

- 7.5 Nutraceuticals & dietary supplements

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Whole grain

- 8.3 Flour

- 8.4 Flakes

- 8.5 Ready-to-cook

- 8.6 Ready-to-eat

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 B2B

- 9.2.1 Food manufacturers

- 9.2.2 Animal feed industry

- 9.2.3 HoReCa (Hotels, Restaurants, Cafes)

- 9.2.4 Others

- 9.3 B2C

- 9.3.1 Supermarkets & Hypermarkets

- 9.3.2 Specialty stores

- 9.3.3 Convenience stores

- 9.3.4 Online retail

- 9.3.5 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.3.7 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Nestle S.A.

- 11.2 Archer Daniels Midland Company

- 11.3 Cargill, Incorporated

- 11.4 Bunge Limited

- 11.5 Kellogg Company

- 11.6 PepsiCo, Inc. (Quaker Oats)

- 11.7 General Mills, Inc.

- 11.8 Britannia Industries Ltd.

- 11.9 ITC Limited

- 11.10 Patanjali Ayurved Limited

- 11.11 Organic India Pvt. Ltd.

- 11.12 24 Mantra Organic (Sresta Natural Bioproducts)

- 11.13 Nature's Path Foods

- 11.14 Bob's Red Mill Natural Foods

- 11.15 Arrowhead Mills (Hain Celestial Group)