|

市场调查报告书

商品编码

1755370

卫生纸市场机会、成长动力、产业趋势分析及2025-2034年预测Hygienic Paper Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

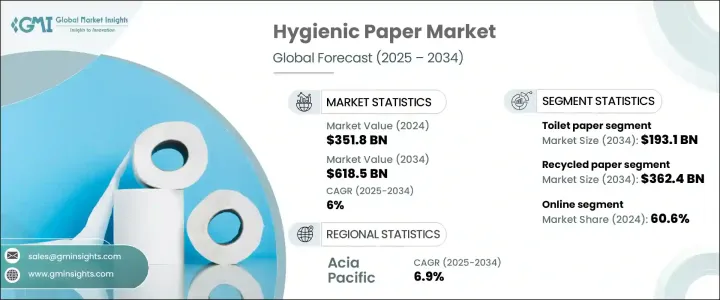

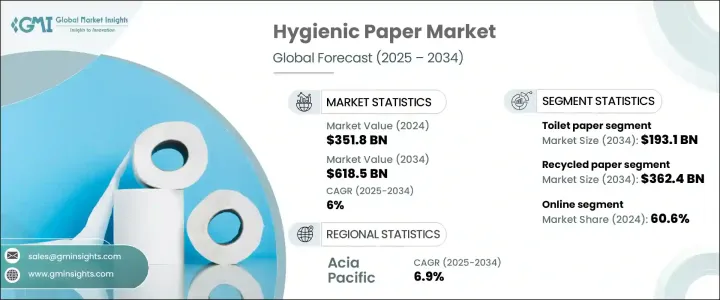

2024年,全球卫生纸市场规模达3,518亿美元,预计到2034年将以6%的复合年增长率成长,达到6,185亿美元。市场强劲的成长轨迹主要得益于消费者对环保产品的偏好日益增长、卫生标准不断提高以及环保意识的不断增强。如今,消费者越来越意识到自身对生态环境的影响,并积极寻求符合绿色价值的永续替代方案。这种行为转变推动了再生卫生纸需求的激增,尤其是在消费者越来越重视安全和环保的情况下。随着个人和社区卫生习惯的不断改进,大众对全球健康议题的关注也促使纸巾、湿纸巾和其他卫生相关产品的广泛普及。

这种行为转变正受到更广泛的永续发展文化运动的强化,而这种文化运动深受环境教育和广泛媒体通报的影响。企业正在透过重新设计产品和供应链来体现这些价值观,确保自身在快速变化的市场中保持竞争力。永续创新和企业责任如今已成为竞争策略的核心。各国政府也发挥重要作用,制定了更严格的环境政策,并提供激励措施来鼓励永续生产。这些法规,加上消费者的期望和技术进步,正在推动环保产品的开发,这些产品既符合卫生标准,又不损害环境完整性。先进材料和永续製程的使用使得生产既高效又环保的卫生纸成为可能,为全球市场创造了长期成长潜力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3518亿美元 |

| 预测值 | 6185亿美元 |

| 复合年增长率 | 6% |

卫生纸市场按类型细分为卫生纸、面纸、纸巾、餐巾纸、湿纸巾以及其他类型,其中包括厨房纸和医用用纸。其中,卫生纸在2024年占据主导地位,创造了1,040亿美元的收入,预计到2034年将达到1931亿美元。其在家庭、企业和公共卫生间的广泛使用确保了稳定的需求。与其他卫生纸产品不同,卫生纸具有不可替代性,且消费量在不同人群和地区之间保持稳定。在许多发展中国家,城市人口的成长和现代卫生设施的普及进一步刺激了其使用量。大量购买习惯也有助于其成为卫生纸领域的主要产品。

就来源而言,市场分为原生纸浆和再生纸。 2024年,再生纸占据主导地位,市值达2,031亿美元,预计2034年将攀升至3,624亿美元。由于消费者和企业越来越倾向于环保产品,再生纸领域将继续保持领先地位。再生卫生纸不仅可以最大限度地减少浪费,还具有成本优势,对製造商和买家都具有吸引力。回收製程的改进显着提高了产品质量,弥合了性能与永续性之间的差距。相较之下,原生纸浆虽然为高阶产品提供了高端品质,但其提取方法耗费资源,会对环境产生负面影响。随着永续发展在全球日益受到关注,这些因素使得再生纸成为更可行的选择。

卫生纸市场的通路包括线上和线下平台。 2024年,线上销售额约占市场份额的60.6%,预计到2034年将以6.5%的复合年增长率成长。由于消费者对便利、快速和非接触式购物的偏好转变,数位平台已占据主导地位。电子商务让价格比较变得便捷,产品种类丰富,以及基于订阅的购买方式,既适合个人消费者,也适合企业消费者。此外,许多製造商正在透过增强线上体验来强化其直接面向消费者的策略,从而使数位管道更具吸引力。

从区域来看,亚太地区在2024年占据了全球卫生纸市场的显着份额,预计在预测期内将以6.9%的最高复合年增长率成长。在该地区,光是中国在2024年的贡献就超过780亿美元,预计到2034年将达到1,587亿美元。都市化进程加快、生活水准提高以及可支配所得的增加是推动需求的关键因素。随着卫生和环保意识的增强,该地区消费者越来越青睐高品质的品牌纸品。製造商也积极投资区域生产和分销基础设施,以满足日益增长的需求。

卫生纸产业的领导者正专注于永续发展、产品创新和高效的供应链管理,以保持竞争力。主要参与者正在根据全球环境趋势和不断变化的消费者期望调整其业务策略,以保持市场份额并实现长期成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 供应商概况

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 衝击力

- 成长动力

- 消费者对环保产品的偏好日益增加

- 提高卫生标准

- 人们对环境议题的认识不断提高,并转向永续实践

- 产业陷阱与挑战

- 造纸所需的能源密集型工艺

- 原料成本与供应链问题

- 成长动力

- 成长潜力分析

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 首选价格范围

- 监管格局

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- Industry structure and concentration

- Competitive intensity assessment

- Company market share analysis

- Competitive positioning matrix

- Product positioning

- Price-performance positioning

- Geographic presence

- Innovation capabilities

- 战略仪表板

- Competitive benchmarking

- Strategic initiatives assessment

- SWOT analysis of key players

- Future competitive outlook

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 卫生纸

- 单层

- 双层

- 其他(三层等)

- 面纸

- 纸巾

- 捲毛巾

- 折迭毛巾

- 其他(中心拉毛巾等)

- 餐巾

- 湿纸巾

- 其他(药用纸、厨房用纸等)

第六章:市场估计与预测:依来源,2021-2034

- 主要趋势

- 原生纸浆

- 再生纸

第七章:市场估计与预测:按价格,2021-2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 家庭

- 商业的

- HoReCa

- 公司的

- 卫生保健

- 其他(水疗中心、机构等)

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 超市/大卖场

- 专卖店

- 其他(个别店舖等)

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- APP

- Cascades

- Essity

- Georgia-Pacific

- Hengan

- Kimberly-Clark

- Mondi

- Nine Dragons Paper

- Oji

- Paperlinx

- Procter & Gamble

- Sofidel

- Suzano

- Vinda

- Wausau Paper

The Global Hygienic Paper Market was valued at USD 351.8 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 618.5 billion by 2034. The market's strong growth trajectory is largely driven by rising consumer preference for eco-friendly products, heightened hygiene standards, and growing environmental consciousness. Shoppers today are increasingly aware of their ecological impact and actively seek sustainable alternatives that align with green values. This shift in behavior has fueled a surge in demand for recycled hygienic paper, especially as consumers place a premium on safety and environmental protection. Public concern over global health issues has also contributed to the widespread adoption of tissues, wipes, and other hygiene-related products as both individual and community hygiene practices continue to evolve.

This behavioral transition is being reinforced by a broader cultural movement toward sustainability, heavily influenced by environmental education and widespread media coverage. Businesses are responding by redesigning products and supply chains to reflect these values, ensuring they stay relevant in a rapidly changing market. Sustainable innovation and corporate responsibility are now central to competitive strategies. Governments are also playing a role by enacting stricter environmental policies while offering incentives to encourage sustainable manufacturing. These regulations, coupled with consumer expectations and technological improvements, are leading to the development of eco-conscious products that meet hygiene standards without compromising environmental integrity. The use of advanced materials and sustainable processes has made it feasible to produce hygienic paper that is both effective and environmentally responsible, creating long-term growth potential for the global market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $351.8 Billion |

| Forecast Value | $618.5 Billion |

| CAGR | 6% |

The hygienic paper market is segmented by type into toilet paper, facial tissues, paper towels, napkins, wet wipes, and others, which include kitchen and medicinal paper. Among these, toilet paper held the dominant share in 2024, generating USD 104 billion in revenue, and is projected to reach USD 193.1 billion by 2034. Its widespread usage in homes, businesses, and public restrooms ensures steady demand. Unlike other hygienic paper products, toilet paper is non-substitutable and consumed consistently across demographics and geographies. In many developing nations, growing urban populations and access to modern sanitation have further fueled usage. Bulk purchasing habits also contribute to the product's reliability as a staple in the hygiene paper segment.

In terms of sources, the market is categorized into virgin pulp and recycled paper. In 2024, recycled paper dominated with a market value of USD 203.1 billion and is expected to climb to USD 362.4 billion by 2034. This segment continues to lead due to the increasing consumer and business preference for environmentally safe options. Recycled hygienic paper not only minimizes waste but also offers cost advantages, making it attractive for both manufacturers and buyers. Improvements in recycling processes have significantly enhanced product quality, bridging the gap between performance and sustainability. In contrast, virgin pulp, while offering high-end quality for premium products, involves resource-intensive extraction methods that negatively impact the environment. These factors make recycled paper the more viable option as sustainability gains traction globally.

Distribution channels in the hygienic paper market include online and offline platforms. In 2024, online sales accounted for approximately 60.6% of the market and are expected to grow at a CAGR of 6.5% through 2034. Digital platforms have gained dominance due to shifting consumer preferences for convenient, fast, and contactless shopping. E-commerce enables easy price comparison, access to a wide product range, and subscription-based purchasing, which suits both individuals and corporate buyers. Moreover, many manufacturers are strengthening their direct-to-consumer strategies through enhanced online experiences, making digital channels even more appealing.

Regionally, Asia Pacific captured a significant share of the global hygienic paper market in 2024 and is projected to grow at the highest CAGR of 6.9% during the forecast period. Within this region, China alone contributed over USD 78 billion in 2024 and is on track to reach USD 158.7 billion by 2034. Rising urbanization, improved living standards, and increasing disposable income are key factors boosting demand. With heightened awareness around hygiene and eco-friendly practices, consumers in the region are embracing high-quality and branded paper products. Manufacturers are also responding with investments in regional production and distribution infrastructure to support this growing demand.

Leading companies in the hygienic paper industry are focusing on sustainability, product innovation, and efficient supply chain management to remain competitive. Key players are aligning their business strategies with global environmental trends and evolving consumer expectations to maintain market share and achieve long-term growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Supplier Landscape

- 3.1.3 Profit margin analysis

- 3.1.4 Disruptions

- 3.1.5 Future outlook

- 3.1.6 Manufacturers

- 3.1.7 Distributors

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer preference for eco-friendly products

- 3.2.1.2 Increased Hygiene Standard

- 3.2.1.3 Growing awareness of environmental issues and a shift towards sustainable practices

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Energy-intensive processes required for paper production

- 3.2.2.2 Raw material costs and supply chain issues

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.4.5 Preferred price range

- 3.5 Regulatory landscape

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.1.1 Industry structure and concentration

- 4.1.2 Competitive intensity assessment

- 4.1.3 Company market share analysis

- 4.1.4 Competitive positioning matrix

- 4.1.4.1 Product positioning

- 4.1.4.2 Price-performance positioning

- 4.1.4.3 Geographic presence

- 4.1.4.4 Innovation capabilities

- 4.1.5 Strategic dashboard

- 4.1.5.1 Competitive benchmarking

- 4.1.5.1.1 Manufacturing capabilities

- 4.1.5.1.2 Product portfolio strength

- 4.1.5.1.3 Distribution network

- 4.1.5.1.4 R&D investments

- 4.1.5.2 Strategic initiatives assessment

- 4.1.5.3 SWOT analysis of key players

- 4.1.5.4 Future competitive outlook

- 4.1.5.1 Competitive benchmarking

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Toilet paper

- 5.2.1 Single ply

- 5.2.2 Double ply

- 5.2.3 Others (Triple ply, etc.)

- 5.3 Facial tissues

- 5.4 Paper towels

- 5.4.1 Roll towels

- 5.4.2 Folded towels

- 5.4.3 Others (Center-pull towels, etc.)

- 5.5 Napkins

- 5.6 Wet wipes

- 5.7 Others (medicinal paper, kitchen paper, etc.)

Chapter 6 Market Estimates & Forecast, By Source, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Virgin pulp

- 6.3 Recycled paper

Chapter 7 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Household

- 8.3 Commercial

- 8.3.1 HoReCa

- 8.3.2 Corporate

- 8.3.3 Healthcare

- 8.3.4 Others (Spa, Institutional, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company website

- 9.3 Offline

- 9.3.1 Supermarket/hypermarket

- 9.3.2 Specialty stores

- 9.3.3 Others (Individual stores, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 APP

- 11.2 Cascades

- 11.3 Essity

- 11.4 Georgia-Pacific

- 11.5 Hengan

- 11.6 Kimberly-Clark

- 11.7 Mondi

- 11.8 Nine Dragons Paper

- 11.9 Oji

- 11.10 Paperlinx

- 11.11 Procter & Gamble

- 11.12 Sofidel

- 11.13 Suzano

- 11.14 Vinda

- 11.15 Wausau Paper