|

市场调查报告书

商品编码

1755382

绝缘混凝土模板 (ICF) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Insulated Concrete Form (ICF) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

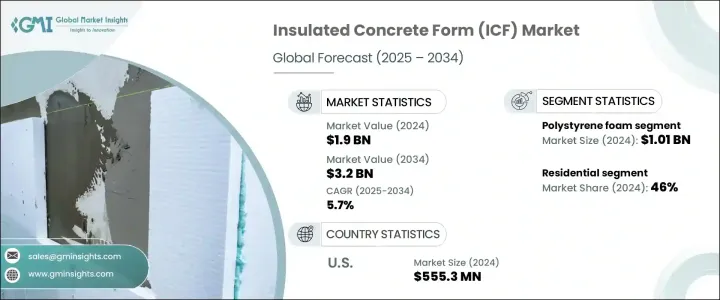

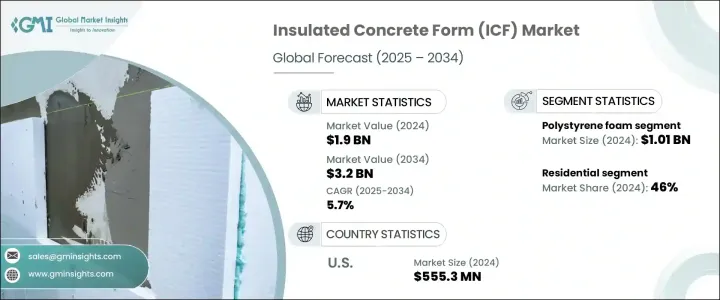

2024年,全球隔热混凝土模板市场价值为19亿美元,预计2034年将以5.7%的复合年增长率成长,达到32亿美元。这一增长势头主要归功于城镇化进程的加快以及对耐用、节能的住宅和商业建筑日益增长的需求。随着城市扩张和基础设施项目规模扩大以满足不断增长的人口需求,建筑业优先考虑能够提供更高能源效率、隔音效果和永续性的解决方案。隔热混凝土模板因其优异的隔热性能和结构强度,正在各个地区获得认可。

政府和监管机构在推广节能建筑实践方面发挥着至关重要的作用。这些倡议正在鼓励开发商和承包商转向支持长期节能和环保责任的先进建筑技术。全球能源政策正在逐步推动近零能耗建筑,推动人们大幅转向使用整合式混凝土(ICF)等现代建筑材料。环保意识的增强,尤其是在房主和开发商群体中,正促使人们越来越多地采用整合式混凝土系统,这些系统被认为是传统建筑方法的更优替代方案。永续建筑规范、更严格的能源法规和绿色认证计画的推动,持续推动着基于整合混凝土的建筑的广泛接受。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 19亿美元 |

| 预测值 | 32亿美元 |

| 复合年增长率 | 5.7% |

在材料方面,聚苯乙烯泡沫塑胶市场在2024年以约10.1亿美元的收入领先市场,预计在预测期内将以6.3%的复合年增长率成长。此细分市场的成长源自于其卓越的隔热性能和成本效益。其轻盈耐用的特性使其在施工现场高度易于管理,从而节省了时间和人工成本。在现场施工过程中,这些材料可以灵活地塑形和切割,这也进一步增加了其受欢迎程度。聚苯乙烯泡沫塑胶产品符合现代建筑标准,强调永续性、热性能和易用性。这种相容性使其成为各种建筑项目的理想选择,从小型住宅到大型机构和商业开发项目。它们在不同结构系统和混凝土应用中的适应性确保了在预测期内需求的一致性。

从应用角度来看,住宅领域在2024年成为领跑者,占市场总收入的46%,预计到2034年复合年增长率将超过6%。由于ICF系统具有隔音效果好、节能高效以及在极端天气条件下的韧性,因此住宅领域持续青睐ICF系统。随着能源成本上升以及消费者对永续生活益处的认识不断提高,住宅建筑中绿色建筑实践的采用势头强劲。激励永续住房解决方案的政策层面的支持进一步增强了这一趋势。建筑商逐渐认识到ICF的长期价值,尤其是在气候波动或恶劣的地区。随着人们对环保住房解决方案的兴趣日益浓厚,以及严格能源法规的日益严格实施,预计住宅建筑在未来几年将继续成为ICF的主要应用领域。

从地区来看,美国以 2024 年 5.553 亿美元的估值引领北美市场,预计 2025 年至 2034 年期间的复合年增长率将达到 6%。市场扩张的动力源于先进的建筑实践、高能源效率标准以及住宅和商业建筑投资的不断增加。对达到或超过现代能源性能预期的建筑的需求日益增长,促使开发商以越来越快的速度采用 ICF。美国多样化的气候区也在这一趋势中发挥重要作用,因为它们需要高性能的隔热系统来降低全年的能耗。越来越多的消费者俱有节能意识,再加上对奖励永续建筑实践的认证的推动,巩固了 ICF 作为美国建筑项目关键材料的地位。

全球隔热混凝土模板市场的主要参与者包括 BecoWallform、Amvic、Buildblock Building System、Fox Blocks、Foam Holdings、Liteform Technologies、Nexcem、Neopar、PFB Corporation、Quad-Lock Building Systems、Polysteel Warmer Wall、Rastra Holding、Standard ICF 和 Superform Products。这些公司积极参与策略合作、产品创新和区域扩张,以巩固其市场地位,并满足全球对隔热混凝土模板日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 川普政府关税的影响

- 贸易影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(客户成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 贸易影响

- 衝击力

- 成长动力

- 都市化和基础设施发展

- 政府推动能源效率的倡议

- 对抗灾结构的需求不断增加

- 产业陷阱与挑战

- 与传统材料相比初始成本更高

- 意识有限且劳动力技能熟练

- 成长动力

- 成长潜力分析

- 监管格局

- 定价分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- Industry structure and concentration

- Competitive intensity assessment

- 公司市占率分析

- 竞争定位矩阵

- 产品定位

- 性价比定位

- 地理分布

- 创新能力

- 战略仪表板

- Competitive benchmarking

- Strategic initiatives assessment

- SWOT analysis of key players

- 未来竞争前景

第五章:市场估计与预测:依资料,2021 年至 2034 年

- 主要趋势

- 聚苯乙烯泡沫塑料

- 聚氨酯泡沫

- 水泥黏合木纤维

- 水泥黏合聚苯乙烯珠

- 泡沫混凝土

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 商业的

- 工业的

- 基础设施

- 住宅

第七章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第八章:公司简介

- Amvic

- BecoWallform

- Buildblock Building System

- Foam Holdings

- Fox Blocks

- Liteform Technologies

- Logix Brands Ltd.

- Neopar

- Nexcem

- PFB Corporation

- Polysteel Warmer Wall

- Quad-Lock Building Systems

- Rastra Holding

- Standard ICF

- Superform Products

The Global Insulated Concrete Form Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 3.2 billion by 2034. This momentum is largely attributed to the increasing pace of urbanization and the growing demand for durable, energy-efficient residential and commercial structures. As cities expand and infrastructure projects scale up to meet rising population needs, the construction sector is prioritizing solutions that offer better energy efficiency, soundproofing, and sustainability. Insulated concrete forms are gaining recognition across various regions due to their high performance in thermal insulation and structural strength.

Governments and regulatory bodies are playing a crucial role by promoting energy-saving construction practices. These initiatives are encouraging developers and contractors to switch to advanced building techniques that support long-term energy savings and environmental responsibility. Global energy policies are progressively pushing for near-zero energy buildings, driving a notable shift toward modern construction materials like ICFs. The surge in eco-consciousness, especially among homeowners and developers, is leading to increased adoption of ICF systems, which are considered superior alternatives to conventional building methods. The push for sustainable building codes, stricter energy regulations, and green certification programs continues to fuel the widespread acceptance of ICF-based construction.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 5.7% |

In terms of material, the polystyrene foam segment led the market with a revenue of approximately USD 1.01 billion in 2024 and is projected to expand at a CAGR of 6.3% over the forecast period. The growth of this segment stems from its excellent thermal insulation properties and cost-effectiveness. Its lightweight and durable nature makes it highly manageable on construction sites, reducing both time and labor expenses. The flexibility to shape and cut these materials during on-site construction activities adds to their growing preference. Polystyrene foam products are aligned with modern building standards that emphasize sustainability, thermal performance, and ease of application. This compatibility makes them ideal for a broad range of construction projects, from small-scale homes to large institutional and commercial developments. Their adaptability across different structural systems and concrete applications ensures consistent demand over the forecast timeline.

Application-wise, the residential segment emerged as the frontrunner in 2024, accounting for 46% of the total market revenue, and is anticipated to register a CAGR of over 6% through 2034. The residential sector continues to favor ICF systems due to their soundproofing capabilities, energy efficiency, and resilience in extreme weather conditions. As energy costs rise and consumers become more aware of the benefits of sustainable living, there is a significant push toward adopting green construction practices in home building. This trend is amplified by policy-level support that incentivizes sustainable housing solutions. Builders are recognizing the long-term value offered by ICFs, particularly in regions with fluctuating or harsh climates. The growing interest in eco-friendly housing solutions and the increasing implementation of stringent energy codes are expected to keep residential construction as the dominant application area for ICFs over the coming years.

Regionally, the United States led the North American market with an estimated valuation of USD 555.3 million in 2024 and is set to witness a CAGR of 6% between 2025 and 2034. The market expansion is driven by a combination of advanced building practices, high energy-efficiency standards, and rising investments in both residential and commercial construction. The demand for buildings that meet or exceed modern energy performance expectations is intensifying, prompting developers to adopt ICFs at a growing rate. The country's diverse climate zones also play a significant role in this trend, as they necessitate high-performance insulation systems to reduce energy consumption throughout the year. The growing number of energy-conscious consumers, combined with the push for certifications that reward sustainable construction practices, has cemented ICFs as a key material in U.S. building projects.

Key players contributing to the global insulated concrete form market include BecoWallform, Amvic, Buildblock Building System, Fox Blocks, Foam Holdings, Liteform Technologies, Nexcem, Neopar, PFB Corporation, Quad-Lock Building Systems, Polysteel Warmer Wall, Rastra Holding, Standard ICF, and Superform Products. These companies are actively engaged in strategic partnerships, product innovation, and regional expansions to strengthen their market positions and cater to the growing global demand for insulated concrete forms.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Trade impact

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (Cost to customers)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook & future considerations

- 3.2.1 Trade impact

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Urbanization and infrastructure development

- 3.3.1.2 Government initiatives promoting energy efficiency

- 3.3.1.3 Increasing demand for disaster-resistant structures

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 Higher initial costs compared to traditional materials

- 3.3.2.2 Limited awareness and skilled workforce

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Pricing analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.1.1 Industry structure and concentration

- 4.1.2 Competitive intensity assessment

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.3.1 Product positioning

- 4.3.2 Price-performance positioning

- 4.3.3 Geographic presence

- 4.3.4 Innovation capabilities

- 4.4 Strategic dashboard

- 4.4.1 Competitive benchmarking

- 4.4.1.1 Manufacturing capabilities

- 4.4.1.2 Product portfolio strength

- 4.4.1.3 Distribution network

- 4.4.1.4 R&D investments

- 4.4.2 Strategic initiatives assessment

- 4.4.3 SWOT analysis of key players

- 4.4.1 Competitive benchmarking

- 4.5 Future competitive outlook

Chapter 5 Market Estimates & Forecast, By Material, 2021 – 2034, (USD Million) (Thousand Per Sq foot)

- 5.1 Key trends

- 5.2 Polystyrene foam

- 5.3 Polyurethane foam

- 5.4 Cement-bonded wood fiber

- 5.5 Cement-bonded polystyrene beads

- 5.6 Cellular concrete

Chapter 6 Market Estimates & Forecast, By Application, 2021 – 2034, (USD Million) (Thousand Per Sq foot)

- 6.1 Key trends

- 6.2 Commercial

- 6.3 Industrial

- 6.4 Infrastructure

- 6.5 Residential

Chapter 7 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Million) (Thousand Per Sq foot)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 Saudi Arabia

- 7.6.2 UAE

- 7.6.3 South Africa

Chapter 8 Company Profiles

- 8.1 Amvic

- 8.2 BecoWallform

- 8.3 Buildblock Building System

- 8.4 Foam Holdings

- 8.5 Fox Blocks

- 8.6 Liteform Technologies

- 8.7 Logix Brands Ltd.

- 8.8 Neopar

- 8.9 Nexcem

- 8.10 PFB Corporation

- 8.11 Polysteel Warmer Wall

- 8.12 Quad-Lock Building Systems

- 8.13 Rastra Holding

- 8.14 Standard ICF

- 8.15 Superform Products