|

市场调查报告书

商品编码

1850104

绝缘混凝土模板(ICF):市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)Insulated Concrete Form (ICF) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

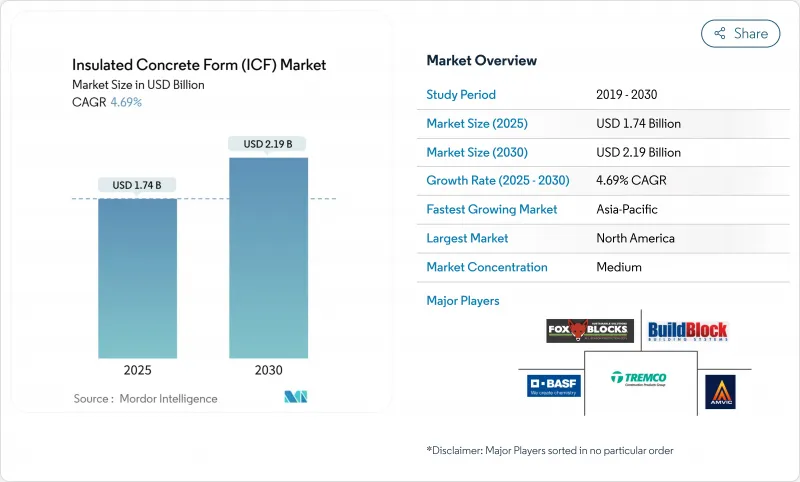

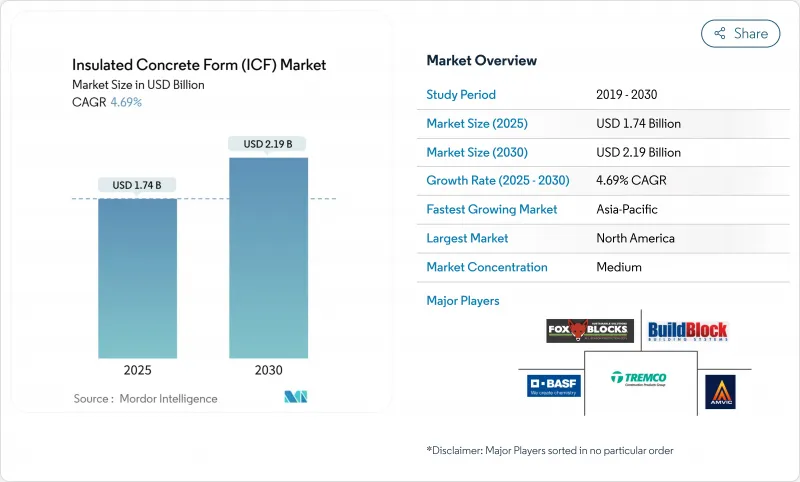

预计绝缘混凝土模板市场将从 2025 年的 17.4 亿美元成长到 2030 年的 21.9 亿美元,复合年增长率为 4.69%。

这种稳定扩张反映了建筑业正转向节能建筑围护结构,以满足日益严格的监管要求,同时降低全生命週期营运成本。强有力的政策支持、不断上涨的能源价格以及日益增强的气候适应意识,正在加速节能建筑围护结构的采用,尤其是在飓风、野火和极端气温使传统墙体面临风险的地区。虽然住宅计划仍然占订单的大部分,但商业开发人员和公共机构正在扩大订单,以实现净零排放和隔音目标。北美仍然是最大的采购地区,但随着中国和印度在其国家建筑规范中纳入更高的隔热等级,亚太地区的成长速度最快。

全球绝缘混凝土模板 (ICF) 市场趋势与洞察

节能高层建筑的需求不断增加

2024年《国际节能规范》强制要求在气候区4区和5区使用外墙保温,将保温混凝土模板定位为多层计划的合规解决方案。由于混凝土核心被隔热材料包裹,开发商可以一步满足监管要求并减少热桥效应。不断上涨的能源成本进一步提高了投资回报,鼓励业主选择能够维持数十年性能的墙体。由于采用此规范的辖区集中在高层建筑占土地利用规划主导地位的大都会圈,因此对保温混凝土的需求可能会成长。

越来越多采用创新施工方法

持续的技术工人短缺正促使承包商选择较少依赖传统框架结构的施工方法。根据组装绝缘混凝土模板的工人报告,由于简化了堆放流程并减少了回访,工时节省高达 30%。块状模组有利于预製和可重复的工作流程,使公司能够在不牺牲品质的情况下扩大劳动力资源。随着劳动力老化和持续的招募挑战,简化的安装方式将增加其长期吸引力。

与木造建筑相比,初始成本较高

即使木材价格飙升,建商在选择隔热混凝土模板时仍需支付3-8%的溢价,小型企业还必须租用混凝土泵并支付结构工程审查费用。儘管全生命週期的公用事业成本较低,但这些成本仍然阻碍了预算受限的计划。虽然激励计划和不断上涨的能源价格正在逐渐抵消这一差额,但初始成本敏感性仍然是一个障碍。

細項分析

2024年,聚苯乙烯块占据了绝缘混凝土模板市场份额的88.60%,预计到2030年将以每年4.72%的速度成长。这一份额的成长主要得益于聚苯乙烯板材,这种板材能够在混凝土浇筑过程中承受湿气,同时达到R-22至R-26的耐候性。阻燃添加剂有助于满足监管要求,而回收计画则对寻求循环经济的市政当局颇具吸引力。

聚氨酯、水泥黏结木纤维和珠粒增强混合物占据着特殊的市场。聚氨酯即使在狭小的地块上也能提供较高的每英吋R值,而水泥和木纤维块则符合区域标准和采购偏好。含有5%生物基成分的生物基聚异戊二烯将于2024年首次亮相,这标誌着绿色化学的新方向。随着隐含碳排放法规的收紧,替代发泡体可能会获得市场份额,但聚苯乙烯的规模化优势将支撑其保持领先地位。

预计到2024年,平板模板将占销售额的54.17%,这巩固了其作为总承包商预设选择的地位。儘管平板解决方案的隔热混凝土模板市场规模预计将稳定成长,但空心网架产品的复合年增长率高达5.32%,能够在不牺牲承载能力的情况下减少混凝土用量,从而带来显着的经济效益。承包商青睐中空网架堆放时更轻的起重、更快的浇筑速度以及更低的爆裂风险。

华夫格栅板适用于需要厚发泡体的高隔热结构,而柱樑结构仍然受到寻求裸露混凝土肋条的建筑师的青睐。连接硬体、实用箱体和定位支撑也在不断发展,从而在易用性方面创造了竞争优势。随着工程可靠性的提高,设计团队可能会指定兼具性能和美观灵活性的混合格栅。

区域分析

2024年,北美将占全球销售量的39.50%,这得益于参考了隔热混凝土模板的《示范能源法规》以及密集的认证安装商网路。美国联邦基础设施资金强调能够抵御极端风灾和野火的弹性建筑,该系统无需额外加层即可带来许多优势。

亚太地区是成长最快的地区,预计到 2030 年复合年增长率为 5.03%。印度的节能建筑规范的目标是节能 25-50%,这对于不熟悉帷幕墙细节的开发商来说是一个可行的选择。

在欧洲,由于实施了最严格的碳排放和能源基准,砌体建筑的传统应用速度有所减缓。在南美洲和中东,电费上涨和城市人口密度不断上升带来了新的可能性,但承包商知识的匮乏以及与之竞争的低成本方法迄今为止限制了砌体建筑的应用。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 节能高层建筑的需求不断增加

- 越来越多采用创新施工程序

- 更严格的绿建筑法规和奖励

- 密集都市区填充区对隔音材料的需求不断增加

- 人们对永续建筑材料的认识不断提高

- 市场限制

- 与木製建筑相比初始成本更高

- 承包商知识缺乏,技术纯熟劳工短缺

- VOC排放法规

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 材料类型

- 聚苯乙烯泡沫塑料

- 聚氨酯泡棉

- 水泥黏合木纤维

- 水泥黏合聚苯乙烯珠

- 系统类型

- 平墙系统

- 华夫格网格系统

- 萤幕网格系统

- 樑柱节点体系

- 建筑类型

- 新建筑

- 维修和重建

- 目的

- 住宅

- 商业的

- 机构

- 地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Airlite Plastics Company & Fox Blocks(Fox Blocks)

- Alleguard

- Amvic Ireland LTD

- BASF

- Beco Products Ltd

- BuildBlock Building Systems LLC

- Carlisle Construction Materials(Carlisle Companies Inc.)

- Durisol

- Future Foam Inc.

- INTEGRASPEC

- LiteForm

- Logix Brands Ltd.

- Polycrete International

- Quad-Lock Building Systems

- RASTRA

- RPM International Inc.

- Sismo Building Technology

- SuperForm

- TF System

- Tremco CPG Inc.

第七章 市场机会与未来展望

The insulated concrete forms market is valued at USD 1.74 billion in 2025 and is forecast to reach USD 2.19 billion by 2030, advancing at a 4.69% CAGR.

The steady expansion reflects the construction sector's pivot toward energy-efficient building envelopes that satisfy tightening codes while lowering lifetime operating costs. Strong policy support, rising energy prices, and heightened awareness of climate resilience are amplifying adoption, especially where hurricanes, wildfires, or temperature extremes put conventional walls at risk. Residential projects still account for most placements, yet commercial developers and public agencies are scaling up orders to meet net-zero and acoustic targets. North America remains the largest regional buyer, but Asia-Pacific is logging the fastest percentage gains as China and India embed higher insulation levels in national building laws.

Global Insulated Concrete Form (ICF) Market Trends and Insights

Rising Demand for Energy-Efficient High-rise Buildings

The 2024 International Energy Conservation Code now mandates exterior continuous insulation in Climate Zones 4 and 5, positioning insulated concrete forms as a compliance solution for multi-story projects. Developers can satisfy code rules and cut thermal bridging within a single step because the concrete core is wrapped by insulation. Higher utility prices further increase the payback value, encouraging owners to select walls that lock in performance for decades. Jurisdictions adopting the code are clustered in metropolitan areas where high-rise construction dominates land-use planning, so demand is likely to intensify.

Increased Adoption of Innovative Construction Procedures

A persistent skilled-labor shortfall is prompting contractors to choose methods that reduce reliance on traditional framing crews. Crews assembling insulated concrete forms report up to 30% schedule savings thanks to simplified stacking and reduced call-backs. The block-like modules lend themselves to prefabrication and repeatable workflows, allowing firms to enlarge their labor pool without sacrificing quality. As the workforce ages and recruitment remains challenging, simplified installation strengthens long-term appeal.

High Upfront Cost Versus Wood Framing

Even after lumber price spikes, builders face a 3-8% premium when choosing insulated concrete forms, and smaller firms must rent concrete pumps and pay for structural engineering reviews. These expenses deter budget-constrained projects despite lower lifetime utility bills. Incentive programs and rising energy tariffs are gradually offsetting the difference, but first-cost sensitivity remains a hurdle.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Green-building Codes and Incentives

- Growing Demand for Acoustic Insulation in Dense Urban Infill

- Limited Contractor Familiarity and Skilled Labor Gap

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polystyrene blocks controlled 88.60% of the insulated concrete forms market share in 2024, and the segment is forecast to expand at 4.72% annually to 2030. This command rests on EPS panels that deliver R-22 to R-26 while resisting moisture during concrete placement. Flame-retardant additives help meet code, and recycling programs appeal to municipalities pursuing circular-economy goals.

Polyurethane, cement-bonded wood fiber, and bead-enhanced mixes occupy specialist niches. Polyurethane delivers higher R-values per inch for tight sites, whereas cement, wood fiber blocks satisfy regional code or sourcing preferences. Bio-based polyiso containing 5% bio-circular feedstock debuted in 2024 and signals an emerging green-chemistry direction. As mandates on embodied carbon tighten, alternative foams could gain share, yet polystyrene's scaling advantages support its leadership.

Flat-wall assemblies captured 54.17% of 2024 revenues, confirming their position as the default choice for general contractors. The insulated concrete forms market size for flat-wall solutions is projected to rise steadily, but screen-grid products, growing at 5.32% CAGR, offer compelling economics by trimming concrete volumes without sacrificing load capacity. Contractors appreciate lighter lifts, faster pours, and fewer blow-out risks when stacking hollow-web grids.

Waffle-grid panels serve high-insulation jobs that demand thicker foam, while post-and-beam formats remain popular with architects who want exposed concrete ribs. Connection hardware, utility chases, and alignment bracing continue to evolve, signaling a competitive push toward ease-of-use. As engineering confidence broadens, design teams may specify hybrid grids that merge performance and aesthetic flexibility.

The Insulated Concrete Forms Market Report Segments the Industry by Material Type (Polystyrene Foam, Polyurethane Foam, and More), System Type (Flat-Wall Systems, Waffle-Grid Systems, and More), Construction Type (New-Build and Retrofit / Remodeling), Application (Residential, Commercial, and Institutional), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

North America generated 39.50% of global revenue in 2024, underpinned by model energy codes that reference insulated concrete forms and a dense network of certified installers. US federal infrastructure funding emphasizes resilient construction that withstands extreme wind and wildfire, benefits that the system delivers without extra layers.

Asia-Pacific is the fastest climber, expected to post a 5.03% CAGR to 2030. India's Energy Conservation Building Code, targeting 25-50% energy savings, positions forms as a ready path for developers unfamiliar with curtain-wall detailing.

Europe enforces some of the strictest carbon and energy benchmarks, yet masonry traditions slow adoption. In South America and the Middle East, rising electricity tariffs and urban densification open potential, but limited contractor familiarity and competing low-cost methods keep penetration modest for now.

- Airlite Plastics Company & Fox Blocks (Fox Blocks)

- Alleguard

- Amvic Ireland LTD

- BASF

- Beco Products Ltd

- BuildBlock Building Systems LLC

- Carlisle Construction Materials (Carlisle Companies Inc.)

- Durisol

- Future Foam Inc.

- INTEGRASPEC

- LiteForm

- Logix Brands Ltd.

- Polycrete International

- Quad-Lock Building Systems

- RASTRA

- RPM International Inc.

- Sismo Building Technology

- SuperForm

- TF System

- Tremco CPG Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Energy-efficient High-rise Buildings

- 4.2.2 Increased Adoption of Innovative Construction Procedures

- 4.2.3 Stricter Green-building Codes and Incentives

- 4.2.4 Growing Demand for Acoustic Insulation in Dense Urban Infill

- 4.2.5 Rising Awareness of Sustainable Construction Materials

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost Versus Wood Framing

- 4.3.2 Limited Contractor Familiarity and Skilled Labor Gap

- 4.3.3 Regulations for VOC Emission

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 Material Type

- 5.1.1 Polystyrene Foam

- 5.1.2 Polyurethane Foam

- 5.1.3 Cement-Bonded Wood Fiber

- 5.1.4 Cement-Bonded Polystyrene Beads

- 5.2 System Type

- 5.2.1 Flat-Wall Systems

- 5.2.2 Waffle-Grid Systems

- 5.2.3 Screen-Grid Systems

- 5.2.4 Post-and-Beam Systems

- 5.3 Construction Type

- 5.3.1 New-build

- 5.3.2 Retrofit / Remodelling

- 5.4 Application

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.3 Institutional

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Airlite Plastics Company & Fox Blocks (Fox Blocks)

- 6.4.2 Alleguard

- 6.4.3 Amvic Ireland LTD

- 6.4.4 BASF

- 6.4.5 Beco Products Ltd

- 6.4.6 BuildBlock Building Systems LLC

- 6.4.7 Carlisle Construction Materials (Carlisle Companies Inc.)

- 6.4.8 Durisol

- 6.4.9 Future Foam Inc.

- 6.4.10 INTEGRASPEC

- 6.4.11 LiteForm

- 6.4.12 Logix Brands Ltd.

- 6.4.13 Polycrete International

- 6.4.14 Quad-Lock Building Systems

- 6.4.15 RASTRA

- 6.4.16 RPM International Inc.

- 6.4.17 Sismo Building Technology

- 6.4.18 SuperForm

- 6.4.19 TF System

- 6.4.20 Tremco CPG Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment