|

市场调查报告书

商品编码

1766164

高压加工设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测High-Pressure Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

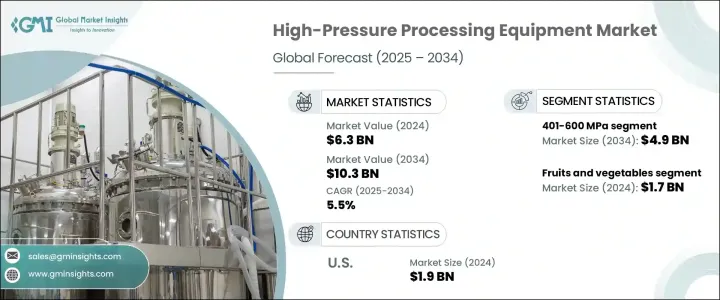

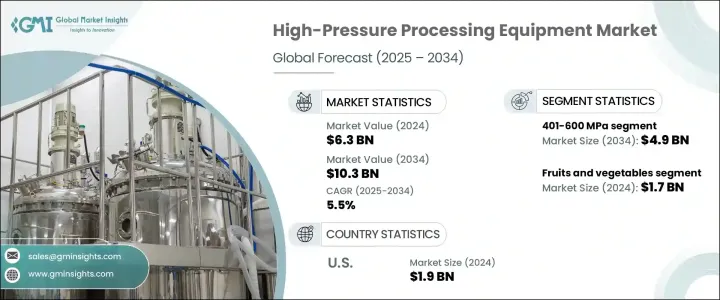

2024年全球高压加工设备市场规模达63亿美元,预计2025年至2034年将以5.5%的复合年增长率成长,达到103亿美元。这一增长源于消费者对健康、无防腐剂食品日益增长的偏好,这与对清洁标籤产品日益增长的需求相一致。高压加工(HPP)技术正越来越多地被应用于生产无需使用化学防腐剂即可保留其天然风味、质地和营养成分的食品。随着消费者健康意识的增强,保持产品完整性至关重要,尤其是在果汁、即食食品和熟食肉类等类别中。高压加工(HPP)技术采用的非热保存方法,使製造商能够提供经过少量加工的食品,这些食品在保持营养价值的同时,还能延长保质期。在竞争激烈、食品安全仍是首要任务的市场中,这种技术尤其具有吸引力。

此外,高压处理 (HPP) 可有效灭活李斯特菌、沙门氏菌和大肠桿菌等有害病原体,确保食品安全。这些病原体是导致食源性疾病的主要因素。该技术无需使用化学防腐剂或加热即可实现这一目标,使其成为一种极具价值的非热食品保鲜方法。透过确保消除这些危险病原体,HPP 可协助食品製造商遵守严格的全球食品安全法规,包括美国食品药物管理局 (FDA)、美国农业部 (USDA) 和其他国际管理机构制定的法规。随着食品安全持续成为消费者的首要关注点,采用 HPP 的製造商不仅可以保护其产品,还可以提升其信誉和品牌声誉。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 63亿美元 |

| 预测值 | 103亿美元 |

| 复合年增长率 | 5.5% |

401-600 MPa 压力段在 2024 年创造了 31 亿美元的市场规模,预计到 2034 年将达到 49 亿美元。这项压力等级实现了安全性和品质的完美平衡,确保有效杀死微生物,同时保留食品的风味、色泽和营养成分。它尤其受到加工肉类、海鲜、乳製品和即食食品等各类产品的加工商的青睐。其多功能性和可扩展性使其成为加工多种食品类别的大型工厂的首选。此压力范围完全符合全球病原体控制监管标准,这对食品生产商至关重要,尤其是在美国、欧洲和日本等出口市场。随着食品安全法规日益严格,401-600 MPa 压力段正成为致力于满足国际合规要求的加工商的行业标准。

2024年,水果和蔬菜细分市场产值达17亿美元,占27.4%。高压加工尤其适用于冷压果汁和冰沙,因为它能够保留这些易腐产品的天然新鲜度、口感和营养成分,同时延长其保质期。这一细分市场需求旺盛,尤其是在北美和亚太地区,注重健康的消费者正在推动市场发展。水果和蔬菜极易变质,而传统的高温巴氏杀菌方法会破坏其颜色、风味和营养成分。高压加工 (HPP) 提供了一种非热解决方案,使其成为优质、有机和清洁标籤产品的关键。由于水果和蔬菜的pH值低且水分活度高,它们容易受到污染,而高压加工可以透过杀死有害微生物来缓解污染。

2024年,美国高压加工设备市场规模达19亿美元,预计2034年将以5.2%的复合年增长率成长。凭藉着完善的食品加工基础设施和日益增长的消费者对清洁标籤产品的需求,美国仍是北美市场的领导者。冷压果汁、有机婴儿食品和新鲜酪梨酱等低加工食品日益流行,刺激了对高压加工技术(HPP)的投资。此外,美国拥有完善的监管框架,美国食品药物管理局(FDA)和美国农业部(USDA)积极推行食品安全标准。高压加工技术被公认为一种无需加热或使用化学物质即可有效杀死病原体的方法,因此对食品製造商而言是一个颇具吸引力的选择。

全球高压加工设备市场的领导者包括包头科发高压技术有限公司、Avure Technologies(JBT Corporation)、美国巴氏杀菌公司(APC)、Engineered Pressure Systems International(EPSI)和Hiperbaric SA。高压加工设备市场的公司正致力于提升其係统的多功能性,以满足从肉类、海鲜到即食食品等各种食品类别的需求。设备设计的创新,以提高效率、可扩展性和食品安全性,是其主要关注点。

许多公司也正在投资扩大其全球业务,与不同地区的食品生产商建立合作伙伴关係,尤其是在北美和欧洲。此外,他们还向製造商宣传高压处理 (HPP) 技术的优势,强调其在延长保质期和维持营养品质方面的作用。永续性是另一个优先事项,各公司都希望提高其设备的能源效率和环境影响。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业影响力量

- 成长动力

- 消费者对清洁标籤和低加工食品的需求不断增长

- 增强食品安全和法规遵从性

- 延长保存期限,支持永续发展目标

- 产业陷阱与挑战

- 高资本投资和营运成本

- 消费者认知度和接受度有限

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依设备类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依设备类型,2021 - 2034 年

- 主要趋势

- 大量处理设备

- 半连续加工设备

- 连续加工设备

- 辅助设备

- 装载/卸载系统

- 泵浦和增压器

- 控制系统

- 传送带和自动化套件

- 其他(实验室/中试系统等)

第六章:市场估计与预测:依压力范围,2021 年至 2034 年

- 主要趋势

- 高达400 MPa

- 401–600兆帕

- 600MPa以上

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 水果和蔬菜

- 肉类和家禽

- 海鲜

- 饮料

- 乳製品

- 即食食品

- 其他(宠物食品等)

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 食品和饮料製造商

- 合约收费服务提供者

- 研究与学术机构

- 製药和生物技术公司

- 其他(宠物食品製造商等)

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直接的

- 间接

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- American Pasteurization Company (APC)

- Avure Technologies (JBT Corporation)

- Bao Tou KeFa High Pressure Technology Co., Ltd.

- Hiperbaric SA

- HPP Italia Srl

- Kobe Steel Ltd.

- Multivac Sepp Haggenmuller SE & Co. KG

- Next HPP

- Pulsemaster

- Quintus Technologies AB

- Stansted Fluid Power Ltd

- Thyssenkrupp AG

- Universal Pure, LLC

The Global High-Pressure Processing Equipment Market was valued at USD 6.3 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 10.3 billion by 2025 - 2034. This growth is driven by a growing consumer preference for healthy, preservative-free foods, which aligns with the increasing demand for clean-label products. HPP technology is increasingly being adopted to produce food that retains its natural taste, texture, and nutritional profile without the use of chemical preservatives. As consumers become more health-conscious, the ability to maintain product integrity, especially in categories like juices, ready-to-eat meals, and deli meats, is vital. The non-thermal preservation method used in HPP allows manufacturers to offer minimally processed foods that have an extended shelf life while maintaining nutritional value. This is particularly appealing in a competitive market where food safety remains a priority.

Additionally, High Pressure Processing (HPP) helps ensure food safety by effectively inactivating harmful pathogens like Listeria, Salmonella, and E. coli, all of which are major contributors to foodborne illnesses. The technology achieves this without the need for chemical preservatives or heat, making it a highly valuable non-thermal food preservation method. By ensuring the elimination of these dangerous pathogens, HPP helps food manufacturers comply with stringent global food safety regulations, including those set by the FDA, USDA, and other international governing bodies. As food safety continues to be a top priority for consumers, manufacturers that utilize HPP can not only protect their products but also enhance their credibility and brand reputation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.3 Billion |

| Forecast Value | $10.3 Billion |

| CAGR | 5.5% |

The 401-600 MPa pressure segment generated USD 3.1 billion in 2024 and is expected to reach USD 4.9 billion by 2034. This pressure level offers the right balance of safety and quality, ensuring effective microbial reduction while preserving the taste, color, and nutrients of the food. It is particularly favored by processors working with a variety of products such as meat, seafood, dairy, and ready-to-eat meals. Its versatility and scalability make it the go-to choice for large-scale facilities processing multiple food categories. This pressure range aligns well with global regulatory standards for pathogen control, which is crucial for food producers, particularly in export markets such as the U.S., Europe, and Japan. As food safety regulations become stricter, the 401-600 MPa segment is becoming the industry standard for processors aiming to meet international compliance.

The fruits and vegetables segment generated USD 1.7 billion and held a 27.4% share in 2024. High-pressure processing is particularly well-suited for cold-pressed juices and smoothies, as it preserves the natural freshness, texture, and nutrition of these perishable products while extending their shelf life. This segment has experienced significant demand, especially in North America and Asia Pacific, where health-conscious consumers are driving the market. Fruits and vegetables are highly susceptible to spoilage, and traditional thermal pasteurization methods can damage their color, flavor, and nutritional content. HPP provides a non-thermal solution, making it essential for premium, organic, and clean-label products. Given their low pH and high water activity, fruits and vegetables are vulnerable to contamination, which HPP helps mitigate by killing harmful microorganisms.

U.S. High-Pressure Processing Equipment Market was valued at USD 1.9 billion in 2024 and is projected to grow at a CAGR of 5.2% through 2034. The U.S. remains the leader in North America due to its well-established food processing infrastructure and growing consumer demand for clean-label products. The increasing popularity of minimally processed foods like cold-pressed juices, organic baby foods, and fresh guacamole has spurred investments in HPP technology. Additionally, the U.S. benefits from a robust regulatory framework, with the FDA and USDA actively promoting food safety standards. HPP technology is recognized as an effective method for eliminating pathogens without using heat or chemicals, making it an attractive option for food manufacturers.

Leading players in the Global High-Pressure Processing Equipment Market include Bao Tou KeFa High-Pressure Technology Co., Ltd., Avure Technologies (JBT Corporation), American Pasteurization Company (APC), Engineered Pressure Systems International (EPSI), and Hiperbaric S.A. Companies in the high-pressure processing equipment market are focusing on enhancing the versatility of their systems to cater to various food categories, from meat and seafood to ready-to-eat meals. Innovation in equipment design to improve efficiency, scalability, and food safety is a primary focus.

Many companies are also investing in the expansion of their global footprint by establishing partnerships with food producers across regions, particularly in North America and Europe. In addition, they are promoting the benefits of HPP technology to manufacturers by emphasizing its role in extending shelf life and maintaining nutritional quality. Sustainability is another priority, with companies looking to improve the energy efficiency and environmental impact of their equipment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Pressure range

- 2.2.4 Application

- 2.2.5 End User

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer demand for clean-label and minimally processed foods

- 3.2.1.2 Enhanced food safety and regulatory compliance

- 3.2.1.3 Extended shelf life supporting sustainability goals

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital investment and operational costs

- 3.2.2.2 Limited consumer awareness and acceptance

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Batch processing equipment

- 5.3 Semi-continuous processing equipment

- 5.4 Continuous processing equipment

- 5.5 Ancillary equipment

- 5.5.1 Loading/unloading systems

- 5.5.2 Pumps and intensifiers

- 5.5.3 Control systems

- 5.5.4 Conveyors and automation kits

- 5.6 Others (Laboratory/Pilot Systems, etc.)

Chapter 6 Market Estimates & Forecast, By Pressure Range, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Up to 400 MPa

- 6.3 401– 600 MPa

- 6.4 Above 600 MPa

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Fruits and vegetables

- 7.3 Meat and poultry

- 7.4 Seafood

- 7.5 Beverages

- 7.6 Dairy products

- 7.7 Ready-to-eat Meals

- 7.8 Others (Pet Food, etc.)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & Beverage manufacturers

- 8.3 Contract tolling service providers

- 8.4 Research & Academic institutions

- 8.5 Pharmaceutical & Biotech firms

- 8.6 Others (Pet Food Manufacturers, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 U.K.

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 American Pasteurization Company (APC)

- 11.2 Avure Technologies (JBT Corporation)

- 11.3 Bao Tou KeFa High Pressure Technology Co., Ltd.

- 11.4 Hiperbaric S.A.

- 11.5 HPP Italia S.r.l.

- 11.6 Kobe Steel Ltd.

- 11.7 Multivac Sepp Haggenmuller SE & Co. KG

- 11.8 Next HPP

- 11.9 Pulsemaster

- 11.10 Quintus Technologies AB

- 11.11 Stansted Fluid Power Ltd

- 11.12 Thyssenkrupp AG

- 11.13 Universal Pure, LLC