|

市场调查报告书

商品编码

1766203

热转印印表机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Thermal Transfer Printer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

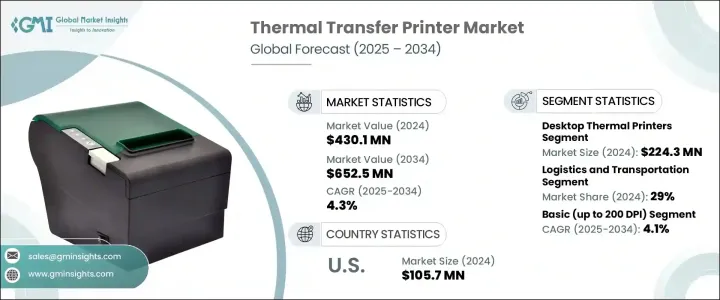

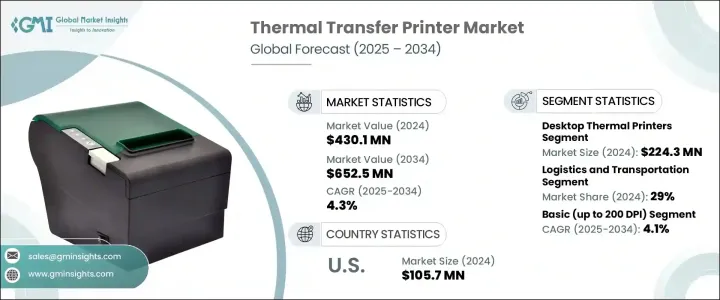

2024 年全球热转印印表机市场规模为 4.301 亿美元,预计到 2034 年将以 4.3% 的复合年增长率成长,达到 6.525 亿美元。这一增长得益于对可靠、持久标籤解决方案日益增长的需求以及印刷技术的持续进步。随着企业优先考虑高效率的标籤系统,对智慧热转印印表机的需求也不断攀升。云端列印、行动连线和无线设定等最新创新正在提高可用性并推动其更广泛的应用。新兴的热激活无墨列印方法也正在重塑市场,因为它们无需使用传统的墨水。同时,向永续发展的转变正在推动环保色带替代品的开发,以减少对生态的影响。製造商正在积极投资更环保的选择,使用可再生、可生物降解的材料来取代石油基塑料,以符合更广泛的企业责任目标。

这些趋势不仅提升了功能性,也使热敏列印技术与环境法规和不断变化的客户期望一致。製造商如今更加重视永续产品开发,推出可生物降解的色带、可回收零件和节能列印系统。为了因应更严格的合规标准,企业正在整合低排放技术并采用更环保的生产流程,以减少碳足迹。同时,使用者对印表机的要求不仅仅是效能,他们想要的是智慧、连网且环保的设备。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.301亿美元 |

| 预测值 | 6.525亿美元 |

| 复合年增长率 | 4.3% |

桌上型热感式印表机市场在2024年创造了2.243亿美元的市场规模,预计复合年增长率为4.1%。其日益普及的趋势得益于其紧凑的设计、无线相容性和用户友好的功能。这类印表机广泛应用于医疗保健、物流和零售等行业,能够支援高效运营,同时优化空间利用。企业更青睐能够处理多种介质类型和尺寸、提高工作流程灵活性并最大程度减少设备占用空间的多功能解决方案。

物流和运输业在2024年占据29%的市场份额,预计到2034年将以4.7%的复合年增长率成长。这些行业严重依赖热转印印表机来製作耐用、可扫描的标籤,用于追踪和运输。高解析度、持久耐用的标籤对于供应链管理至关重要,因为它们能够承受环境压力和频繁搬运。行动列印功能也越来越受欢迎,可以在配送过程中和配送点按需製作标籤。这种便携性提高了整个物流工作流程的准确性和速度,支援即时库存控制和无缝营运。

美国热转印印表机市场占83%的市场份额,2024年市场规模达1.057亿美元。这一领先地位的形成得益于快节奏产业对耐用标籤解决方案日益增长的需求以及电子商务的快速发展。随着直接面向客户的订单履行模式的兴起,对列印的运输标籤、条码和包装标识的需求也随之增加,而热转印印表机能够有效地列印这些标籤。美国企业正积极采用这些技术,以快速可靠的方式满足大量生产需求。

为全球热转印印表机产业成长做出贡献的主要公司包括 APS Group、Domino Printing、SATO America、Markem-Imaje、Linx Printing Technologies、Videojet Technologies、Weber Packaging Solutions、PrintJet、Brother、Hanin (HRPT)、Kite Packaging、DNP Group、Brady、Heller Group 和 TE。为了巩固其在全球热转印印表机市场的地位,各公司正在执行以创新、客製化和永续性为中心的策略。他们正在开发具有基于云端的列印、远端存取和无缝移动整合功能的智慧印表机,以满足精通技术的用户的需求并提高操作便利性。主要参与者也正在推出可生物降解色带等永续产品,以减少对环境的影响并吸引具有环保意识的买家。此外,製造商透过提供适用于不同行业应用的模组化紧凑设计来提高产品灵活性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计(HS 编码 - 84433290)

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 桌上型热感式印表机

- 行动热感式印表机

- 工业热感式印表机

第六章:市场估计与预测:依彩色印刷能力,2021 - 2034 年

- 主要趋势

- 单色

- 多色的

第七章:市场估计与预测:按列印速度,2021 - 2034 年

- 主要趋势

- 慢速(最高 150 毫米/秒)

- 中(200 毫米/秒)

- 快速(300 毫米/秒)

- 超快(400 毫米/秒)

第八章:市场估计与预测:依印刷质量,2021 - 2034 年

- 主要趋势

- 基本(最高 200 DPI)

- 半专业(高达 300 DPI)

- 专业(高达 600 DPI)

第九章:市场估计与预测:依用途,2021 - 2034 年

- 主要趋势

- 卡片和徽章印表机

- 条码

- 标籤

- 收据

- 标籤

- 腕带

- 其他的

第 10 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 製造业

- 物流和运输

- 卫生保健

- 零售

- 政府

- 其他(酒店业等)

第 11 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直销

- 间接销售

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十三章:公司简介

- APS Group

- Brady

- Brother

- DNP Group

- Domino Printing

- Hanin (HRPT)

- Hellermann Tyton

- Kite Packaging

- Linx Printing Technologies

- Markem-Imaje

- PrintJet

- SATO America

- TE Connectivity

- Videojet Technologies

- Weber Packaging Solutions

The Global Thermal Transfer Printer Market was valued at USD 430.1 million in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 652.5 million by 2034. This growth is fueled by the rising need for reliable, long-lasting labeling solutions and continued advancements in printing technologies. As businesses prioritize efficient labeling systems, the demand for smart thermal transfer printers is climbing. Recent innovations such as cloud printing, mobile connectivity, and wireless setup are enhancing usability and driving wider adoption. Emerging heat-activated, inkless printing methods are also reshaping the market by eliminating traditional ink needs. Meanwhile, the shift toward sustainability is driving the development of environmentally friendly ribbon alternatives that reduce ecological impact. Manufacturers are actively investing in greener options using renewable, biodegradable materials to replace petroleum-based plastics, aligning with broader corporate responsibility goals.

These trends are not only improving functionality but also aligning thermal printing technology with environmental regulations and evolving customer expectations. Manufacturers are now placing greater emphasis on sustainable product development by introducing biodegradable ribbons, recyclable components, and energy-efficient printing systems. In response to stricter compliance standards, companies are integrating low-emission technologies and adopting greener production processes to reduce their carbon footprint. At the same time, users are demanding printers that offer more than just performance-they want smart, connected, and eco-conscious devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $430.1 Million |

| Forecast Value | $652.5 Million |

| CAGR | 4.3% |

The desktop thermal printers segment generated USD 224.3 million in 2024 and is forecast to grow at a 4.1% CAGR. Their increasing popularity is linked to compact designs, wireless compatibility, and user-friendly features. Widely adopted in sectors such as healthcare, logistics, and retail, these printers support efficient operations while optimizing space. Businesses prefer multifunctional solutions capable of handling multiple media types and sizes, improving workflow flexibility, and minimizing equipment footprint.

The logistics and transportation segment represented a 29% share in 2024 and is projected to grow at a 4.7% CAGR through 2034. These industries rely heavily on thermal transfer printers to create durable, scannable labels for tracking and shipping. High-resolution, long-lasting labels are critical for supply chain management, as they withstand environmental stress and constant handling. Mobile printing capabilities are also gaining popularity, enabling on-demand label production during deliveries and at distribution points. This portability enhances accuracy and speed across logistics workflows, supporting real-time inventory control and seamless operations.

United States Thermal Transfer Printer Market held an 83% share and generated USD 105.7 million in 2024. This leadership position is driven by the growing need for durable labeling solutions in fast-paced industries and the rapid development of e-commerce. With the rise in direct-to-customer fulfillment, there's a higher requirement for printed shipping labels, barcodes, and packaging identifiers, all of which are produced efficiently with thermal transfer printers. U.S. companies are embracing these technologies to meet high-volume demands with speed and reliability.

Leading players contributing to the growth of the Global Thermal Transfer Printer Industry include APS Group, Domino Printing, SATO America, Markem-Imaje, Linx Printing Technologies, Videojet Technologies, Weber Packaging Solutions, PrintJet, Brother, Hanin (HRPT), Kite Packaging, DNP Group, Brady, Hellermann Tyton, and TE Connectivity. To solidify their positions in the global thermal transfer printer market, companies are executing strategies centered on innovation, customization, and sustainability. They are developing smart printers with cloud-based printing, remote access, and seamless mobile integration to cater to tech-savvy users and boost operational convenience. Key players are also launching sustainable products like biodegradable ribbons to reduce environmental impact and appeal to eco-conscious buyers. Additionally, manufacturers are enhancing product flexibility by offering modular, compact designs suitable for varied industry applications.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Color printing capability

- 2.2.4 Print speed

- 2.2.5 Print quality

- 2.2.6 Usage

- 2.2.7 End use industry

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code – 84433290)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Million, Thousand Units)

- 5.1 Key trends

- 5.2 Desktop thermal printers

- 5.3 Mobile thermal printers

- 5.4 Industrial thermal printers

Chapter 6 Market Estimates & Forecast, By Color Printing Capability, 2021 - 2034 ($Million, Thousand Units)

- 6.1 Key trends

- 6.2 Single color

- 6.3 Multi color

Chapter 7 Market Estimates & Forecast, By Print Speed, 2021 - 2034 ($Million, Thousand Units)

- 7.1 Key trends

- 7.2 Slow (Up to 150 mm/sec)

- 7.3 Medium (200 mm/sec)

- 7.4 Fast (300 mm/sec)

- 7.5 Ultra-fast (400 mm/sec)

Chapter 8 Market Estimates & Forecast, By Print Quality, 2021 - 2034 ($Million, Thousand Units)

- 8.1 Key trends

- 8.2 Basic (up to 200 DPI)

- 8.3 Semiprofessional (up to 300 DPI)

- 8.4 Professional (up to 600 DPI)

Chapter 9 Market Estimates & Forecast, By Usage, 2021 - 2034 ($Million, Thousand Units)

- 9.1 Key trends

- 9.2 Card and badge printers

- 9.3 Barcodes

- 9.4 Labels

- 9.5 Receipts

- 9.6 Tags

- 9.7 Wristbands

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Million, Thousand Units)

- 10.1 Key trends

- 10.2 Manufacturing

- 10.3 Logistics and transportation

- 10.4 Healthcare

- 10.5 Retail

- 10.6 Government

- 10.7 Others (hospitality etc.)

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Million, Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Million, Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 APS Group

- 13.2 Brady

- 13.3 Brother

- 13.4 DNP Group

- 13.5 Domino Printing

- 13.6 Hanin (HRPT)

- 13.7 Hellermann Tyton

- 13.8 Kite Packaging

- 13.9 Linx Printing Technologies

- 13.10 Markem-Imaje

- 13.11 PrintJet

- 13.12 SATO America

- 13.13 TE Connectivity

- 13.14 Videojet Technologies

- 13.15 Weber Packaging Solutions