|

市场调查报告书

商品编码

1766217

低脂克菲尔市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Low Fat Content Kefir Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

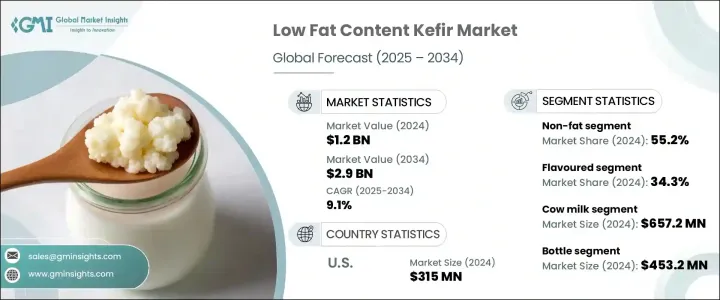

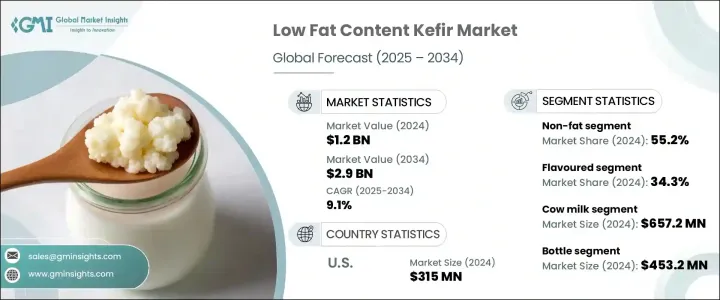

2024年,全球低脂克菲尔市场规模达12亿美元,预计到2034年将以9.1%的复合年增长率成长,达到29亿美元。这一增长与消费者日益重视体重管理以及对促进消化和免疫健康的营养乳製品需求的不断增长相契合。低脂克菲尔吸引了寻求高蛋白、低饱和脂肪益生菌饮料的消费者。生活方式的改变,尤其是千禧世代和都市白领的生活方式的改变,推动了人们对便利、功能性、低脂营养食品的需求。随着人们对清洁标籤乳製品的日益青睐,市场也在不断发展变化,这为传统乳製品和植物基开菲尔生产商都带来了机会。

随着电子商务和健康食品零售通路的不断扩张,有机、草饲和无乳糖低脂产品也越来越普及。消费者越来越青睐低糖和清洁标籤的产品,促使各大品牌在低脂克菲尔中添加益生菌、维生素和矿物质。发酵技术、精准益生菌菌株和微胶囊技术的发展确保了益生菌的稳定性,从而提高了产品品质和保质期。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12亿美元 |

| 预测值 | 29亿美元 |

| 复合年增长率 | 9.1% |

2024年,脱脂克菲尔占据55.2%的市场份额,预计到2034年将以9.2%的复合年增长率成长。低热量和健康乳製品的需求不断增长,推动了该细分市场的成长。患有糖尿病、心臟病或胆固醇等疾病的人越来越青睐脱脂克菲尔,因为它富含高蛋白和益生菌,且不含其他乳製品中的脂肪。这一趋势在北美和欧洲尤为明显,这些地区以推崇清洁标籤和低脂饮食而闻名。乳糖不耐症的消费者也青睐添加了乳糖酶或由无乳糖牛奶製成的脱脂克菲尔。脱脂克菲尔虽然不含脂肪,但口感顺滑、风味浓郁,因此广受欢迎,尤其是在即饮和便携功能性饮料领域。

2024年,风味克菲尔占据了34.3%的市场份额,预计到2034年将以9.4%的复合年增长率快速成长。其广受欢迎之处在于加入了水果、蜂蜜和香草等天然香料,吸引了年轻消费者和克菲尔新手。风味克菲尔鼓励首次购买,并透过重复购买培养顾客忠诚度。同时,无味或原味克菲尔在註重健康的消费者和喜欢将其用作冰沙底料的消费者中拥有强大的追随者。清洁标籤运动和健康宣传驱动的创新推动了有机克菲尔的普及,儘管传统克菲尔因其价格实惠和易于获取而仍然占据主导地位。希腊式克菲尔以其更浓稠的质地和更高的蛋白质含量而闻名,正日益受到青睐。此外,冷冻克菲尔正在成为一种功能性甜点替代品,拓宽了该产品在市场上的多样性。

2024年,美国低脂克菲尔市场规模达3.15亿美元,预计2034年将以9.2%的复合年增长率成长。美国市场领先地位源自于消费者对低热量、富含益生菌、有益健康的乳製品的强劲需求。各大公司已建立广泛的经销网络,为注重健康的消费者提供创新且极具吸引力的产品。完善的零售基础设施——包括超市、大卖场和线上通路——提升了便利性和可近性。此外,消费者对改善消化和免疫力的功能性食品的认识不断提高,也进一步推动了低脂克菲尔的普及。美国市场对清洁标籤和有机产品的关注进一步增强了消费者的信任和忠诚度。

全球低脂克菲尔市场的领导者包括 Wallaby Yogurt Company、Maple Hill Creamery, LLC、Green Valley Creamery、Danone SA 和 Lifeway Foods, Inc. 为巩固市场地位,低脂克菲尔行业的企业高度重视创新和产品差异化。他们投资开发新配方,包括有机、无乳糖和草饲等选项,以满足多样化的消费者需求。不断扩展的口味种类以及添加益生菌、维生素和矿物质的强化产品,有助于提升产品吸引力和復购率。市场领导者建立强大的分销网络,利用电商和以健康为中心的零售通路来提高产品的可及性。与健康专家和意见领袖的合作则提升了产品的可信度和消费者的信任度。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计资料(HS 编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 製造流程分析

- 牛奶製备和标准化

- 发酵过程

- 调味剂添加与配方

- 包装和品质控制

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依脂肪含量,2021 - 2034 年

- 主要趋势

- 脱脂(0–0.5%脂肪)

- 低脂(1-2%脂肪)

- 低脂(2-3%脂肪)

- 其他脂肪含量水平

第六章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 原味/无味

- 调味

- 水果口味

- 香草

- 巧克力

- 其他口味

- 有机的

- 传统的

- 希腊风格

- 《冰雪奇缘》

- 其他产品类型

第七章:市场估计与预测:按来源,2021 - 2034 年

- 主要趋势

- 牛奶

- 山羊乳

- 羊奶

- 植物性替代品

- 椰子基

- 杏仁基

- 大豆基

- 燕麦基

- 其他植物替代品

- 其他来源

第八章:市场估计与预测:依包装类型,2021 - 2034 年

- 主要趋势

- 瓶子

- 塑胶瓶

- 玻璃瓶

- 袋装

- 利乐包装

- 杯子和浴缸

- 其他包装类型

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 超市和大卖场

- 便利商店

- 专卖店

- 健康食品商店

- 天然产品零售商

- 其他专卖店

- 网路零售

- 餐饮服务

- 咖啡馆和餐厅

- 冰沙和果汁吧

- 其他餐饮通路

- 直销

- 其他分销管道

第 10 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 早餐

- 点心

- 运动后

- 甜点替代品

- 烹饪和食谱原料

- 其他消费场合

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十二章:公司简介

- Andechser Natur

- Biotiful Dairy Ltd.

- Danone SA

- Evolve Kefir

- Green Valley Creamery

- Harmonica

- Lifeway Foods, Inc.

- Maple Hill Creamery, LLC

- Miil

- Redwood Hill Farm & Creamery

- Valio Ltd.

- Wallaby Yogurt Company

The Global Low Fat Content Kefir Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 2.9 billion by 2034. This growth aligns with the increasing consumer focus on weight management and the rising demand for nutritious dairy products that promote digestive and immune health. Low-fat kefir appeals to consumers seeking high-protein, low-saturated-fat probiotic beverages. Lifestyle changes, particularly among millennials and urban professionals, have driven demand for convenient, functional, low-fat nutrition options. The market is evolving with a growing preference for clean-label dairy products, presenting opportunities for both traditional dairy and plant-based kefir producers.

Organic, grass-fed, and lactose-free low-fat options are becoming more widely available, supported by expanding e-commerce and health food retail channels. Consumers increasingly prefer products with low sugar content and clean-label attributes, prompting brands to fortify low-fat kefir with added probiotics, vitamins, and minerals. Technological advances in fermentation, precision probiotic strains, and microencapsulation ensure probiotic stability, boosting product quality and shelf life.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.9 Billion |

| CAGR | 9.1% |

Non-fat kefir segment held a 55.2% share in 2024 and is expected to grow at a CAGR of 9.2% through 2034. The rising demand for low-calorie and healthier dairy choices is driving this segment's growth. Individuals managing conditions like diabetes, heart disease, or cholesterol increasingly prefer non-fat kefir, which delivers high protein and probiotic benefits without the fat content found in other dairy products. This trend is particularly notable in North America and Europe, regions known for embracing clean-label and low-fat diets. Lactose-intolerant consumers also favor non-fat kefir when it is fortified with lactase or produced from lactose-free milk. The creamy texture and rich flavor of non-fat kefir, despite its lack of fat, have made it popular, especially in ready-to-drink and on-the-go functional beverage categories.

Flavored kefir segment captured a 34.3% share in 2024 and is projected to grow at a faster CAGR of 9.4% by 2034. Its widespread appeal comes from the incorporation of natural flavors like fruits, honey, and vanilla, which attract younger consumers and those new to kefir. Flavored varieties encourage first-time purchases and foster customer loyalty through repeat buying. Meanwhile, unflavored or plain kefir maintains a strong following among health-conscious consumers and those who prefer to use it as a smoothie base. The clean-label movement and innovation driven by health claims have boosted the popularity of organic kefir, though conventional kefir remains dominant due to affordability and accessibility. Greek-style kefir, known for its thicker texture and higher protein content, is gaining traction. Additionally, frozen kefir is emerging as a functional dessert alternative, broadening the product's versatility in the market.

United States Low Fat Content Kefir Market was valued at USD 315 million in 2024 and is forecast to grow at a CAGR of 9.2% through 2034. The country's leadership stems from strong consumer demand for low-calorie, probiotic-rich dairy products that support health and wellness. Major companies have developed extensive distribution networks, offering innovative and appealing products tailored to health-conscious consumers. The well-established retail infrastructure-including supermarkets, hypermarkets, and online channels-adds convenience and accessibility. Moreover, growing consumer awareness about functional foods that improve digestion and immunity fuels the popularity of low-fat kefir. The U.S. market's focus on clean-label and organic offerings further strengthens consumer trust and loyalty.

Leading companies in the Global Low Fat Content Kefir Market include Wallaby Yogurt Company, Maple Hill Creamery, LLC, Green Valley Creamery, Danone S.A., and Lifeway Foods, Inc. To strengthen their market positions, companies in the low-fat kefir sector focus heavily on innovation and product differentiation. They invest in developing new formulations that include organic, lactose-free, and grass-fed options to meet diverse consumer needs. Expanding flavor varieties and fortified products with added probiotics, vitamins, and minerals help boost appeal and repeat purchase rates. Market leaders build strong distribution networks, leveraging e-commerce and health-focused retail channels to improve accessibility. Collaborations with health experts and influencers promote product credibility and consumer trust.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Fat content

- 2.2.3 Product type

- 2.2.4 Sources

- 2.2.5 Packaging type

- 2.2.6 Distribution channel

- 2.2.7 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only )

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Manufacturing process analysis

- 3.13.1 Milk preparation & standardization

- 3.13.2 Fermentation process

- 3.13.3 Flavour addition & formulation

- 3.13.4 Packaging & quality control

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Fat Content, 2021 - 2034 (USD Million) (Thousand Liters)

- 5.1 Key trend

- 5.2 Non-fat (0–0.5% fat)

- 5.3 Low-fat (1–2% fat)

- 5.4 Reduced-fat (2–3% fat)

- 5.5 Other fat content levels

Chapter 6 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million) (Thousand Liters)

- 6.1 Key trend

- 6.2 Plain/unflavoured

- 6.3 Flavoured

- 6.3.1 Fruit flavors

- 6.3.2 Vanilla

- 6.3.3 Chocolate

- 6.3.4 Other flavors

- 6.4 Organic

- 6.5 Conventional

- 6.6 Greek-style

- 6.7 Frozen

- 6.8 Other product types

Chapter 7 Market Estimates & Forecast, By Source, 2021 - 2034 (USD Million) (Thousand Liters)

- 7.1 Key trend

- 7.2 Cow milk

- 7.3 Goat milk

- 7.4 Sheep milk

- 7.5 Plant-based alternatives

- 7.5.1 Coconut-based

- 7.5.2 Almond-based

- 7.5.3 Soy-based

- 7.5.4 Oat-based

- 7.5.5 Other plant-based alternatives

- 7.6 Other sources

Chapter 8 Market Estimates & Forecast, By Packaging Type, 2021 - 2034 (USD Million) (Thousand Liters)

- 8.1 Key trend

- 8.2 Bottles

- 8.2.1 Plastic bottles

- 8.2.2 Glass bottles

- 8.3 Pouches

- 8.4 Tetra packs

- 8.5 Cups & tubs

- 8.6 Other packaging types

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Thousand Liters)

- 9.1 Key trend

- 9.2 Supermarkets & hypermarkets

- 9.3 Convenience stores

- 9.4 Specialty stores

- 9.4.1 Health food stores

- 9.4.2 Natural product retailers

- 9.4.3 Other specialty stores

- 9.5 Online retail

- 9.6 Foodservice

- 9.6.1 Cafes & restaurants

- 9.6.2 Smoothie & juice bars

- 9.6.3 Other foodservice channels

- 9.7 Direct sales

- 9.8 Other distribution channels

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million) (Thousand Liters)

- 10.1 Key trend

- 10.2 Breakfast

- 10.3 Snacking

- 10.4 Post-workout

- 10.5 Dessert alternative

- 10.6 Cooking & recipe ingredient

- 10.7 Other consumption occasions

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million) (Thousand Liters)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East & Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East & Africa

Chapter 12 Company Profiles

- 12.1 Andechser Natur

- 12.2 Biotiful Dairy Ltd.

- 12.3 Danone S.A.

- 12.4 Evolve Kefir

- 12.5 Green Valley Creamery

- 12.6 Harmonica

- 12.7 Lifeway Foods, Inc.

- 12.8 Maple Hill Creamery, LLC

- 12.9 Miil

- 12.10 Redwood Hill Farm & Creamery

- 12.11 Valio Ltd.

- 12.12 Wallaby Yogurt Company