|

市场调查报告书

商品编码

1766229

电脑缝纫与刺绣机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Computerized Sewing and Embroidery Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

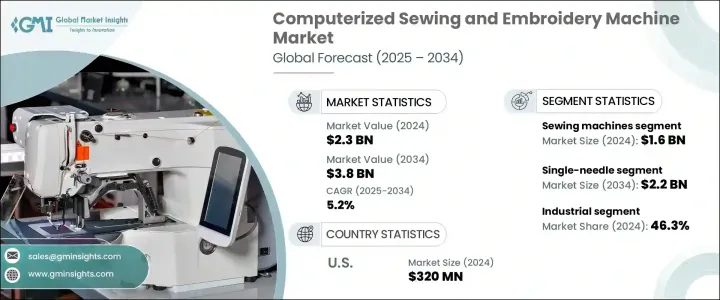

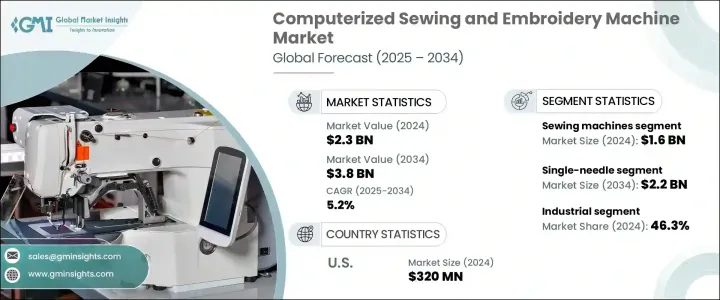

2024年,全球电脑缝纫和刺绣机市场规模达23亿美元,预计到2034年将以5.2%的复合年增长率成长,达到38亿美元。这一成长轨迹主要得益于全球纺织业的持续扩张。随着人口成长和生活方式的改变,全球服装需求不断增长,纺织业正呈现持续成长动能。电脑缝纫和刺绣机在满足这一需求方面发挥关键作用,它能够以极低的维护成本实现大批量服装生产,并保持始终如一的品质。这些机器尤其受到青睐,因为它们能够在极短的时间内复製复杂精緻的剪裁。

线上零售的蓬勃发展和消费者偏好的不断变化,极大地影响了客製化和时尚服装的需求。随着人们对快时尚和独特设计的追求日益增长,製造商开始转向自动化解决方案,以在不影响精度的情况下满足高生产力标准。有组织的零售网路的发展,尤其是在城市地区,进一步促进了缝纫和刺绣机在不同终端使用环境中的应用。此外,全球市场动态和纺织业不断变化的政策加剧了竞争,迫使製造商不断创新和升级其产品。因此,先进功能和智慧技术的整合已成为保持竞争力的关键,无论对于大型製造商还是致力于在快速发展的行业中保持领先地位的小型生产单位而言,电脑化机器都不可或缺。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 23亿美元 |

| 预测值 | 38亿美元 |

| 复合年增长率 | 5.2% |

按类型划分,市场可分为缝纫机、刺绣机和多功能缝纫机。其中,缝纫机占了相当大的份额,2024 年市场规模超过 16 亿美元,预计 2025 年至 2034 年的复合年增长率约为 4.9%。由于其适应性强、操作简便且经济高效,缝纫机在家庭和各行各业中都得到了广泛的应用。自动剪线、图案客製化和便利针迹选择等增强功能现已成为新缝纫机的标配,帮助用户更方便地生产出高品质的服装。旨在促进本地纺织製造业发展的政策支持也促进了该细分市场的成长,使现代设备更容易获得。

按类别细分,市场分为单针缝纫机和多针缝纫机。单针缝纫机类别在2024年占据最大份额,占了整个市场的60.8%,预计到2034年将达到22亿美元。单针缝纫机因其速度快、精度高且在标准服装生产中易于使用而备受青睐。这些机器正越来越多地升级为数位控制,允许操作员调整缝纫图案并即时监控性能。在品质标准高且消费者期望不断变化且成熟的市场中,对先进单针缝纫机的需求尤其强劲。

根据应用,市场细分为住宅、商业和工业类别。工业领域在2024年以46.3%的市占率领先市场,预计在整个预测期内将维持这一地位。工业级机器对于高容量运作至关重要,因为耐用性和速度至关重要。这些系统经过精心设计,可长时间运作而无需停机,是连续生产环境的理想选择。纺织基础雄厚且政府推出了旨在实现製造业基础设施现代化的支持性政策的国家,正在推动该领域的持续成长。

2024年,美国市场规模超过3.2亿美元,预计到2034年将以5.2%的复合年增长率成长。这一成长主要得益于充满活力的时尚生态系统和浓厚的DIY文化,这两者都推动了对精密且用户友好的机器的需求。纺织生产中自动化和智慧技术的日益普及也推动了设备升级。进口资料反映出,旨在提高生产力和营运效率的高科技机械的进口量持续成长。

电脑缝纫和刺绣机市场的製造商正在运用多种策略来巩固其市场地位。这些策略包括推出技术先进的产品、进行全球扩张、建立策略联盟以及丰富产品组合以瞄准不同的消费群体。企业也透过探索环保材料和节能技术来回应永续发展的需求。此外,与区域分销商和当地零售合作伙伴合作已被证明是市场渗透的有效途径,尤其是在新兴经济体。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- MEA

- 拉丁美洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 缝纫机

- 刺绣机

- 组合机

第六章:市场估计与预测:按速度,2021 - 2034 年

- 主要趋势

- 最高 500 SPM

- 500-1,000 SPM

- 1,000-1,500 SPM

- 1,500-2,000 SPM

- 2,500-3,000 马里兰州立大学

- 3,000 SPM 以上

第七章:市场估计与预测:依类别,2021 - 2034 年

- 主要趋势

- 单针

- 多针

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 住宅

- 商业的

- 时装设计师和精品店

- 客製化刺绣店

- 家纺零售商

- 室内装潢企业

- 工业的

- 大型服装製造商

- 汽车内装製造商

- 医疗保健纺织品製造商

- 制服供应商

- 其他的

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直销

- 间接销售

- 大型超市

- 专卖店

- 线上零售商

- 独立经销商

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- Baby Lock

- Bernina International AG

- Brother Industries Ltd.

- Durkopp Adler AG

- Elna International Corp. SA

- Husqvarna AB

- Janome Sewing Machine Co., Ltd.

- Juki Corporation

- Necchi Italia Srl

- Pfaff Sewing Machines

- Ricoma International Corporation

- SunStar Precision Co., Ltd.

- Tajima Industries Ltd.

- The Singer Company Limited LLC

- ZSK Stickmaschinen GmbH

The Global Computerized Sewing and Embroidery Machine Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 3.8 billion by 2034. This growth trajectory is primarily supported by the continuous expansion of the global textile industry. As global demand for apparel increases in response to population growth and lifestyle changes, the textile industry is witnessing sustained momentum. Computerized sewing and embroidery machines play a critical role in meeting this demand by enabling high-volume garment production with minimal maintenance and consistent quality. These machines are particularly favored for their ability to replicate intricate and refined tailoring in a fraction of the time required by manual labor.

The proliferation of online retail and changing consumer preferences have significantly influenced the demand for customized and fashionable clothing. With a growing appetite for fast fashion and unique designs, manufacturers are turning to automated solutions that can meet high productivity standards without compromising on precision. The development of organized retail networks, particularly in urban areas, has further encouraged the adoption of sewing and embroidery machines across different end-use settings. Moreover, global market dynamics and constant policy shifts in the textile sector are amplifying competition, compelling manufacturers to innovate and upgrade their offerings. As a result, the integration of advanced features and smart technologies has become central to staying competitive, making computerized machines indispensable for both large-scale manufacturers and small production units aiming to stay ahead in a rapidly evolving industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 5.2% |

In terms of type, the market is segmented into sewing machines, embroidery machines, and combination machines. Among these, sewing machines accounted for a significant portion, exceeding USD 1.6 billion in 2024, and are expected to grow at a CAGR of approximately 4.9% from 2025 to 2034. These machines enjoy widespread use across households and industries alike due to their adaptability, simplicity, and cost-efficiency. Enhanced functionalities such as automatic thread cutting, pattern customization, and easy stitch selection are now standard in newer models, helping users produce high-quality garments with greater convenience. Policy support aimed at boosting local textile manufacturing has also contributed to the growth of this segment by making modern equipment more accessible.

When segmented by category, the market is classified into single-needle and multi-needle machines. The single-needle category held the largest share in 2024, capturing 60.8% of the total market, and is expected to reach USD 2.2 billion by 2034. Single-needle machines are favored for their speed, precision, and ease of use in standard garment production. They are increasingly being upgraded with digital controls that allow operators to adjust stitching patterns and monitor performance in real time. The demand for advanced single-needle machines is particularly strong in mature markets where quality standards are high and consumer expectations continue to evolve.

Based on application, the market is segmented into residential, commercial, and industrial categories. The industrial segment led the market in 2024 with a 46.3% share and is expected to maintain this position throughout the forecast period. Industrial-grade machines are essential for high-capacity operations where durability and speed are critical. These systems are engineered to handle extended usage without downtime, making them ideal for continuous production environments. Countries with a strong textile base and supportive government policies aimed at modernizing manufacturing infrastructure are contributing to the sustained growth of this segment.

The United States market surpassed USD 320 million in 2024 and is anticipated to grow at a CAGR of 5.2% through 2034. This growth is largely driven by a vibrant fashion ecosystem and a strong do-it-yourself culture, both of which are pushing the demand for sophisticated and user-friendly machines. The increasing adoption of automation and smart technologies in textile production is also fueling equipment upgrades. Import data reflects a consistent rise in the inflow of high-tech machinery designed for enhanced productivity and operational efficiency.

Manufacturers in the computerized sewing and embroidery machine market are leveraging multiple strategies to reinforce their market position. These include rolling out technologically advanced products, pursuing global expansion, establishing strategic alliances, and diversifying product portfolios to target various consumer segments. Companies are also responding to sustainability demands by exploring eco-friendly materials and energy-efficient technologies. Moreover, aligning with regional distributors and local retail partners has proven effective for market penetration, particularly in emerging economies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Speed

- 2.2.4 Category

- 2.2.5 Application

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion)(Thousand Units)

- 5.1 Key trends

- 5.2 Sewing machines

- 5.3 Embroidery machines

- 5.4 Combination machines

Chapter 6 Market Estimates & Forecast, By Speed, 2021 - 2034, (USD Billion)(Thousand Units)

- 6.1 Key trends

- 6.2 Up to 500 SPM

- 6.3 500-1,000 SPM

- 6.4 1,000-1,500 SPM

- 6.5 1,500-2,000 SPM

- 6.6 2,500-3,000 SPM

- 6.7 Above 3,000 SPM

Chapter 7 Market Estimates & Forecast, By Category, 2021 - 2034, (USD Billion)(Thousand Units)

- 7.1 Key trends

- 7.2 Single?needle

- 7.3 Multi?needle

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion)(Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Fashion designers & boutiques

- 8.3.2 Custom embroidery shops

- 8.3.3 Home textile retailers

- 8.3.4 Upholstery businesses

- 8.4 Industrial

- 8.4.1 Large?Scale apparel manufacturers

- 8.4.2 Automotive interior manufacturers

- 8.4.3 Healthcare textile manufacturers

- 8.4.4 Uniform suppliers

- 8.4.5 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion)(Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

- 9.3.1 Hypermarkets

- 9.3.2 Specialty stores

- 9.3.3 Online retailers

- 9.3.4 Independent dealers

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion)(Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Baby Lock

- 11.2 Bernina International AG

- 11.3 Brother Industries Ltd.

- 11.4 Durkopp Adler AG

- 11.5 Elna International Corp. SA

- 11.6 Husqvarna AB

- 11.7 Janome Sewing Machine Co., Ltd.

- 11.8 Juki Corporation

- 11.9 Necchi Italia S.r.l.

- 11.10 Pfaff Sewing Machines

- 11.11 Ricoma International Corporation

- 11.12 SunStar Precision Co., Ltd.

- 11.13 Tajima Industries Ltd.

- 11.14 The Singer Company Limited LLC

- 11.15 ZSK Stickmaschinen GmbH