|

市场调查报告书

商品编码

1766262

工业印表机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Industrial Printer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

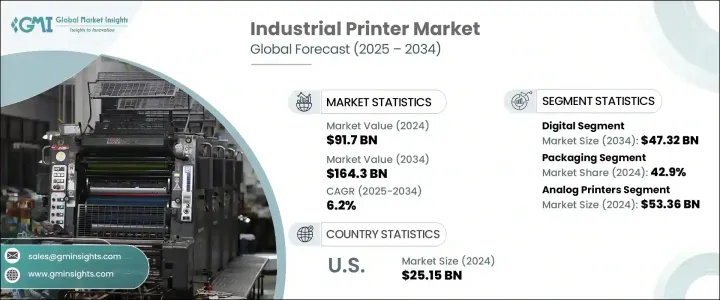

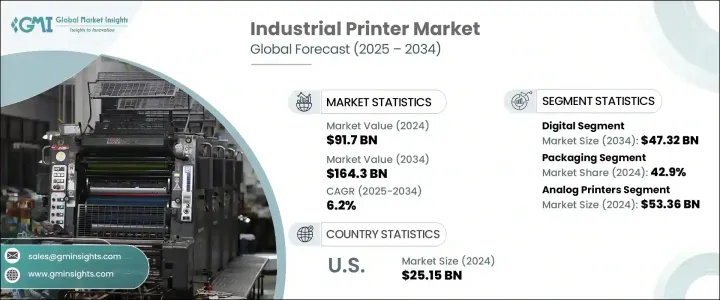

2024 年全球工业印表机市场价值为 917 亿美元,预计到 2034 年将以 6.2% 的复合年增长率增长至 1,643 亿美元。随着工业自动化日益普及,以及包装、纺织、电子和製造等行业对高速、高解析度列印的需求,该市场正在持续扩张。国际贸易的扩张和电子商务的兴起大大增加了对准确标籤和即时产品编码的需求。数位印刷和柔版印刷的融合因其速度、适应性和客製化而受到重视,正在获得发展势头,尤其是在可追溯性要求变得更加严格的情况下。从类比印刷平台到数位印刷平台的转变有助于改善与 ERP 系统和供应链的同步,从而提高营运效率。同时,对环保实践的日益重视也增加了人们对低浪费、节能印刷解决方案的兴趣。随着越来越多的行业采用自动化和即时追踪,工业印刷正在迅速发展以满足不断变化的需求和生产週期。

不断扩展的工业应用场景也促进了市场成长,包括品牌应用和电子产品的精密电路列印需求。纺织和电子等行业越来越多地使用数位和喷墨印表机进行灵活的按需生产。包装仍然是最主要的应用领域,这得益于对智慧个人化包装日益增长的需求。小型企业由于价格实惠而开始采用紧凑型桌上型印表机,而传统的类比印表机仍然适用于成熟产业的大规模生产。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 917亿美元 |

| 预测值 | 1643亿美元 |

| 复合年增长率 | 6.2% |

2024年,数位印刷产值达251亿美元,预计到2034年将达到473.2亿美元。该领域的快速成长归功于其高效、快速交付成果的能力以及无需印版等设定。这使其成为短期、客製化和时效性专案的理想选择。在註重精准度和频繁设计变更的行业中,数位印刷的应用尤其广泛。其鲜艳的色彩输出、高品质的成像和按需列印功能等特性,使数位印刷机成为高级包装和标籤的首选。此外,其节能运作和使用无毒油墨等永续特性也与企业环保目标相契合。

2024 年,包装产业占据工业印表机市场的主导地位,占整体市场份额的 42.9%,预计到 2034 年将以 6.6% 的复合年增长率成长。线上零售的快速成长以及对品牌化和客製化包装的追求推动了该领域对高性能列印的需求。工业印表机在这一领域至关重要,因为它们能够以经济高效的方式大规模生产详细的标籤、图形和条码。这一点在快速消费品、医疗保健和食品服务等行业越来越多地采用灵活的包装形式的情况下尤其重要。随着永续性成为优先事项,人们对可回收材料和环保油墨的兴趣也越来越大。工业印表机能够按需提供高速、无浪费的列印,这是满足动态包装需求的关键资产。

2024年,北美工业印表机市场规模达251.5亿美元。该地区在包装、电子和製药製造业的雄厚基础,持续支撑着按需标籤和智慧包装解决方案的需求成长。随着个人化趋势的兴起,北美各地的企业正在升级其列印能力,以提供精准、快速和客製化的产品。此外,由于电子商务行业的蓬勃发展,该地区对条码和运输相关列印的需求也日益增长。

全球工业印表机市场的主要参与者包括理光株式会社、达美乐印刷科学、佳能公司、武藤控股株式会社、惠普公司、Durst Phototechnik AG、爱普生株式会社、康丽数码有限公司、斑马技术公司、精工控股株式会社、赛尔公司、兄弟会公司控股委员会、柯尼梉堡式会社经公司和图社社科。领先的工业印表机製造商正致力于透过数位技术和永续材料的研发投资来巩固其市场地位。许多公司正在推出具有增强影像解析度的节能印表机,以及专为中小企业量身定制的紧凑型、经济高效的型号。该公司还透过整合用于即时资料监控和自动化工作流程的软体来扩展产品组合,提高可追溯性和营运效率。与工业自动化公司和供应链解决方案提供者的合作有助于提升他们的价值主张。此外,参与者正在透过开发低VOC墨水和可回收墨盒来实现环保目标。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 工业自动化和数位化的兴起

- 电子商务成长与全球贸易扩张

- 印刷电子产品需求不断成长

- 产业陷阱与挑战

- 初期投资成本高

- 技术快速淘汰

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按下印表机技术

- 监管格局

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计(HS编码84433990)

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按印表机技术,2021 - 2034 年(十亿美元)

- 平版印刷

- 柔版印刷

- 萤幕

- 凹版印刷

- 凸版印刷

- 数位的

第六章:市场估计与预测:按印表机类型,2021 - 2034 年(十亿美元)

- 主要趋势

- 类比印表机

- 桌上型印表机

第七章:市场估计与预测:按应用,2021 - 2034 年(十亿美元)

- 包装

- 纺织品

- 电子产品

- 其他的

第八章:市场估计与预测:按最终用途,2021 - 2034 年(十亿美元)

- 主要趋势

- 个人的

- 家庭

第九章:市场估计与预测:按配销通路,2021 - 2034 年(十亿美元)

- 主要趋势

- 直接的

- 间接

第十章:市场估计与预测:按地区,2021 - 2034 年(十亿美元)

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Brother Industries Ltd.

- Canon Inc

- Domino Printing Sciences

- Durst Phototechnik AG

- Epson Corporation

- Heidelberger Druckmaschinen AG

- HP Inc

- Kornit Digital Ltd.

- Konica Minolta, Inc.

- Mutoh Holdings Co., Ltd.

- Ricoh Company Ltd.

- Seiko Holdings Corporation

- Xaar plc

- Xerox Holdings Corporation

- Zebra Technologies Corporation

The Global Industrial Printer Market was valued at USD 91.7 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 164.3 billion by 2034. This market is experiencing consistent expansion as industrial automation becomes more prevalent and industries demand high-speed, high-resolution printing across sectors such as packaging, textiles, electronics, and manufacturing. The expansion of international trade and the rise in e-commerce have significantly increased the need for accurate labeling and real-time product coding. Integration of digital and flexographic printing-valued for their speed, adaptability, and customization-is gaining momentum, particularly as traceability requirements become stricter. The shift from analog to digital printing platforms has helped improve synchronization with ERP systems and supply chains, promoting operational efficiency. Meanwhile, growing emphasis on eco-conscious practices has increased interest in low-waste, energy-efficient printing solutions. As more industries embrace automation and real-time tracking, industrial printing is rapidly evolving to meet changing demands and production cycles.

An expanding range of industrial use cases is also contributing to market growth, including branding applications and precise circuit printing needs in electronics. Sectors such as textiles and electronics are increasingly using digital and inkjet printers for flexible, on-demand production. Packaging remains the top application area, fueled by increasing demand for smart, personalized packaging. Smaller businesses are adopting compact desktop printers due to affordability, while traditional analog printers still cater to large-scale production across established industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $91.7 Billion |

| Forecast Value | $164.3 Billion |

| CAGR | 6.2% |

In 2024, digital printing generated USD 25.1 billion and is projected to reach USD 47.32 billion by 2034. The rapid growth of this segment is attributed to its efficiency, ability to deliver quick results, and elimination of setup needs such as printing plates. This makes it ideal for short-run, customized, and time-sensitive projects. Its adoption is strong in industries where precision and frequent design changes are essential. Features like vivid color output, high-quality imaging, and on-demand printing capabilities make digital printers a go-to for advanced packaging and labeling. Additionally, sustainable features such as energy-efficient operations and the use of non-toxic inks align well with corporate environmental goals.

The packaging sector dominated the industrial printer market in 2024, accounting for 42.9% of the overall share, and is projected to grow at a CAGR of 6.6% through 2034. Demand for high-performance printing in this segment is driven by the rapid growth of online retail and the push for branded and customized packaging. Industrial printers are essential in this space for their ability to cost-effectively produce detailed labels, graphics, and barcodes at scale. This is particularly important as industries such as FMCG, healthcare, and food services increasingly adopt flexible packaging formats. As sustainability becomes a priority, there's greater interest in recyclable materials and eco-friendly inks. The capacity of industrial printers to deliver high-speed, waste-free prints on demand is a key asset for meeting dynamic packaging needs.

North America Industrial Printer Market generated USD 25.15 billion in 2024. The region's strong foundation in packaging, electronics, and pharmaceutical manufacturing continues to support the rise in demand for on-demand labeling and smart packaging solutions. As personalization trends gain momentum, businesses across North America are upgrading their printing capabilities to deliver precise, fast, and custom results. The region also benefits from the increasing need for barcode and shipping-related prints due to a thriving e-commerce sector.

Prominent players in the Global Industrial Printer Market include Ricoh Company Ltd., Domino Printing Sciences, Canon Inc., Mutoh Holdings Co., Ltd., HP Inc., Durst Phototechnik AG, Epson Corporation, Kornit Digital Ltd., Zebra Technologies Corporation, Seiko Holdings Corporation, Xaar plc, Brother Industries Ltd., Konica Minolta, Inc., Heidelberger Druckmaschinen AG, Xerox Holdings Corporation. Leading industrial printer manufacturers are focusing on strengthening their market position through R&D investments in digital technologies and sustainable materials. Many are rolling out energy-efficient printers with enhanced image resolution, as well as compact, cost-effective models tailored for SMEs. Companies are also expanding portfolios by integrating software for real-time data monitoring and automated workflow, improving traceability and operational efficiency. Collaborations with industrial automation firms and supply chain solution providers help enhance their value propositions. Additionally, players are aligning with environmental goals by developing low-VOC inks and recyclable cartridges.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Printer technology

- 2.2.3 Printer type

- 2.2.4 Substrate type

- 2.2.5 Ink type

- 2.2.6 Application

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 The rising industrial automation and digitization

- 3.2.1.2 E-commerce growth and global trade expansion

- 3.2.1.3 Increasing demand for printed electronics

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Rapid technological obsolescence

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Printer technology

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code 84433990)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Printer Technology, 2021 - 2034 ($Bn) (Thousand Units)

- 1.1 Offset lithography

- 1.2 Flexography

- 1.3 Screen

- 1.4 Gravure

- 1.5 Letter press

- 1.6 Digital

Chapter 6 Market Estimates & Forecast, By Printer Type, 2021 - 2034 ($Bn) (Thousand Units)

- 1.7 Key trends

- 1.8 Analog printers

- 1.9 Desktop printers

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn) (Thousand Units)

- 1.10 Packaging

- 1.11 Textiles

- 1.12 Electronics

- 1.13 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 1.14 Key trends

- 1.15 Personal

- 1.16 Household

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 2.1 Key trends

- 2.2 Direct

- 2.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 2.4 Key trends

- 2.5 North America

- 2.5.1 U.S.

- 2.5.2 Canada

- 2.6 Europe

- 2.6.1 UK

- 2.6.2 Germany

- 2.6.3 France

- 2.6.4 Italy

- 2.6.5 Spain

- 2.6.6 Russia

- 2.7 Asia Pacific

- 2.7.1 China

- 2.7.2 India

- 2.7.3 Japan

- 2.7.4 South Korea

- 2.7.5 Australia

- 2.8 Latin America

- 2.8.1 Brazil

- 2.8.2 Mexico

- 2.9 MEA

- 2.9.1 UAE

- 2.9.2 South Africa

- 2.9.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Brother Industries Ltd.

- 11.2 Canon Inc

- 11.3 Domino Printing Sciences

- 11.4 Durst Phototechnik AG

- 11.5 Epson Corporation

- 11.6 Heidelberger Druckmaschinen AG

- 11.7 HP Inc

- 11.8 Kornit Digital Ltd.

- 11.9 Konica Minolta, Inc.

- 11.10 Mutoh Holdings Co., Ltd.

- 11.11 Ricoh Company Ltd.

- 11.12 Seiko Holdings Corporation

- 11.13 Xaar plc

- 11.14 Xerox Holdings Corporation

- 11.15 Zebra Technologies Corporation