|

市场调查报告书

商品编码

1773341

工业喷墨印表机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Industrial Inkjet Printers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

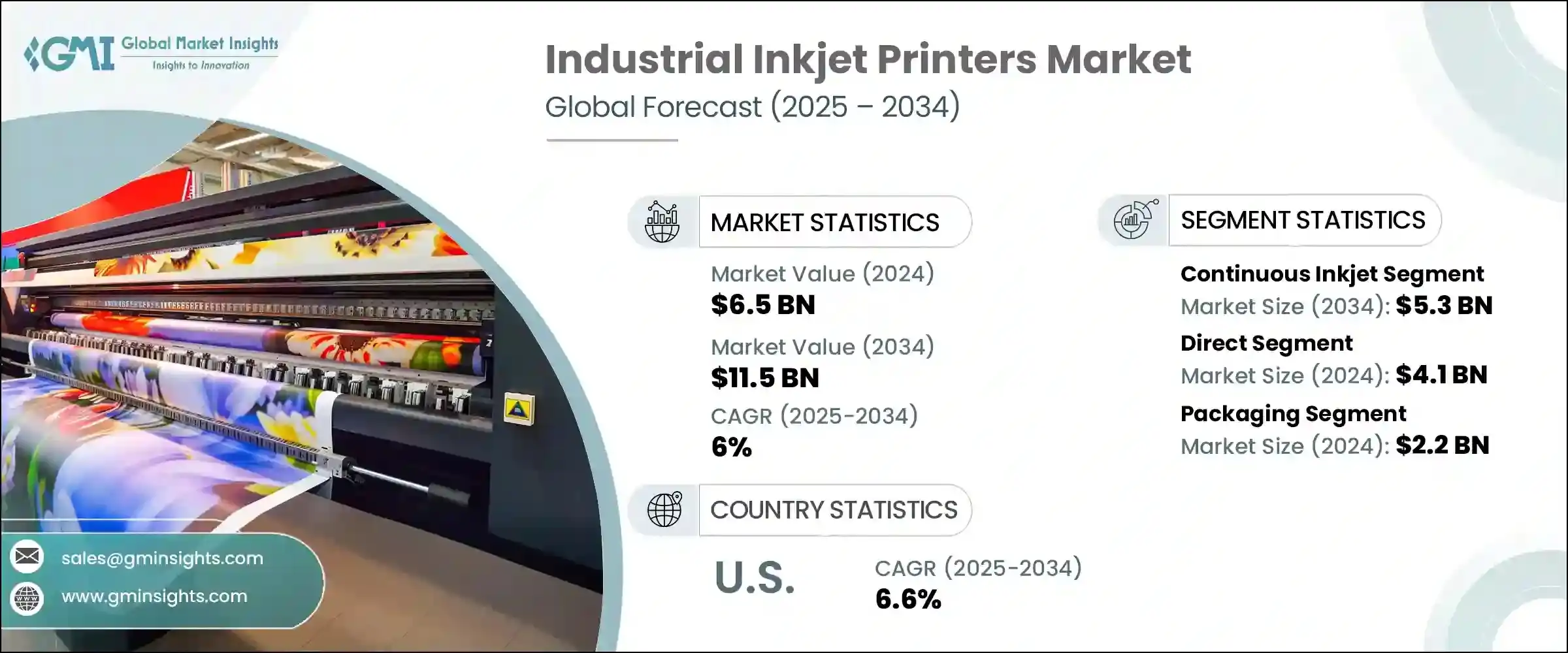

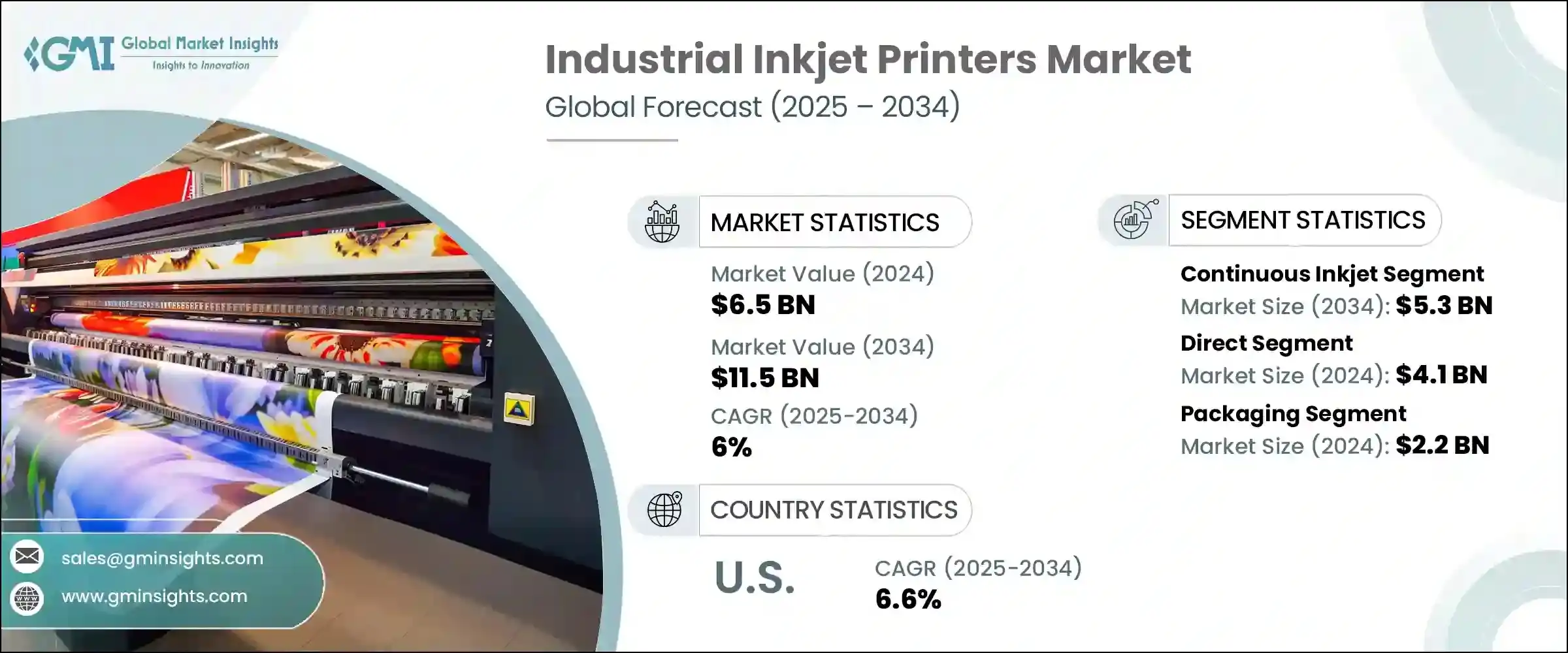

2024年,全球工业喷墨印表机市场规模达65亿美元,预计到2034年将以6%的复合年增长率成长,达到115亿美元。製药、纺织和包装等行业对可变资料列印的需求显着增长,尤其是在各种材料上即时列印条码、日期、序号和批次程式码的需求。消费者对产品个性化、更严格的监管标准以及竞争激烈的市场中品牌差异化的期望推动了这一成长。

喷墨系统为短版作业提供灵活且经济高效的高解析度列印解决方案,无需昂贵的设备改造,正吸引越来越多的终端用户采用。此外,永续发展的势头日益强劲,尤其是在美国环保署 (EPA) 强调减少浪费和提高能源效率的背景下。因此,越来越多的公司选择喷墨列印作为环保且高效的替代方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 65亿美元 |

| 预测值 | 115亿美元 |

| 复合年增长率 | 6% |

技术进步,尤其是在印表机头设计、数位墨水配方以及与工业 4.0 平台整合方面的进步,正在显着提升喷墨印表机的性能。这些改进实现了超高解析度输出,并透过利用微滴控制和更高像素精度等特性,使装饰包装、薄膜标籤和定製材料等特殊应用受益。此外,工业喷墨技术已在积层製造领域占据一席之地,尤其是黏合剂喷射技术,该技术已被证明是生物医学、航太和汽车等各领域 3D 列印的可行方法。随着这些机器的发展,潜在的投资报酬率持续成长,巩固了它们在现代生产环境中的地位。

2024年,连续喷墨 (CIJ) 市场规模达29亿美元,预计2034年将增加至53亿美元。该市场以其高速、非接触式列印能力以及极低的维护需求引领市场。其耐用性以及在严苛环境下提供稳定输出的能力,使其成为需要在各种承印物上列印可变资讯(例如有效期限和追踪码)的企业的热门选择。凭藉强大的附着力和即使在严苛的工业条件下也能无缝运作的CIJ系统,其市场地位持续保持强劲。

2024年,直销市场规模达41亿美元,预估2025-2034年复合年增长率为6.1%。需要高度客製化和技术复杂性的工业应用是推动这一市场发展的主要动力。爱普生、马肯依玛士、多米诺印刷科学和伟迪捷等领先製造商透过与客户建立直接关係,强化了其市场策略。这些公司提供个人化服务,包括系统设定、即时技术支援、维护协议以及与现有工作流程的全面集成,从而确保长期的客户保留和满意度。

2024年,北美工业喷墨印表机市场规模达9亿美元,预计2025年至2034年期间的复合年增长率将达到6.6%。美国的主导地位源自于其完善且技术先进的製造业生态系统。喷墨系统广泛应用于电子、食品生产和製药等行业的标记、编码和标籤製程。这些系统能够有效地整合到现有的自动化设备中,显着提高产量,同时最大限度地减少停机时间。业界领导者持续不断的研发工作,致力于提升工业喷墨技术的性能、耐用性和运作效率。

影响工业喷墨印表机产业竞争格局的主要参与者包括佳能、富士胶片、Durst Phototechnik、惠普、兄弟工业、柯尼卡美能达、爱普生、日立工业设备系统、三菱重工印刷包装机械、电子成像、基恩士、Leibinger Group 和多米诺印刷科学。

为了巩固市场地位,工业喷墨印表机产业的领导者专注于与客户直接互动,提供客製化解决方案,并提供包括维护、培训和整合在内的全方位服务。许多企业正在大力投资研发,以改善印表机头技术、油墨化学和永续实践,从而满足法规要求和客户期望。策略合作和收购也很常见,这有助于扩大产品组合併进入新的区域市场。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 监理框架

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特五力分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- MEA

- 拉丁美洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依技术,2021-2034 年

- 主要趋势

- 连续喷墨

- 按需投放

- UV喷墨

- 其他的

第六章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 食品和饮料

- 化学

- 製药

- 包装

- 个人护理和化妆品

- 其他的

第七章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 直销

- 间接销售

第八章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第九章:公司简介

- Brother Industries

- Canon

- Domino Printing Sciences

- Durst Phototechnik

- Electronics For Imaging

- Epson

- Fujifilm

- Hitachi Industrial Equipment Systems

- HP

- Keyence

- Konica Minolta

- Leibinger Group

- Markem-Imaje

- Mitsubishi Heavy Industries Printing & Packaging Machinery

- Videojet

The Global Industrial Inkjet Printers Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 11.5 billion by 2034. Industries such as pharmaceuticals, textiles, and packaging are significantly boosting the demand for variable data printing, particularly for real-time labeling with barcodes, dates, serial numbers, and batch codes across diverse materials. This growth is fueled by consumer expectations for product personalization, stricter regulatory standards, and brand differentiation in competitive markets.

Inkjet systems offer a flexible and cost-effective solution for high-resolution printing on short-run jobs without the need for costly retooling, which is attracting growing adoption among end-users. Furthermore, sustainability is gaining momentum, especially with the emphasis from the U.S. Environmental Protection Agency (EPA) on reducing waste and improving energy efficiency. As a result, more companies are turning to inkjet printing as an environmentally responsible and productive alternative.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 6% |

Technological advancements, especially in printhead design, digital ink formulations, and integration with Industry 4.0 platforms, are significantly enhancing the performance of inkjet printers. These improvements allow for ultra-high-resolution outputs, benefiting specialized applications like decorative packaging, film labeling, and custom materials by leveraging features such as micro-droplet control and increased pixel accuracy. Additionally, industrial inkjet technology has found a place in additive manufacturing, particularly binder jetting, which is proving to be a viable method in 3D printing across various sectors, including biomedical, aerospace, and automotive. The potential return on investment continues to increase as these machines evolve, solidifying their role in modern production environments.

The continuous inkjet (CIJ) segment accounted for USD 2.9 billion in 2024 and is expected to rise to USD 5.3 billion by 2034. This segment leads the market due to its ability to perform high-speed, non-contact printing with minimal maintenance requirements. Its durability and ability to deliver consistent output in demanding settings make it a popular choice for businesses that rely on printing variable information such as expiration dates and tracking codes on a variety of substrates. With strong adhesion properties and seamless operation even under challenging industrial conditions, CIJ systems continue to maintain a strong market position.

The direct sales segment accounted for USD 4.1 billion in 2024 and is anticipated to grow at a CAGR of 6.1% during 2025-2034. Industrial applications that demand a high degree of customization and technical complexity primarily drive this segment. Leading manufacturers such as Epson, Markem-Imaje, Domino Printing Sciences, and Videojet have strengthened their market approach by building direct relationships with clients. These companies provide personalized services, including system setup, real-time technical support, maintenance agreements, and full integration with existing workflows, ensuring long-term client retention and satisfaction.

North America Industrial Inkjet Printers Market was valued at USD 900 million in 2024 and is projected to grow at a CAGR of 6.6% between 2025 and 2034. The dominance of the U.S. stems from its well-established and technologically advanced manufacturing ecosystem. Inkjet systems are widely adopted for marking, coding, and labeling processes within various sectors such as electronics, food production, and pharmaceuticals. These systems integrate efficiently into existing automation setups, significantly boosting throughput while minimizing downtime. Ongoing research and development efforts by industry leaders continue to enhance the performance, durability, and operational efficiency of industrial inkjet technologies.

Key players shaping the competitive landscape of the Industrial Inkjet Printer Industry include Canon, Fujifilm, Durst Phototechnik, HP, Brother Industries, Konica Minolta, Epson, Hitachi Industrial Equipment Systems, Mitsubishi Heavy Industries Printing & Packaging Machinery, Electronics For Imaging, Keyence, Leibinger Group, and Domino Printing Sciences.

To strengthen their market position, leading companies in the industrial inkjet printers industry are focusing on direct client engagement, enabling tailored solutions, and offering full-service packages including maintenance, training, and integration. Many are investing heavily in R&D to advance printhead technology, ink chemistry, and sustainable practices to align with regulatory requirements and customer expectations. Strategic collaborations and acquisitions are also common, helping to expand product portfolios and access new regional markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 End use industry

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Continuous inkjet

- 5.3 Drop on demand

- 5.4 UV inkjet

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By End Use Industry, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Food & beverage

- 6.3 Chemical

- 6.4 Pharmaceutical

- 6.5 Packaging

- 6.6 Personal care & cosmetics

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Indirect sales

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034, ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 The U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 South Africa

Chapter 9 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 9.1 Brother Industries

- 9.2 Canon

- 9.3 Domino Printing Sciences

- 9.4 Durst Phototechnik

- 9.5 Electronics For Imaging

- 9.6 Epson

- 9.7 Fujifilm

- 9.8 Hitachi Industrial Equipment Systems

- 9.9 HP

- 9.10 Keyence

- 9.11 Konica Minolta

- 9.12 Leibinger Group

- 9.13 Markem-Imaje

- 9.14 Mitsubishi Heavy Industries Printing & Packaging Machinery

- 9.15 Videojet