|

市场调查报告书

商品编码

1766280

溶栓药物市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Thrombolytic Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

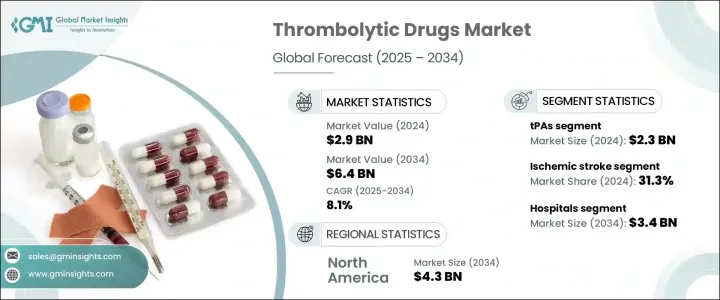

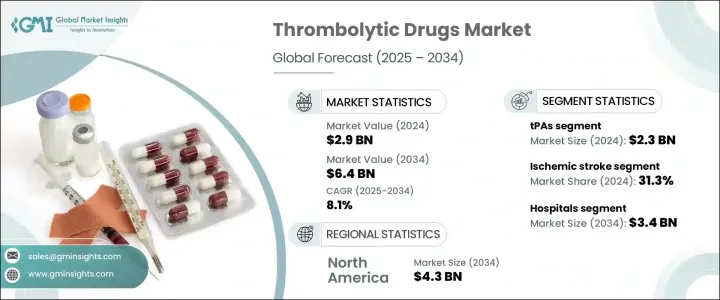

2024年,全球溶栓药物市场规模达29亿美元,预计2034年将以8.1%的复合年增长率成长,达到64亿美元。这一稳定增长反映了全球心血管疾病负担的日益加重,包括心臟病发作、中风、肺栓塞和其他血栓相关疾病。随着久坐不动的生活方式、肥胖、高血压和人口老化日益普遍,血栓栓塞事件的发生率正在加速上升。这些趋势推动了对可在紧急情况下有效给药的速效溶栓药物的庞大需求。卫生系统正在认识到此类治疗的迫切性,尤其是在急诊环境中,快速介入对于改善患者预后至关重要。

科技在推动市场发展方面发挥着至关重要的作用。药物研发和给药方法的进步有助于提高溶栓疗法的精准度和效率。剂量和剂型的创新也支持更广泛的临床应用。同时,由于诊断和影像技术的进步,人们对早期介入的认识也不断提高。及时发现和及时治疗正成为医院和急诊室的标准,而这些地方正是溶栓药物最常用的地方。随着临床实践的发展,对有效、安全且易于管理的治疗方法的需求也在增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 29亿美元 |

| 预测值 | 64亿美元 |

| 复合年增长率 | 8.1% |

血栓溶解药物,通常称为纤溶酶原抑制剂,对于溶解因各种心血管疾病形成的血栓至关重要。这些药物透过活化人体的纤溶系统来分解纤维蛋白(血块中的主要蛋白质)。血栓溶解药物市场包含几个主要类别,包括组织型纤溶酶原激活剂 (tPA)、链激酶和尿激酶型纤溶酶原激活剂 (uPA),其应用主要集中在医院和重症监护室。

其中,组织型纤溶酶原激活剂(tPA)领域引领全球市场,2024年收入达23亿美元。预计到2034年,该领域营收将增加至51亿美元,复合年增长率为8.2%。 tPA的主导地位源自于其在重大健康事件中高效溶解血栓。由于在急性病例中及时使用具有充分的临床证据,这些药物被广泛使用。 tPA使用率上升的潜在驱动因素之一是全球糖尿病病例激增。糖尿病会透过血管损伤、凝血倾向增强和代谢失衡增加血栓事件的风险,所有这些都增加了对积极溶栓疗法的需求。

就溶栓药物治疗的疾病而言,缺血性中风是最大的适应症领域,2024年占全球市场份额的31.3%。由于缺血性中风的高发病率,该领域预计在2034年之前保持强劲增长,缺血性中风占全球中风病例的大多数。这些中风通常由脑部血流阻塞引起,需要立即就医。全球中风病例数量的不断增长,加上人们对中风预防和管理意识的不断提高,正在增加对溶栓疗法的需求。糖尿病、高血压和肥胖等通常与中风风险相关的疾病,进一步推动了使用这些药物进行有效医疗干预的需求。

以终端用户划分,医院在2024年成为领先的细分市场,占54.8%的市场。预计到2034年,该细分市场的规模将达到34亿美元,复合年增长率为7.7%。医院凭藉其快速诊断和及时启动治疗的能力,成为需要溶栓治疗患者的主要护理场所。心臟病发作和中风导致的急诊入院率不断上升,持续支撑着医院的需求。此外,全球对重症监护基础设施的投资正在扩大此类治疗的可近性,尤其是在城市地区和发达的医疗保健系统中。虽然门诊中心的吸引力日益增强,但医院仍是溶栓药物给药的基石。

从区域来看,北美在2024年引领市场,创造了20亿美元的收入。预计到2034年,该地区的收入将达到43亿美元,复合年增长率为7.9%。北美的市场领导地位归功于其先进的医疗基础设施、良好的报销环境以及血栓性疾病的高发病率。该地区越来越多地采用先进疗法,并推行支持性医疗政策,这持续推动了对溶栓剂的需求。此外,药物创新、强大的临床产品线以及强大的产业影响力,也有助于该地区在全球市场中占据主导地位。

竞争环境的本质在于,领先的企业不断投资研发,拓展产品线,并瞄准新兴市场以拓宽市场进入管道。各公司正努力提升药物安全性,简化给药方式,以在严格监管、注重疗效的市场中保持优势。这些努力凸显了溶栓药物研发的持续发展,而这种发展受到创新、临床需求和策略定位的影响。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 心脑血管事件发生率上升

- 扩大初级中风中心和急救护理基础设施

- 溶栓药物製剂的进展

- 有利的指导方针和协议纳入

- 产业陷阱与挑战

- 出血风险高且治疗窗口窄

- 来自机械干预和直接口服抗凝血剂(DOAC)的竞争

- 市场机会

- 政府措施和资金

- 针对罕见凝血障碍的溶栓剂的开发

- 成长动力

- 成长潜力分析

- 管道分析

- 未来市场趋势

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 临床试验分析

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 扩张计划

第五章:市场估计与预测:按药物类别,2021 年至 2034 年

- 主要趋势

- 组织纤溶酶原激活剂(tPA)

- 链激酶衍生物

- 尿激酶型纤溶酶原激活剂(uPA)

第六章:市场估计与预测:按适应症,2021 年至 2034 年

- 主要趋势

- 缺血性中风

- 心肌梗塞

- 肺栓塞

- 深层静脉栓塞

- 导管阻塞

- 其他适应症

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用途

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- Boehringer Ingelheim

- Chiesi Farmaceutici

- Genentech (F. Hoffmann-La Roche)

- Gennova Biopharmaceuticals

- Karma Pharmatech

- Lupin

- MicrobixBiosystems

- Reliance Lifesciences

- TechpoolBio-Pharma (Shanghai Pharma)

The Global Thrombolytic Drugs Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 6.4 billion by 2034. This steady rise reflects the growing burden of cardiovascular diseases across the globe, including heart attacks, strokes, pulmonary embolism, and other clot-related conditions. As sedentary lifestyles, obesity, hypertension, and aging populations become increasingly common, the prevalence of thromboembolic events is accelerating. These trends are driving significant demand for fast-acting clot-dissolving medications that can be administered effectively in emergencies. Health systems are recognizing the urgency of such treatments, especially in acute care settings, where rapid intervention is critical for improving patient outcomes.

Technology is playing a vital role in propelling the market forward. Advancements in drug development and delivery methods are helping enhance the precision and efficiency of thrombolytic therapies. Innovations in dosing and formulation are also supporting broader clinical adoption. Alongside these developments, awareness surrounding early intervention is growing, thanks to improved diagnostic and imaging technologies. Timely detection and prompt treatment are becoming the standard in hospitals and emergency rooms, where these drugs are most commonly used. As clinical practice evolves, so does the need for therapeutics that are not only effective but also safe and easy to administer.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 8.1% |

Thrombolytic drugs, often referred to as fibrinolytic agents, are essential in dissolving blood clots that form due to various cardiovascular conditions. These medications work by activating the body's fibrinolytic system to break down fibrin, the primary protein found in clots. The market comprises several key categories, including tissue plasminogen activators (tPAs), streptokinase, and urokinase-type plasminogen activators (uPAs), with applications mostly concentrated in hospitals and critical care settings.

Among these, the tPAs segment led the global market, generating USD 2.3 billion in revenue in 2024. This segment is expected to rise to USD 5.1 billion by 2034, growing at a CAGR of 8.2%. The dominance of tPAs stems from their high efficacy in clot resolution during critical health events. These agents are widely prescribed due to well-documented clinical benefits when used promptly in acute cases. One of the underlying drivers of increased tPA utilization is the global surge in diabetes cases. The disease heightens the risk of thrombotic events through vascular damage, increased clotting tendencies, and metabolic imbalances, all of which raise the need for aggressive clot-busting therapies.

In terms of medical conditions treated with thrombolytics, ischemic stroke represented the largest indication segment, accounting for 31.3% of the global market share in 2024. This segment is on track to maintain strong growth through 2034, supported by the high incidence of ischemic strokes, which make up the majority of stroke cases globally. These strokes are typically caused by obstructions in cerebral blood flow and require immediate medical attention. The growing number of stroke cases worldwide, combined with rising awareness of stroke prevention and management, is increasing the demand for thrombolytic therapies. Conditions such as diabetes, high blood pressure, and obesity-commonly linked to stroke risk-are further boosting the need for effective medical intervention using these drugs.

By end user, hospitals emerged as the leading segment in 2024, holding a 54.8% share of the market. This segment is expected to reach USD 3.4 billion by 2034, progressing at a CAGR of 7.7%. Hospitals serve as the primary point of care for patients requiring thrombolytic treatment, thanks to their ability to conduct rapid diagnostics and initiate therapy without delay. The increasing frequency of emergency admissions due to heart attacks and strokes continues to support hospital demand. Additionally, global investment in critical care infrastructure is expanding access to such treatments, especially in urban areas and developed healthcare systems. While outpatient centers are gaining traction, hospital settings remain the cornerstone of thrombolytic drug administration.

Regionally, North America led the market in 2024, generating USD 2 billion in revenue. The region is forecasted to reach USD 4.3 billion by 2034, growing at a CAGR of 7.9%. The market leadership of North America can be attributed to its advanced healthcare infrastructure, favorable reimbursement environment, and high prevalence of thrombotic disorders. The increased adoption of advanced therapies and supportive healthcare policies in this region continue to drive the demand for thrombolytics. Additionally, pharmaceutical innovation, a robust clinical pipeline, and strong industry presence contribute to the region's dominance in the global landscape.

The competitive environment is defined by leading players investing in research, expanding product lines, and targeting emerging markets to broaden access. Companies are striving to improve drug safety profiles and streamline delivery methods to maintain their edge in a tightly regulated, performance-focused market. These efforts underscore the ongoing evolution of thrombolytic drug development, shaped by innovation, clinical demand, and strategic positioning.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Drug class

- 2.2.3 Indication

- 2.2.4 End use

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of cardiovascular and cerebrovascular events

- 3.2.1.2 Expansion of primary stroke centers and emergency care infrastructure

- 3.2.1.3 Advancements in thrombolytic drug formulations

- 3.2.1.4 Favorable guidelines and protocol inclusion

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High risk of bleeding and narrow therapeutic window

- 3.2.2.2 Competition from mechanical interventions and direct oral anticoagulants (DOACs)

- 3.2.3 Market opportunities

- 3.2.3.1 Government initiatives and funding

- 3.2.3.2 Development of thrombolytics tailored to rare clotting disorders

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.7 Clinical trial analysis

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Mergers and acquisitions

- 4.5.2 Partnerships and collaborations

- 4.5.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Tissue plasminogen activators (tPAs)

- 5.3 Streptokinase derivatives

- 5.4 Urokinase-type plasminogen activators (uPAs)

Chapter 6 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Ischemic stroke

- 6.3 Myocardial infarction

- 6.4 Pulmonary embolism

- 6.5 Deep vein thrombosis

- 6.6 Catheter occlusion

- 6.7 Other indications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Boehringer Ingelheim

- 9.3 Chiesi Farmaceutici

- 9.4 Genentech (F. Hoffmann-La Roche)

- 9.5 Gennova Biopharmaceuticals

- 9.6 Karma Pharmatech

- 9.7 Lupin

- 9.8 MicrobixBiosystems

- 9.9 Reliance Lifesciences

- 9.10 TechpoolBio-Pharma (Shanghai Pharma)