|

市场调查报告书

商品编码

1766303

细胞株开发市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cell Line Development Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

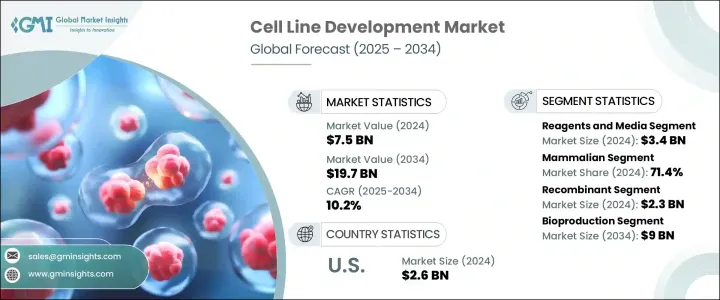

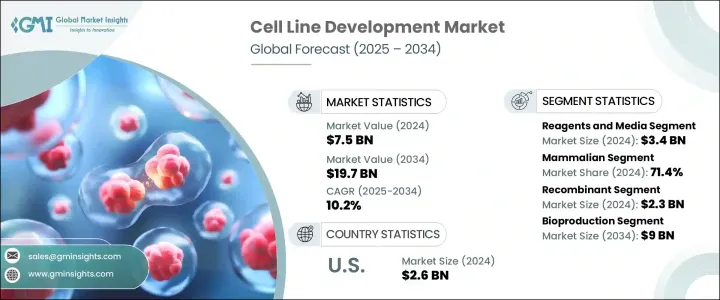

2024 年全球细胞株开发市场价值 75 亿美元,预计到 2034 年将以 10.2% 的复合年增长率成长,达到 197 亿美元。市场扩张的动力源于对生物製剂和生物相似药日益增长的关注,尤其是随着製药业转向个人化治疗和精准医疗。对单株抗体、疫苗和重组蛋白的需求激增,使得开发高度稳定和高产量的细胞系成为当务之急。自体免疫疾病、癌症和传染性疾病等慢性疾病的增加导致生物製剂的应用日益广泛,而生物製剂在很大程度上依赖特征明确的细胞系。这也增加了对品质控制生产系统的需求。合约开发和製造组织 (CDMO) 为市场发展做出了重大贡献。

越来越多的中小型生物技术公司将细胞株开发外包给CDMO,以降低营运成本并加快进度,从而受益于CDMO的技术专长、可扩展的平台以及对FDA等机构的合规性。这一趋势使公司能够专注于研发创新等核心竞争力,同时利用CDMO提供端到端服务,包括细胞株筛选、克隆筛选、製程优化和GMP生产。这些合作关係还能提供先进的技术、简化的工作流程和成熟的品质保证框架,从而加快进入临床试验阶段,并降低与内部产能限制相关的风险。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 75亿美元 |

| 预测值 | 197亿美元 |

| 复合年增长率 | 10.2% |

2024年,试剂和培养基细分市场产值达34亿美元。由于其在研发和生产阶段的细胞生长和维持中发挥核心作用,该细分市场将继续占据主导地位。随着哺乳动物细胞在生物製剂生产中的使用量显着增加,对高效试剂和细胞培养基的需求也随之激增。无蛋白质和无血清培养基的日益普及,正推动该细分市场的发展,它们能够提高可扩展性、降低污染风险,并在大规模生产环境中保持一致性。此类培养基对于监管审批和生物製剂生产的效率至关重要,因为生物製剂生产需要严格的製程控制。

就细胞类型而言,哺乳动物细胞细分市场在2024年创造了最高的收入,占71.4%。其主导地位与其卓越的表达人源性治疗性蛋白的能力以及精准的翻译后修饰能力息息相关。 CHO和HEK-293等广泛使用的细胞係因其强大的蛋白质折迭、糖基化和可扩展性而备受生物製剂生产的青睐。 CRISPR-Cas9等基因编辑工具的技术进步,加上自动化和高通量系统,持续提升了哺乳动物细胞株开发的速度和稳定性,进一步巩固了其在市场上的领先地位。

2024年,美国细胞株开发市场规模达26亿美元,这得益于先进的生物製药基础设施、高发生率的慢性病发病率以及尖端生物疗法的广泛应用。美国完善的製药生态系统,包括顶尖的生技公司和大量的研发投入,在市场扩张中扮演关键角色。美国各地的研究机构和创新中心也在加速基因编辑和自动化平台的技术进步,以实现更快、更有效率的开发週期。政府和私营部门的资金也在推动创新,进一步巩固了美国在该领域的领先地位。

全球细胞株开发市场的主要公司包括 PromoCell、诺华、Genscript Biotech、赛多利斯、赛默飞世尔科技、ProBioGen、Cytiva(丹纳赫集团)、ASIMOV、Advanced Instruments、Sigma Aldrich(默克集团)、Eurofins Scientific、药明康德、Aragen Life Sciences、Fyonigen Life 和沙龙集团。细胞株开发领域的顶尖企业正在大力投资技术创新,例如自动化细胞筛选平台、一次性生物反应器和基于 CRISPR 的基因组编辑。许多公司正在与生物技术公司和合约研发生产组织 (CDMO) 建立策略联盟,以增强服务范围并扩大生产能力。收购也是整合新技术或获得区域准入的热门倡议。各公司正专注于研发无血清和化学成分确定的培养基,以帮助提高法规遵循和可扩展性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 全球疫苗产量不断成长

- 全球癌症发生率不断上升

- 细胞株开发的技术创新

- 不断发展的生物技术产业

- 产业陷阱与挑战

- 复杂的监管格局

- 与干细胞研究相关的挑战

- 市场机会

- 个人化医疗和再生疗法的新兴应用

- 人工智慧在细胞株优化的应用

- 成长动力

- 成长潜力分析

- 监管格局

- 未来市场趋势

- CHO 细胞系的新兴治疗应用

- 技术格局

- 当前的技术趋势

- 新兴技术

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品和服务,2021 年至 2034 年

- 主要趋势

- 试剂和培养基

- 装置

- 孵化器

- 离心机

- 生物反应器

- 仓储设备

- 显微镜

- 电穿孔仪

- 萤光活化细胞分选

- 其他设备

- 配件和耗材

- 服务

第六章:市场估计与预测:依来源,2021 年至 2034 年

- 主要趋势

- 哺乳动物

- 中国仓鼠卵巢(CHO)

- 人类胚胎肾(HEK)

- 幼仓鼠肾(BHK)

- 鼠骨髓瘤

- 其他哺乳动物来源

- 非哺乳动物

- 昆虫

- 两栖类

第七章:市场估计与预测:按细胞株,2021 – 2034

- 主要趋势

- 重组

- 杂交瘤

- 连续性细胞系

- 原代细胞系

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 生物生产

- 药物研发

- 毒性测试

- 组织工程

- 研究

第九章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 製药和生物技术公司

- 学术和研究机构

- 合约研究组织(CRO)

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Advanced Instruments

- Aragen Life Sciences

- ASIMOV

- Cytiva (Danaher Corporation)

- Eurofins Scientific

- Fyonibio

- Genscript Biotech

- Lonza Group

- Novartis

- ProBioGen

- PromoCell

- Sartorius

- Sigma Aldrich (Merck KGaA)

- Thermo Fisher Scientific

- WuXi AppTec

The Global Cell Line Development Market was valued at USD 7.5 billion in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 19.7 billion by 2034. Market expansion is being fueled by a growing focus on biologics and biosimilars, particularly as the pharmaceutical industry shifts toward personalized therapies and precision medicine. The surge in demand for monoclonal antibodies, vaccines, and recombinant proteins has placed a strong emphasis on the development of highly stable and productive cell lines. The increase in chronic illnesses-such as autoimmune diseases, cancer, and infectious disorders-has led to the rising adoption of biologics, which depend heavily on well-characterized cell lines. This has also elevated the need for quality-controlled production systems. Contract development and manufacturing organizations (CDMOs) have contributed significantly to market momentum.

Small and mid-sized biotech firms are increasingly outsourcing their cell line development to CDMOs to reduce overhead costs and accelerate timelines, benefiting from their technical expertise, scalable platforms, and regulatory compliance with agencies like the FDA. This trend allows companies to focus on core competencies such as research and innovation while leveraging CDMOs for end-to-end services including cell line screening, clone selection, process optimization, and GMP manufacturing. These partnerships also offer access to advanced technologies, streamlined workflows, and proven quality assurance frameworks, enabling faster entry into clinical trials and reducing risks associated with internal capacity limitations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.5 Billion |

| Forecast Value | $19.7 Billion |

| CAGR | 10.2% |

The reagents and media segment generated USD 3.4 billion in 2024. This segment continues to dominate due to its central role in cell growth and maintenance across both R&D and production stages. With a notable increase in the use of mammalian cells for biologics manufacturing, the demand for high-efficiency reagents and cell culture media has surged. A growing preference for protein-free and serum-free media is helping the segment gain traction, offering improved scalability, reduced risk of contamination, and consistency in large-scale production environments. Such media types are essential for regulatory approval and efficiency in biologics manufacturing, which demands stringent process control.

In terms of cell type, mammalian cells segment generated the highest revenue in 2024, accounting for 71.4%. Their dominance is linked to their superior ability to express human-compatible therapeutic proteins with accurate post-translational modifications. Widely used cell lines such as CHO and HEK-293 are favored in biologics production due to their robust protein folding, glycosylation, and scalability. Technological progress in gene editing tools, such as CRISPR-Cas9, combined with automation and high-throughput systems, continues to enhance the speed and stability of mammalian cell line development, further reinforcing their leadership in the market.

United States Cell Line Development Market was valued at USD 2.6 billion in 2024, driven by a combination of advanced biopharma infrastructure, high rates of chronic disease, and strong adoption of cutting-edge biologic therapies. The country's well-established pharmaceutical ecosystem, which includes top-tier biotech firms and extensive R&D investment, plays a pivotal role in expanding the market. Research institutions and innovation hubs across the US are also accelerating technological advancements in gene editing and automated platforms, leading to faster and more efficient development cycles. Government and private sector funding are also propelling innovation, further supporting the country's leadership in the field.

Key companies operating in the Global Cell Line Development Market include PromoCell, Novartis, Genscript Biotech, Sartorius, Thermo Fisher Scientific, ProBioGen, Cytiva (Danaher Corporation), ASIMOV, Advanced Instruments, Sigma Aldrich (Merck KGaA), Eurofins Scientific, WuXi AppTec, Aragen Life Sciences, Fyonibio, and Lonza Group. Top-tier players in the cell line development space are heavily investing in technological innovations like automated cell screening platforms, single-use bioreactors, and CRISPR-based genome editing. Many companies are forming strategic alliances with biotech firms and CDMOs to enhance service offerings and expand production capabilities. Acquisitions are also a popular move to integrate novel technologies or gain regional access. Firms are focusing on R&D to develop serum-free and chemically defined media, helping improve regulatory compliance and scalability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Products & services

- 2.2.3 Source

- 2.2.4 Cell line

- 2.2.5 Application

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing vaccine production worldwide

- 3.2.1.2 Increasing prevalence of cancer across the globe

- 3.2.1.3 Technological innovations in cell line development

- 3.2.1.4 Growing biotechnology industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complex regulatory landscape

- 3.2.2.2 Challenges related to stem cell research

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging applications in personalized medicine and regenerative therapies

- 3.2.3.2 Adoption of artificial intelligence in cell line optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Future market trends

- 3.6 Emerging therapeutic applications of CHO cell lines

- 3.7 Technology landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Products & Services, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reagents and media

- 5.3 Equipment

- 5.3.1 Incubator

- 5.3.2 Centrifuges

- 5.3.3 Bioreactors

- 5.3.4 Storage equipment

- 5.3.5 Microscopes

- 5.3.6 Electroporators

- 5.3.7 Fluorescence-activated cell sorting

- 5.3.8 Other equipment

- 5.4 Accessories and consumables

- 5.5 Services

Chapter 6 Market Estimates and Forecast, By Source, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Mammalian

- 6.2.1 Chinese Hamster Ovary (CHO)

- 6.2.2 Human Embryonic Kidney (HEK)

- 6.2.3 Baby Hamster Kidney (BHK)

- 6.2.4 Murine myeloma

- 6.2.5 Other mammalian sources

- 6.3 Non-mammalian

- 6.3.1 Insects

- 6.3.2 Amphibians

Chapter 7 Market Estimates and Forecast, By Cell Line, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Recombinant

- 7.3 Hybridomas

- 7.4 Continuous cell lines

- 7.5 Primary cell lines

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Bioproduction

- 8.3 Drug discovery

- 8.4 Toxicity testing

- 8.5 Tissue engineering

- 8.6 Research

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Pharmaceutical and biotechnology companies

- 9.3 Academic and research institutes

- 9.4 Contract research organizations (CROs)

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Advanced Instruments

- 11.2 Aragen Life Sciences

- 11.3 ASIMOV

- 11.4 Cytiva (Danaher Corporation)

- 11.5 Eurofins Scientific

- 11.6 Fyonibio

- 11.7 Genscript Biotech

- 11.8 Lonza Group

- 11.9 Novartis

- 11.10 ProBioGen

- 11.11 PromoCell

- 11.12 Sartorius

- 11.13 Sigma Aldrich (Merck KGaA)

- 11.14 Thermo Fisher Scientific

- 11.15 WuXi AppTec