|

市场调查报告书

商品编码

1766309

工业热水器市场机会、成长动力、产业趋势分析及2025-2034年预测Industrial Water Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

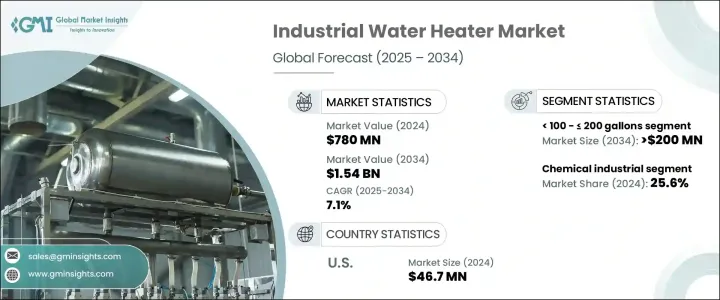

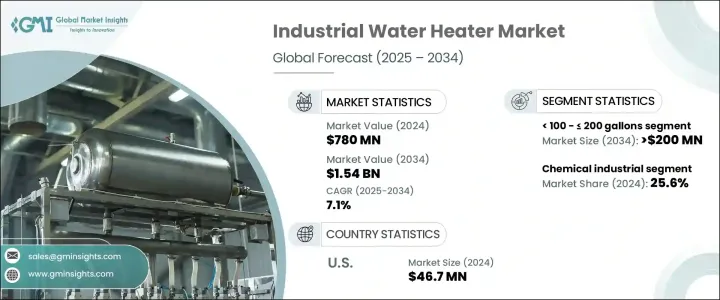

全球工业热水器市场规模达7.8亿美元,预计2034年将以7.1%的复合年增长率成长,达到15.4亿美元。这一增长主要源于对节能係统日益增长的需求以及工业能源消耗的增加。这一上升趋势反映了行业整体向可持续且经济高效的供暖解决方案的转变,这些解决方案与全球减少排放和遵守严格能源法规的努力相一致。

工业运作正在快速发展,促使製造商采用更可靠、更先进的热水技术。对于不仅能提供稳定性能,还能减少停机时间的系统的需求显着激增。这些进步对于注重优化能源使用并维持营运效率的产业尤其重要。采用先进热能技术的先进热水器正在取代老旧系统,减少对环境的影响并改善整体能源管理。对自动化工业流程的日益重视也促进了需求的成长,预测性维护和人工智慧驱动的温度控制等智慧功能增强了营运灵活性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.8亿美元 |

| 预测值 | 15.4亿美元 |

| 复合年增长率 | 7.1% |

製造设施中数位基础设施的日益整合,进一步支持了现代热水设备的采用。工业 4.0 创新正在重塑工业供热格局,使设施能够预测维护需求并避免意外故障。这种变革不仅是为了提高效能,也是为了支持可扩展的运营,特别是对于那些需要应对季节性或波动性加工需求的设施而言。

依容量划分,工业热水器市场主要分为三大类:100 加仑至 200 加仑(含 100 加仑)、200 加仑以上至 500 加仑(含 500 加仑)以及 500 加仑以上。其中,容量在 100 加仑至 200 加仑(含 100 加仑)之间的系统正受到广泛关注,预计到 2034 年,其市场规模将超过 2 亿美元。这些设备越来越多地被应用于需要灵活模组化加热解决方案的场合。其紧凑的体积、更高的能源效率以及与智慧技术的兼容性使其适用于各种工业应用。该领域市场的成长主要归功于从传统的燃料系统向现代环保替代能源的转变,这些替代能源在不影响性能的情况下实现了高效率。

根据应用,市场可分为多个行业,包括纸浆和造纸、食品加工、金属和采矿、化学品、炼油厂等。其中,化学工业在2024年占据了最高份额,占整个市场的25.6%。这种主导地位源自于对耐腐蚀、高性能、能够承受腐蚀性化学环境的加热器的持续需求。化学加工产业优先考虑能源优化,因此高效能热水器对于确保恶劣操作条件下的可靠性和製程稳定性至关重要。

从地区来看,美国工业热水器的普及率持续成长。 2022年,美国市场规模为3,550万美元,2023年增至4,370万美元,2024年则达4,670万美元。这项成长主要得益于以节能为重点的监管规定,以及鼓励投资高效能设备的优惠税政策。此外,旨在减少工业设施排放的联邦政府措施也进一步推动了以先进暖气解决方案取代过时系统的趋势。

积极塑造工业热水器市场竞争格局的知名公司包括阿里斯顿集团、AO史密斯、Bradford White Corporation、FLEXIHEAT UK、Eemax、Hevac、Jaguar India、Hubbell Heaters、Lochinvar、Thermex Corporation、Sioux Corporation、Thermotech Systems、Herambh Coolingz、Viessmann和Andrews。这些公司不断创新,以满足全球各行各业对永续、智慧和耐用热水解决方案日益增长的需求。他们专注于产品开发、智慧技术整合以及向新兴市场的扩张,预计将在预测期内继续影响竞争态势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依产能,2021 - 2034 年

- 主要趋势

- < 100 - ≤ 200 加仑

- > 200 - ≤ 500 加仑

- > 500 加仑

第六章:市场规模及预测:依燃料,2021 - 2034 年

- 主要趋势

- 电的

- 气体

- 其他的

第七章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 食品加工

- 纸浆和造纸

- 化学

- 炼油厂

- 金属与矿业

- 其他的

第八章:市场规模及预测:依销售管道,2021 - 2034 年

- 主要趋势

- 在线的

- 经销商

- 零售

第九章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 葡萄牙

- 罗马尼亚

- 荷兰

- 瑞士

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 埃及

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第十章:公司简介

- AO Smith

- Andrews

- Ariston Group

- Bradford White Corporation

- Eemax

- FLEXIHEAT UK

- Herambh Coolingz

- Hevac

- Hubbell Heaters

- Jaguar India

- Lochinvar

- Sioux Corporation

- Thermex Corporation

- Thermotech Systems

- Viessmann

The Global Industrial Water Heater Market was valued at USD 780 million and is estimated to grow at a CAGR of 7.1% to reach USD 1.54 billion by 2034. The growth is driven by the rising need for energy-efficient systems and increased industrial energy consumption. This upward trend reflects a broader industry shift toward sustainable and cost-effective heating solutions that align with global efforts to reduce emissions and comply with stringent energy regulations.

Industrial operations are evolving rapidly, prompting manufacturers to adopt more reliable and advanced water heating technologies. There is a noticeable demand surge for systems that not only deliver consistent performance but also reduce operational downtime. These advancements are especially relevant for industries focused on optimizing their energy use while maintaining operational efficiency. Sophisticated water heaters featuring advanced thermal energy technologies are now replacing older systems, reducing environmental impact and improving overall energy management. The growing emphasis on automated industrial processes is also contributing to the rise in demand, with smart features like predictive maintenance and AI-driven temperature control enhancing operational flexibility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $780 Million |

| Forecast Value | $1.54 Billion |

| CAGR | 7.1% |

The increasing integration of digital infrastructure in manufacturing facilities is further supporting the adoption of modern water heating equipment. Industry 4.0 innovations are reshaping industrial heating landscapes, enabling facilities to anticipate maintenance requirements and avoid unexpected failures. This evolution is not just about improving performance but also about supporting scalable operations, especially for facilities dealing with seasonal or fluctuating processing demands.

By capacity, the industrial water heater market is segmented into three key categories: 100 to <= 200 gallons, > 200 to <= 500 gallons, and > 500 gallons. Among these, systems with capacities ranging from 100 to <= 200 gallons are gaining widespread attention, and their market is projected to exceed USD 200 million by 2034. These units are increasingly being adopted in settings that require flexible and modular heating solutions. Their compact footprint, enhanced energy efficiency, and compatibility with smart technologies make them suitable for various industrial applications. The market's growth in this segment is largely attributed to the transition from traditional fuel-based systems to modern, environmentally friendly alternatives that deliver high efficiency without compromising performance.

Based on application, the market is divided into several industries, including pulp and paper, food processing, metal and mining, chemicals, refinery, and others. Among these, the chemical industry accounted for the highest share in 2024, representing 25.6% of the total market. This dominance is fueled by a consistent demand for corrosion-resistant, high-performance heaters that can withstand aggressive chemical environments. The chemical processing sector prioritizes energy optimization, making high-efficiency water heaters essential for ensuring reliability and process stability in harsh operating conditions.

Regionally, the United States continues to demonstrate consistent growth in industrial water heater adoption. The market in the U.S. was valued at USD 35.5 million in 2022, increased to USD 43.7 million in 2023, and reached USD 46.7 million in 2024. This growth is primarily supported by regulatory mandates focused on energy conservation, as well as favorable tax provisions that encourage investments in high-efficiency equipment. Additionally, federal initiatives designed to reduce emissions from industrial facilities have further fueled the replacement of outdated systems with advanced heating solutions.

Prominent companies actively shaping the competitive landscape of the industrial water heater market include Ariston Group, A.O. Smith, Bradford White Corporation, FLEXIHEAT UK, Eemax, Hevac, Jaguar India, Hubbell Heaters, Lochinvar, Thermex Corporation, Sioux Corporation, Thermotech Systems, Herambh Coolingz, Viessmann, and Andrews. These players are constantly innovating to meet the growing demand for sustainable, smart, and durable water heating solutions across global industries. Their focus on product development, integration of smart technologies, and expansion into emerging markets is expected to continue influencing the competitive dynamics over the forecast period.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 < 100 - ≤ 200 gallons

- 5.3 > 200 - ≤ 500 gallons

- 5.4 > 500 gallons

Chapter 6 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Electric

- 6.3 Gas

- 6.4 Others

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Food processing

- 7.3 Pulp & paper

- 7.4 Chemical

- 7.5 Refinery

- 7.6 Metal & mining

- 7.7 Others

Chapter 8 Market Size and Forecast, By Sales Channel, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Dealer

- 8.4 Retail

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Portugal

- 9.3.7 Romania

- 9.3.8 Netherlands

- 9.3.9 Switzerland

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Egypt

- 9.5.4 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 A.O. Smith

- 10.2 Andrews

- 10.3 Ariston Group

- 10.4 Bradford White Corporation

- 10.5 Eemax

- 10.6 FLEXIHEAT UK

- 10.7 Herambh Coolingz

- 10.8 Hevac

- 10.9 Hubbell Heaters

- 10.10 Jaguar India

- 10.11 Lochinvar

- 10.12 Sioux Corporation

- 10.13 Thermex Corporation

- 10.14 Thermotech Systems

- 10.15 Viessmann