|

市场调查报告书

商品编码

1766344

工业液压设备市场机会、成长动力、产业趋势分析及2025-2034年预测Industrial Hydraulic Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

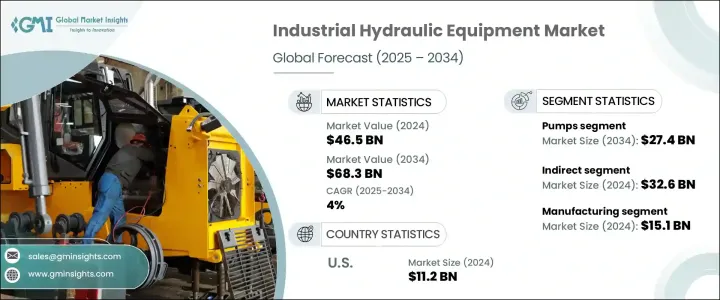

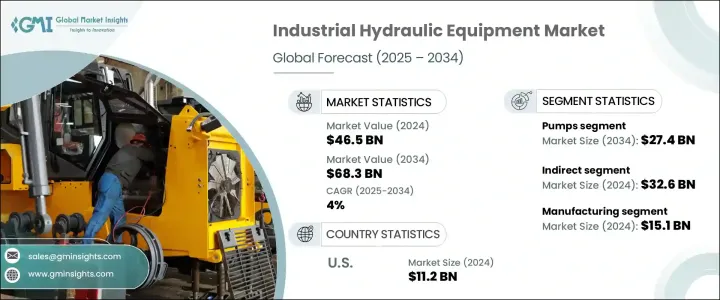

2024年,全球工业液压设备市场规模达465亿美元,预计2034年将以4%的复合年增长率成长,达到683亿美元。工业4.0在工业设施中的日益普及,推动着液压系统整合和应用方式的显着转变。透过整合感测器、物联网模组和人工智慧预测技术等智慧组件,製造商正在提升液压系统的运作能力。这些先进的解决方案能够即时追踪压力、温度和流体流量等关键参数,从而显着改进预测性维护策略,最大限度地减少停机时间,并提高整体能源效率。因此,现代电液系统如今已能够在全自动工业框架内无缝运行,使液压技术成为智慧製造崛起的重要支柱。

在新兴经济体中,快速的城市发展正推动对重型建筑和土方机械的需求激增。液压系统在这些机械中不可或缺,为极端条件下的作业提供所需的动力和控制。随着全球基础设施项目的扩张,对起重机、挖土机和钻井系统等设备的需求持续成长。这些机械依靠高性能液压系统来确保精度、可靠性和耐用性。同时,各行各业也越来越重视能够降低能耗、保障环境安全的永续替代方案。这一趋势推动着生态高效液压解决方案的创新,预计在未来几年开闢新的成长途径。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 465亿美元 |

| 预测值 | 683亿美元 |

| 复合年增长率 | 4% |

依产品类型划分,市场可分为泵浦、汽缸、马达、阀门及其他。其中,泵类产品占最大市场份额,预计2024年市场价值为185亿美元,到2034年将达到274亿美元。泵浦的广泛应用源自于其将机械能转化为液压能的重要作用,而液压能对各种工业应用都至关重要。从装配线到起重系统和物料运输作业,泵浦是固定和移动工业设备中流体动力系统的支柱。对高精度计量和节能的日益追求,推动了变数泵等先进技术的发展,这些技术能够提高效率和动态控制能力。

在活跃的工业环境中,日常维护和零件更换週期也支撑了对液压泵的持续需求。随着老旧零件的使用寿命临近,企业会持续投资于符合现代性能标准的更新、更有效率的液压解决方案。涵盖泵浦、缸、马达、阀门等更广泛的产品领域,其市场规模在 2024 年达到 326 亿美元,预计在预测期内的复合年增长率将达到 3.4%。

推动该市场成长的另一个因素是间接分销管道的扩张。越来越多的授权供应商、专业经销商和数位平台正在提升产品在不同产业和地区的可及性。这些经销商通常将核心液压产品与相关工程服务(例如流体状态监测、过滤套件和液压油管理系统)捆绑销售。这种一体化方案简化了采购流程,并加强了客户关係。此外,现场技术支援和即时产品演示进一步增强了工业买家的信心,使分销商能够保持强劲且具有竞争力的市场地位。

依最终用途产业细分,市场涵盖製造业、建筑业、林业和农业、采矿业、石油和天然气、航太业、航空航太业等。製造业在2024年达到151亿美元,预计2034年将以4.5%的复合年增长率成长。液压系统在製造过程中发挥着至关重要的作用,尤其是在用于材料成型、金属成型和高压机械任务的设备中。随着各行各业向全自动生产线迈进,液压系统必须提供更高水准的回应能力、能源管理和一致性。自动化的推动增加了对整合液压解决方案的需求,这些解决方案需要提供精确的控制、更短的循环时间和更低的营运成本。

从地区来看,美国引领北美工业液压设备市场,2024 年市场规模达 112 亿美元,预计到 2034 年复合年增长率将达到 3.8%。美国强大的工业基础和持续的基础设施投资使其成为区域市场成长的关键推动力。汽车製造、建筑施工和物料搬运等行业对可靠性和智慧自动化功能的液压系统的需求持续强劲。数位控制和智慧电液技术的日益普及,进一步推动了美国液压设备供应商的创新,他们正在不断扩大业务规模以满足这一需求。

纵观整个市场格局,企业正透过推出技术先进、节能高效且可客製化的液压设备来满足不断变化的客户期望。整合智慧控制功能、物联网连接和预测性维护功能已成为满足现代工业需求的核心策略。同时,更严格的全球能源和排放标准也迫使製造商采用更环保的设计原则。为了保持竞争力,企业不仅在丰富产品线,还在建立策略合作伙伴关係和进行收购,以扩大其在行动和工业自动化专业领域的影响力。这种持续的转变正在重塑市场,使其朝着更智慧、更有效率、更环保的液压系统发展。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 监理框架

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特五力分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- MEA

- 拉丁美洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 泵浦

- 圆柱

- 马达

- 阀门

- 其他的

第六章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 製造业

- 建造

- 林业和农业

- 矿业

- 石油和天然气

- 海洋

- 航太航太

- 其他的

第七章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 直接的

- 间接

第八章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第九章:公司简介

- Bosch Rexroth

- Bucher Hydraulics

- Caterpillar

- Danfoss

- Eaton

- HAWE Hydraulik

- Hitachi Construction Machinery

- HYDAC International

- Kawasaki Heavy Industries

- Komatsu

- KTI Hydraulics

- KYB

- Liebherr-International

- Mitsubishi Heavy Industries

- Parker-Hannifin

The Global Industrial Hydraulic Equipment Market was valued at USD 46.5 billion in 2024 and is estimated to grow at a CAGR of 4% to reach USD 68.3 billion by 2034. The growing adoption of Industry 4.0 across industrial facilities is driving a notable shift in how hydraulic systems are integrated and utilized. By incorporating intelligent components such as sensors, IoT-enabled modules, and AI-powered predictive technologies, manufacturers are enhancing the operational capabilities of hydraulic systems. These advanced solutions enable real-time tracking of essential parameters, including pressure, temperature, and fluid flow, which significantly improves predictive maintenance strategies, minimizes downtime, and boosts overall energy efficiency. As a result, modern electro-hydraulic systems now function seamlessly within fully automated industrial frameworks, establishing hydraulics as an essential pillar in the rise of smart manufacturing.

In emerging economies, rapid urban development is fueling a surge in demand for heavy-duty construction and earth-moving machinery. Hydraulic systems are indispensable in these machines, delivering the power and control required for operations under extreme conditions. As infrastructure projects expand globally, there is a continuous need for equipment such as cranes, excavators, and drilling systems. These machines depend on high-performance hydraulic systems for precision, reliability, and durability. In parallel, industries are increasingly focusing on sustainable alternatives that promote lower energy consumption and environmental safety. This trend is prompting innovation toward eco-efficient hydraulic solutions, which is expected to unlock new growth avenues in the years ahead.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $46.5 Billion |

| Forecast Value | $68.3 Billion |

| CAGR | 4% |

By product type, the market is segmented into pumps, cylinders, motors, valves, and others. Among these, the pump segment held the largest value share, estimated at USD 18.5 billion in 2024, and is projected to reach USD 27.4 billion by 2034. The widespread use of pumps stems from their fundamental role in converting mechanical energy into hydraulic power, which is vital across a variety of industrial applications. From assembly lines to lifting systems and material transport operations, pumps serve as the backbone of fluid power systems in both fixed and mobile industrial equipment. The increasing push for high-precision metering and energy conservation has led to the development of advanced technologies such as variable displacement pumps, which offer improved efficiency and dynamic control.

Consistent demand for hydraulic pumps is also supported by routine maintenance and part replacement cycles in active industrial environments. As older components reach the end of their service lives, businesses continue to invest in newer, more efficient hydraulic solutions that align with modern performance standards. The broader product segment, encompassing pumps, cylinders, motors, valves, and others, reached USD 32.6 billion in 2024 and is anticipated to grow at a CAGR of 3.4% during the forecast period.

Another factor contributing to the growth of this market is the expansion of indirect distribution channels. A growing number of authorized vendors, specialized dealers, and digital platforms are enhancing product accessibility across diverse industries and geographies. These distributors often bundle core hydraulic products with related engineering services such as fluid condition monitoring, filtration packages, and hydraulic fluid management systems. This all-in-one approach simplifies procurement and strengthens customer relationships. Additionally, on-ground technical support and real-time product demonstrations further reinforce confidence among industrial buyers, enabling distributors to maintain a resilient and competitive market presence.

When segmented by end-use industry, the market includes manufacturing, construction, forestry and agriculture, mining, oil and gas, marine, aerospace and aviation, and others. The manufacturing sector accounted for USD 15.1 billion in 2024 and is projected to grow at a CAGR of 4.5% through 2034. Hydraulics play a critical role in manufacturing operations, particularly in equipment used for material forming, metal shaping, and high-pressure mechanical tasks. As industries move toward fully automated production lines, hydraulic systems must deliver higher levels of responsiveness, energy management, and consistency. The push for automation has increased the demand for integrated hydraulic solutions that provide precise control, reduced cycle times, and lower operational costs.

Regionally, the United States led the North America industrial hydraulic equipment market, which was valued at USD 11.2 billion in 2024 and is forecast to expand at a CAGR of 3.8% through 2034. The country's robust industrial base and consistent investment in infrastructure development have made it a key contributor to regional market growth. Industries such as automotive manufacturing, building construction, and material handling continue to generate strong demand for hydraulic systems that offer reliability and intelligent automation features. The growing emphasis on digital control and smart electro-hydraulics is further fueling innovation across U.S.-based hydraulic equipment suppliers, who are increasingly scaling their operations to meet this demand.

Across the market landscape, companies are responding to evolving customer expectations by introducing technologically advanced, energy-efficient, and customizable hydraulic equipment. Integrating intelligent control features, IoT connectivity, and predictive maintenance capabilities has become a central strategy for meeting modern industrial demands. At the same time, stricter global energy and emissions standards are compelling manufacturers to adopt greener design principles. To stay competitive, businesses are not only diversifying their product lines but also forming strategic partnerships and acquisitions to expand their presence in specialized segments of mobile and industrial automation. This ongoing shift is reshaping the market, steering it toward more intelligent, efficient, and environmentally responsible hydraulic systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 End use industry

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Pumps

- 5.3 Cylinder

- 5.4 Motors

- 5.5 Valves

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By End Use Industry, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Manufacturing

- 6.3 Construction

- 6.4 Forestry & agriculture

- 6.5 Mining

- 6.6 Oil & Gas

- 6.7 Marine

- 6.8 Aerospace & aviation

- 6.9 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Direct

- 7.3 Indirect

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034, ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 The U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 South Africa

Chapter 9 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 9.1 Bosch Rexroth

- 9.2 Bucher Hydraulics

- 9.3 Caterpillar

- 9.4 Danfoss

- 9.5 Eaton

- 9.6 HAWE Hydraulik

- 9.7 Hitachi Construction Machinery

- 9.8 HYDAC International

- 9.9 Kawasaki Heavy Industries

- 9.10 Komatsu

- 9.11 KTI Hydraulics

- 9.12 KYB

- 9.13 Liebherr-International

- 9.14 Mitsubishi Heavy Industries

- 9.15 Parker-Hannifin