|

市场调查报告书

商品编码

1632063

移动式液压帮浦:全球市场占有率分析、产业趋势/统计、成长预测(2025-2030)Global Mobile Hydraulic Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

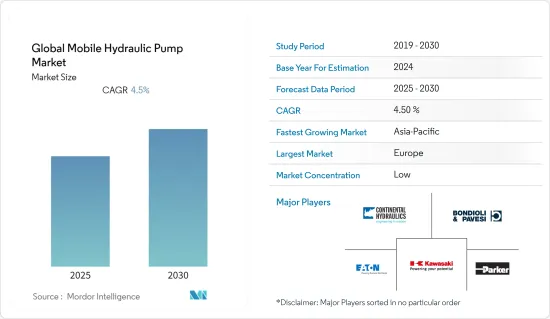

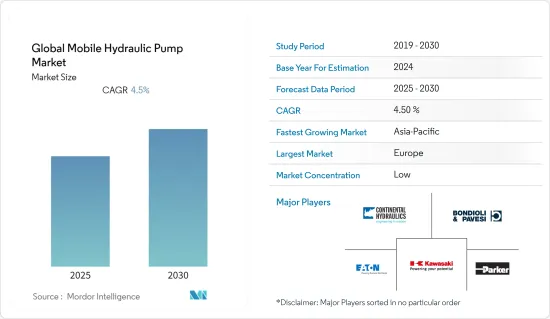

全球移动式液压帮浦市场预计在预测期内复合年增长率为 4.5%。

移动式液压泵在将机械动力转化为液压能的各个行业中普遍存在。这些泵浦用于挖土机、起重机、拖拉机、装载机、吸尘器、林业机械、平土机、自动卸货卡车、采矿设备和其他应用。

技术创新和市场对高性能、高效高压泵和液压系统不断增长的需求意味着需要高度的专业技术知识和能力。因此,泵需要不断开发并整合到各个应用领域的生产过程中。

然而,符合法规要求的先进泵浦的价格高于标准泵浦。

此外,全球建设活动的增加、汽车销售的增加以及采矿业使用的增加也推动了对移动式液压泵的需求。此外,政府法规的重点是减少二氧化碳排放,民众的节能意识也不断增强。由于这些因素,预计移动式液压帮浦市场在预测期内将出现良好的成长。

移动式液压帮浦市场趋势

建设产业主导市场

移动式液压泵,特别是齿轮泵,主要用于建设产业。施工机械在挖掘、土方、起重、物料输送等作业中的广泛应用预计将推动施工机械市场的发展。

发展中国家,无论是已开发国家或开发中国家,都在加大对工具机的投资,以改善其生产流程和系统。未来,建筑业和液压系统将受益于这两个行业的成熟。

已开发国家和新兴国家的製造商都在增加对工具机的投资,以增强其生产流程和系统。这两个市场的成熟可能在未来几年对建筑业和液压系统有所帮助。

市场是由各国建设活动活性化和建筑支出增加所推动的。

亚太地区是成长最快的市场

中国、印度等重要开发中国家的快速发展和都市化正在推动液压泵产业的扩张。

城市人口的扩张导致许多国家快速工业化。因此,消费者需求和产品不断增加,影响最终使用领域的扩大。

由于存在多个施工机械、物料输送设备和施工机械製造设施,因此液压齿轮帮浦是主要的消费者。亚太地区国家占很大份额。

由于COVID-19的影响,最终用途产业的大多数公司正在寻求将生产设施迁移到印度和东南亚国协,以取代中国。政府的支持措施可能会鼓励跨国公司向这些国家扩张,这将对该地区的商业机会产生直接影响。

移动式液压帮浦产业概况

移动式液压帮浦市场竞争相当激烈,企业规模各异。随着组织继续进行策略性投资以抵消目前所经历的经济放缓,预计该市场将出现大量联盟、合併和收购。该市场由主要解决方案服务提供商博世力士乐、林德液压、伊顿公司、川崎精密机械和 Bondioli &Pavesi Inc 组成。

2022年4月,林德液压为其全球生产网络投资了5,000万欧元。这些资金将用于升级德国和其他国际地点的设备。

2021 年 5 月,博世力士乐推出高速、高功率Hagglunds Atom 液压马达。 Hagglunds Atom 液压马达比类似尺寸的马达每分钟可提供更多转数和更多功率。非常适合移动、船舶和回收应用。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- COVID-19 对产业的影响

- 技术简介

第五章市场动态

- 市场驱动因素

- 越来越多使用物联网数位化,带来更智慧的液压泵产品

- 行动油压设备小型化的需求

- 市场限制因素

- 一些最终用户中售后市场供应商和翻新/二手产品的数量增加

第六章 市场细分

- 依产品类型

- 叶片

- 活塞

- 齿轮

- 按最终用户产业

- 建造

- 农业

- 物料输送

- 采矿/采矿

- 航太/国防

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 供应商排名分析

第八章 竞争格局

- 公司简介

- Bondioli & Pavesi Inc

- Bosch Rexroth

- Bucher Hydraulics(Bucher Industries AG)

- Continental Hydraulics Inc

- Daikin-Sauer-Danfoss Ltd

- Dana Inc

- Danfoss Power Solutions

- Eaton Corporation

- Fluidyne Fluid Power

- HANSA-TMP Srl

- HAWE Hydraulik SE

- Jiangsu Hengli Hydraulic Co., Ltd

- Hydro Leduc

- Kawasaki Precision Machinery

- KYB Americas Corporation

- Liebherr Group

- Linde Hydraulics

- Mottrol Co., Ltd

- Parker Hannifin Corporation

- Poclain Hydraulics Inc

第九章市场展望

The Global Mobile Hydraulic Pump Market is expected to register a CAGR of 4.5% during the forecast period.

Mobile Hydraulic Pumps have become widespread across industries that convert mechanical power into hydraulic energy. These pumps are used on excavators, cranes, tractors, loaders, vacuum trucks, forestry equipment, graders, dump trucks, mining machinery, and other applications.

The increasing number of innovations and the demands of the markets for high-performance, efficient high-pressure pumps and water hydraulics systems means that a high degree of specialist engineering knowledge and competence is required. As a result, continuous development of pumps and their integration into production processes in various application areas are necessary.

However, the prices of sophisticated pumps that meet regulatory requirements are higher than those of standard pumps.

Moreover, the need for mobile hydraulic pumps is driven by the increase in worldwide construction activities, rising automobile sales, and increased use in the mining industry. Furthermore, government regulations focus on reducing CO2 emissions and increasing public awareness regarding energy conservation. Such factors are expected to provide lucrative growth in the mobile hydraulic pump market during the forecast period.

Mobile Hydraulic Pump Market Trends

Construction Industry to Dominate the Market

Mobile Hydraulic Pumps, particularly gear pumps, are largely used in the construction industry. Extensive application of construction equipment in operations, such as excavation, earth-moving, and lifting and material handling, is expected to drive the market for construction equipment.

Manufacturers are expanding their investments in machine tools in developed and developing countries to improve their production processes and systems. The building industry and hydraulic systems will benefit from the maturation of both areas in the coming years.

In both developed and developing countries, manufacturers are increasing their investments in machine tools to enhance their production processes and systems. Both markets' maturity will help the construction sector and hydraulic systems throughout the next few years.

The market is being propelled forward by an increase in construction activity and rising construction spending in various countries.

Asia-Pacific to be the fastest growing market

Rapid development and urbanization in important developing nations such as China and India are driving the expansion of the hydraulic pumps industry.

Because of the expanding urban population, many countries are seeing fast industrialization. As a result, there has been an increase in consumer demands and products, affecting the expansion of end-use sectors.

Owing to the presence of the leading consumers of hydraulic gear pumps due to the presence of several manufacturing facilities for construction equipment, material handling equipment, and construction equipment, including key players such as Mitsubishi, Hangcha Group, and Komatsu Ltd. Countries in the Asia-Pacific region held the major share.

Due to the impact of COVID-19, the bulk of end-use sector companies are seeking to relocate their production facilities to India and ASEAN countries as an alternative to China. Supporting government actions may draw global players to these countries, which will directly impact the region's opportunities.

Mobile Hydraulic Pump Industry Overview

The mobile hydraulic pump market is quite competitive with the presence of diverse firms of different sizes. This market is anticipated to encounter a number of partnerships, mergers, and acquisitions as organizations continue to invest strategically in offsetting the present slowdowns that they are experiencing. The market comprises key solutions and service providers, Bosch Rexroth, Linde Hydraulics, Eaton Corporation, Kawasaki Precision Machinery, and Bondioli & Pavesi Inc.

In April 2022, Linde Hydraulics invested EUR50 million across its global production network. The money would be used for upgrading its facilities in Germany and other international locations.

In May 2021, Bosch Rexroth launched its fast and power-dense Hagglunds Atom hydraulic motor. The Hagglunds Atom hydraulic motor would be supplying more revolutions per minute, along with more power than motors of similar size. It would be ideal for mobile, marine, and recycling applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Impact of COVID-19 on the Industry

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing use of IoT and digitization leading to smart hydraulic pump products

- 5.1.2 Demand for miniaturization of mobile hydraulic equipment

- 5.2 Market Restraints

- 5.2.1 Increasing presence of aftermarket suppliers and refurbished/used products in some end-users

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Vane

- 6.1.2 Piston

- 6.1.3 Gear

- 6.2 By End-user Industry

- 6.2.1 Construction

- 6.2.2 Agriculture

- 6.2.3 Material Handling

- 6.2.4 Mining & Extraction

- 6.2.5 Aerospace and Defense

- 6.2.6 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 VENDOR RANKING ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Bondioli & Pavesi Inc

- 8.1.2 Bosch Rexroth

- 8.1.3 Bucher Hydraulics (Bucher Industries AG)

- 8.1.4 Continental Hydraulics Inc

- 8.1.5 Daikin-Sauer-Danfoss Ltd

- 8.1.6 Dana Inc

- 8.1.7 Danfoss Power Solutions

- 8.1.8 Eaton Corporation

- 8.1.9 Fluidyne Fluid Power

- 8.1.10 HANSA-TMP S.r.l

- 8.1.11 HAWE Hydraulik SE

- 8.1.12 Jiangsu Hengli Hydraulic Co., Ltd

- 8.1.13 Hydro Leduc

- 8.1.14 Kawasaki Precision Machinery

- 8.1.15 KYB Americas Corporation

- 8.1.16 Liebherr Group

- 8.1.17 Linde Hydraulics

- 8.1.18 Mottrol Co., Ltd

- 8.1.19 Parker Hannifin Corporation

- 8.1.20 Poclain Hydraulics Inc