|

市场调查报告书

商品编码

1766345

工业开环电流感测器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Industrial Open Loop Current Transducer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

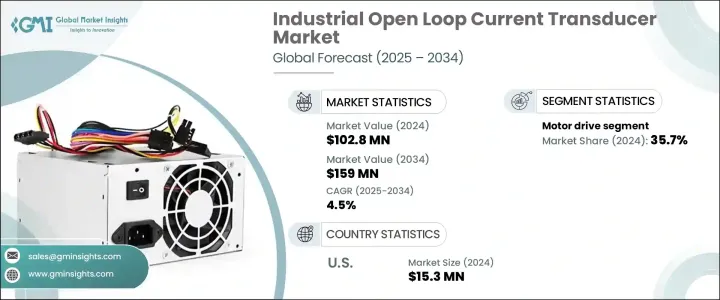

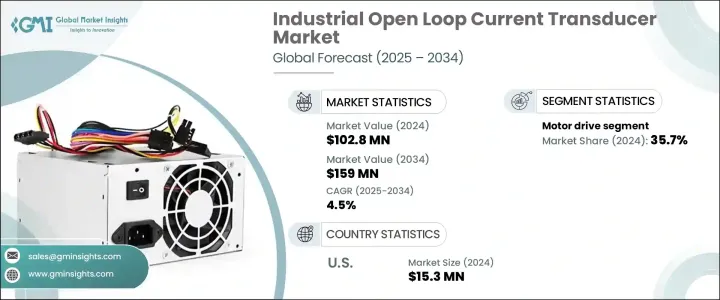

2024年,全球工业开环电流感测器市场规模达1.028亿美元,预计2034年将以4.5%的复合年增长率成长,达到1.59亿美元。这一成长主要得益于纺织、汽车和电子等多个产业自动化程度的不断提高。这些产业需要精确的电流测量来增强製程控制、安全性和效率。开环电流感测器因其能够在生产和能源系统中实现即时电气监控而发展势头强劲。向智慧技术的转变,尤其是在工业自动化领域,为这些感测器与机器人、再生能源系统和高压设备的整合创造了新的机会。

随着全球对能源管理和成本优化的持续关注,对精确可靠的电流感测技术的需求持续高涨。电动车、清洁能源系统和自动化製造的不断发展,正推动开环电流感测器日益重要的地位。地缘政治贸易行动也影响了市场动态。由于关税,采购策略的转变导致一些製造商减少对进口的依赖,并探索国内生产。虽然增加的成本通常会转嫁给消费者,但能够调整供应链或恢復营运的公司正在获得竞争优势,从而重塑市场运作方式。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.028亿美元 |

| 预测值 | 1.59亿美元 |

| 复合年增长率 | 4.5% |

电动车的日益普及以及再生能源基础设施的持续发展,大大加速了对电流感测解决方案的需求。开环电流感测器在逆变器和转换器电流监测中发挥至关重要的作用,有助于确保最佳的电力分配和系统可靠性。在工业基础不断成长且再生能源计画活跃的国家和地区,对开环电流感测器的需求尤其强劲。随着智慧电网专案的蓬勃发展,对先进电流测量系统的需求也日益增长。

到2034年,UPS和SMPS应用市场规模将达到4,000万美元。在备用电源和电源转换系统中,开环电流感测器提供必要的电流调节。这些设备广泛应用于资料中心、电信和消费性电子产品的电源。随着对紧凑型节能电子产品的需求不断增长,对快速响应电流感测的需求也在增长,这些电流感测能够保护电池并支援运作安全。电动车的蓬勃发展以及对储能解决方案投资的不断增加,进一步巩固了该领域强劲的业绩前景。

2024年,美国工业开环电流感测器市场规模达到1,530万美元,预计受基础设施升级和数位化製造趋势推动,该市场将稳定成长。支持能源和交通现代化的投资正在推动电流感测器在智慧工厂和电动车基础设施中的部署。生产线上机器人和连网设备的广泛应用,进一步加剧了对即时监控工具的需求,以在自动化环境中保持效能、安全性和成本效益。

引领全球工业开环电流感测器市场的领导者包括凤凰城电气、Howard Butler、Topstek、江森自控、NK Technologies、西门子、ABB 和德州仪器。为了巩固市场地位,工业开环电流感测器领域的企业正专注于几项核心策略,包括推出针对各种工业应用、精度更高、热稳定性更强的感测器型号。

与自动化解决方案提供者的策略合作使他们能够拓展新兴垂直领域。许多品牌正在提高生产灵活性,以应对全球采购和关税的变化。小型化、物联网相容设备的研发投入也为企业带来了竞争优势。此外,注重数位分销、技术支援和本地化製造,有助于品牌扩大客户覆盖范围,同时快速回应不断变化的行业需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 贸易管理关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 策略倡议

- 公司市占率分析

- 竞争基准测试

- 创新与技术格局

第五章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 马达驱动

- 转换器和逆变器

- 电池管理

- UPS和开关电源

- 其他的

第六章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 俄罗斯

- 英国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 韩国

- 澳洲

- 印度

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第七章:公司简介

- ABB

- Howard Butler

- Johnson Controls

- NK Technologies

- Phoenix Contact

- Siemens

- Texas Instruments

- Topstek

The Global Industrial Open Loop Current Transducer Market was valued at USD 102.8 million in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 159 million by 2034. This growth is largely fueled by the rising implementation of automation across multiple sectors, including textiles, automotive, and electronics. These industries require accurate current measurements for enhanced process control, safety, and efficiency. Open-loop current transducers are gaining momentum as they enable real-time electrical monitoring in production and energy systems. The shift toward smart technologies, particularly within industrial automation, is creating new opportunities for these sensors to integrate with robotics, renewable systems, and high-voltage equipment.

As the global focus on energy management and cost optimization continues, demand for precise and reliable current sensing technology remains high. Ongoing developments in electric vehicles, clean energy systems, and automated manufacturing are contributing to the growing relevance of open-loop current transducers. Geopolitical trade actions have also impacted market dynamics. Shifting sourcing strategies due to tariffs have led some manufacturers to reduce reliance on imports and explore domestic production. While increased costs are frequently passed on to consumers, companies able to adjust their supply chains or restore operations are gaining a competitive edge, reshaping how the market functions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $102.8 Million |

| Forecast Value | $159 Million |

| CAGR | 4.5% |

The rising popularity of electric vehicles and the ongoing development of renewable energy infrastructure have significantly accelerated the need for current sensing solutions. Open loop current transducers play an essential role in monitoring current in inverters and converters, ensuring optimal power distribution and system reliability. Demand is especially strong in states and regions with growing industrial bases and active renewable energy initiatives. With smart grid projects gaining momentum, the requirement for advanced current measurement systems is expanding.

The UPS and SMPS application segment will reach USD 40 million by 2034. In backup power and power conversion systems, open-loop current transducers provide essential current regulation. These devices are widely used in power supplies for data centers, telecommunications, and consumer electronics. As demand for compact, energy-efficient electronics continues to rise, so does the need for rapid-response current sensing that safeguards batteries and supports operational safety. The electric vehicle boom and increasing investments in energy storage solutions further reinforce this segment's strong performance outlook.

U.S. Industrial Open Loop Current Transducer Market reached USD 15.3 million in 2024 and is projected to grow steadily due to infrastructure upgrades and digital manufacturing trends. Investments supporting energy and transportation modernization are boosting the deployment of current sensors across smart factories and EV infrastructure. Greater adoption of robotics and connected equipment in production lines further intensifies the need for real-time monitoring tools to maintain performance, safety, and cost efficiency in automated environments.

Leading players shaping the Global Industrial Open Loop Current Transducer Market include Phoenix Contact, Howard Butler, Topstek, Johnson Controls, NK Technologies, Siemens, ABB, and Texas Instruments. To strengthen their presence, companies in the industrial open loop current transducer space are focusing on several core strategies. These include launching sensor models with enhanced accuracy and thermal stability for diverse industrial applications.

Strategic collaborations with automation solution providers allow them to expand into emerging verticals. Many brands are improving production flexibility to handle shifts in global sourcing and tariffs. Investments in R&D for miniaturized, IoT-compatible devices also give players a competitive edge. Furthermore, an emphasis on digital distribution, technical support, and localized manufacturing is helping brands improve customer reach while responding quickly to evolving industrial demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trade administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's Analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL Analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiatives

- 4.4 Company market share analysis, 2024

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034, (USD Million)

- 5.1 Key trends

- 5.2 Motor drive

- 5.3 Converter & inverter

- 5.4 Battery management

- 5.5 UPS & SMPS

- 5.6 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034, (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 France

- 6.3.3 Russia

- 6.3.4 UK

- 6.3.5 Spain

- 6.3.6 Italy

- 6.3.7 Netherlands

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 South Korea

- 6.4.4 Australia

- 6.4.5 India

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 ABB

- 7.2 Howard Butler

- 7.3 Johnson Controls

- 7.4 NK Technologies

- 7.5 Phoenix Contact

- 7.6 Siemens

- 7.7 Texas Instruments

- 7.8 Topstek