|

市场调查报告书

商品编码

1766350

汽车电子燃料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive E-Fuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

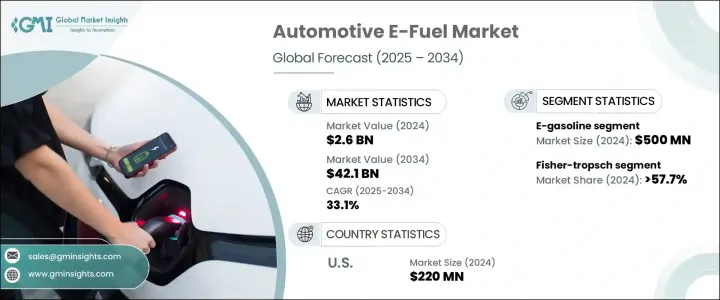

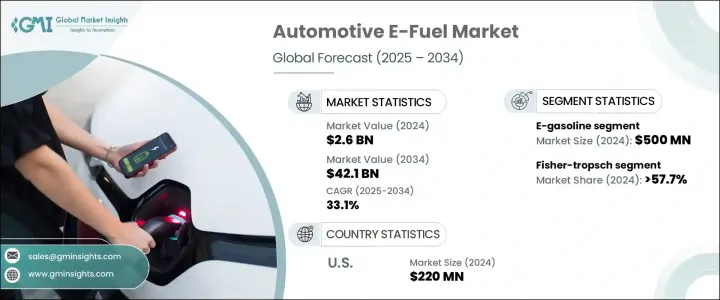

全球汽车电子燃料市场规模达26亿美元,预计2034年将以33.1%的复合年增长率成长,达到421亿美元。这一强劲成长的动力源于日益增长的减排压力和向更永续的交通燃料转型的压力。世界各国政府正在加强排放法规,这促使人们增加对清洁燃料替代品的投资。电子燃料正逐渐成为颇具前景的解决方案,尤其适用于航空、长途货运和海运等难以实现电气化的产业。这些合成燃料无需改造即可在现有的内燃机(ICE)车辆上使用,只需进行少量改造,这使其成为一种极具吸引力的脱碳方案,同时又能充分利用现有基础设施。

随着能源转型策略的不断发展,电子燃料因其与传统引擎的兼容性以及实现近乎碳中和性能的潜力而脱颖而出。支持性监管框架正在加速这些燃料的普及。相关部门正在推出财政激励措施,例如拨款、税收减免和资助项目,以促进可持续燃料技术的研发。此外,全球致力于实现能源来源多元化并减少对化石燃料的依赖,这正推动炼油厂、汽车製造商和能源公司投资可扩展的电子燃料生产。利用再生电力、绿色氢能和捕获的二氧化碳合成燃料的能力,为传统汽油和柴油提供了一种循环且更清洁的替代品。这种适应性使电子燃料成为弥合当前化石燃料依赖与零排放交通运输产业长期愿景之间差距的策略选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 26亿美元 |

| 预测值 | 421亿美元 |

| 复合年增长率 | 33.1% |

汽车电子燃料市场分为多种产品类型,包括电子汽油、电子柴油、电子煤油、乙醇和电子甲醇。其中,电子汽油细分市场在2024年的价值达到5亿美元。电子汽油可以直接取代传统汽油,无需进行技术改造即可用于现有的汽油引擎。它能够在不进行额外基础设施改造的情况下提供低排放的替代方案,使其成为向清洁燃料转型的关键重点领域。其他细分市场,例如电子柴油和电子煤油,也展现出巨大的潜力,尤其是在重型车辆和航空应用领域,液体燃料在这些领域仍然至关重要。

就生产技术而言,市场细分为费托合成法、eRWGS 合成法和其他方法。费托合成技术在 2024 年占据市场主导地位,占总市占率的 57.7% 以上。此製程利用氢气和一氧化碳的混合物(称为合成气)合成液态碳氢化合物。所得燃料可取代传统柴油和航空燃料,从而减少温室气体排放。费托合成法提供了一种可扩展的高品质合成燃料生产路线,其在市场上的主导地位凸显了其商业可行性以及与现有燃料分销网络的兼容性。

从地区来看,美国仍然是汽车电子燃料领域的主要参与者。 2022年,该市场规模为1.6亿美元,2023年成长至1.7亿美元,2024年将达2.2亿美元。美国市场的成长得益于公共和私营部门对替代燃料技术的强劲投资,以及积极推动交通脱碳的措施。各州正在实施清洁能源政策,并鼓励以永续航空燃料和低碳货运解决方案为重点的试点计画。持续的创新,加上技术开发商与汽车公司之间日益壮大的合作网络,使美国成为全球电子燃料发展的关键贡献者。

竞争格局由少数几家在合成燃料生产和商业化方面处于领先地位的公司所塑造。这些公司主要利用再生能源和碳捕集技术生产电子汽油和电子甲醇,旨在实现内燃机汽车的碳中和运作。他们的努力旨在提高产能、提升製程效率,并将电子燃料整合到主流燃料供应链中。透过持续投资尖端技术和策略合作,这些参与者正在帮助扩大市场规模,以满足全球对永续汽车燃料日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 策略倡议

- 竞争基准测试

- 战略仪表板

- 创新与技术格局

第五章:市场规模及预测:按再生能源,2021 - 2034 年

- 主要趋势

- 现场太阳能

- 风

第六章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 费托合成

- 增强型多普勒雷达系统

- 其他的

第七章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 电子汽油

- 电动柴油

- 电子煤油

- 乙醇

- 电子甲醇

- 其他的

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 荷兰

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- Archer Daniels Midland

- Arcadia eFuels

- Ballard Power Systems

- Ceres Power Holding

- Clean Fuels Alliance America

- Climeworks

- eFuel Pacific

- Electrochaea

- ExxonMobil

- FuelCell Energy

- HIF Global

- INFRA Synthetic Fuels

- LanzaJet

- Liquid Wind

- MAN Energy Solutions

- Norsk e-Fuel

- Porsche

- Sunfire

The Global Automotive E-Fuel Market was valued at USD 2.6 billion and is estimated to grow at a CAGR of 33.1% to reach USD 42.1 billion by 2034. This robust growth is driven by mounting pressure to reduce carbon emissions and shift toward more sustainable transportation fuels. Governments worldwide are tightening emissions regulations, prompting increased investment in cleaner fuel alternatives. E-fuels are emerging as a promising solution, especially for sectors that are difficult to electrify, such as aviation, long-haul freight, and maritime transport. These synthetic fuels can be used in existing internal combustion engine (ICE) vehicles with minimal or no modification, which makes them an attractive option for decarbonization while leveraging the current infrastructure.

As energy transition strategies evolve, e-fuels stand out due to their compatibility with traditional engines and their potential to deliver near carbon-neutral performance. Supportive regulatory frameworks are accelerating the adoption of these fuels. Authorities are rolling out financial incentives such as grants, tax breaks, and funding programs to promote research and development of sustainable fuel technologies. Additionally, global efforts to diversify energy sources and reduce dependence on fossil fuels are pushing refiners, automakers, and energy firms to invest in scalable e-fuel production. The ability to synthesize fuels from renewable electricity, green hydrogen, and captured carbon dioxide offers a circular and cleaner alternative to conventional gasoline and diesel. This adaptability positions e-fuels as a strategic option to bridge the gap between current fossil fuel dependency and the long-term vision of a zero-emissions transportation sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $42.1 Billion |

| CAGR | 33.1% |

The automotive e-fuel market is categorized into several product types, including e-gasoline, e-diesel, e-kerosene, ethanol, and e-methanol. Among these, the e-gasoline segment recorded a value of USD 500 million in 2024. E-gasoline acts as a direct replacement for conventional petrol, which allows it to be used in current gasoline engines without the need for technical modifications. Its ability to offer a lower-emission alternative without additional infrastructure changes makes it a key focus area in the transition to cleaner fuels. Other segments like e-diesel and e-kerosene also show promising potential, especially for heavy-duty vehicles and aviation applications, respectively, where liquid fuels remain essential.

In terms of production technology, the market is segmented into Fischer-Tropsch, eRWGS, and other methods. Fischer-Tropsch technology led the market in 2024, accounting for over 57.7% of the total share. This process synthesizes liquid hydrocarbons from a mixture of hydrogen and carbon monoxide, known as synthesis gas. The resulting fuels can serve as substitutes for traditional diesel and jet fuel, enabling reductions in greenhouse gas emissions. Fischer-Tropsch offers a scalable route for producing high-quality synthetic fuels, and its dominance in the market underscores its commercial viability and compatibility with current fuel distribution networks.

Regionally, the United States remains a major player in the automotive e-fuel space. The market was valued at USD 160 million in 2022, grew to USD 170 million in 2023, and reached USD 220 million in 2024. Growth in the U.S. market is underpinned by strong public and private investment in alternative fuel technologies and a proactive approach toward decarbonizing transportation. Various states are implementing clean energy policies and incentivizing pilot projects that focus on sustainable aviation fuels and low-carbon solutions for freight mobility. Continuous innovation, coupled with a growing network of partnerships between technology developers and automotive companies, positions the U.S. as a key contributor to global e-fuel development.

The competitive landscape is shaped by a handful of leading companies that are pioneering the production and commercialization of synthetic fuels. These companies are primarily involved in producing e-gasoline and e-methanol using renewable energy sources and captured carbon, targeting the carbon-neutral operation of ICE vehicles. Their efforts are geared toward increasing production capacity, enhancing process efficiency, and integrating e-fuels into mainstream fuel supply chains. Through ongoing investment in cutting-edge technology and strategic collaborations, these players are helping scale up the market to meet the rising global demand for sustainable automotive fuels.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Renewable Source, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 On-site solar

- 5.3 Wind

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Fischer-Tropsch

- 6.3 eRWGS

- 6.4 Others

Chapter 7 Market Size and Forecast, By Product, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 E-gasoline

- 7.3 E-diesel

- 7.4 E-kerosene

- 7.5 Ethanol

- 7.6 E-methanol

- 7.7 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Netherlands

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 Archer Daniels Midland

- 9.2 Arcadia eFuels

- 9.3 Ballard Power Systems

- 9.4 Ceres Power Holding

- 9.5 Clean Fuels Alliance America

- 9.6 Climeworks

- 9.7 eFuel Pacific

- 9.8 Electrochaea

- 9.9 ExxonMobil

- 9.10 FuelCell Energy

- 9.11 HIF Global

- 9.12 INFRA Synthetic Fuels

- 9.13 LanzaJet

- 9.14 Liquid Wind

- 9.15 MAN Energy Solutions

- 9.16 Norsk e-Fuel

- 9.17 Porsche

- 9.18 Sunfire