|

市场调查报告书

商品编码

1435219

汽车催化剂:市场占有率分析、产业趋势、成长预测(2024-2029)Automotive Catalyst - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

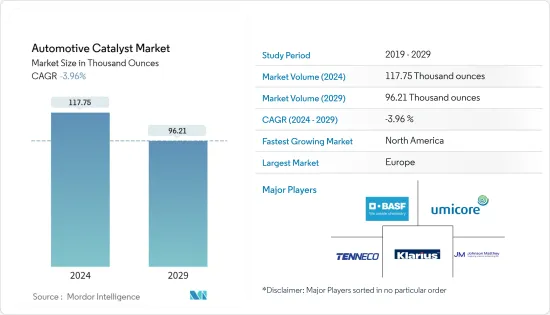

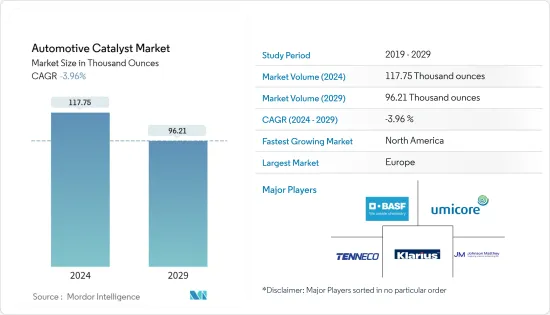

2024年汽车催化剂市场规模预计为117,750盎司,预计到2029年将下降至96,210盎司。

由于封锁和限制导致製造设施和工厂关闭,冠状病毒感染疾病(COVID-19)大流行对市场产生了负面影响。供应链和运输中断造成了进一步的市场瓶颈。然而,随着所研究市场的需求復苏,该产业在 2021 年出现復苏。

主要亮点

- 短期内,世界各国政府执行的严格排放标准和汽车产量的增加是推动研究市场成长的主要因素。

- 另一方面,电动车的日益普及正在阻碍市场成长。

- 然而,开发中国家对排放标准的日益关注预计将为汽车催化剂市场提供未来的成长机会。

- 由于欧洲采用严格的排放标准,预计欧洲将主导市场并拥有全球最大的市场占有率。

汽车触媒市场趋势

小客车领域占市场主导地位

- 内燃机因引擎内不完全燃烧而产生有毒排放。

- 除了二氧化碳对人类有毒之外,都市区上空的停滞气团还可以长时间保留污染物。当阳光与这些污染物相互作用时,HC、NOx 和阳光之间发生化学反应,在地球表面形成臭氧。

- 汽车催化剂用于汽车排气系统,控制碳氢化合物、碳氧化物和氮氧化物等有害气体的排放。这些催化剂有助于将有害气体转化为毒性较小的气体,例如氮气和二氧化碳。

- 根据国际工业组织(OICA)的数据,2022年全球小客车总产量为6,159万辆,比2021年成长8%,比2020年成长10%。小客车产量的增加预计将增加预测期内对汽车催化剂的需求。

- 印度汽车产业的投资增加和进步预计将为汽车催化剂市场带来上升的需求。例如,塔塔汽车在2022年4月宣布,计画未来5年向小客车业务投资30.8亿美元。预计这将对国内车用催化剂市场产生正面影响。

- 在英国,通膨上升、供应链管理问题、地缘政治不稳定和冠状病毒是小客车产量下降的主要因素。例如,根据OICA的数据,2022年该国小客车总合为7,75,014辆,而2021年小客车产量为8,59,575辆,产量下降率为10%。美国脱欧和紧张局势的影响中美之间的衝突也对该国的汽车生产产生重大影响。这些因素都将对国内车用触媒市场产生负面影响。

- 开发中国家政府正在透过大力投资燃油效率等新排放气体控制技术来应对排放气体法规,预计将促进汽车触媒市场的成长。四效催化剂比旧催化剂更有效。

- 预计上述因素将在预测期内对汽车催化剂市场产生重大影响。

欧洲主导市场

- 由于该地区排放气体标准日益严格,预计汽车触媒市场将由欧洲主导。

- 近年来,由于政府严格控制污染的规定,对汽车催化剂的需求迅速增加。

- 根据 OICA 的数据,2022 年小客车产业产量整体下降。相较于2021年下降了1%,汽车触媒市场尚未达到復苏期。产量大幅下降是由于政府机构制定的环境标准不断变化。这在该地区小客车市场中自动催化剂的下降中发挥了重要作用。斯洛维尼亚和乌兹别克斯坦等国家的小客车需求大幅下降,而奥地利、葡萄牙和白俄罗斯等国家的汽车产量激增,这正在增加该地区对汽车催化剂的需求。我是。

- 此外,德国汽车工业也受到半导体短缺和原材料供应有限的打击。同样,新的世界统一轻型汽车测试程序(WLTP)的实施、中美贸易紧张局势导致全球汽车需求减少,以及新的欧盟28国排放标准要求汽车製造商达到平均二氧化碳排放。也可以考虑。所有新销售车辆每公里污染物排放量为95克,对小客车生产产生了负面影响。但到了2022年,国内汽车产量因半导体短缺而逐渐恢復。例如,根据 OICA 的数据,2022 年德国小客车产量约为 3,480,357 辆,较 2021 年成长 12%。因此,小客车行业产量的增加预计将带来汽车需求的上升。催化剂市场。

- 由于半导体持续短缺,欧洲地区的轻型商用车产量正在下降。例如,根据 OICA 的数据,2022 年年轻型商用车产量约为 2,148,379 辆,较 2021 年减少 2%。这些短缺预计将限制国内汽车催化剂市场的需求成长。

- 由于网路购物和都市化的加快,俄罗斯的轻型商用车产量在过去三年中有所增加,在该国创建了需要高效物流的新零售和电子商务平台。相较之下,俄乌战争导致经济制裁、大宗商品价格飙升、供应链中断,影响了国内轻型商用车生产,也影响了国内汽车触媒市场。例如,根据 OICA 的数据,2022 年年轻型商用车产量约为 83,813 辆,较 2021 年减少 35%。

- 在法国,持续的半导体短缺和供应链短缺对国内轻型商用车生产造成轻微影响。例如,根据OICA的数据,2022年国内轻型商用车产量较2021年的433,401辆下降14%至372,707辆。

- 预计上述因素将在未来几年对市场产生重大影响。

汽车触媒产业概况

汽车催化剂市场本质上是分散的。该市场的主要企业(排名不分先后)包括BASF SE、Tenneco Inc.、Johnson Matthey、Klarius Products Ltd 和 Umicore。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 汽车产量增加

- 车辆废气的严格规定

- 其他司机

- 抑制因素

- 电动车的普及

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 种类

- 铂

- 钯

- 铑

- 其他类型

- 汽车模型

- 小客车

- 轻型商用车

- 大型商用车

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率分析**/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- CDTi Advanced Materials Inc.

- CLARIANT

- Cummins Inc.

- DCL International Inc.

- Ecocat India Pvt Ltd

- Johnson Matthey

- Klarius Products Ltd

- NE CHEMCAT CORPORATION

- Tenneco Inc.

- Umicore

第七章 市场机会及未来趋势

第八章开发中国家日益重视排放标准

第9章 其他机会

The Automotive Catalyst Market size is estimated at 117.75 Thousand ounces in 2024, and is expected to decline to 96.21 Thousand ounces by 2029.

The COVID-19 pandemic negatively impacted the market due to the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, stringent emission standards implemented by governments across the world and an increase in the production of automobiles are the major factors driving the growth of the market studied.

- On the flip side, the rise in the popularity of electric vehicles is hindering the growth of the market.

- However, surge in emphasis of developing nations towards the emission standards is anticipated to provide future growth opportunity to the automotive catalyst market.

- Europe is expected to dominate the market and have the largest market share globally, owing to the adoption of stringent emission standards in the region.

Automotive Catalyst Market Trends

The Passenger Cars Segment to Dominate the Market

- Internal combustion engines produce toxic emissions due to incomplete combustion in the engine.

- Apart from the fact that CO is poisonous to humans, the stagnant air masses over urban areas can hold the pollutants for long periods. When sunlight interacts with these pollutants, the formation of ground-level ozone occurs due to the chemical reaction between HC, NOx, and sunlight.

- The automotive catalyst is used in the exhaust system of vehicles to control the emission of harmful gases, such as hydrocarbons, carbon oxides, and nitrogen oxides, as these catalysts help in converting harmful gases into less toxic gases, such as nitrogen and carbon dioxide.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, the total number of passenger cars produced globally was 61.59 million units, which showed an increase of 8% compared to 2021 and 10% compared to 2020. Therefore, an increase in the production of passenger cars is expected to create an upside demand for automotive catalysts in the forecast period.

- Increased investments and advancements in the automobile industry in India is expected to create an upside demand for automotive catalyst market. For instance, in April 2022, Tata Motors announced plans to invest USD 3.08 billion in its passenger vehicle business over the next five years. This is expected to have a positive impact on the automotive catalyst market in the country.

- In the United Kingdom, rising inflation, supply chain management issues, geopolitical unrest and COVID were the major contributors for the decrease in the production of passenger cars. For instance, according to OICA, in 2022, the country produced a total of 7,75,014 units of passenger vehicles at a 10% production decline rate as compared to 8,59,575 passenger vehicles produced in 2021. The fallout due to Brexit and the tensions between the United States and China have also significantly affected vehicle production in the country. These factors will negatively affect the market for automotive catalyst in the country.

- The governments of developing nations are taking initiatives in concern of emission control by spending hugely on new emission controlling technologies like fuel efficiency, which is expected to boost the growth of the automotive catalyst market. A four-way catalyst has better efficiency than older catalysts.

- The aforementioned factors are expected to show a significant impact on the automotive catalyst market during the forecast period.

Europe to Dominate the Market

- Europe is expected to dominate the automotive catalyst market due to the increasingly stringent emission standards in the region.

- Stringent government regulations to restrain pollution surged the demand for automotive catalysts in recent times.

- In the Passenger car segment, according to OICA, there was a decline in overall production in 2022. With a decrease of 1% compared to 2021, the automotive catalyst market is yet to see a recovery period. The major decrease in production was due to the constant change in the environmental standards set by the governing bodies. This played a vital role in the decrease of automotive catalysts from the passenger car segment in the region. Countries like Slovnia, and Uzbekistan have seen a major decrease in the demand for passenger cars while countries like Austria, Portugal, Belarus, and others have seen a surge in automotive production thereby increasing the demand for automotive catalysts in the region.

- Moreover, in Germany, the automotive industry has been hampered by the shortage of semiconductors and a limited supply of raw materials. Similarly, other factors such as the implementation of the new Worldwide Harmonized Light-Duty Vehicles Test Procedure (WLTP) and US-China trade conflicts which decreased the international automotive demand, EU-28's new emission standard which mandates carmakers to achieve average CO2 emissions of 95 grams per kilometre across newly sold vehicles had negatively affected the production of passenger cars. However, in 2022 the automobile production in the country recovered gradually from semiconductor shortages. For instance, according to OICA, around 34,80,357 passenger cars were produced in Germany in 2022, which shows an increase of 12% compared to 2021. Therefore, increase in the production of passeger car segment is expected to create an upside demand for automotive catalyst market.

- Due to the ongoing semiconductor shortages, the production of light commercial vehicles in the Europe region is declining. For instance, in 2022, according to OICA, around 21,48,379 units of light commercial vehicles were produced, which declined by 2% compared to 2021. These shortages are expected to restrict the growth of demand for automotive catalysts market in the country.

- Russia's production of light commercial vehicles has increased in the last three years due to an increase in online shopping and urbanization, which has created new retail and e-commerce platforms in the country that require efficient logistics. In contrast, the Russia-Ukraine war has resulted in economic sanctions, a jump in commodity prices, and supply chain interruptions, impacting the production of light commercial vehicles in the country, and affecting the automotive catalysts market in the country. For instance, according to OICA, in 2022, around 83,813 units of light commercial vehicles were produced, which shows a decrease of 35% compared to 2021.

- In France, due to the ongoing semiconductor shortage and supply chain shortages slightly affected the light commercial vehicles production in the country. For instance, according to OICA, in 2022 the country's light commercial vehicles production volume declined by 14% to 3,72,707 units as compared to 4,33,401 units produced in 2021.

- The abovementioned factors are expected to show a significant impact on the market in the coming years.

Automotive Catalyst Industry Overview

The Automotive Catalyst Market is partially fragmented in nature. The major players in this market (not in a particular order) include BASF SE, Tenneco Inc., Johnson Matthey, Klarius Products Ltd, and Umicore, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase in Automobile Production

- 4.1.2 Stringent Regulations Related to Automotive Emission

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Rise in Popularity of Electric Vehicles

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Platinum

- 5.1.2 Palladium

- 5.1.3 Rhodium

- 5.1.4 Other Types

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Heavy Commercial Vehicles

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 CDTi Advanced Materials Inc.

- 6.4.3 CLARIANT

- 6.4.4 Cummins Inc.

- 6.4.5 DCL International Inc.

- 6.4.6 Ecocat India Pvt Ltd

- 6.4.7 Johnson Matthey

- 6.4.8 Klarius Products Ltd

- 6.4.9 N.E. CHEMCAT CORPORATION

- 6.4.10 Tenneco Inc.

- 6.4.11 Umicore