|

市场调查报告书

商品编码

1766365

垂直农业市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Vertical Farming Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

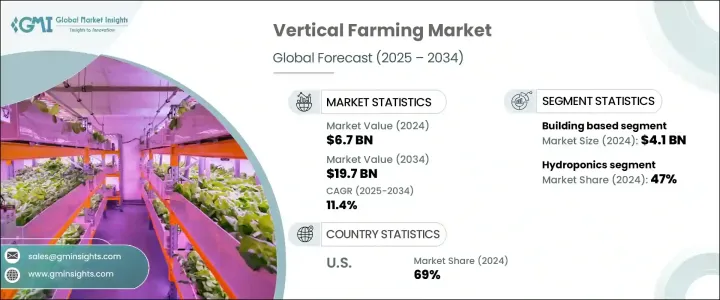

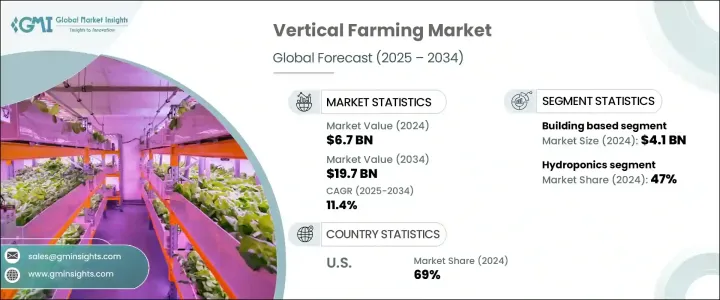

2024年,全球垂直农业市场规模达67亿美元,预计2034年将以11.4%的复合年增长率成长,达到197亿美元。这一增长主要源于城市人口扩张、对粮食安全的日益重视以及对永续农业实践日益增长的需求。垂直农业是一种受控环境农业方法,它利用水耕、气耕和鱼菜共生等技术在室内高效种植作物。这些系统可实现全年生产,并透过减少用水量和土地使用量来最大限度地节约资源。

智慧感测器、物联网、人工智慧和节能LED照明等先进技术进一步提高了作物产量和营运效率。水耕法因其易用性和久经考验的生产力,仍然是人们的首选方法,其次是其他可持续的替代方法。借助气候控制环境、自动灌溉、水肥一体化和即时监控,垂直农场能够确保始终如一的品质和产量。消费者对无化学成分、本地种植和新鲜农产品的兴趣日益浓厚,也促使农民种植更多作物,包括蔬菜、香草和水果。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 67亿美元 |

| 预测值 | 197亿美元 |

| 复合年增长率 | 11.4% |

高昂的安装成本仍然是垂直农业推广的主要障碍之一。安装先进的环境控制系统(从LED生长灯到水耕或气耕系统)的前期费用可能远高于传统农业。此外,为支持垂直农业基础设施而购买或建造建筑物或货柜也会产生额外成本。

2024年,以建筑为基础的垂直农业领域创造了41亿美元的市场规模,这得益于其高效扩展和灵活设计方案的优势。这些建筑物——无论是翻新的仓库还是专门建造的设施——每平方英尺都能支撑多层种植,从而提高产量密度。它们还能整合照明、气候和灌溉自动化系统,支援全年稳定生产。靠近城区不仅可以减少运输时间和成本,还能确保更快地将更新鲜的产品送达消费者。这些优势正吸引商业种植者大力投资以建筑为基础的垂直农场。

水耕法在2024年占据了47%的市场份额,巩固了其作为主导方法的地位。该系统使植物能够在营养丰富的水溶液中茁壮成长,与传统农业相比,用水量可减少高达90%。它无需化学投入,并支援快速的作物週期和高产量。与气培法或鱼菜共生法等复杂系统相比,水耕法更易于实施和管理,适用于多种作物,尤其是草本植物和绿叶蔬菜,是商业规模运作的理想选择。

2024年,美国垂直农业市场占69%的份额。对本地种植、永续农产品的需求持续成长,这与消费者对环境影响最小的新鲜食品的期望相符。主要大都市地区因其能够靠近终端消费者开展垂直农业业务而成为垂直农业中心。美国先进的技术基础设施正在加速水耕系统、人工智慧气候控制、LED照明和数据驱动自动化平台等解决方案的部署。这些创新显着提高了营运的可扩展性和可靠性,使农场即使在不可预测的外部气候条件下也能持续生产。

垂直农业产业的知名公司包括 Ecopia、Signify、MechaTronix、Panasonic、UNI-TROLL、C-LED srl、飞利浦、AMS OSRAM AG、Tungsram、Nuvege、通用电子、Artechno、LED iBond、Parus 和 Organizzazione Orlandelli。垂直农业市场公司采用的关键策略是透过创新、合作和地理扩张来加强市场占有率。参与者正在大力投资研发节能照明、更智慧的自动化系统和永续的营养输送模式。许多公司正在与零售商和食品分销商结成策略联盟,以确保更好的市场渗透率。一些公司正在探索城市房地产机会,以建立更靠近消费者的农场。此外,该公司正在部署模组化农业单位和可扩展模型,以满足中小型企业的需求,从而扩大可及性。注重资源优化和环保包装也有助于这些品牌符合消费者期望和监管标准。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 都市化与有限的耕地

- 对新鲜、无农药农产品的需求

- 政府措施和激励措施

- 产业陷阱与挑战

- 初期投资成本高

- 技术复杂性

- 机会

- 技术进步

- 供应链优化

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按组件

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依结构,2021 年至 2034 年

- 主要趋势

- 基于货柜

- 基于建筑

第六章:市场估计与预测:按工艺,2021 年至 2034 年

- 主要趋势

- 水耕

- 气雾栽培

- 水产养殖

第七章:市场估计与预测:按组成部分,2021 年至 2034 年

- 主要趋势

- 照明系统

- 灌溉和水肥一体化

- 气候控制

- 感应器

第八章:市场估计与预测:依作物类型,2021 年至 2034 年

- 主要趋势

- 水果

- 蔬菜

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AMS OSRAM AG

- Artechno

- C-LED srl

- Ecopia

- General Electronics

- LED iBond

- MechaTronix

- Nuvege

- Organizzazione Orlandelli

- Panasonic

- Parus

- Philips

- Signify

- Tungsram

- UNI-TROLL

The Global Vertical Farming Market was valued at USD 6.7 billion in 2024 and is estimated to grow at a CAGR of 11.4% to reach USD 19.7 billion by 2034. This growth is largely driven by urban population expansion, the increasing emphasis on food security, and the rising demand for sustainable agricultural practices. Vertical farming, a controlled environment agriculture method, uses techniques like hydroponics, aeroponics, and aquaponics to cultivate crops efficiently indoors. These systems offer year-round production and maximize resource conservation by using less water and land.

Advanced technologies such as smart sensors, IoT, artificial intelligence, and energy-efficient LED lighting have further enhanced crop output and operational efficiency. Hydroponics remains the preferred method due to its ease of use and proven productivity, followed by other sustainable alternatives. With the help of climate-controlled environments, automated irrigation, fertigation, and real-time monitoring, vertical farms ensure consistent quality and quantity. The growing consumer interest in chemical-free, locally grown, and fresh produce is also pushing farmers to diversify crops, including vegetables, herbs, and fruits.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.7 Billion |

| Forecast Value | $19.7 Billion |

| CAGR | 11.4% |

High setup costs remain one of the primary barriers to vertical farming adoption. The upfront expenses related to installing advanced environmental control systems-ranging from LED grow lights to hydroponic or aeroponic systems-can be significantly higher than conventional agriculture. Facilities also incur added costs for acquiring or constructing buildings or containers to support vertical farming infrastructure.

In 2024, the building-based vertical farming segment generated USD 4.1 billion, driven by its ability to scale efficiently and offer flexible design options. These structures-whether renovated warehouses or purpose-built facilities-can support multiple growing layers per square foot, enhancing output density. They also accommodate integrated automation systems for lighting, climate, and irrigation, supporting stable production throughout the year. Proximity to urban areas not only reduces transportation time and costs but also ensures quicker delivery of fresher products to consumers. These benefits are attracting commercial growers to invest heavily in building-based vertical farms.

Hydroponics segment accounted for 47% share in 2024, solidifying its position as the dominant method. This system enables plants to thrive in nutrient-enriched water solutions, cutting down water usage by up to 90% compared to traditional farming. It eliminates the need for chemical inputs and supports rapid crop cycles and high yields. Hydroponics is simpler to implement and manage than complex systems like aeroponics or aquaponics, making it suitable for a wide variety of crops-particularly herbs and leafy greens-and ideal for commercial-scale operations.

U.S. Vertical Farming Market held a 69% share in 2024. Demand for locally grown, sustainable produce continues to increase, aligning with consumer expectations for fresh food with minimal environmental impact. Major metropolitan areas emerge as vertical farming hubs due to their ability to host these operations close to end consumers. The country's advanced technology infrastructure is accelerating the deployment of solutions such as hydroponic systems, AI-enabled climate control, LED lighting, and data-driven automation platforms. These innovations have significantly enhanced operational scalability and reliability, allowing farms to produce consistently even amid unpredictable external climates.

Prominent names in the Vertical Farming Industry include Ecopia, Signify, MechaTronix, Panasonic, UNI-TROLL, C-LED srl, Philips, AMS OSRAM AG, Tungsram, Nuvege, General Electronics, Artechno, LED iBond, Parus, and Organizzazione Orlandelli. Key strategies adopted by companies in the vertical farming market focus on strengthening market presence through innovation, partnerships, and geographic expansion. Players are heavily investing in research to develop energy-efficient lighting, smarter automation systems, and sustainable nutrient delivery models. Many are forming strategic alliances with retailers and food distributors to ensure better market penetration. Some firms are exploring urban real estate opportunities to establish farms closer to consumers. In addition, companies are deploying modular farming units and scalable models that cater to small and mid-sized businesses, broadening accessibility. Focus on resource optimization and environmentally responsible packaging is also helping these brands align with consumer expectations and regulatory standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Process

- 2.2.3 Crop Type

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization and limited arable land

- 3.2.1.2 Demand for fresh, pesticide-free produce

- 3.2.1.3 Government initiatives and incentives

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Technical complexity

- 3.2.3 Opportunities

- 3.2.4 Technological advancements

- 3.2.5 Supply chain optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By component

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Structure, 2021 – 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Shipping-container based

- 5.3 Building based

Chapter 6 Market Estimates and Forecast, By Process, 2021 – 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Hydroponics

- 6.3 Aeroponics

- 6.4 Aquaponics

Chapter 7 Market Estimates and Forecast, By Component, 2021 – 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Lighting systems

- 7.3 Irrigation and fertigation

- 7.4 Climate control

- 7.5 Sensors

Chapter 8 Market Estimates and Forecast, By Crop Type, 2021 – 2034 ($ Bn)

- 8.1 Key trends

- 8.2 Fruits

- 8.3 Vegetables

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AMS OSRAM AG

- 10.2 Artechno

- 10.3 C-LED srl

- 10.4 Ecopia

- 10.5 General Electronics

- 10.6 LED iBond

- 10.7 MechaTronix

- 10.8 Nuvege

- 10.9 Organizzazione Orlandelli

- 10.10 Panasonic

- 10.11 Parus

- 10.12 Philips

- 10.13 Signify

- 10.14 Tungsram

- 10.15 UNI-TROLL