|

市场调查报告书

商品编码

1773215

固定式燃料电池市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Stationary Fuel Cell Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球固定式燃料电池市场规模达16亿美元,预计2034年将以13.7%的复合年增长率成长,达到59亿美元。这些燃料电池提供稳定可靠的电力来源,使其成为永久装置的理想选择。它们可以使用各种燃料,例如氢气、沼气或天然气,具体取决于燃料电池技术的类型。小型和大型燃料电池系统的需求不断增长,以及公共和私营部门对氢能基础设施的投资,可能会推动市场成长。

随着企业寻求可靠清洁的能源解决方案,燃料电池越来越多地用于关键区域供电,从而减少对电网的依赖并增强能源安全。这些系统提供不间断供电,排放量极低,非常适合停机可能导致重大营运损失的行业。其可扩展性和灵活性也使其能够整合到各种应用中——从资料中心和医院到远端设施以及製造业的备用电源。此外,随着永续发展目标的日益严格和碳减排目标的日益严格,向燃料电池技术的转变与更广泛的环境和监管要求相一致。这种转变正在推动公共和私营部门的投资和创新,进一步加速燃料电池在全球的普及。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 16亿美元 |

| 预测值 | 59亿美元 |

| 复合年增长率 | 13.7% |

预计到2034年,住宅市场规模将超过22亿美元,这得益于住宅环境对更小尺寸、更低噪音电源的需求日益增长。这些特性使得固定式燃料电池能够以可靠、紧凑的能源解决方案,为城郊和城市住宅提供高效的能源解决方案。此外,消费者对能源独立性、永续性和清洁能源优势的认识也将推动该产业的扩张。

预计到2034年,热电联产(CHP)市场价值将超过9亿美元,这得益于燃料电池系统卓越的热效率,该系统能够同时产生电能和热能,从而最大限度地提高能源利用率并减少损耗。 2024年2月,Scale Microgrids收购了位于康乃狄克州布里奇波特的一个9.6兆瓦的热电联产燃料电池项目,该项目包含一个1.6英里(约2.6公里)的热迴路,将由HyAxiom公司製造和营运。此外,工业製程热能需求的不断成长将影响产品的部署。

预计2034年,亚太地区固定式燃料电池市场规模将达48亿美元。中国和印度等国的快速城镇化预计将刺激燃料电池的普及。此外,随着各行各业日益寻求经济高效、可持续的能源解决方案来满足其高功率需求,亚太地区的主要製造业中心也将推动市场大幅成长,从而进一步加速该地区固定式燃料电池的部署。

固定式燃料电池产业的知名企业有 Altergy、AFC Energy、Bloom Energy、Ballard Power Systems、Cummins、Doosan Fuel Cell、Fuji Electric、Fuel Cell Energy、GenCell、poscoenergy、Plug Power、Nuvera Fuel Cells、西门子能源、SFC Energy 和东芝公司。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与技术格局

第五章:市场规模及预测:依产能,2021 - 2034 年

- 主要趋势

- < 3 千瓦

- 3 - 10 千瓦

- >10 - 50 千瓦

- >50千瓦

第六章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 主电源

- 热电联产

- 其他的

第七章:市场规模及预测:依最终用途,2021 - 2034

- 主要趋势

- 住宅

- 商业的

- 工业/公用事业

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 奥地利

- 亚太地区

- 日本

- 韩国

- 中国

- 印度

- 菲律宾

- 越南

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 拉丁美洲

- 巴西

- 秘鲁

- 墨西哥

第九章:公司简介

- Altergy

- AFC Energy

- Bloom Energy

- Ballard Power Systems

- Cummins

- Doosan Fuel Cell

- Fuji Electric

- Fuel Cell Energy

- GenCell

- poscoenergy

- Plug Power

- Nuvera Fuel Cells

- Siemens Energy

- SFC Energy

- Toshiba Corporation

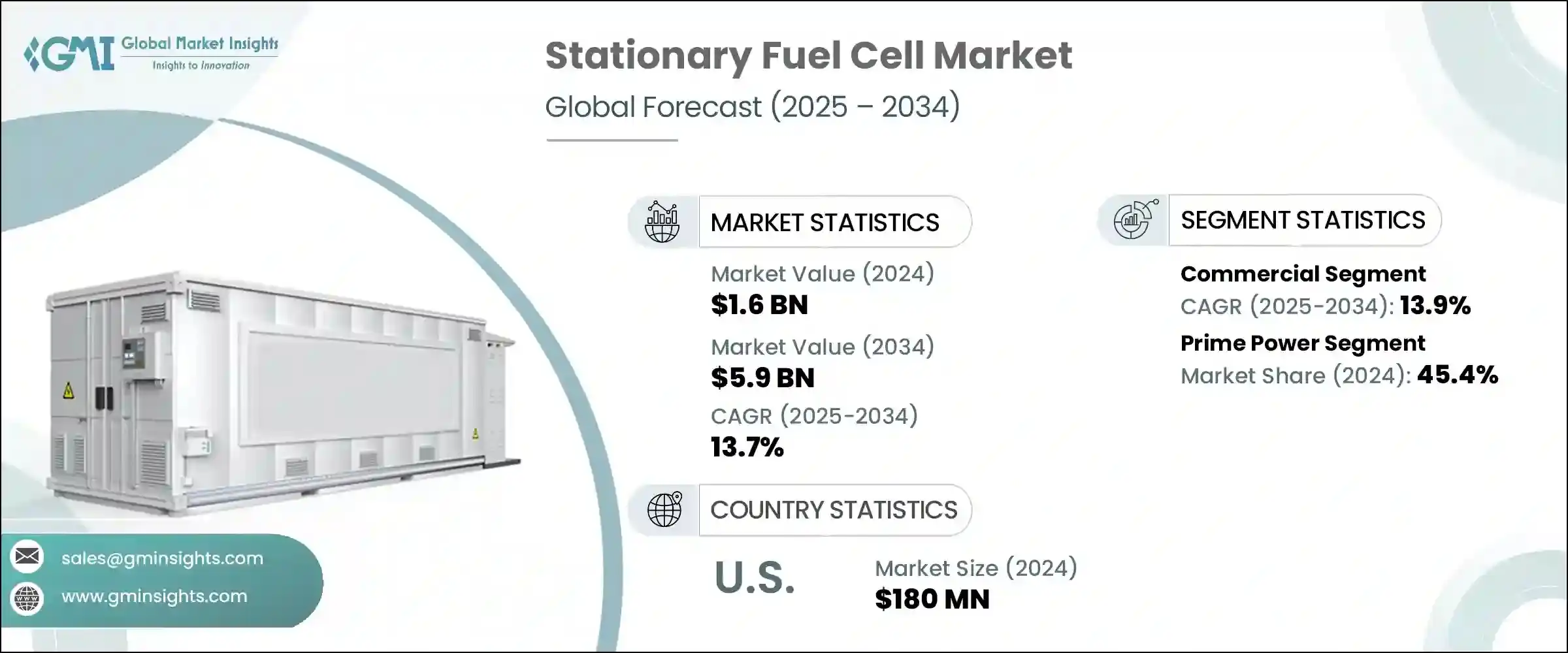

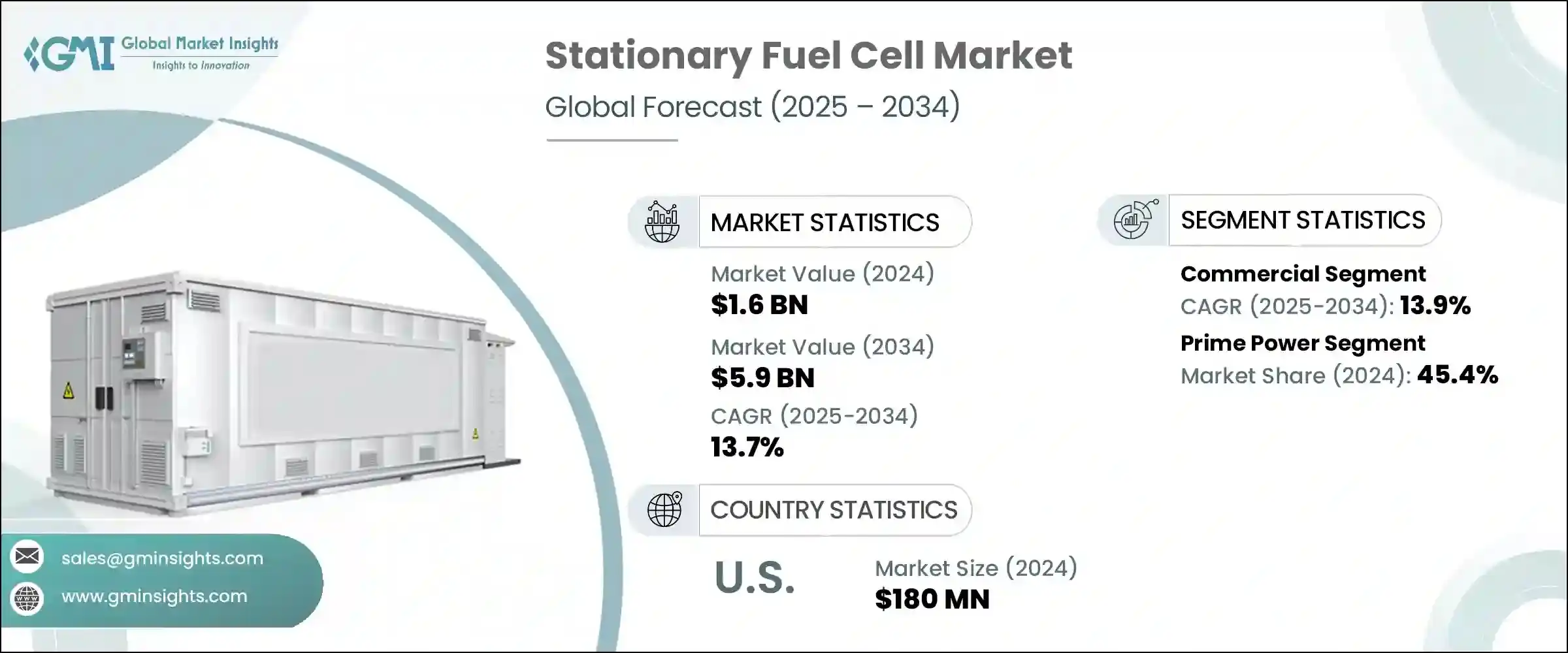

The Global Stationary Fuel Cell Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 13.7% to reach USD 5.9 billion by 2034. These fuel cells provide a stable and dependable electricity source, making them ideal for permanent installations. They can run on various fuels, such as hydrogen, biogas, or natural gas, depending on the type of fuel cell technology. The rising demand for both small and large-capacity fuel cell systems, along with investments in hydrogen infrastructure by both public and private sectors, will likely boost market growth.

As businesses seek reliable and clean energy solutions, fuel cells are increasingly used to provide power in critical areas, reducing grid dependence and enhancing energy security. These systems offer uninterrupted power supply with minimal emissions, making them ideal for industries where downtime can lead to significant operational losses. Their scalability and flexibility also allow integration across a wide range of applications-from data centers and hospitals to remote facilities and backup power in manufacturing. Moreover, as sustainability goals tighten and carbon reduction targets become more stringent, the shift toward fuel cell technology aligns with broader environmental and regulatory mandates. This transition is driving investment and innovation across both public and private sectors, further accelerating fuel cell adoption globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 13.7% |

The residential segment is estimated to reach over USD 2.2 billion by 2034, augmented by the growing need for smaller sizes and lower noise-level power sources in the residential environment. These features make stationary fuel cells highly efficient for suburban and urban residences in the form of reliable and compact energy solutions. Additionally, consumer awareness about energy independence, sustainability, and the benefits of clean energy will drive the industry expansion.

The CHP segment is estimated to be worth more than USD 0.9 billion by 2034, owing to the great thermal efficiency of fuel cell systems that generate power and heat together, maximizing the energy utilization and reducing losses. In February 2024, Scale Microgrids acquired a 9.6 MW CHP fuel cell project in Bridgeport, Connecticut, which includes a 1.6-mile thermal loop and will be fabricated and operated by HyAxiom. Moreover, growing demand for industrial process heat will influence product deployment.

Asia Pacific stationary fuel cell market is projected to hit USD 4.8 billion by 2034. Rapid urbanization in countries including China and India is expected to stimulate fuel cell adoption. Additionally, Asia Pacific's major manufacturing hubs will foster substantial market growth as industries increasingly seek cost-effective, efficient, and sustainable energy solutions to meet their high-power requirements, further accelerating stationary fuel cell deployment in the region.

Eminent players operating in the stationary fuel cell industry are Altergy, AFC Energy, Bloom Energy, Ballard Power Systems, Cummins, Doosan Fuel Cell, Fuji Electric, Fuel Cell Energy, GenCell, poscoenergy, Plug Power, Nuvera Fuel Cells, Siemens Energy, SFC Energy, and Toshiba Corporation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 < 3 kW

- 5.3 3 - 10 kW

- 5.4 >10 - 50 kW

- 5.5 >50 kW

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Prime power

- 6.3 CHP

- 6.4 Others

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industry/utility

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 South Korea

- 8.4.3 China

- 8.4.4 India

- 8.4.5 Philippines

- 8.4.6 Vietnam

- 8.5 Middle East & Africa

- 8.5.1 South Africa

- 8.5.2 Saudi Arabia

- 8.5.3 UAE

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Peru

- 8.6.3 Mexico

Chapter 9 Company Profiles

- 9.1 Altergy

- 9.2 AFC Energy

- 9.3 Bloom Energy

- 9.4 Ballard Power Systems

- 9.5 Cummins

- 9.6 Doosan Fuel Cell

- 9.7 Fuji Electric

- 9.8 Fuel Cell Energy

- 9.9 GenCell

- 9.10 poscoenergy

- 9.11 Plug Power

- 9.12 Nuvera Fuel Cells

- 9.13 Siemens Energy

- 9.14 SFC Energy

- 9.15 Toshiba Corporation