|

市场调查报告书

商品编码

1773225

酒窖市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Wine Cellar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球酒窖市场价值为 32 亿美元,预计到 2034 年将以 5.1% 的复合年增长率达到 52 亿美元。生活方式的演变和可支配收入的提高推动了葡萄酒消费的成长,进而刺激了对住宅和商业酒窖的需求。行销活动和城市富裕程度提高了人们对适当葡萄酒储存的认识,尤其是在城市居民和酒店业专业人士中。葡萄酒旅游业的扩张和向高端品牌的转变,促使製造商生产设计前卫、紧凑且可控温的酒窖。随着葡萄酒保存从奢侈品转变为家庭常态,消费者观念也在改变,支持了市场的稳定发展。全球高净值人士 (HNWI) 数量的成长是另一个关键驱动因素。高净值人士倾向于选择与他们的收藏相符的客製化储存方案,他们正在将葡萄酒收藏转变为身份的象征和投资。

这一日益增长的趋势正推动对高端、精密设计的酒窖系统的需求激增,这些系统不仅提供气候控制功能,还能与奢华家居的美学设计无缝融合。越来越多的房主寻求将功能性与建筑优雅相结合的客製化解决方案,从而推动了装饰、智慧温度调节和湿度控制方面的创新。因此,製造商竞相推出配备数位监控、模组化酒架和更高能源效率的先进酒窖设计。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 32亿美元 |

| 预测值 | 52亿美元 |

| 复合年增长率 | 5.1% |

独立式酒窖市场在2024年创造了12亿美元的产值,预计到2034年将成长至21亿美元。其吸引力在于便携性和易用性,无需专业安装。无论是住宅用户还是商业场所,都对采用耐用防銹材料、隔热性能更好以及额外配件存储空间的酒窖类型青睐有加,这使得它们成为灵活多变、功能多样的理想之选。

商业领域在2024年以19亿美元的规模引领市场,预计复合年增长率将达到5.2%。餐厅、饭店和酒吧正在投资先进的储存系统,以保持葡萄酒的品质并提升宾客体验。配备基于物联网的温湿度监控系统,甚至人工智慧控制的气候系统的酒窖,确保了葡萄酒陈酿和上桌的精准条件。这种技术驱动的方法,加上葡萄酒搭配体验的流行,巩固了商业领域的主导地位。

美国酒窖市场在2024年创收11亿美元,预计2034年将以5%的复合年增长率成长。这一成长主要源自于葡萄酒鑑赏力的提升、家庭娱乐趋势的兴起以及智慧储藏技术的普及。富裕的房主正在投资时尚订製的酒窖,青睐能够监控温度、湿度和库存的智慧系统。兼具美感与实用性的智慧系统,逐渐成为高级住宅的标准配备。

酒窖产业的知名企业包括 Miele、Vinotech、Whirlpool、Avanti、Sub-Zero、Gaggenau、EuroCave、U-line、Liebherr、Rocco、Avallon、Wine Enthusiast、Perlick、Thermador、NewAir、Electrolux、Haier、Viking、Groupe、Tirtech、Cier、Latech、Mirin、Leier、Viking、Groupe、Tirtech、Cier、La Cellier、Viteplus)、Danby 和 Honeywell。推动酒窖市场成功的关键策略包括利用设计创新、客製化和智慧整合。各公司正在投资研发,以创建节能冷却系统、智慧库存追踪和时尚美观的设计。与房地产开发商和豪华住宅建筑商的合作有助于接触高端住宅业主,而与餐厅、酒店和葡萄酒旅游场所的合作则扩大了其商业足迹。各品牌也强调环保材料和隔热材料,以符合永续消费者的偏好。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 贸易统计(HS编码)

- 主要进口国

- 主要出口国

- 波特五力分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 独立式酒窖

- 内置酒窖

- 步入式酒窖

- 葡萄酒墙

- 酒柜

- 其他的

第六章:市场估计与预测:依产能,2021-2034

- 主要趋势

- 小瓶(50瓶以下)

- 中型(50-100瓶)

- 大瓶装(100-200瓶)

- 特大(超过200瓶)

第七章:市场估计与预测:依定价,2021-2034 年

- 主要趋势

- 低成本

- 大量的

- 优质的

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 住宅

- 商业的

- 餐厅和酒吧

- 饭店和度假村

- 葡萄酒商店和品酒室

- 其他的

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- B2B

- B2C

- 专卖店

- 家居装饰店

- 网路零售

- 百货公司

- 其他的

第 10 章:市场估计与预测:按地区,2021 年至 2034 年,

- 主要趋势

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- Avallon

- Avanti

- Danby

- Electrolux

- EuroCave

- Gaggenau

- Groupe Frio (Climadiff, La Sommeliere, Avintage, Temtech, Le Cellier, Vitempus)

- Haier

- Honeywell

- Liebherr

- Miele

- NewAir

- Perlick

- Rocco

- Sub-Zero

- Thermador

- U-line

- Viking

- Vinotemp

- Vintech

- Whirlpool

- Wine Enthusiast

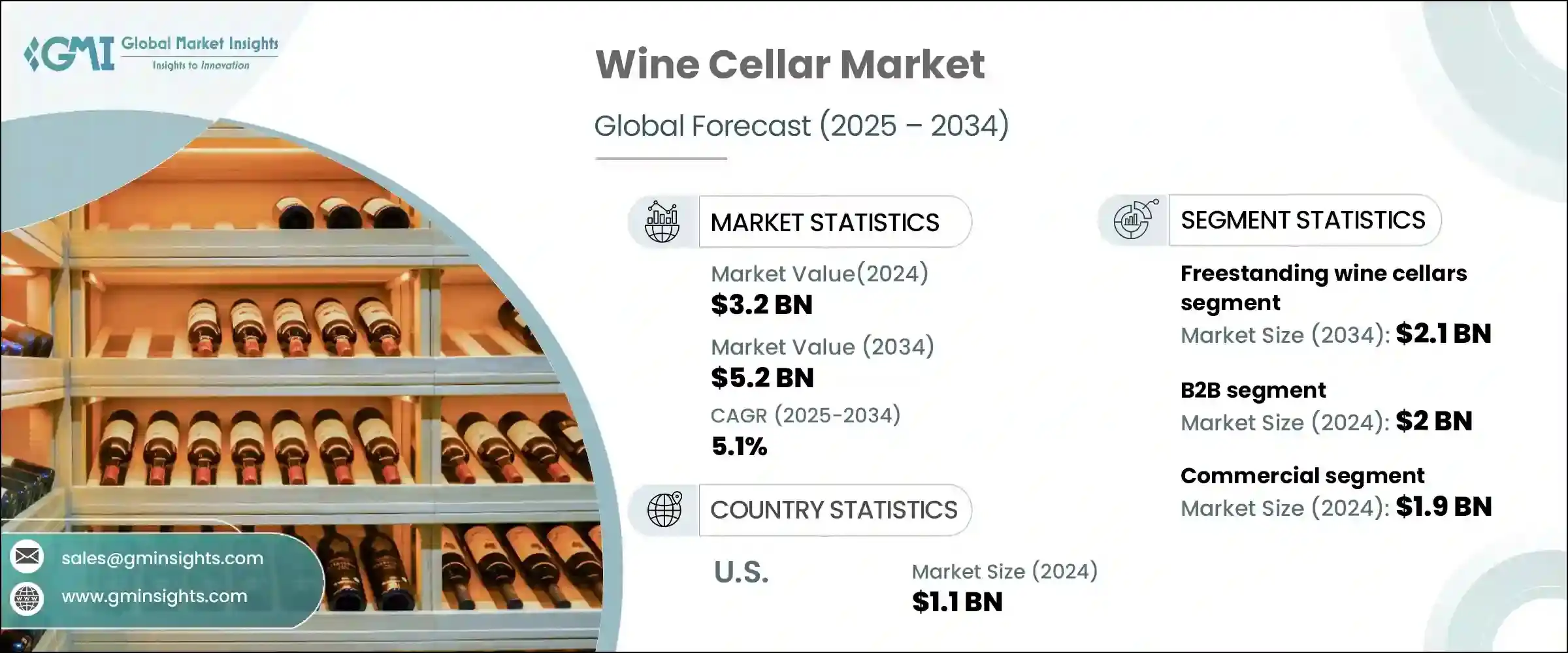

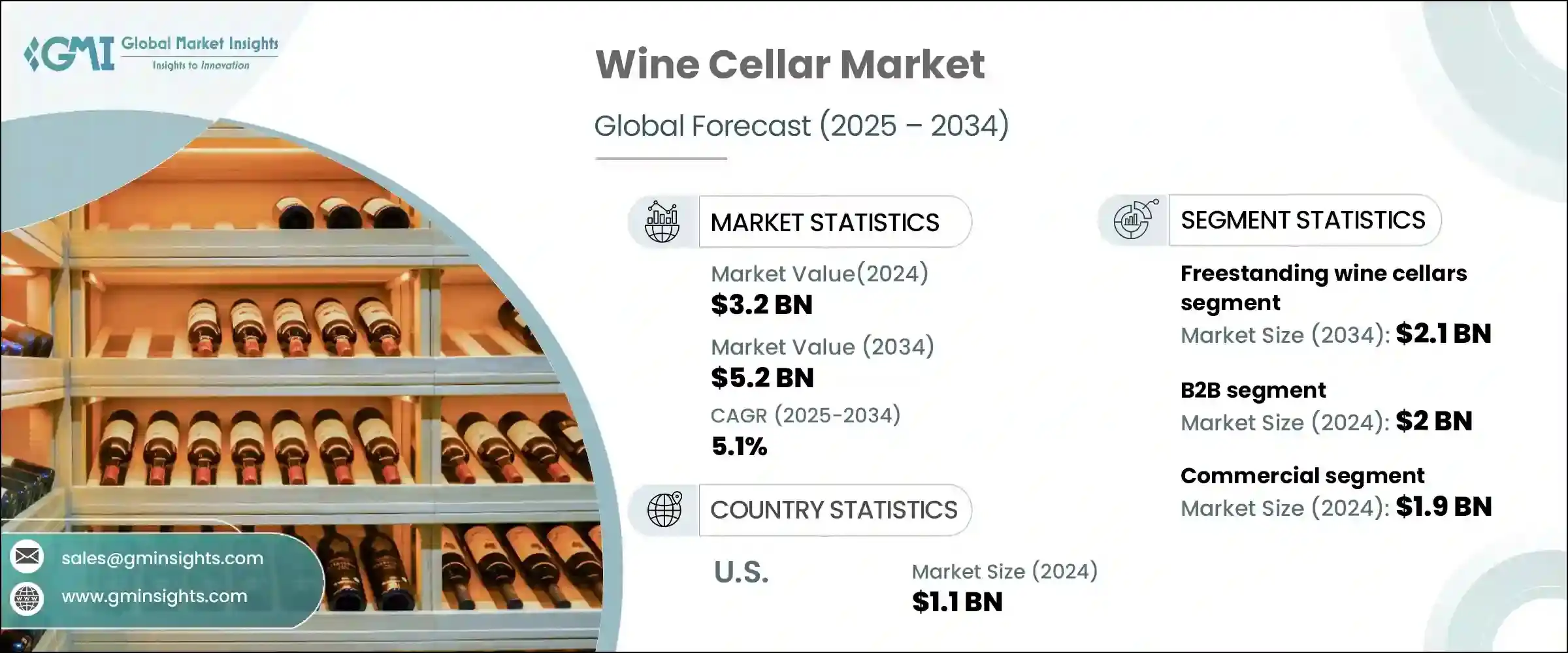

The Global Wine Cellar Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 5.2 billion by 2034. Lifestyle evolution and higher disposable incomes are steering a rise in wine consumption, which in turn is fueling demand for both residential and commercial wine cellars. Marketing campaigns and urban affluence have heightened awareness around proper wine storage, particularly among city dwellers and hospitality professionals. The expansion of wine tourism and a shift toward premium labels are encouraging manufacturers to produce design-forward, compact, and temperature-controlled cellars. As wine preservation transforms from a luxury to a household norm, consumer attitudes are shifting, supporting steady market development. The growing number of high-net-worth individuals (HNWIs) globally is another key driver. With their inclination toward bespoke storage options that reflect their collections, HNWIs are transforming wine collecting into both status symbols and investments.

This growing trend is fueling a surge in demand for high-end, precision-engineered wine cellar systems that not only offer climate control but also integrate seamlessly into luxury home aesthetics. Homeowners are increasingly seeking customized solutions that merge functionality with architectural elegance, driving innovation in finishes, smart temperature regulation, and humidity control. As a result, manufacturers are competing to deliver state-of-the-art cellar designs equipped with digital monitoring, modular racking, and enhanced energy efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 5.1% |

The freestanding wine cellars segment generated USD 1.2 billion in 2024 and is projected to grow to USD 2.1 billion by 2034. Their appeal lies in their portability and ease of use without requiring professional installation. Both homeowners and commercial venues are drawn to models featuring durable, rust-resistant materials, better insulation, and additional storage for accessories, making them ideal for versatile placement and functionality.

The commercial segment led the market at USD 1.9 billion in 2024 and is expected to grow at a CAGR of 5.2%. Restaurants, hotels, and wine bars are investing in advanced storage systems to maintain collection quality and enhance guest experience. Cellars equipped with IoT-based temperature and humidity monitoring-and even AI-controlled climate systems-ensure precise conditions for aging and serving wines. This technology-driven approach, combined with the popularity of wine-pairing experiences, consolidates the dominance of the commercial sector.

U.S. Wine Cellar Market generated USD 1.1 billion in 2024 and is forecast to grow at a CAGR of 5% through 2034. This growth is anchored by increasing wine appreciation, home entertainment trends, and the adoption of smart storage technologies. Affluent homeowners are investing in stylish and customized wine cellars, favoring smart systems that monitor temperature, humidity, and inventory. The blend of aesthetic appeal and functionality is establishing these installations as standard additions in upscale residences.

Well-known players in the Wine Cellar Industry include Miele, Vinotech, Whirlpool, Avanti, Sub-Zero, Gaggenau, EuroCave, U-line, Liebherr, Rocco, Avallon, Wine Enthusiast, Perlick, Thermador, NewAir, Electrolux, Haier, Viking, Groupe Farious (Climadiff, La Sommeliere, Avintage, Temtech, Le Cellier, Viteplus), Danby, and Honeywell. Key strategies driving success in the wine cellar market include leveraging design innovation, customization, and smart integration. Companies are investing in R&D to create energy-efficient cooling systems, smart inventory tracking, and sleek aesthetics. Partnerships with real estate developers and luxury home builders are helping reach upscale homeowners, while collaborations with restaurants, hotels, and wine tourism venues expand their commercial footprint. Brands also emphasize eco-friendly materials and insulation to align with sustainable consumer preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Capacity

- 2.2.4 Price range

- 2.2.5 Application

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Freestanding wine cellars

- 5.3 Built-in wine cellars

- 5.4 Walk-in wine cellars

- 5.5 Wine walls

- 5.6 Wine cabinets

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Small (under 50 bottles)

- 6.3 Medium (50–100 bottles)

- 6.4 Large (100–200 bottles)

- 6.5 Extra-large (over 200 bottles)

Chapter 7 Market Estimates & Forecast, By Pricing, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Low cost

- 7.3 Mass

- 7.4 Premium

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Restaurants and bars

- 8.3.2 Hotels and resorts

- 8.3.3 Wine shops and tasting rooms

- 8.3.4 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Units)

- 9.1 Key Trends

- 9.2 B2B

- 9.3 B2C

- 9.3.1 Specialty stores

- 9.3.2 Home improvement stores

- 9.3.3 Online retail

- 9.3.4 Department stores

- 9.3.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 The U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Avallon

- 11.2 Avanti

- 11.3 Danby

- 11.4 Electrolux

- 11.5 EuroCave

- 11.6 Gaggenau

- 11.7 Groupe Frio (Climadiff, La Sommeliere, Avintage, Temtech, Le Cellier, Vitempus)

- 11.8 Haier

- 11.9 Honeywell

- 11.10 Liebherr

- 11.11 Miele

- 11.12 NewAir

- 11.13 Perlick

- 11.14 Rocco

- 11.15 Sub-Zero

- 11.16 Thermador

- 11.17 U-line

- 11.18 Viking

- 11.19 Vinotemp

- 11.20 Vintech

- 11.21 Whirlpool

- 11.22 Wine Enthusiast