|

市场调查报告书

商品编码

1773229

中密度纤维板市场机会、成长动力、产业趋势分析及2025-2034年预测Medium Density Fiberboard Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

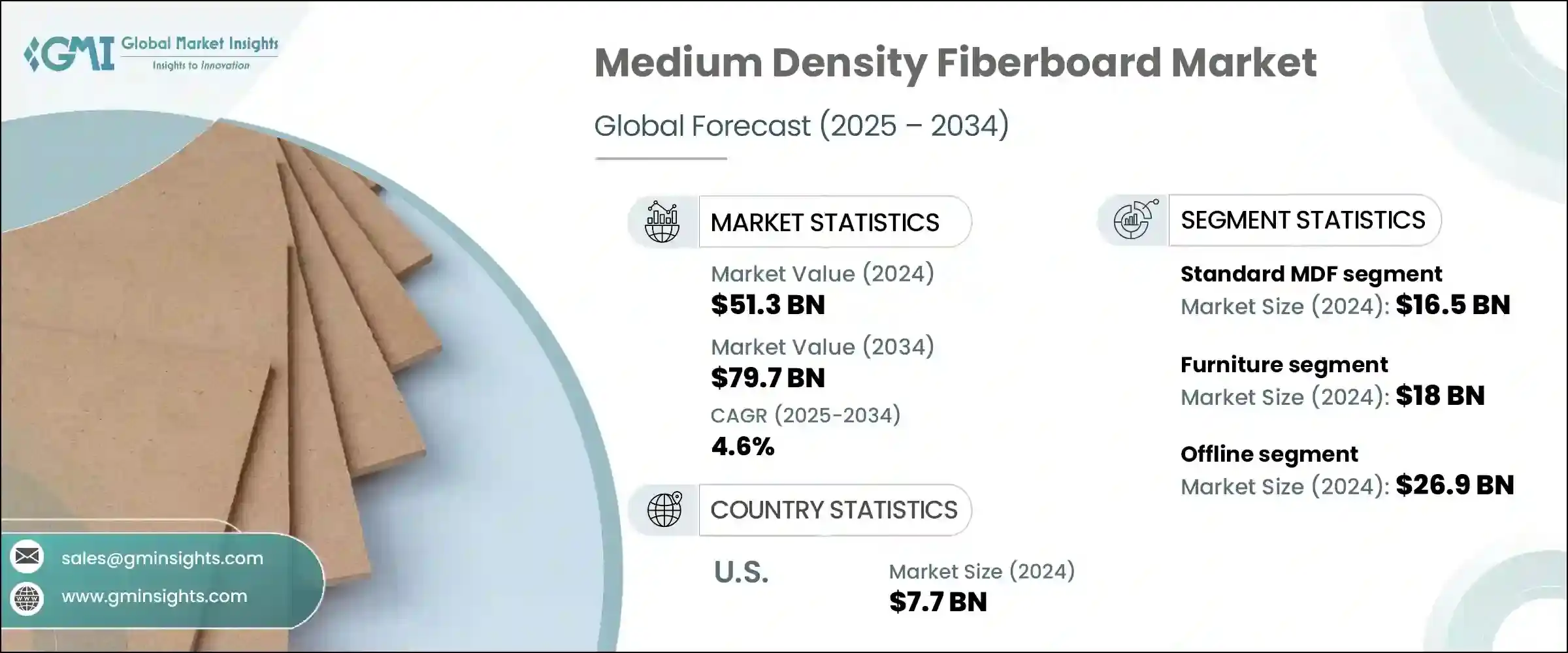

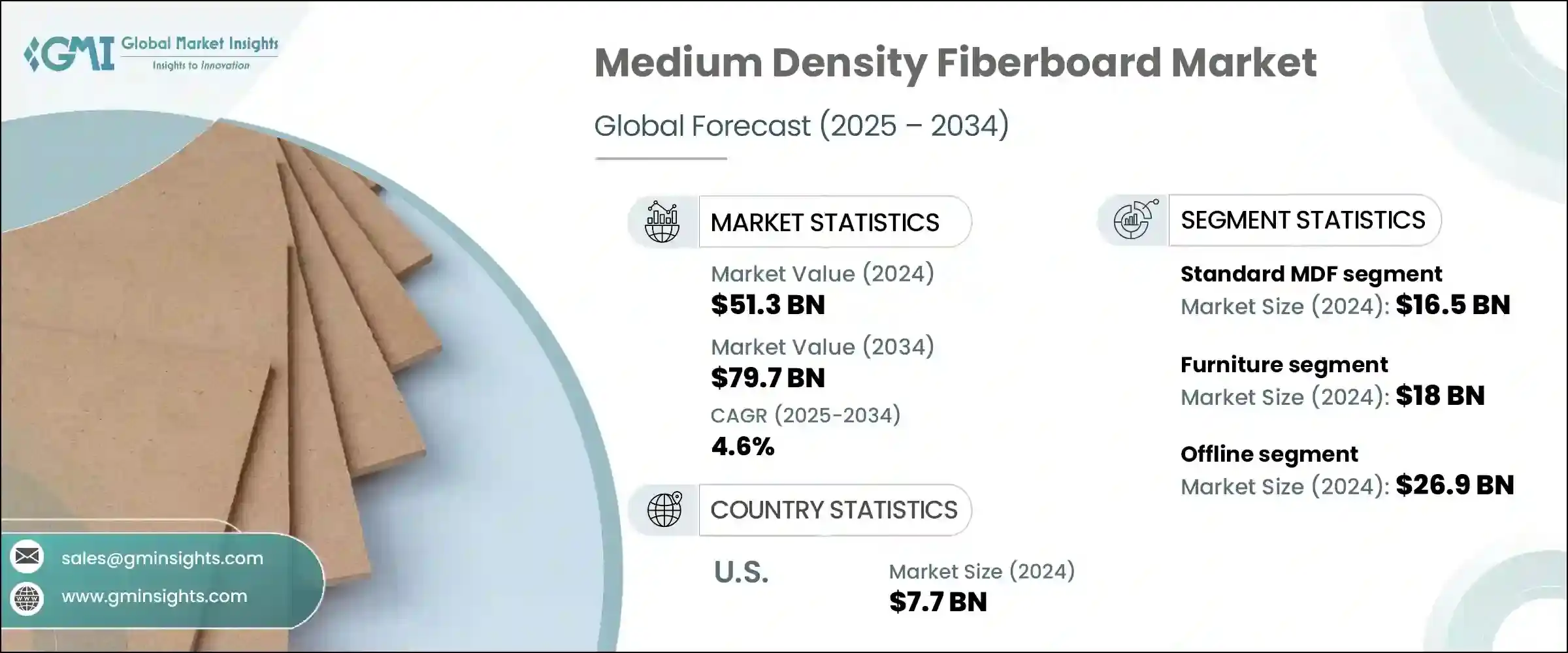

2024年,全球中密度纤维板市场规模达513亿美元,预计2034年将以4.6%的复合年增长率成长,达到797亿美元。这一稳步增长得益于建筑、室内设计和家具领域应用的不断增长。中密度纤维板(MDF)产品功能多样、价格实惠,使其成为追求品质与成本效益平衡的製造商的热门选择。市场对耐用、防火或防潮建筑材料的需求日益增长,进一步推动了市场发展。此外,製造技术的进步和低排放甲醛基胶黏剂的引入,提高了产品强度和环保合规性。随着城市建筑和家居改造的持续兴起,中密度纤维板(MDF)正逐渐成为胶合板、水泥和塑胶等材料的可靠替代品。

在快速城镇化和人口激增的推动下,住宅市场的成长持续推高了对采用中密度纤维板 (MDF) 製成的现代木质家具的需求。随着越来越多的人迁入城市,住房开发也加速,人们越来越倾向于选择节省空间、价格实惠且美观的家具解决方案。中密度纤维板凭藉其适应性强、表面光滑以及与各种饰面和设计的兼容性,满足了这些需求。消费者越来越青睐即装即用和模组化的家具风格,这些家具通常采用中密度纤维板製造,因为其易于加工且经久耐用。此外,永续发展趋势正在推动消费者转向工程木材替代品,这进一步巩固了中密度纤维板作为新建和改造城市住宅中经济高效、耐用环保的家居解决方案的首选材料的地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 513亿美元 |

| 预测值 | 797亿美元 |

| 复合年增长率 | 4.6% |

2024年,标准中密度纤维板(MDF)市场规模达165亿美元,预计2034年将以4.6%的复合年增长率成长。由于其灵活性和极具竞争力的价格,该领域在家具和建筑市场持续受到欢迎。作为传统木材的经济实惠替代品,MDF在地板、橱柜和其他结构部件中的应用日益广泛。商业和住宅建筑项目的扩张,尤其是在欧洲地区,可能会在预测期内为标准中密度纤维板带来进一步的发展动力。其易于自订和高品质的表面处理是其需求成长的关键因素。

2024年,家具业的市场价值达到180亿美元,预计2025年至2034年期间的复合年增长率将达到4.7%。由于製造商倾向于使用环保且经济的原材料,例如再造林木材衍生物,预计该领域将在中密度纤维板(MDF)的使用中保持主导地位。消费者对美观、耐用且紧凑的预组装家具的需求激增,这些解决方案适合现代生活空间。中密度纤维板易于精细加工和精密切割,是复杂家具设计的理想选择。此外,随着远距办公成为长期趋势,家庭办公领域明显转向使用符合人体工学且节省空间的中密度纤维板家具,这进一步推动了该领域的扩张。

美国中密度纤维板市场在2024年创收77亿美元,预计2025年至2034年的复合年增长率将达到5.6%。该地区的成长源于住宅和商业建筑项目中对中密度纤维板(MDF)的大量使用。人们对可持续且经济实惠的实木替代品的兴趣日益浓厚,推动了中密度纤维板在橱柜、镶板和室内装饰中的应用。疫情期间,房屋翻新需求激增,直接增加了中密度纤维板家具的需求。此外,人们对环保材料(尤其是低排放和由再生材料製成的材料)的日益关注,将继续加强美国市场的扩张,因为美国的环境法规正在影响消费者的购买行为。

致力于在中密度纤维板市场中获得竞争优势的关键公司包括 West Fraser Timber、Kastamonu Entegre、Dare Panel Group、ARAUCO、Egger Group、Unilin、Greenply Industries、Georgia-Pacific、Evergreen Fiberboard、TRENOX Laminates、KronosS、Century Pulury Pibers、Dongwhaiberboard、TRENOX Laminates、KronosNo、Century Pelboards、Dongwhah。为巩固市场地位,中密度纤维板 (MDF) 製造商正专注于扩大产能、实现产品多样化和生产技术进步。一些公司正在投资环保替代品和无甲醛树脂,以满足日益严格的环保标准。创新专为模组化家具和预製房屋设计的轻质耐用中密度纤维板是一项关键的成长策略。与家俱生产商、家居装饰零售商和建筑公司建立合作伙伴关係,可以更好地分销并进入高需求地区。此外,企业正在利用数位平台和 B2B 网路来扩大市场范围。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:市场洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 波特五力分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- MEA

- 拉丁美洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品 2021 - 2034

- 主要趋势

- 标准中密度纤维板

- 防潮中密度纤维板

- 防火中密度纤维板

第六章:市场估计与预测:按应用 2021 - 2034

- 主要趋势

- 包装

- 建筑和地板

- 室内装潢

- 家具

- 其他的

第七章:市场估计与预测:依价格区间 2021 - 2034

- 主要趋势

- 低的

- 中等的

- 高的

第八章:市场估计与预测:按配销通路2021 - 2034

- 主要趋势

- 在线的

- 离线

第九章:市场估计与预测:按地区 2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- ARAUCO

- Century Plyboards

- Dare Panel Group

- Dongwha Malaysia Holdings

- Egger Group

- Evergreen Fiberboard

- Georgia-Pacific

- Greenply Industries

- Kastamonu Entegre

- Kronospan

- Nag Hamady Fiber Board

- Norbord

- TRENOX Laminates

- Unilin

- West Fraser Timber

The Global Medium Density Fiberboard Market was valued at USD 51.3 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 79.7 billion by 2034. This steady growth is driven by increasing applications across the construction, interior design, and furniture sectors. The versatility and affordability of MDF products have made them a popular choice for manufacturers aiming to balance quality with cost-efficiency. The growing demand for durable and fire- or moisture-resistant building materials is further boosting the market. Additionally, advances in manufacturing techniques and the integration of low-emission formaldehyde-based adhesives have improved product strength and environmental compliance. As construction and home remodeling continue rising in urban areas, MDF is emerging as a reliable alternative to materials like plywood, cement, and plastic.

Growth in the residential sector, driven by rapid urbanization and a surge in population, continues to elevate demand for modern, wooden furniture built with MDF panels. As more individuals migrate to cities and housing development accelerates, there's a rising preference for space-efficient, affordable, and aesthetically pleasing furniture solutions. MDF panels meet these needs due to their adaptability, smooth surface, and compatibility with a wide range of finishes and designs. Consumers are increasingly favoring ready-to-assemble and modular furniture styles, which are often manufactured using MDF for its ease of machining and durability. Moreover, sustainability trends are pushing buyers toward engineered wood alternatives, further reinforcing MDF as a go-to material for cost-effective, durable, and eco-friendly home furnishing solutions in new and remodeled urban dwellings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $51.3 Billion |

| Forecast Value | $79.7 Billion |

| CAGR | 4.6% |

In 2024, standard MDF generated USD 16.5 billion and is forecasted to grow at a CAGR of 4.6% through 2034. This segment continues to gain popularity in the furniture and construction markets due to its flexibility and competitive pricing. Its ability to serve as an affordable substitute for traditional wood has increased its presence in flooring, cabinetry, and other structural components. Expansion in commercial and residential construction projects, particularly in European regions, will likely create further momentum for standard MDF panels over the forecast period. The ease of customization and high-quality finish it offers plays a crucial role in its rising demand.

The furniture sector accounted for USD 18 billion in market value in 2024 and is projected to grow at a 4.7% CAGR between 2025 and 2034. This segment is expected to maintain a dominant share in MDF usage, as manufacturers lean toward eco-friendly and economical raw materials such as reforested wood derivatives. The demand for pre-assembled and low-maintenance furniture has surged, with consumers seeking aesthetic, durable, and compact solutions suited for modern living spaces. MDF allows detailed machining and precision cutting, ideal for intricate furniture designs. Additionally, with remote work becoming a long-term trend, there's a noticeable shift toward ergonomic and space-saving MDF-based furniture for home offices, which further drives segment expansion.

U.S. Medium Density Fiberboard Market generated USD 7.7 billion in 2024 and is expected to grow at a CAGR of 5.6% from 2025 to 2034. Growth in this region stems from robust use of MDF in both residential and commercial construction projects. Rising interest in sustainable and budget-conscious alternatives to solid wood has fueled the adoption of MDF across cabinetry, paneling, and interior decor. Home renovations surged during the pandemic, which directly increased demand for MDF-based furnishings. Additionally, increasing focus on eco-friendly materials, especially those with low emissions and made from recycled content, continues to strengthen market expansion in the U.S. market, where environmental regulations are shaping buying behavior.

Key companies working to gain a competitive edge in the Medium Density Fiberboard Market include West Fraser Timber, Kastamonu Entegre, Dare Panel Group, ARAUCO, Egger Group, Unilin, Greenply Industries, Georgia-Pacific, Evergreen Fiberboard, TRENOX Laminates, Kronospan, Century Plyboards, Dongwha Malaysia Holdings, Norbord, and Nag Hamady Fiber Board. To strengthen their market position, MDF manufacturers are focusing on capacity expansions, product diversification, and technological advancements in production. Several companies are investing in eco-friendly alternatives and formaldehyde-free resins to meet rising environmental standards. Innovation in lightweight yet durable MDF boards tailored for modular furniture and prefabricated housing is a key growth strategy. Partnerships with furniture producers, home improvement retailers, and construction firms enable better distribution and access to high-demand regions. Additionally, firms are leveraging digital platforms and B2B networks to expand market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 Price range

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and strategic recommendations

Chapter 3 Market Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behaviour analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behaviour

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product 2021 - 2034, (USD Billion) (Thousand units)

- 5.1 Key trends

- 5.2 Standard MDF

- 5.3 Moisture resistant MDF

- 5.4 Fire resistant MDF

Chapter 6 Market Estimates & Forecast, By Application 2021 - 2034, (USD Billion) (Thousand units)

- 6.1 Key trends

- 6.2 Packaging

- 6.3 Construction & flooring

- 6.4 Interior decoration

- 6.5 Furniture

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Price Range 2021 - 2034, (USD Billion) (Thousand units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel 2021 - 2034, (USD Billion) (Thousand units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates & Forecast, By Region 2021 - 2034, (USD Billion) (Thousand units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 ARAUCO

- 10.2 Century Plyboards

- 10.3 Dare Panel Group

- 10.4 Dongwha Malaysia Holdings

- 10.5 Egger Group

- 10.6 Evergreen Fiberboard

- 10.7 Georgia-Pacific

- 10.8 Greenply Industries

- 10.9 Kastamonu Entegre

- 10.10 Kronospan

- 10.11 Nag Hamady Fiber Board

- 10.12 Norbord

- 10.13 TRENOX Laminates

- 10.14 Unilin

- 10.15 West Fraser Timber