|

市场调查报告书

商品编码

1773263

翻新笔记型电脑市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Refurbished Laptop Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

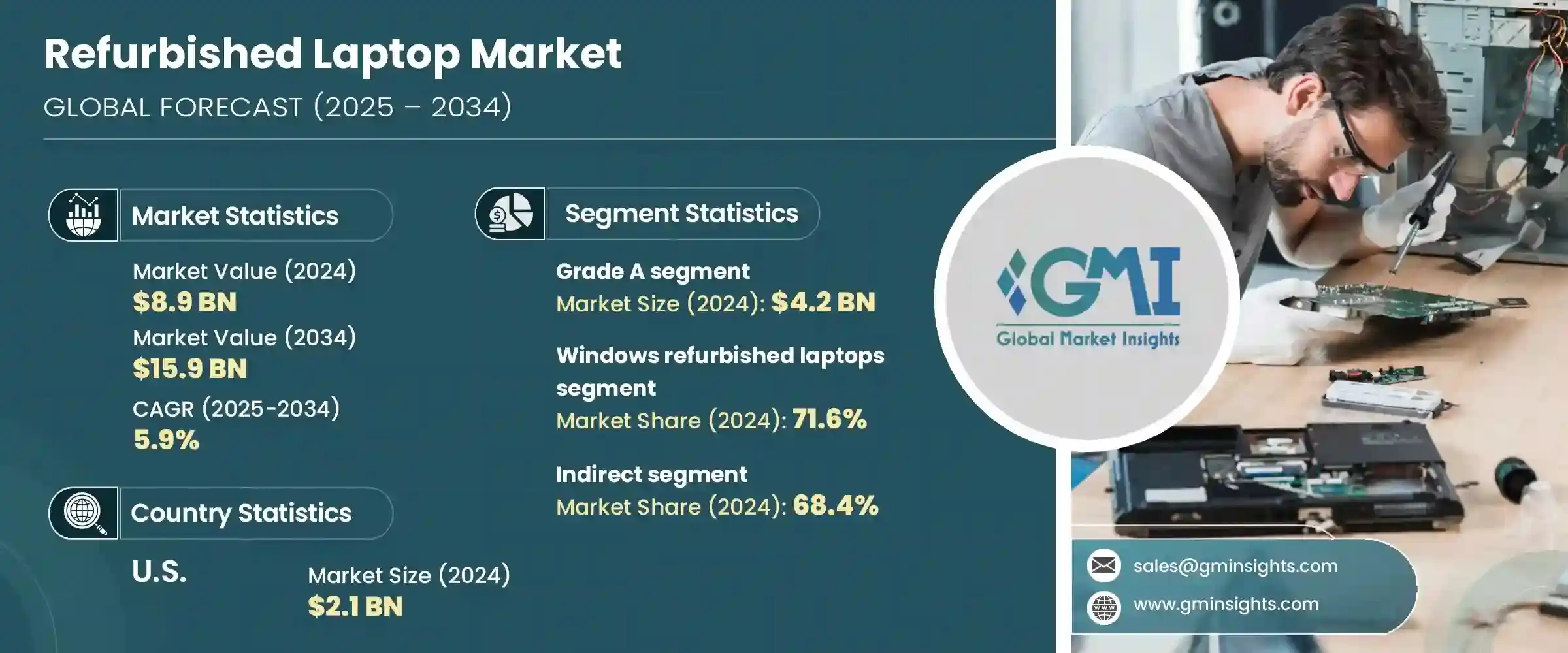

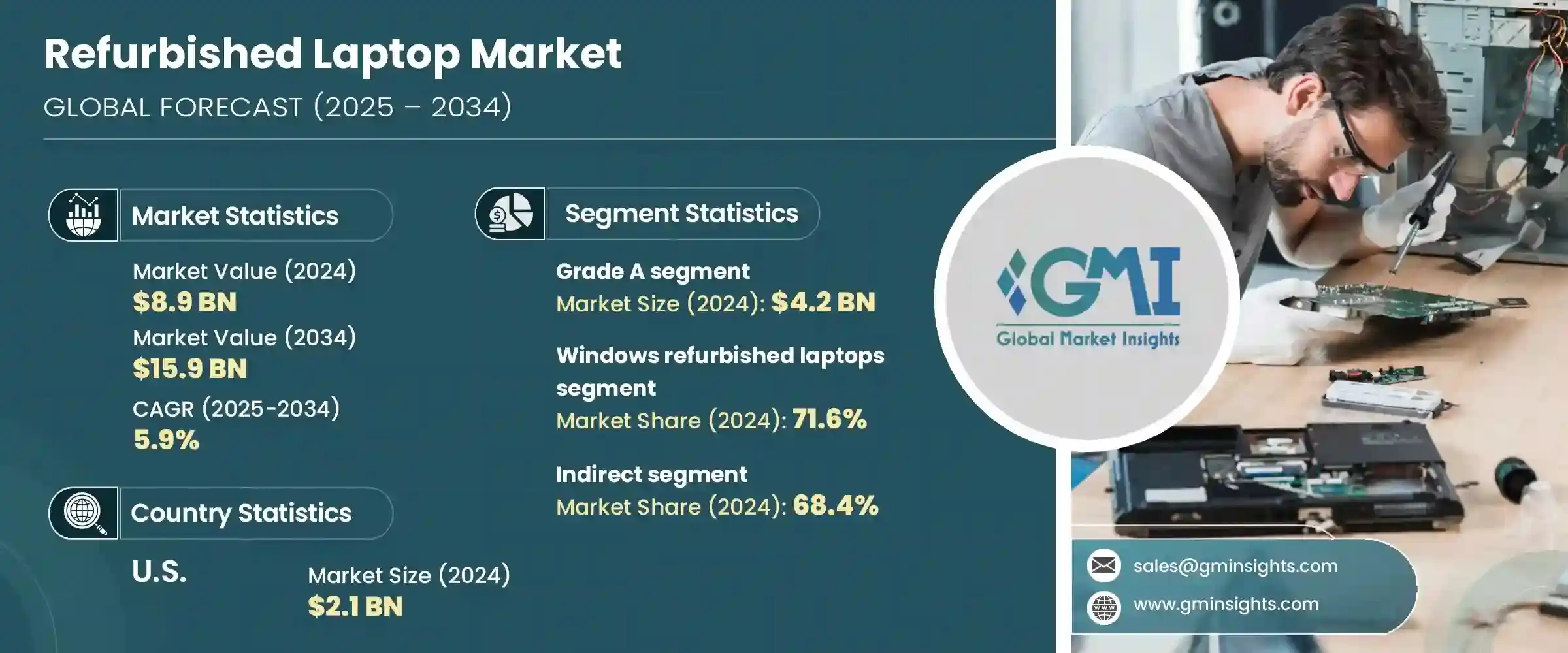

2024 年全球翻新笔记型电脑市场价值为 89 亿美元,预计到 2034 年将以 5.9% 的复合年增长率增长至 159 亿美元。这一市场激增主要由中小企业 (SMB) 和教育部门推动,这两个部门的预算都很紧张。翻新笔记型电脑的价格比全新机型低 30-50%,为这些组织提供了一种经济高效的方式,可以为其员工和学生配备可靠的技术。 COVID-19 疫情加速了数位转型,增加了对经济实惠的运算设备的需求,促使各机构寻求经济实惠的替代方案。此外,翻新笔记型电脑非常符合永续发展目标,因为它们可以减少电子垃圾并降低碳排放。更高的品质检测标准、延长保固期和经过认证的翻新流程增强了消费者信心。

混合式学习、远距办公和自带设备 (BYOD) 政策的兴起显着提升了对翻新笔记型电脑的需求,使其成为中小企业和教育机构的重要资源。随着越来越多的学生和员工需要在家中和办公室灵活地使用技术,企业越来越多地转向能够支持这些新工作和学习环境的经济高效的解决方案。这种转变不仅推动了销量,还鼓励在有限的预算内持续升级和更换。此外,翻新笔记型电脑的灵活性和经济实惠性使学校和企业能够快速适应不断变化的需求,而无需牺牲性能或可靠性,从而巩固了其作为市场扩张关键驱动力的作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 89亿美元 |

| 预测值 | 159亿美元 |

| 复合年增长率 | 5.9% |

2024年,A级笔记型电脑市场规模达42亿美元,引领市场,预计2034年将以6.1%的复合年增长率成长。这些A级翻新笔记型电脑以其如同新品般的外观、极小的磨损以及堪比新机的可靠性能而备受青睐。消费者青睐这些产品,因为它们既能节省成本,又能兼顾品质和保固范围。该细分市场持续涌入来自企业租期满后的回收和短期商务用途的产品。来自可靠政府来源的产业资料证实了这个高端类别的稳定供需。

2024年,搭载Windows作业系统的翻新笔记型电脑占了71.6%的市场份额,预计到2034年将以6.1%的复合年增长率成长。 Windows仍然是全球使用最广泛的作业系统,尤其是在企业和个人环境中,这导致了大量基于Windows的装置可供翻新。 Windows旗下拥有丰富的品牌、型号和规格,为客户提供了不同价位的广泛选择,从而增强了其市场主导地位。

美国翻新笔记型电脑市场在2024年创收21亿美元,预计2025年至2034年的复合年增长率将达到5.6%。该地区受益于强大的电子商务基础设施,以及对经济实惠且环保的技术解决方案的日益重视。这个竞争激烈的市场迎合了学生、自由工作者和小型企业的需求,他们都在寻求可靠且经济实惠的设备。美国市场的领先地位源于广泛的互联网接入、精通数位技术的消费者以及强大的IT资产处置(ITAD)公司网络,这些公司确保了翻新笔记型电脑的可靠来源。

引领翻新笔记型电脑市场的领先公司包括:TechSoup、Walmart Renewed、Lenovo Outlet、Dell Refurbished、Amazon Renewed、HP Renew、Arrow Direct、Refurbees、Newegg Renewed、Refurb That、TigerDirect Refurbished、Apple Certified Refurapioed、Refurb That、TigerDirect Refurbished、Apple Certified Refur为了巩固市场地位,翻新笔记型电脑行业的主要参与者专注于透过严格的测试和认证来提升产品质量,并提供延长保固套餐以赢得消费者的信任。他们专注于打造多样化的产品组合,以满足不同客户的预算和偏好,同时加强与企业客户的合作伙伴关係,以确保设备租赁期满。各公司也利用先进的翻新技术来提高性能并延长产品生命週期。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 中小企业和教育领域的需求不断增长

- 企业IT资产处分计划

- 电子商务成长

- OEM和认证翻新商的参与

- 产业陷阱与挑战

- 消费者认知与信任问题

- 技术快速淘汰

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按年级

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计数据

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依等级,2021 - 2034 年

- 主要趋势

- A级

- B级

- C级

- D级

第六章:市场估计与预测:按作业系统,2021 - 2034 年

- 主要趋势

- Windows 翻新笔记型电脑

- Mac 翻新笔记型电脑

- 其他的

第七章:市场估计与预测:按萤幕尺寸,2021 - 2034 年

- 主要趋势

- 11-13英寸

- 14-16英寸

- 17吋以上

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 个人消费者

- 企业

- 其他的

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直接的

- 间接

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- Amazon Renewed

- Apple Certified Refurbished

- Arrow Direct

- Back Market

- Dell Refurbished

- HP Renew

- Laptop Outlet

- Lenovo Outlet

- Newegg Renewed

- Refurb That

- Refurb.io

- Refurbees

- TechSoup

- TigerDirect Refurbished

- Walmart Renewed

The Global Refurbished Laptop Market was valued at USD 8.9 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 15.9 billion by 2034. This market surge is primarily driven by small and medium-sized businesses (SMBs) and the education sector, both of which operate under tight budget constraints. Refurbished laptops, priced 30-50% lower than brand-new models, offer these organizations a cost-effective way to equip their workforce and students with reliable technology. The digital transformation accelerated by the COVID-19 pandemic increased demand for affordable computing devices, pushing institutions to seek budget-friendly alternatives. Additionally, refurbished laptops align well with sustainability goals, as they reduce electronic waste and lower carbon emissions. Higher standards in quality testing, extended warranties, and certified refurbishing processes have boosted consumer confidence.

The rise in hybrid learning, remote working, and Bring Your Own Device (BYOD) policies has significantly boosted the demand for refurbished laptops, making them an essential resource for SMBs and educational institutions alike. As more students and employees require flexible access to technology both at home and in the office, organizations are increasingly turning to cost-effective solutions that can support these new working and learning environments. This shift not only drives volume sales but also encourages continuous upgrades and replacements within limited budgets. Moreover, the flexibility and affordability of refurbished laptops enable schools and businesses to quickly adapt to changing needs without compromising on performance or reliability, reinforcing their role as key drivers of market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.9 Billion |

| Forecast Value | $15.9 Billion |

| CAGR | 5.9% |

In 2024, the grade A segment led the market generating USD 4.2 billion, and is anticipated to grow at a CAGR of 6.1% until 2034. These Grade A refurbished laptops attract buyers due to their like-new appearance, minimal wear, and reliable performance that rivals new devices. Consumers favor them for delivering cost savings without compromising quality or warranty coverage. This segment receives a steady influx of products from corporate off-lease returns and short-term business use. Industry data from trusted government sources corroborate the steady demand and supply in this high-grade category.

Refurbished laptops running on the Windows operating system segment dominated with a 71.6% market share in 2024 and are expected to grow at a CAGR of 6.1% by 2034. Windows remains the most widely used OS globally, especially in corporate and personal environments, which contributes to the abundance of Windows-based devices available for refurbishment. The variety of brands, models, and specifications under the Windows umbrella offers customers a broad spectrum of choices at different price ranges, enhancing its market dominance.

United States Refurbished Laptop Market generated USD 2.1 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2034. This region benefits from robust e-commerce infrastructure and a growing emphasis on affordable and environmentally friendly technology solutions. The competitive market caters to students, freelancers, and small businesses all seeking dependable yet budget-conscious devices. The U.S. market's leadership stems from widespread internet accessibility, digitally savvy consumers, and a strong network of IT asset disposition (ITAD) companies that ensure reliable sources of refurbished laptops.

Leading companies shaping the Refurbished Laptop Market include: TechSoup, Walmart Renewed, Lenovo Outlet, Dell Refurbished, Amazon Renewed, HP Renew, Arrow Direct, Refurbees, Newegg Renewed, Refurb That, TigerDirect Refurbished, Apple Certified Refurbished, Refurb.io, Laptop Outlet, and Back Market. To solidify their market presence, key players in the refurbished laptop industry focus on enhancing product quality through rigorous testing and certification, offering extended warranty packages that build consumer trust. They emphasize creating diverse product portfolios that cater to varying customer budgets and preferences while strengthening partnerships with corporate clients to secure off-lease devices. Companies are also leveraging advanced refurbishing technologies to improve performance and extend product lifecycles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Grade

- 2.2.3 Operating System

- 2.2.4 Screen Size

- 2.2.5 End use

- 2.2.6 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand in SMB and education sectors

- 3.2.1.2 Corporate IT asset disposal programs

- 3.2.1.3 E-commerce growth

- 3.2.1.4 OEM and certified Refurbisher involvement

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Consumer perception and trust issues

- 3.2.2.2 Rapid tech obsolescence

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By grade

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Grade, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Grade A

- 5.3 Grade B

- 5.4 Grade C

- 5.5 Grade D

Chapter 6 Market Estimates & Forecast, By Operating System, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Windows refurbished laptops

- 6.3 Mac refurbished laptops

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Screen Size, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 11-13 inches

- 7.3 14-16 inches

- 7.4 17 inches and above

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Individual consumers

- 8.3 Businesses

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Amazon Renewed

- 11.2 Apple Certified Refurbished

- 11.3 Arrow Direct

- 11.4 Back Market

- 11.5 Dell Refurbished

- 11.6 HP Renew

- 11.7 Laptop Outlet

- 11.8 Lenovo Outlet

- 11.9 Newegg Renewed

- 11.10 Refurb That

- 11.11 Refurb.io

- 11.12 Refurbees

- 11.13 TechSoup

- 11.14 TigerDirect Refurbished

- 11.15 Walmart Renewed