|

市场调查报告书

商品编码

1773271

住宅微型逆变器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Residential Micro Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

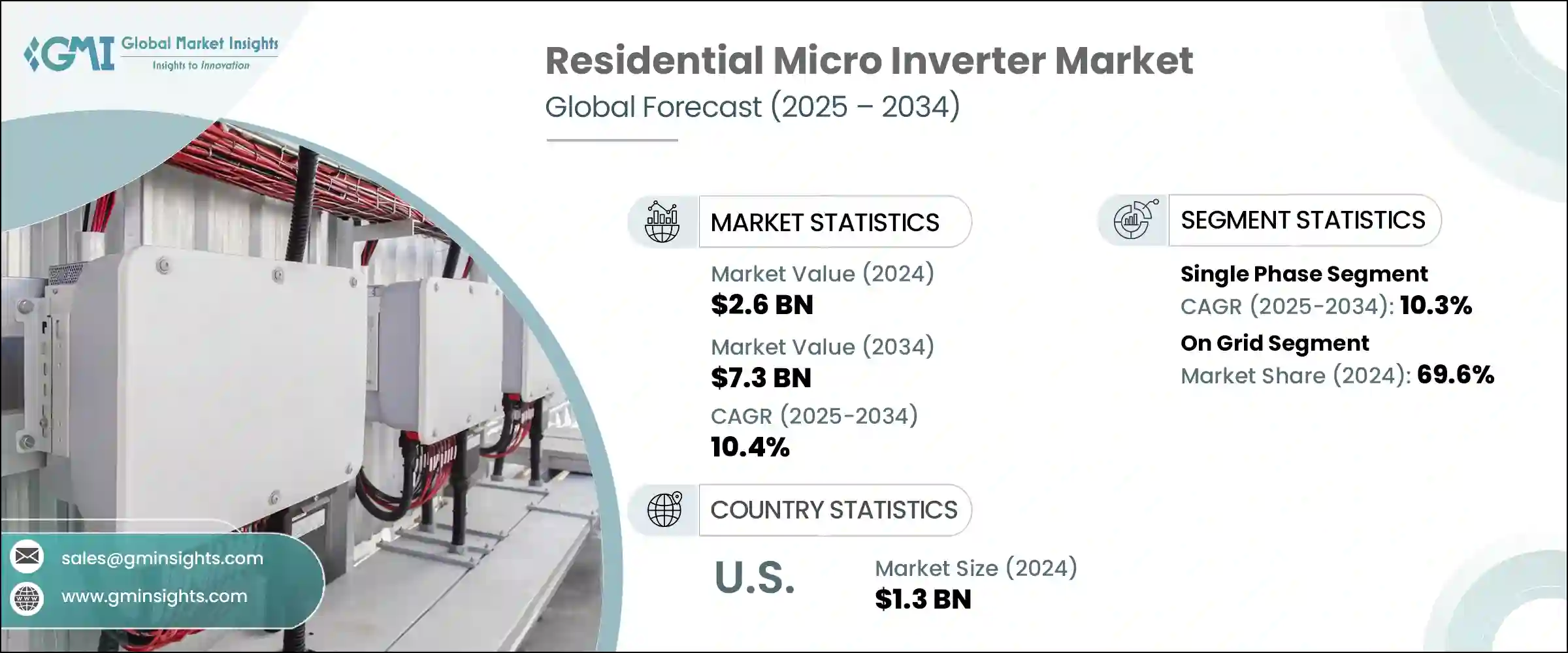

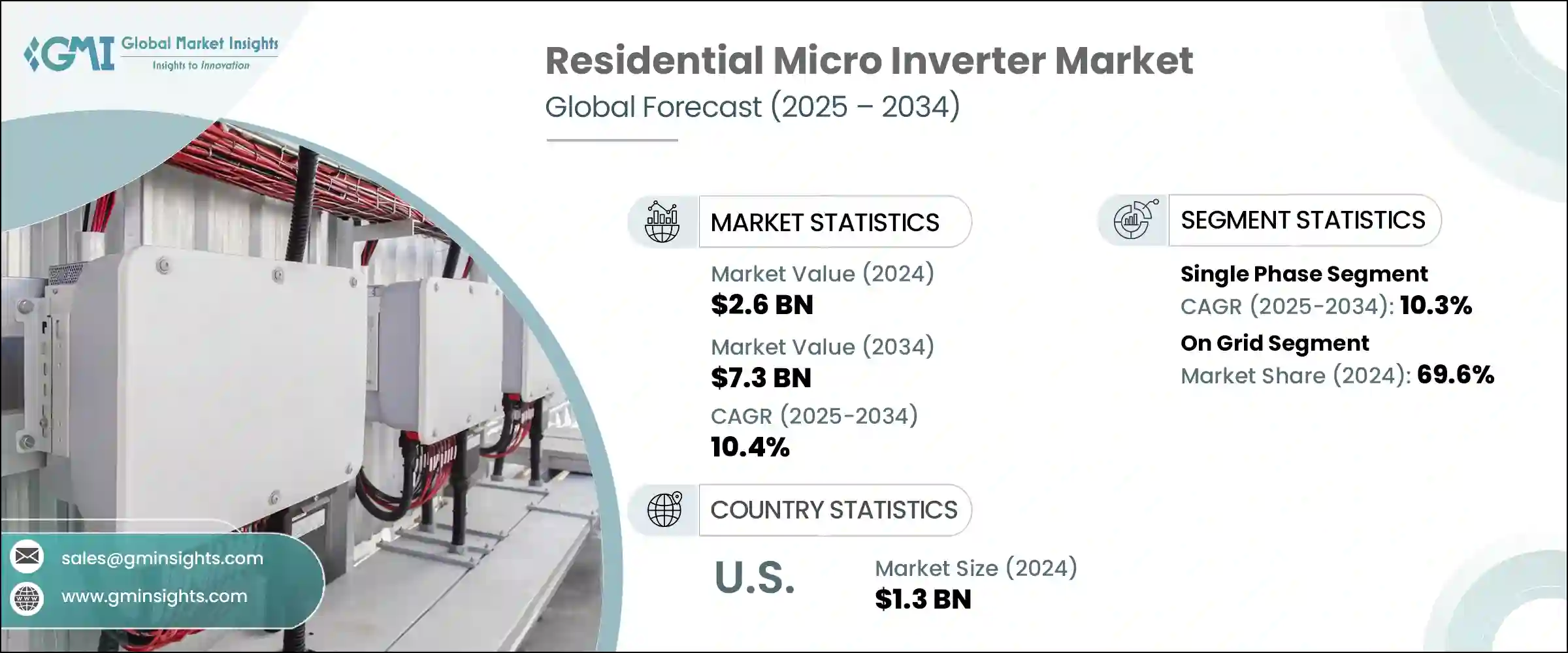

2024年,全球住宅微型逆变器市场规模达26亿美元,预计2034年将以10.4%的复合年增长率成长,达到73亿美元。人们对能源自给自足的兴趣日益浓厚,以及对家庭用电控制的加强,推动了住宅微型逆变器解决方案的普及。随着电费持续上涨,以及电网日益不稳定,越来越多的房主开始投资可靠的太阳能屋顶系统。微型逆变器因其能够提供稳定的性能,并在波动期间保持系统完整性而备受青睐。政府支持的奖励计画和家庭太阳能装置融资管道的改善也促进了微型逆变器的普及,尤其是在政策支持推动光伏组件和微型逆变器等分散式能源发展的市场。

紧凑型模组化太阳能装置日益增长的需求,推动了微型逆变器系统在住宅领域的部署。这些设备使房主能够追踪每块太阳能板的输出,同时消除了集中式系统的脆弱性。对能源自主性和安全监管协调的日益重视,正在推动市场扩张。在新兴经济体中,随着国家太阳能目标的实施,住宅屋顶安装量不断增加,微型逆变器的应用也正在加速。随着这些趋势的持续,微型逆变器正成为确保长期性能、灵活性和系统弹性的关键技术。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 26亿美元 |

| 预测值 | 73亿美元 |

| 复合年增长率 | 10.4% |

预计到2034年,单相微型逆变器系统市场将以10.3%的复合年增长率成长。这些解决方案可在单一电池板层面提供效能最佳化,并透过持续创新和成本效益提升而不断增强。消费者对将这些系统与家用电池储能和智慧能源解决方案相结合的兴趣,正推动其在住宅应用领域的扩张。智慧能源管理功能和远端监控能力的进步预计将进一步推动成长。

独立式住宅系统市场预计将在2025年至2034年间以14.1%的复合年增长率成长,这得益于偏远地区对离网能源解决方案日益增长的偏好。寻求能源独立的房主,尤其是在电网不稳定的地区,正在选择整合电池储能的微型逆变器。这些系统使住宅能够自主运行,并在电网中断时提供备用电源,从而提高能源安全性和吸引力。

到2034年,亚太地区户用微型逆变器市场规模将达到9亿美元,这得益于户用光电系统对智慧模组级能源管理的需求不断增长。智慧电网系统的持续发展和服务欠缺地区的电气化也推动了其部署。大众对自给自足能源使用益处的认识不断提高,以及优化整体系统输出的能力不断增强,正在增强整个地区的市场机会。

该行业的主要参与者包括森萨塔科技、禾迈、恩沃(浙江恩沃)、SMA Solar Technology、中智杰、Sparq Systems、Fimer Group、Yotta Energy、昱能电力系统、领能太阳能、宁波德业逆变科技、TSUNESS、Enphase Energy、古瑞瓦特新能源、奇力康电源和达方电子。为了巩固市场地位,领先的家用微型逆变器公司正优先考虑技术差异化,透过持续研发智慧电网相容性、组件级性能优化和整合储能解决方案。各公司正在扩展产品线,以满足更广泛的屋顶配置和能源需求。与太阳能板製造商、分销商和公用事业提供者建立策略联盟,可以提升市场准入和品牌定位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 策略倡议

- 公司市占率

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依阶段,2021 - 2034

- 主要趋势

- 单相

- 三相

第六章:市场规模及预测:依连结性,2021 - 2034

- 主要趋势

- 独立

- 在电网上

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 义大利

- 波兰

- 荷兰

- 奥地利

- 英国

- 法国

- 西班牙

- 比利时

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 以色列

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 埃及

- 奈及利亚

- 拉丁美洲

- 巴西

- 智利

- 墨西哥

第八章:公司简介

- Altenergy Power Systems

- Chilicon Power

- Chisageess

- Darfon Electronics

- Enphase Energy

- Envertech (Zhejiang Envertech)

- Fimer Group

- Growatt New Energy

- Hoymiles

- Lead Solar Energy

- NingBo Deye Inverter Technology

- Sensata Technologies

- SMA Solar Technology

- Sparq Systems

- TSUNESS

- Yotta Energy

The Global Residential Micro Inverter Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 7.3 billion by 2034. Rising interest in energy self-reliance and greater control over household electricity consumption is driving the adoption of residential microinverter solutions. As electricity costs continue to rise and utility grids face growing instability, more homeowners are investing in reliable solar rooftop systems. Microinverters are favored for their ability to deliver consistent performance and maintain system integrity during fluctuations. Government-backed incentive programs and improved access to financing for home solar installations are also encouraging adoption, especially in markets where policy support boosts distributed energy resources like PV modules and microinverters.

Growing demand for compact, modular solar installations is supporting the residential deployment of microinverter systems. These devices allow homeowners to track each panel's output while eliminating the vulnerability of a centralized system. Increasing emphasis on energy autonomy and regulatory alignment around safety is reinforcing market expansion. Adoption is accelerating in emerging economies where residential rooftop installations are rising in response to national solar targets. As these trends persist, microinverters are emerging as a critical technology to ensure long-term performance, flexibility, and system resilience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 10.4% |

Single phase microinverter systems segment is predicted to grow at a CAGR of 10.3% through 2034. These solutions offer performance optimization at the individual panel level and are being enhanced through continuous innovation and cost-efficiency improvements. Consumer interest in pairing these systems with home battery storage and smart energy solutions is fueling their expansion in residential applications. Advancements in intelligent energy management features and remote monitoring capabilities are expected to push growth further.

The standalone residential systems segment is poised to grow at a 14.1% CAGR between 2025 and 2034, supported by the growing preference for off-grid energy solutions in remote regions. Homeowners looking for energy independence, especially in areas with unreliable grid access, are opting for microinverters integrated with battery storage. These systems enable homes to operate autonomously and provide backup during grid outages, improving energy security and appeal.

Asia Pacific Residential Micro Inverter Market will reach USD 900 million by 2034, driven by greater demand for smart, module-level energy management in residential PV setups. Continued development of smart grid systems and electrification of underserved regions is also propelling deployment. Greater public awareness about the benefits of self-sufficient energy use and the ability to optimize overall system output are enhancing market opportunities across the region.

Key players operating across this industry landscape include Sensata Technologies, Hoymiles, Envertech (Zhejiang Envertech), SMA Solar Technology, Chisageess, Sparq Systems, Fimer Group, Yotta Energy, Altenergy Power Systems, Lead Solar Energy, NingBo Deye Inverter Technology, TSUNESS, Enphase Energy, Growatt New Energy, Chilicon Power, and Darfon Electronics. To solidify their market presence, leading residential micro inverter companies are prioritizing technology differentiation through continuous R&D in smart grid compatibility, panel-level performance optimization, and integrated storage solutions. Firms are expanding their product lines to cater to a wider range of rooftop configurations and energy demands. Strategic alliances with solar panel manufacturers, distributors, and utility providers improve market access and brand positioning.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiative

- 4.4 Company market share

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Single phase

- 5.3 Triple phase

Chapter 6 Market Size and Forecast, By Connectivity, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Standalone

- 6.3 On grid

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 Poland

- 7.3.4 Netherlands

- 7.3.5 Austria

- 7.3.6 UK

- 7.3.7 France

- 7.3.8 Spain

- 7.3.9 Belgium

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Israel

- 7.5.2 Saudi Arabia

- 7.5.3 UAE

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.5.6 Nigeria

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Chile

- 7.6.3 Mexico

Chapter 8 Company Profiles

- 8.1 Altenergy Power Systems

- 8.2 Chilicon Power

- 8.3 Chisageess

- 8.4 Darfon Electronics

- 8.5 Enphase Energy

- 8.6 Envertech (Zhejiang Envertech)

- 8.7 Fimer Group

- 8.8 Growatt New Energy

- 8.9 Hoymiles

- 8.10 Lead Solar Energy

- 8.11 NingBo Deye Inverter Technology

- 8.12 Sensata Technologies

- 8.13 SMA Solar Technology

- 8.14 Sparq Systems

- 8.15 TSUNESS

- 8.16 Yotta Energy