|

市场调查报告书

商品编码

1773319

军用非可控天线市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Military Non-steerable Antenna Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

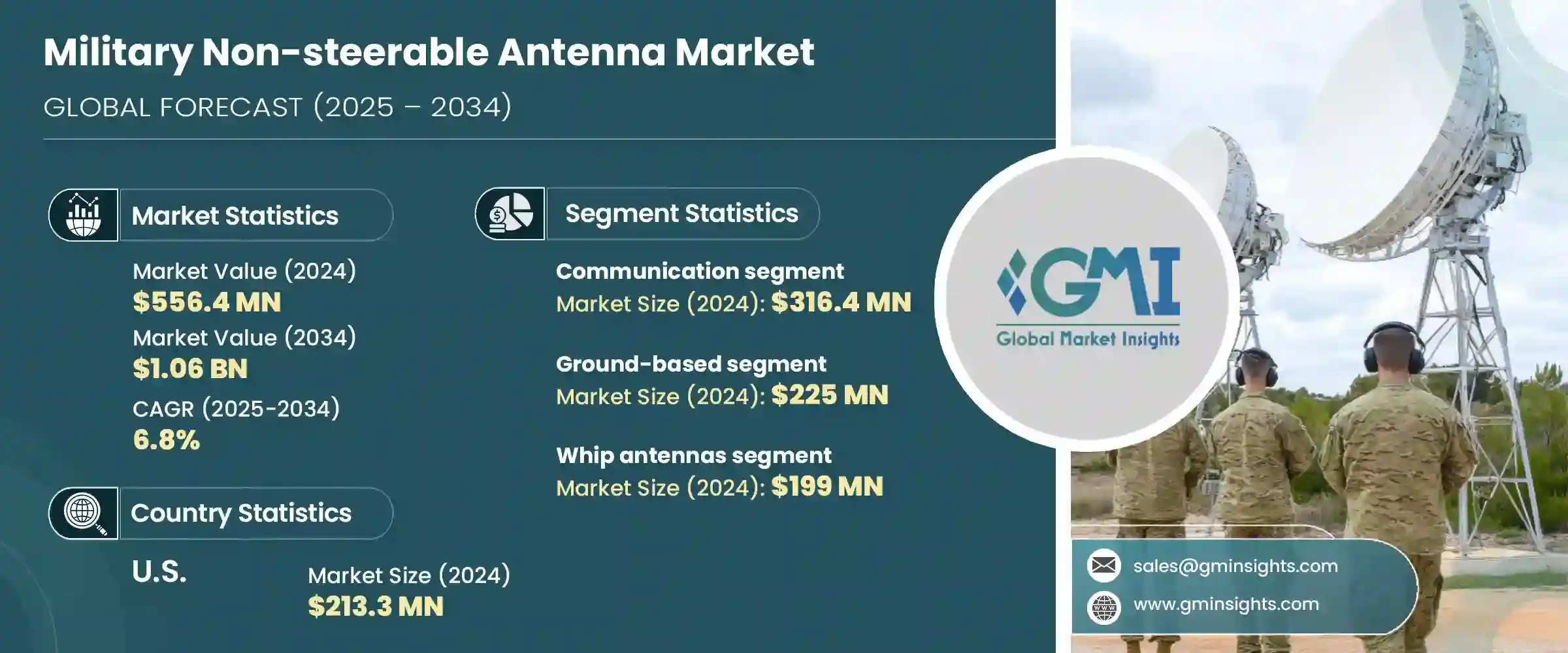

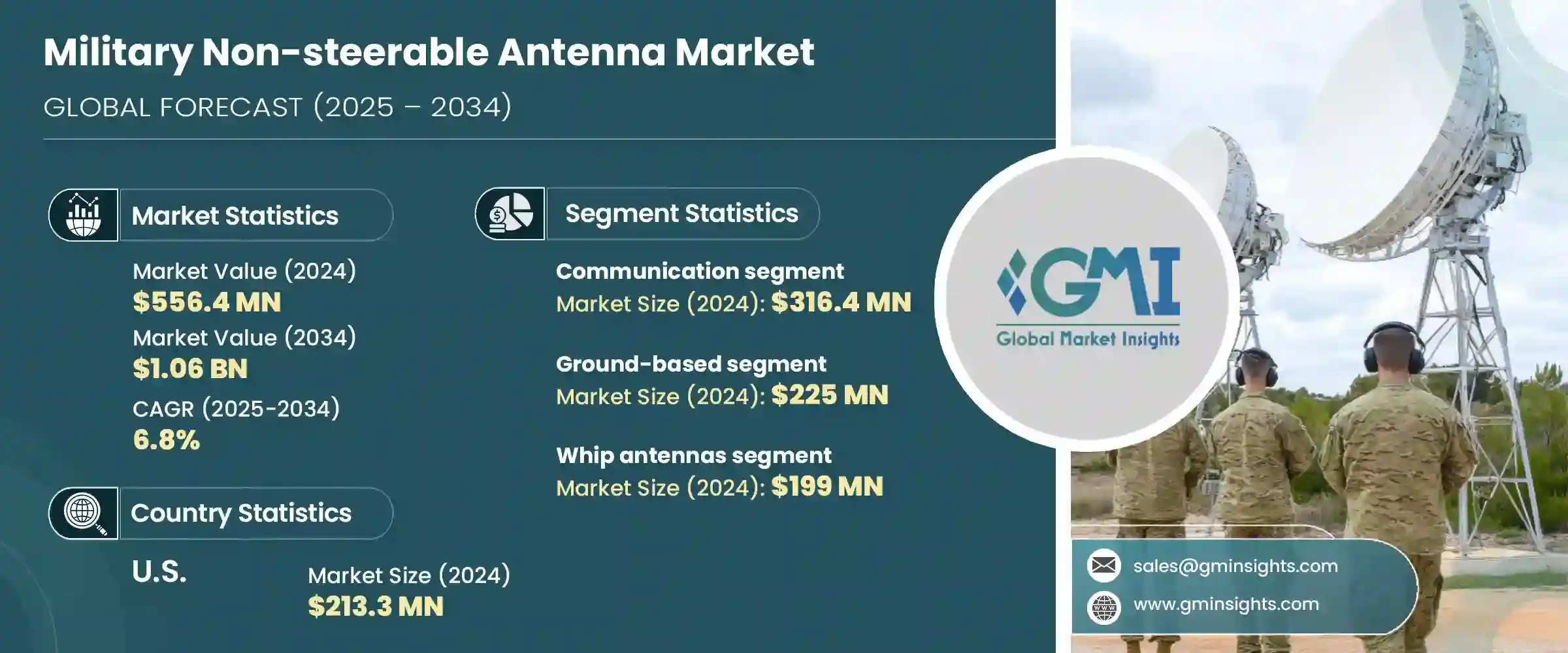

2024 年全球军用非定向天线市场价值为 5.564 亿美元,预计到 2034 年将以 6.8% 的复合年增长率增长,达到 10.6 亿美元。无人系统的兴起和对远端监视行动的日益关注推动了市场扩张。随着各国国防预算的增加和战术行动变得更加复杂,对坚固耐用和免维护通讯系统的需求也随之增加。军用非定向天线以其全方位覆盖、快速部署和高耐用性而闻名,已成为国防通讯领域的重要资产。这些系统对于在动态和电子对抗环境中传输语音、资料和命令讯号至关重要,即使在存在主动干扰或讯号干扰的情况下也是如此。

由于现代战争强调联合部队协同和即时跨域通信,这些天线正安装在作战车辆、海军舰队、前线作战基地和监视基础设施上。印度、美国、中国和北约成员国等全球大国正优先考虑安装坚固耐用、轻基础设施的系统。随着对强化战场通讯的需求日益增长,各国正积极投资于高可用性且降低后勤复杂性的系统,这使得非定向天线成为当今数位防御架构的首选解决方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.564亿美元 |

| 预测值 | 10.6亿美元 |

| 复合年增长率 | 6.8% |

预计到2034年,电子战领域将以8.6%的复合年增长率成长,这得益于非定向天线在干扰、讯号拦截和被动监视等支援行动中发挥的作用。轻型固定天线正越来越多地整合到电子战系统中,以提供态势感知并增强频谱控制。这些系统正在进一步小型化,并适用于无人机平台,从而实现灵活的战术部署,缩短设定时间并提高生存能力。

预计2025年至2034年间,机载平台市场将以8.2%的复合年增长率成长。这一增长主要源于对ISR(情报、监视和侦察)任务日益增长的需求,以及对有人驾驶和无人机日益增长的依赖。为了满足这些新的需求,人们正在部署支援高频通讯和电子战能力的抗振、紧凑型非可控天线。现代国防计画正在将这些天线嵌入机载通讯套件中,以确保跨战区和战略作战区域的安全连接。

2024年,德国军用非定向天线市场规模达2,000万美元。德国致力于透过与北约的合作和内部现代化项目来加强其通讯基础设施,这推动了市场需求的成长。德国正在投资安全的多频系统,以实现任务弹性和战略自主性。亨索尔特(HENSOLDT)和罗德与施瓦茨(Rohde & Schwarz)等知名国防企业在生产和系统开发中发挥着重要作用。旨在在军事环境中采用5G技术并增强网路安全通讯的全国性计画是推动该市场成长的主要因素。

引领军用非定向天线市场的关键公司包括 MTI Wireless Edge、Abracon、HR Smith Group of Companies、L3Harris Technologies, Inc.、Hascall-Denke 和 Rohde & Schwarz。军用非定向天线领域的领先公司正专注于策略创新、全球合作伙伴关係和材料改进,以增强其市场地位。许多公司正在开发紧凑、轻巧且坚固耐用的天线设计,并针对跨海陆空系统的多平台整合进行了最佳化。这些公司投资研发,以满足不断变化的频率需求、电磁弹性和互通性标准。与国防部门和原始设备製造商 (OEM) 的合作,使得在关键任务项目中部署客製化系统成为可能。企业也在进行在地化生产,以遵守国防采购政策并缩短交货时间。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 全球国防预算不断增加

- 对强大的战场通讯的需求不断增加

- 扩大战术和机动军事单位

- 无人系统和远端监控的成长

- 需要低维护且经济高效的天线解决方案

- 产业陷阱与挑战

- 方向控制有限,影响讯号精度

- 易受电子战和讯号干扰

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按天线类型,2021 年至 2034 年

- 主要趋势

- 刀片天线

- 鞭状天线

- 贴片天线

- 共形天线

- 橡胶鸭天线

- 环形天线

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 沟通

- 导航

- 电子战

第七章:市场估计与预测:按平台,2021 年至 2034 年

- 主要趋势

- 地面

- 海军

- 空降

- 便携式

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Abeillon

- Abracon

- Antcom

- CBG Systems

- Chelton Limited

- Comrod Communication AS

- Fei Teng Wireless Technology

- Hascall-Denke

- HR Smith Group of Companies

- KNL

- L3Harris Technologies, Inc.

- MTI Wireless Edge

- RAMI

- Rohde & Schwarz

- Rojone Pty Ltd

- Thales

The Global Military Non-steerable Antenna Market was valued at USD 556.4 million in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 1.06 billion by 2034. The market expansion is being propelled by the rise of unmanned systems and increased focus on remote surveillance operations. With countries expanding their defense budgets and tactical operations becoming more intricate, the demand for rugged and maintenance-free communication systems has intensified. Military non-steerable antennas, known for their all-directional reach, rapid deployment, and high durability, have become essential assets in the defense communication landscape. These systems are vital for transmitting voice, data, and command signals across dynamic and electronically contested environments, even where active jamming or signal interference exists.

As modern warfare emphasizes joint-force coordination and real-time cross-domain communication, these antennas are being mounted on combat vehicles, naval fleets, forward operating bases, and surveillance infrastructure. Global powers such as India, the United States, China, and members of NATO are prioritizing the installation of robust, infrastructure-light systems. With a growing push for hardened battlefield communications, countries are actively investing in systems that provide high availability with reduced logistical complexity, positioning non-steerable antennas as a preferred solution in today's digital defense architecture.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $556.4 Million |

| Forecast Value | $1.06 Billion |

| CAGR | 6.8% |

The electronic warfare segment is expected to grow at a CAGR of 8.6% through 2034, driven by the role non-steerable antennas play in supporting operations such as jamming, signal interception, and passive surveillance. Lightweight fixed antennas are being increasingly integrated into electronic warfare systems to provide situational awareness and enhance spectrum control. These systems are being further miniaturized and adapted for unmanned aerial platforms, enabling flexible tactical deployments with reduced setup time and improved survivability.

The airborne platforms segment is expected to grow at a CAGR of 8.2% between 2025 and 2034. This surge is largely due to the intensifying need for ISR (intelligence, surveillance, and reconnaissance) missions and growing reliance on both manned and unmanned aircraft. Vibration-resistant, compact non-steerable antennas that support high-frequency communication and electronic warfare capabilities are being deployed to meet these new demands. Modern defense initiatives are embedding these antennas in airborne communication suites to ensure secure links across combat zones and strategic areas of operation.

Germany Military Non-steerable Antenna Market accounted for USD 20 million in 2024. The country's focus on strengthening its communication infrastructure through NATO collaboration and internal modernization programs is boosting demand. Germany is investing in secure, multi-frequency systems for mission resilience and strategic autonomy. Prominent defense companies such as HENSOLDT and Rohde & Schwarz are playing a major role in production and system development. Nationwide programs geared toward adopting 5G in military environments and enhancing cyber secure communications are major factors driving this market upward.

Key companies leading the Military Non-steerable Antenna Market include MTI Wireless Edge, Abracon, HR Smith Group of Companies, L3Harris Technologies, Inc., Hascall-Denke, and Rohde & Schwarz. Leading firms in the military non-steerable antenna space are focusing on strategic innovation, global partnerships, and material advancements to strengthen their presence. Many are developing compact, lightweight, and ruggedized antenna designs optimized for multi-platform integration across air, land, and sea systems. These companies invest in R&D to meet evolving frequency demands, electromagnetic resilience, and interoperability standards. Collaborations with defense ministries and OEMs allow tailored system deployment in mission-critical programs. Businesses are also localizing production to comply with defense procurement policies and enhance delivery timelines.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising defense budgets globally

- 3.3.1.2 Increased demand for robust battlefield communication

- 3.3.1.3 Expansion of tactical and mobile military units

- 3.3.1.4 Growth in unmanned systems and remote surveillance

- 3.3.1.5 Need for low-maintenance and cost-effective antenna solutions

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Limited directional control affecting signal precision

- 3.3.2.2 Vulnerability to electronic warfare and signal interference

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Antenna Type, 2021 – 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Blade antennas

- 5.3 Whip antennas

- 5.4 Patch antennas

- 5.5 Conformal antennas

- 5.6 Rubbery ducky antennas

- 5.7 Loop antennas

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Communication

- 6.3 Navigation

- 6.4 Electronic warfare

Chapter 7 Market Estimates and Forecast, By Platform, 2021 – 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Ground-based

- 7.3 Naval

- 7.4 Airborne

- 7.5 Man-portable

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abeillon

- 9.2 Abracon

- 9.3 Antcom

- 9.4 CBG Systems

- 9.5 Chelton Limited

- 9.6 Comrod Communication AS

- 9.7 Fei Teng Wireless Technology

- 9.8 Hascall-Denke

- 9.9 HR Smith Group of Companies

- 9.10 KNL

- 9.11 L3Harris Technologies, Inc.

- 9.12 MTI Wireless Edge

- 9.13 RAMI

- 9.14 Rohde & Schwarz

- 9.15 Rojone Pty Ltd

- 9.16 Thales