|

市场调查报告书

商品编码

1750448

卫星相控阵天线市场机会、成长动力、产业趋势分析及2025-2034年预测Satellite Phased Array Antenna Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

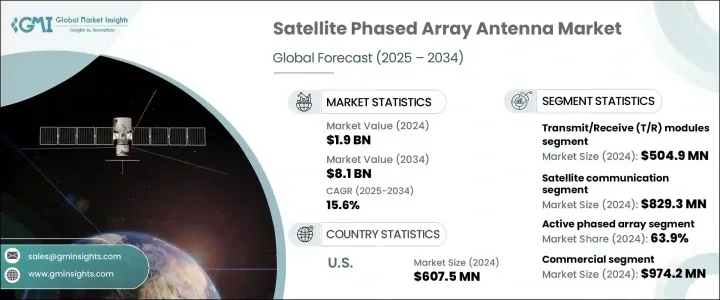

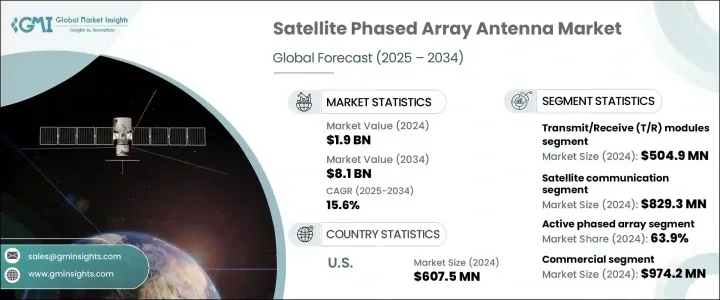

2024年,全球卫星相控阵天线市场规模达19亿美元,预计2034年将以15.6%的复合年增长率成长,达到81亿美元。这主要得益于政府和私营部门投资的增加、5G技术的推广、物联网(IoT)设备的兴起以及低地球轨道(LEO)卫星应用的不断扩展。随着越来越多的组织和政府致力于改善通讯基础设施和太空探索,高性能波束控制天线对于可靠的连接和监控至关重要。

然而,尤其是川普政府对中国进口产品征收关税等挑战,对市场产生了显着影响。这些关税提高了半导体和射频模组等组装零件的价格,从而提高了美国製造商的生产成本,而这些零件通常来自中国。全球供应链的中断促使企业探索新的贸易来源并调整生产策略,增加了市场的复杂性。此外,正在进行的国防现代化计画以及政府在太空探索和卫星基础设施方面增加的投资,极大地促进了对先进卫星通讯系统的需求。随着各国优先增强军事能力,对可靠、高性能卫星通讯技术的需求已成为国家安全、情报收集和监视的关键。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 19亿美元 |

| 预测值 | 81亿美元 |

| 复合年增长率 | 15.6% |

2024年,发射/接收(T/R)模组贡献了5.049亿美元的市场规模。这些模组在确保卫星通讯系统所需的高速、低延迟功能方面发挥着至关重要的作用。军用和商用领域对整合微型T/R模组的小型化、节能天线的需求日益增长。这些天线具有卓越的讯号完整性和热管理性能,为高性能、电子可控卫星通讯系统提供了增强的多功能性。

市场也按阵列类型细分,预计有源相控阵将在2024年占据主导地位,市占率达63.9%。主动阵列在波束灵活性、讯号增益和精度方面具有显着优势。这些天线的每个单元都有独立的发射/接收模组,可实现动态波束成形、冗余和更高的讯号强度。这些特性使主动相控阵成为低地球轨道卫星星座、国防系统和行动通讯平台等应用的理想选择,因为快速追踪和稳健的连接至关重要。

受卫星通讯、国防和太空探索领域投资增加的推动,美国卫星相控阵天线市场在2024年实现了6.075亿美元的产值。在美国国家航空暨太空总署(NASA)和国防部等机构的大力支持下,对低地球轨道卫星星座和先进军事通讯系统的需求持续推动市场的发展。

全球卫星相控阵天线市场中的公司,包括ViaSat、波音、霍尼韦尔国际和ALCAN系统,正在采取关键策略来巩固其地位。这些公司专注于扩展其产品供应,尤其是在波束控制技术领域,以满足对高性能卫星系统日益增长的需求。与政府机构和私人航太公司的合作也是一项关键策略,使他们能够利用资金用于太空探索和国防计画。此外,市场领导者正在大力投资研发,以提高天线效率和小型化,确保在对更灵活、可扩展解决方案的需求不断增长的情况下保持竞争力。这些策略确保了他们在全球市场的持续主导地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 全球连结需求激增

- 政府和私部门投资成长

- 5G技术的推出与物联网(IoT)设备的普及

- 卫星相控阵天线在军事和国防领域的应用日益增多

- 天线技术的不断进步

- 产业陷阱与挑战

- 卫星相控阵天线製造成本高

- 光束控制的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依组件,2021-2034

- 主要趋势

- 微控制器/微处理器

- 现场可程式闸阵列(FPGA)

- 功率放大器 (PA)

- 低杂讯放大器(LNA)

- 移相器

- 发射/接收 (T/R) 模组

- 其他的

第六章:市场估计与预测:按阵列类型,2021-2034

- 主要趋势

- 主动相控阵

- 被动相控阵

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 卫星通讯

- 雷达与感测

- 导航和追踪

- 行动连接

- 地球观测

- 电子战

- 其他的

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 商业的

- 国防和安全

- 研究与学术机构

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Airbus

- Av-Comm Space & Defence

- ALCAN Systems

- Anokiwave

- AST & Science

- Boeing

- C-COM Satellite Systems

- Chengdu Ruidiwei

- Get SAT Ltd

- Honeywell International Inc.

- Iridium Communications Inc

- KEYCOM Corporation

- Requtech

- ThinKom Solutions, Inc.

- ViaSat

The Global Satellite Phased Array Antenna Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 15.6% to reach USD 8.1 billion by 2034, driven by increasing investments from both government and private sectors, the roll-out of 5G technology, the rise of Internet of Things (IoT) devices, and the expanding use of Low Earth Orbit (LEO) satellites. As more organizations and governments focus on improving communications infrastructure and space exploration, the need for high-performance, beam-steering antennas becomes critical for reliable connectivity and surveillance.

However, challenges such as tariffs imposed on Chinese imports, particularly by the Trump administration, had a notable impact on the market. These tariffs raised the production costs for U.S.-based manufacturers by increasing the price of assembly components such as semiconductors and RF modules, which are often sourced from China. This disruption in the global supply chain led companies to explore new trade sources and adjust production strategies, adding complexity to the market. Additionally, the ongoing defense modernization initiatives and increased government investments in space exploration and satellite-based infrastructure are significantly contributing to the demand for advanced satellite communication systems. As countries prioritize enhancing their military capabilities, the need for reliable, high-performance satellite communication technologies has become essential for national security, intelligence gathering, and surveillance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $8.1 Billion |

| CAGR | 15.6% |

In 2024, Transmit/Receive (T/R) modules contributed USD 504.9 million. These modules play a vital role in ensuring the high-speed, low-latency functionality required for satellite communication systems. The increasing demand for smaller, energy-efficient antennas that incorporate miniaturized T/R modules is expanding across both military and commercial sectors. These antennas, with superior signal integrity and thermal management, provide enhanced versatility for high-performance, electronically steerable satellite communication systems.

The market is also segmented by array type, with active phased arrays expected to dominate with a market share of 63.9% in 2024. Active arrays offer significant advantages in beam agility, signal gain, and precision. These antennas have individual transmit/receive modules for each element, enabling dynamic beamforming, redundancy, and improved signal strength. These features make active phased arrays ideal for applications in LEO satellite constellations, defense systems, and mobile communication platforms, where rapid tracking and robust connectivity are essential.

United States Satellite Phased Array Antenna Market generated USD 607.5 million in 2024, driven by increasing investments in satellite communication, defense, and space exploration. The demand for LEO satellite constellations and advanced military communication systems continues to drive the market forward, with strong support from agencies like NASA and the Department of Defense.

Companies in the Global Satellite Phased Array Antenna Market, including ViaSat, Boeing, Honeywell International, and ALCAN Systems, are adopting key strategies to solidify their positions. These companies are focusing on expanding their product offerings, particularly in beam-steering technology, to meet the growing demand for high-performance satellite systems. Collaboration with government organizations and private space companies has also been a critical strategy, enabling them to leverage funding for space exploration and defense projects. Additionally, market leaders are investing heavily in research and development to enhance antenna efficiency and miniaturization, ensuring that they remain competitive as the demand for more agile, scalable solutions rises. These strategies ensure their ongoing dominance in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.3.1.1 Price volatility in key materials

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact (selling price)

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.4 Key companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in demand for global connectivity

- 3.7.1.2 Growth in government and private sector investments

- 3.7.1.3 Rollout of 5G technology and the proliferation of Internet of Things (IoT) devices

- 3.7.1.4 Increasing applications of satellite phased array antenna in military and defense

- 3.7.1.5 Rising advancements in antenna technology

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High manufacturing cost associated with the satellite phased array antenna

- 3.7.2.2 Complexity in beam steering and control

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Microcontrollers / microprocessors

- 5.3 Field programmable gate arrays (FPGAs)

- 5.4 Power amplifiers (PAs)

- 5.5 Low noise amplifiers (LNAs)

- 5.6 Phase shifters

- 5.7 Transmit/receive (T/R) modules

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Array Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Active phased array

- 6.3 Passive phased array

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Satellite communication

- 7.3 Radar & sensing

- 7.4 Navigation & tracking

- 7.5 Mobile connectivity

- 7.6 Earth observation

- 7.7 Electronic warfare

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Defense & security

- 8.4 Research & academic institutions

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Airbus

- 10.2 Av-Comm Space & Defence

- 10.3 ALCAN Systems

- 10.4 Anokiwave

- 10.5 AST & Science

- 10.6 Boeing

- 10.7 C-COM Satellite Systems

- 10.8 Chengdu Ruidiwei

- 10.9 Get SAT Ltd

- 10.10 Honeywell International Inc.

- 10.11 Iridium Communications Inc

- 10.12 KEYCOM Corporation

- 10.13 Requtech

- 10.14 ThinKom Solutions, Inc.

- 10.15 ViaSat