|

市场调查报告书

商品编码

1773330

眼镜包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Eyewear Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

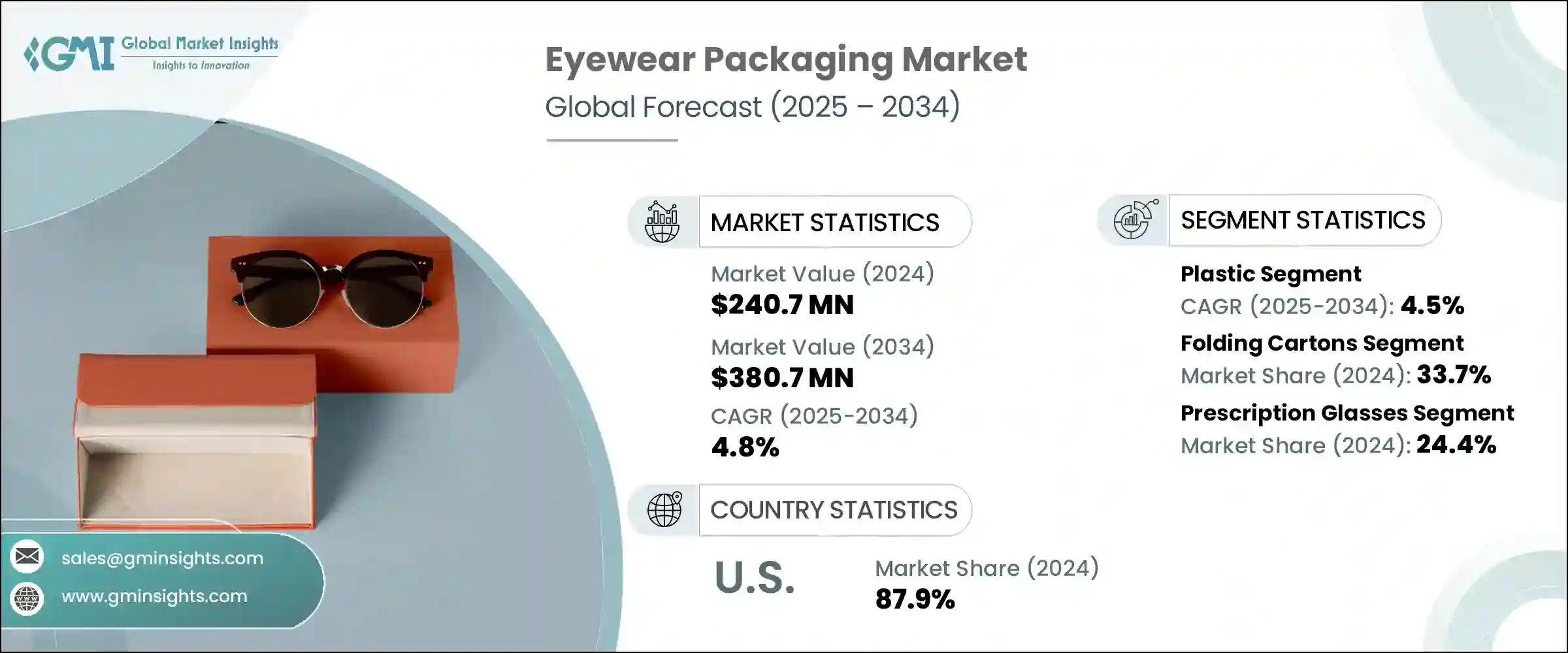

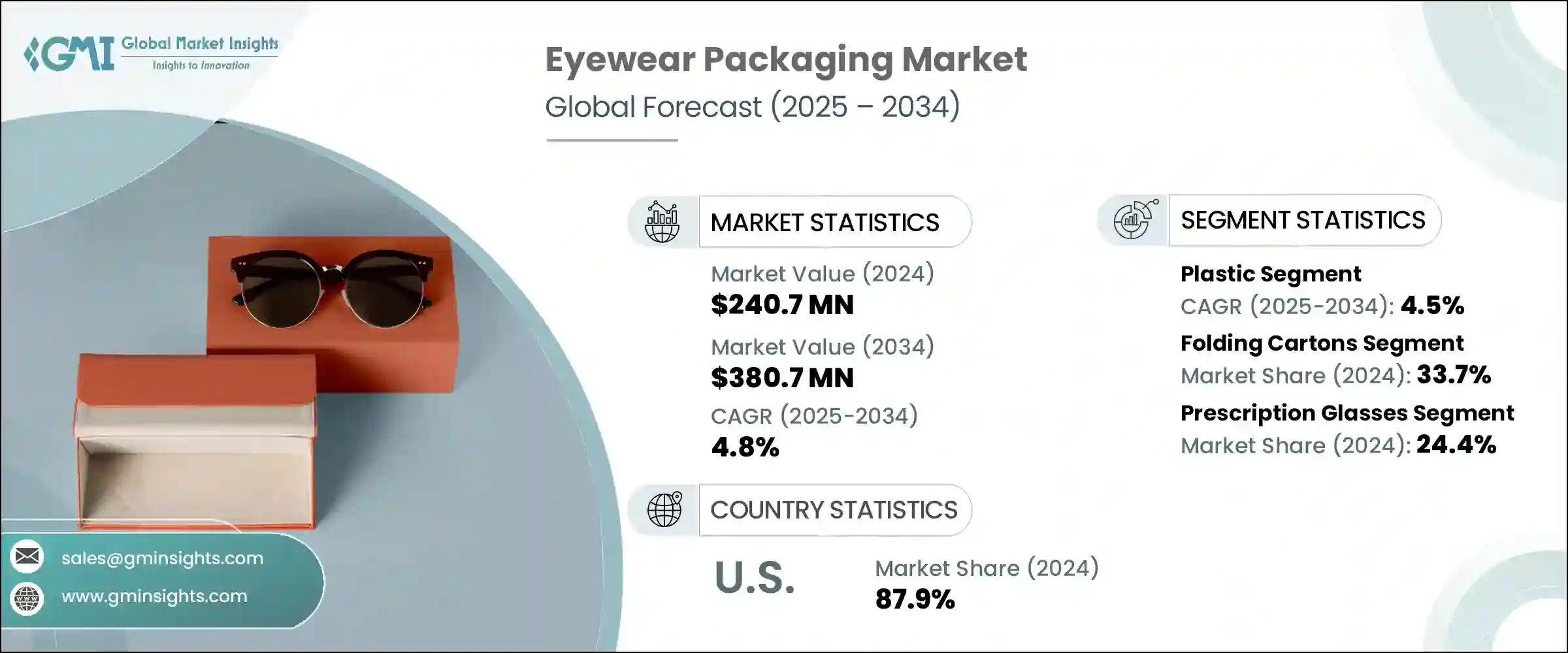

2024 年全球眼镜包装市场价值为 2.407 亿美元,预计到 2034 年将以 4.8% 的复合年增长率增长至 3.807 亿美元。这一增长主要得益于对时尚眼镜和处方眼镜需求的不断增长,以及电子商务作为主要销售管道的迅速崛起。由于萤幕使用率的提高、视力矫正需求以及眼镜逐渐成为时尚配件等因素,越来越多的人群依赖眼镜。因此,对能够体现品牌形象、提升产品外观并保护高端产品的高品质包装的需求显着增长。各品牌正专注于将视觉吸引力与结构完整性相结合的包装,以满足这些不断变化的期望,并在竞争激烈的市场环境中巩固客户忠诚度。

线上零售日益占据主导地位,重塑了眼镜产品的销售方式,对耐用且外观精美的包装的需求也随之增加。如今,在直销通路中,保护性、以品牌为中心的设计对于减少产品损坏和提升开箱体验至关重要。此外,消费者对环保解决方案的偏好也日益增长,这推动了包装向可回收和可持续材料的转变。极简主义美学与负责任采购材料的整合反映了全球消费者偏好和合规要求的变化。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.407亿美元 |

| 预测值 | 3.807亿美元 |

| 复合年增长率 | 4.8% |

预计到2034年,纸和纸板市场规模将达到1.043亿美元。随着可回收性、轻量化和永续采购成为人们优先考虑的因素,纸质包装正日益受到欢迎。这些材料广泛用于外包装和店内展示,帮助品牌迎合日益增长的环保意识消费者群体。越来越多的企业采用FSC认证的纸板和简洁的设计,在增强环保责任感的同时,保持产品的外观吸引力。

2024年,折迭纸盒在眼镜包装市场的占有率为33.7%。折迭纸盒以其经济高效和用途广泛而闻名,在零售和线上管道仍然是首选的二次包装。这些纸盒提供了充足的品牌展示空间,易于定制,并且由于其可折迭和轻质的特性,支持永续物流。由于其在运输和货架展示方面效率更高,折迭纸盒在大批量销售中的应用尤为突出。

2024年,美国眼镜包装市场占据了87.9%的市场。美国市场趋势正受到消费者对高端包装、永续性和增强型网购体验的偏好的影响。随着电子商务的持续蓬勃发展,对功能性、时尚性包装的需求日益增长,这些包装不仅能确保配送过程中的保护,还能提供引人入胜的客户互动体验。包装创新正成为成熟且要求严苛的市场中实现差异化的关键。

活跃于眼镜包装市场的关键公司包括 Giorgio Fedon and Figli、Kling、King Home Printing、Ibex Packaging、Box Muse、Gatto Astucci 和 Classic Packaging。为了确保在眼镜包装行业的竞争地位,领先的参与者正在投资永续性、客製化和先进的设计技术。许多公司正在转向可生物降解和可回收的包装材料,以满足环境法规和消费者期望。品牌差异化是透过反映产品身分的个人化和奢华风格的包装来实现的。公司正在增强结构设计能力,以确保运输过程中的耐用性,尤其是对于线上订单。与眼镜製造商和直接面向消费者的品牌的合作有助于加强他们的客户群。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 对永续和环保包装的需求不断增长

- 时尚和处方眼镜领域的眼镜销售成长

- 拓展电子商务分销管道

- 奢侈品和设计师眼镜包装的客製化趋势

- 更重视高端化与品牌差异化

- 产业陷阱与挑战

- 可持续和客製化包装解决方案成本高

- 跨多个市场的监管合规挑战

- 市场机会

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 历史价格分析(2021-2024)

- 价格趋势驱动因素

- 区域价格差异

- 价格预测(2025-2034年)

- 定价策略

- 新兴商业模式

- 合规性要求

- 永续性措施

- 永续材料评估

- 碳足迹分析

- 循环经济实施

- 永续性认证和标准

- 永续性投资报酬率分析

- 全球消费者情绪分析

- 专利分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 市场集中度分析

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各区域市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係和合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按材料,2021-2034

- 主要趋势

- 塑胶

- 纸和纸板

- 金属

- 皮革

- 其他的

第六章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 折迭纸盒

- 硬盒/箱

- 袋装

- 其他的

第七章:市场估计与预测:依眼镜分类,2021-2034

- 主要趋势

- 处方眼镜

- 太阳眼镜

- 运动眼镜

- 安全/工业眼镜

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Box Muse

- Classic Packaging

- Gatto Astucci

- Giorgio Fedon and Figli

- Ibex Packaging

- King Home Printing

- Kling

- Lsuny Company

- Marber

- Packman Packaging

- Packtek

- Processo Plast Enterprise

- Rongyu Packing

- Salazar Packaging

The Global Eyewear Packaging Market was valued at USD 240.7 million in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 380.7 million by 2034. This growth is being propelled by increasing demand for both fashion and prescription eyewear, alongside the rapid rise of e-commerce as a dominant sales channel. A wider demographic now relies on eyewear due to factors like increased screen usage, vision correction needs, and the evolution of eyewear into a fashion-forward accessory. As a result, the need for high-quality packaging that reflects brand identity, elevates presentation, and protects premium products has grown significantly. Brands are focusing on packaging that merges visual appeal with structural integrity to meet these shifting expectations and reinforce customer loyalty in a competitive market landscape.

The growing dominance of online retail has reshaped how eyewear products are sold, increasing the demand for durable and visually appealing packaging. Protective, brand-focused designs are now essential to reduce product damage and boost unboxing experiences in direct-to-consumer channels. There is also a rising preference for eco-conscious solutions, which is driving a shift toward recyclable and sustainable materials in packaging. The integration of minimalist aesthetics and responsibly sourced materials reflects changing global preferences and compliance requirements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $240.7 Million |

| Forecast Value | $380.7 Million |

| CAGR | 4.8% |

The paper and paperboard segment is expected to reach USD 104.3 million by 2034. With recyclability, lightweight, and sustainable sourcing becoming priorities, paper-based packaging is gaining popularity. These materials are used widely for exterior packaging and in-store displays, helping brands align with the growing eco-conscious consumer segment. Companies are increasingly incorporating FSC-certified boards and clean designs to enhance environmental responsibility while keeping their products visually appealing.

The folding cartons segment in the eyewear packaging market held a 33.7% share in 2024. Known for their cost-effectiveness and versatility, folding cartons remain a preferred secondary packaging choice in both retail and online settings. These cartons offer substantial space for branding, are easy to customize, and support sustainable logistics due to their collapsible and lightweight nature. Their use is particularly prominent in high-volume sales due to the efficiency they bring in shipping and shelf display.

United States Eyewear Packaging Market captured an 87.9% share in 2024. Market trends in the U.S. are being shaped by consumer preferences for premium packaging, sustainability, and enhanced online shopping experiences. As e-commerce continues to thrive, the need for functional and stylish packaging ensures protection during delivery, while offering an engaging customer interaction is growing steadily. Packaging innovation is becoming a tool for differentiation in a mature and demanding marketplace.

Key companies active in the Eyewear Packaging Market include Giorgio Fedon and Figli, Kling, King Home Printing, Ibex Packaging, Box Muse, Gatto Astucci, and Classic Packaging. To secure a competitive position in the eyewear packaging industry, leading players are investing in sustainability, customization, and advanced design technologies. Many companies are shifting toward biodegradable and recyclable packaging materials to meet environmental regulations and consumer expectations. Brand differentiation is achieved through personalized and luxury-inspired packaging that reflects the product's identity. Firms are enhancing structural design capabilities to ensure durability during shipping, especially for online orders. Partnerships with eyewear manufacturers and direct-to-consumer brands help strengthen their client base.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Material trends

- 2.2.2 Product Type trends

- 2.2.3 Eyewear trends

- 2.2.4 Regional trends

- 2.3 TAM analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable and eco-friendly packaging

- 3.2.1.2 Growth in eyewear sales across fashion and prescription segments

- 3.2.1.3 Expansion of e-commerce distribution channels

- 3.2.1.4 Customization trends in luxury and designer eyewear packaging

- 3.2.1.5 Increasing focus on premiumization and brand differentiation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of sustainable and custom packaging solutions

- 3.2.2.2 Regulatory compliance challenges across multiple markets

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2021-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2025-2034)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability roi analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia pacific

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&d

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Material,2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Plastic

- 5.3 Paper & paperboard

- 5.4 Metal

- 5.5 Leather

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Folding cartons

- 6.3 Rigid boxes/cases

- 6.4 Pouches

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Eyewear, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Prescription glasses

- 7.3 Sunglasses

- 7.4 Sports eyewear

- 7.5 Safety/industrial glasses

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Box Muse

- 9.2 Classic Packaging

- 9.3 Gatto Astucci

- 9.4 Giorgio Fedon and Figli

- 9.5 Ibex Packaging

- 9.6 King Home Printing

- 9.7 Kling

- 9.8 Lsuny Company

- 9.9 Marber

- 9.10 Packman Packaging

- 9.11 Packtek

- 9.12 Processo Plast Enterprise

- 9.13 Rongyu Packing

- 9.14 Salazar Packaging