|

市场调查报告书

商品编码

1773332

水性胶合剂涂抹器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Water-based Adhesive Applicators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

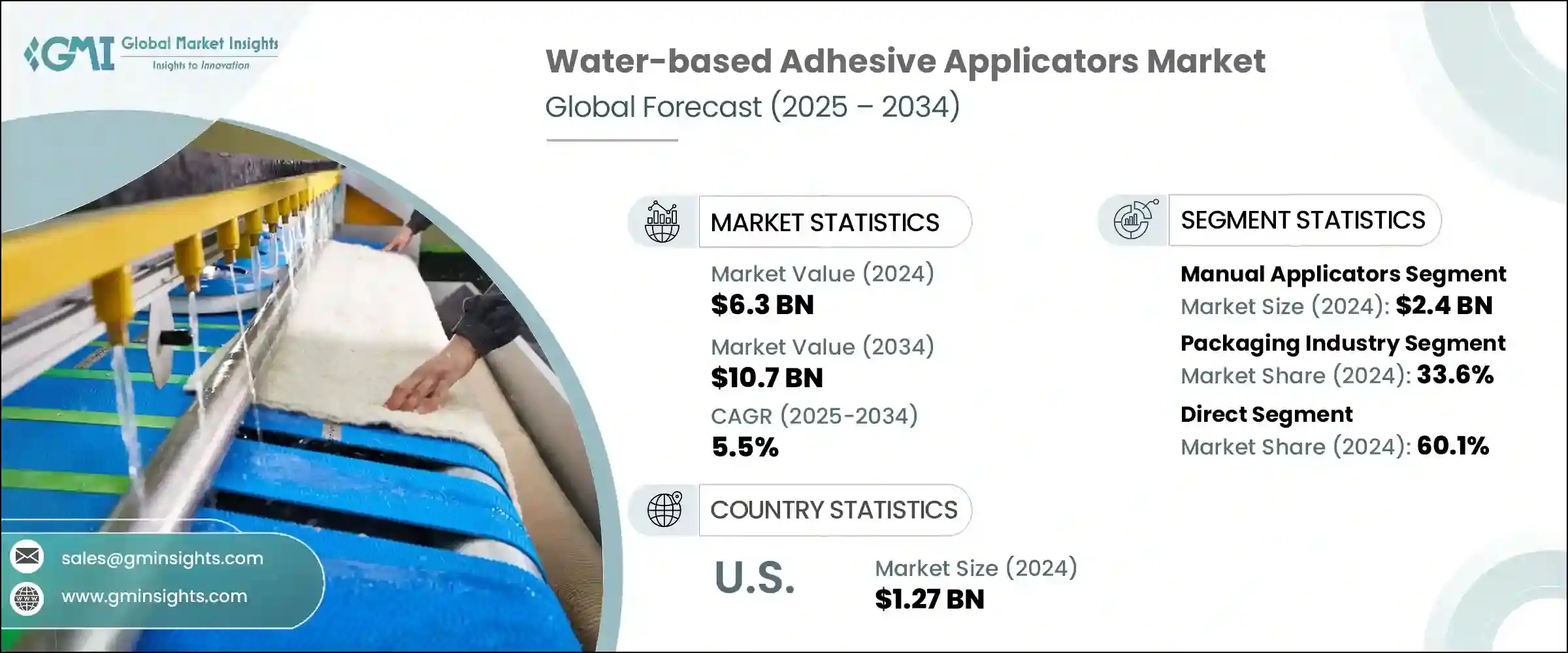

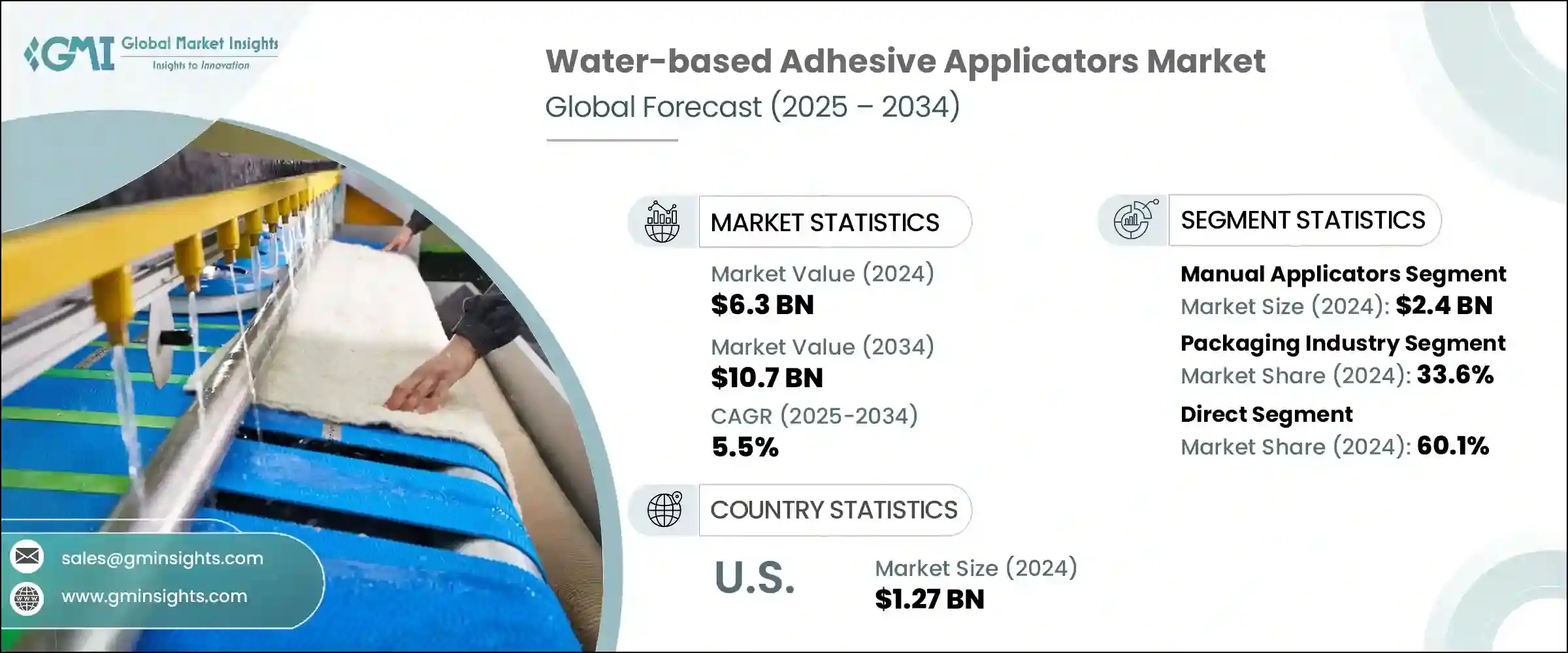

2024年,全球水性胶合剂涂抹器市场规模达63亿美元,预计到2034年将以5.5%的复合年增长率成长,达到107亿美元。受电子商务、快速消费品以及食品饮料行业蓬勃发展的推动,包装行业正稳步成长。随着人们对环保包装的日益青睐,这些涂抹器因其与可回收材料的兼容性,广泛用于贴标、密封和软包装。除了提供清洁高效的黏合效果外,它们还支援永续发展,并在高速生产中表现出色。

同时,家具和木工领域的需求也在不断增长,这些涂胶机在黏合木材、层压板和单板等多孔材料方面发挥着至关重要的作用。 DIY家装和模组化家具等趋势进一步推动了这项需求。半自动和全自动涂胶系统的日益普及也正在重塑市场格局,尤其是在建筑和消费品等领域。这些技术提高了营运效率,减少了材料浪费,并提供了一致的胶合剂应用,与全球製造环境中的自动化趋势一致。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 63亿美元 |

| 预测值 | 107亿美元 |

| 复合年增长率 | 5.5% |

2024年,手动涂胶机市场规模达24亿美元,预计到2034年将以4.4%的复合年增长率成长。手动涂胶机的吸引力在于其成本效益和灵活性,使其成为小批量或高精度操作的理想选择。中小型製造商,尤其是包装、家具和纺织品製造商,在自动化并非必需或成本合理的情况下,仍继续使用手动涂胶机。这些设备还能在不均匀或复杂的表面上提供更好的黏合剂控制,这使得它们在各种工业环境中的精细黏合任务中广受欢迎。

2024年,直接分销管道占据60.1%的市场份额,预计2025年至2034年的复合年增长率将达到5.8%。直销正日益受到青睐,因为它使製造商能够客製化解决方案并快速回应客户需求。建筑、汽车和包装等行业通常需要客製化的黏合剂系统,并重视製造商在整合、培训和售后服务方面的密切参与。使用半自动和智慧胶合剂的企业高度依赖此管道来获得稳定的性能、技术支援和精简的采购流程。

2024年,北美水性胶合剂涂抹器市场规模达12.7亿美元,预计到2034年将以5%的复合年增长率成长。美国市场的成长主要得益于其在包装、汽车、木工和建筑等领域的工业实力。随着人们对排放问题的日益关注,水性黏合剂因其低挥发性有机化合物(VOC)和合规性而备受青睐。此外,美国各行各业的先进製造和自动化趋势持续推动对高性能涂抹器系统的需求,这些系统能够提高速度、安全性和精度。

水性胶合剂涂抹器市场的主要参与者包括 Buhnen GmbH & Co. KG、Nordson Corporation、Robatech AG、ITW Dynatec、HB Fuller Company、3M Company、Franklin International、Graco Inc.、Sika AG、Henkel AG & Co. KGaA、Valco Melton、Gluco Inc.、Sika AG、Henkel AG & Co. KGaA、Valcoy Corporation、Glue Machine Corporation、Set Corporation.在水性胶合剂涂抹器市场竞争的公司优先考虑创新、自动化和定制,以增强其市场地位。许多公司都在大力投资研发,以开发符合不断发展的工业和环境标准的环保、节能係统。为了保持竞争力,领先的公司正在透过提供即时监控和效能资料的智慧、支援物联网的涂抹器来扩展其产品线。与终端使用产业和 OEM 建立策略合作伙伴关係也有助于促进跨不同製造平台的整合。公司正在优化直销网络,以确保更快的交货、更好的技术支援和更好的客户保留率。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 自动涂抹器采用率上升

- 包装产业需求激增

- 智慧控制系统集成

- 黏合剂配方的进步

- 产业陷阱与挑战

- 水性黏合剂的性能限制

- 自动涂抹器的初始投资较高

- 机会

- 医疗和卫生应用领域

- 对轻型车辆的需求不断增加

- 与智慧製造(工业4.0)的融合

- 对无VOC黏合剂解决方案的需求

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计数据

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按自动化,2021 - 2034 年

- 主要趋势

- 手动涂抹器

- 半自动涂抹器

- 自动涂抹器

第六章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 包装产业

- 家具和木工

- 建筑和建筑材料

- 汽车和航太

- 纺织服装

- 金属

- 玻璃

- 其他(泡沫、纺织品/织物、皮革)

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直接的

- 间接

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第九章:公司简介

- 3M Company

- Ad Tech (FPC Corporation)

- Buhnen GmbH & Co. KG

- Dymax Corporation

- Franklin International

- Glue Machinery Corporation

- Graco Inc.

- HB Fuller Company

- Henkel AG & Co. KGaA

- ITW Dynatec

- Nordson Corporation

- Robatech AG

- Sika AG

- Surebonder (FPC Corporation)

- Valco Melton

The Global Water-based Adhesive Applicators Market was valued at USD 6.3 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 10.7 billion by 2034. The industry is witnessing steady growth driven by expansion in the packaging sector, fueled by the boom in e-commerce, fast-moving consumer goods, and food and beverage industries. With a growing preference for eco-conscious packaging, these applicators are widely used for labeling, sealing, and flexible packaging due to their compatibility with recyclable materials. In addition to offering clean and efficient bonding, they support sustainability efforts and function well in high-speed production.

Simultaneously, demand is rising in the furniture and woodworking segments, where these applicators play a vital role in bonding porous materials like wood, laminates, and veneers. Trends such as DIY home improvement and modular furniture have further fueled this uptake. The growing adoption of semi-automatic and automatic applicator systems is also reshaping the market landscape, particularly in sectors like construction and consumer goods. These technologies improve operational efficiency, lower material waste, and offer consistent adhesive application, aligning with automation trends across global manufacturing environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.3 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 5.5% |

In 2024, the manual applicators segment generated USD 2.4 billion and is projected to grow at a CAGR of 4.4% through 2034. Their appeal lies in cost-efficiency and flexibility, making them ideal for low-volume or precision-focused operations. Small and mid-sized manufacturers, especially in packaging, furniture, and textiles, continue to use manual applicators where automation is not essential or cost-justified. These devices also deliver better adhesive control on non-uniform or complex surfaces, which makes them popular for detailed bonding tasks in varied industrial settings.

The direct distribution channels segment held a 60.1% share in 2024 and is expected to grow at a CAGR of 5.8% from 2025 to 2034. Direct sales are gaining traction as they allow manufacturers to tailor their solutions and respond rapidly to customer needs. Industries such as construction, automotive, and packaging often require custom adhesive systems and value close manufacturer involvement for integration, training, and after-sales services. Businesses using semi-automatic and smart applicators rely heavily on this channel for consistent performance, technical assistance, and streamlined procurement.

North America Water-based Adhesive Applicators Market generated USD 1.27 billion in 2024, projected to grow at a CAGR of 5% through 2034. Growth in the U.S. market is largely fueled by the country's industrial strength in sectors like packaging, automotive, woodworking, and construction. With rising concerns around emissions, water-based adhesives are preferred for their low VOCs and regulatory compliance. Additionally, advanced manufacturing and automation trends across U.S. industries continue to drive the demand for high-performance applicator systems that improve speed, safety, and precision.

Key players in the Water-based Adhesive Applicators Market include Buhnen GmbH & Co. KG, Nordson Corporation, Robatech AG, ITW Dynatec, H.B. Fuller Company, 3M Company, Franklin International, Graco Inc., Sika AG, Henkel AG & Co. KGaA, Valco Melton, Glue Machinery Corporation, Surebonder (FPC Corporation), Dymax Corporation, and Ad Tech (FPC Corporation). Companies competing in the water-based adhesive applicators market are prioritizing innovation, automation, and customization to enhance their market position. Many are heavily investing in R&D to develop eco-friendly, energy-efficient systems that meet evolving industrial and environmental standards. To stay competitive, leading firms are expanding their product lines with smart, IoT-enabled applicators that provide real-time monitoring and performance data. Strategic partnerships with end-use industries and OEMs also help boost integration across diverse manufacturing platforms. Firms are optimizing direct sales networks to ensure faster delivery, improved technical support, and better customer retention.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Automation

- 2.2.3 End use

- 2.2.4 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in automated applicator adoption

- 3.2.1.2 Surge in demand from the packaging sector

- 3.2.1.3 Integration of smart control systems

- 3.2.1.4 Advancements in adhesive formulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Performance limitations of water-based adhesives

- 3.2.2.2 High initial investment for automated applicators

- 3.2.3 Opportunities

- 3.2.3.1 Adoption in medical and hygiene applications

- 3.2.3.2 Increasing demand for lightweight vehicles

- 3.2.3.3 Integration with smart manufacturing (Industry 4.0)

- 3.2.3.4 Demand for VOC-free adhesive solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Automation, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Manual applicator

- 5.3 Semi-automatic applicators

- 5.4 Automatic applicators

Chapter 6 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Packaging industry

- 6.3 Furniture & woodworking

- 6.4 Construction & building materials

- 6.5 Automotive & aerospace

- 6.6 Textile & apparel

- 6.7 Metals

- 6.8 Glass

- 6.9 Others (Foam, textiles/fabrics, leather)

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Direct

- 7.3 Indirect

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Indonesia

- 8.4.7 Malaysia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 3M Company

- 9.2 Ad Tech (FPC Corporation)

- 9.3 Buhnen GmbH & Co. KG

- 9.4 Dymax Corporation

- 9.5 Franklin International

- 9.6 Glue Machinery Corporation

- 9.7 Graco Inc.

- 9.8 H.B. Fuller Company

- 9.9 Henkel AG & Co. KGaA

- 9.10 ITW Dynatec

- 9.11 Nordson Corporation

- 9.12 Robatech AG

- 9.13 Sika AG

- 9.14 Surebonder (FPC Corporation)

- 9.15 Valco Melton