|

市场调查报告书

商品编码

1835660

水性胶合剂:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Water-borne Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

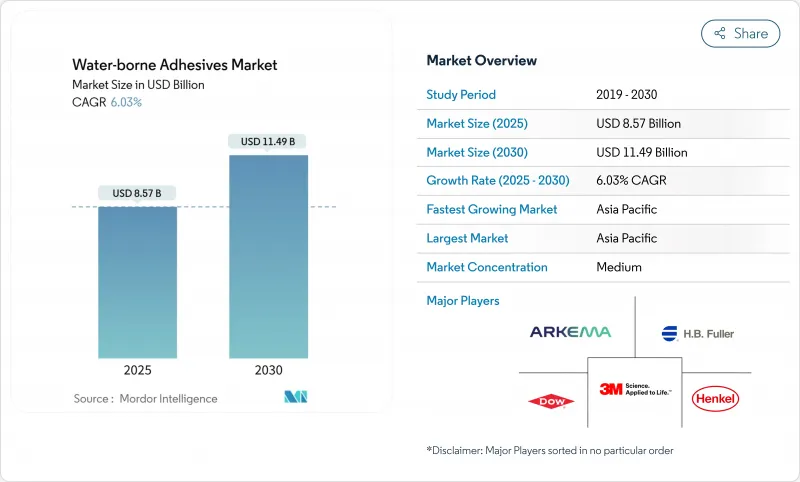

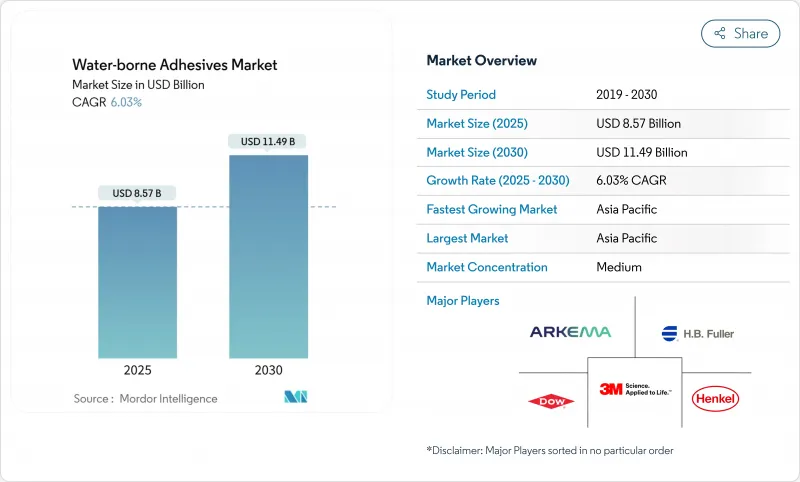

预计 2025 年水性黏合剂市场价值将达到 85.7 亿美元,到 2030 年预计将达到 114.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.03%。

随着製造商加速从溶剂型化学品向水性化学品的转型,以应对日益严格的全球挥发性有机化合物 (VOC) 法规并满足品牌商的永续性目标,水性黏合剂市场正在蓬勃发展。电子商务包装、汽车轻量化和模组化建筑的快速发展进一步推动了这一成长势头,这些领域都需要高性能、低排放的黏合剂系统。监管趋同,尤其是《欧洲挥发性有机化合物排放指令》和《永续产品生态设计》法规,实际上赋予了水性化学品经营许可,促使跨国公司重组其产品组合,同时也为新兴市场提供了技术转移机会。

全球水性胶合剂市场趋势与洞察

电商主导北美瓦楞纸箱热潮

线上零售额的爆炸性成长导致瓦楞纸托运商每美元使用的黏合剂比传统零售商多七倍。品牌商正在收紧「自有货柜运输」要求,促使加工商采用快速固化水性胶合剂,例如HB Fuller的Advantra系列,该系列胶合剂能够承受多节点物流,同时符合路边回收指南。自动化封箱生产线进一步推动了对清洁、低黏度配方的需求,这些配方与高速施用器相容。这些因素共同提振了水性胶合剂市场,因为加工商指定使用符合环保要求的化学品,以确保与全通路零售商达成交易。

欧洲VOC减量要求加速溶剂型涂料向水型涂料的转变

由于欧盟《挥发性排放(VOC)溶剂排放指令》严格限制工业排放,水性系统已成为汽车内装、地板材料和建筑幕墙板的标准。在最近的欧洲涂料展上,一种生物基聚氨酯分散体得到了展示,其剪切强度相当于或优于溶剂基替代品。阿科玛推出了一款用于低碳包装的丙烯酸水性黏合剂,工业级销量成长了5.1%。

热阻差距限制了其在高温应用领域的渗透

持续暴露在150°C以上的高温下,对大多数水性网路构成挑战。虽然3M的Fastbond 1000NF代表了其在提供经GREENGUARD认证、能够承受週期性峰值的黏接方面取得的进步,但重型引擎、烤箱面板和引擎盖内衬仍然主要采用溶剂型体系。弥补这一热Delta需要新型有机硅混合晶格,目前该技术正处于研发的早期阶段。

报告中分析的其他驱动因素和限制因素

- 东协模组化建筑推动PVA需求激增

- 轻量化汽车黏合促进了亚洲聚氨酯分散体的发展。

- 更高的初始成本和投资

細項分析

丙烯酸乳液凭藉其多功能性和低成本,预计销售量,但由于其高剥离强度和柔韧性,以及在锂离子电池组和杀菌袋层压板中的重要特性,预计其复合年增长率将达到6.55%。

由于丙烯和丙烯酸原料价格波动,丙烯酸嵌段面临利润压力,迫使供应商整合生物丙烯酸酯製程路线和产品线。氯丁二烯分散体和利基混合材料在金属家具、鞋类和采矿带等需要耐油性的应用领域仍然产量受限。整体而言,能够平衡价格敏感型丙烯酸和高价值聚氨酯产品的改质材料生产商将实现多层次的成长。

受全通路零售向袋装、小袋和邮寄袋转变的推动,到2024年,软质包装将占水性胶合剂市场规模的40%。然而,由于品牌商寻求结合PET、氧化铝和生物基PLA薄膜的高阻隔设计,多层复合胶合剂是成长最快的细分市场,复合年增长率高达7.23%。水性双组分系统目前的黏合强度超过65N/15mm,可与溶剂型聚氨酯领先相媲美,同时确保符合食品接触要求。

胶带、标籤和印刷品供应链正在采用基于分散体的压敏胶,以实现快速自动化应用,且无需拉线。书籍装订和纸张加工应用正在采用新型醋酸乙烯酯-乙烯共聚物提供的低能耗热固化循环。电子商务的蓬勃发展正在推动对即时黏性、防撕裂瓦楞纸箱黏合剂的需求成长。

水性胶合剂市场报告按树脂类型(例如丙烯酸、聚醋酸乙烯酯乳液)、应用领域(例如软包装、胶带和标籤)、终端用户行业(例如建筑施工、纸张和纸板)、基材(例如纸张和纸板、金属)以及地区(例如亚太地区、北美)对行业进行了细分。市场预测以美元计算。

区域分析

到2024年,亚太地区的销售额将领先全球40%,这得益于其无与伦比的製造业深度、强劲的建筑产品线以及电动车生产的加速发展。中国二线城市将推动面板胶合剂的普及,而印度的基础建设将支撑销售成长。该地区6.89%的复合年增长率也受到日本和韩国法规收紧的推动,这些法规透过税收减免和绿色采购清单鼓励使用无溶剂胶粘剂。

北美则位居第二,受电商包装和汽车轻量化的推动。美国持续要求降低消费品的挥发性有机化合物(VOC)限值,扩大了水性胶合剂市场;而加拿大的能源效率法规则刺激了住宅维修隔热材料的采用。墨西哥的加工出口走廊越来越多地指定使用水性配方,以满足原始设备製造商(OEM)的出口要求。

欧洲正透过严格的指令发挥重要的技术影响力。德国汽车内装、法国软质食品包装和英国木质房屋产业都在推动欧洲大陆的需求。在欧盟凝聚基金的支持下,东欧加工商正在升级到分散生产线,溶剂份额的下降速度比最初预期的要快。

南美市场前景看好,巴西建设业復苏,相关企业对包装的需求也推动了汉高在云迪亚伊的新创新中心的建设,推动了需求的温和成长。阿根廷市场需求保持稳定,儘管规模较小,但专注于柔性食品包装。沙乌地阿拉伯的计划和南非的零售物流开始指定使用水性涂料以满足进口标准。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 电商主导北美瓦楞纸箱热潮

- 欧洲VOC减量指令加速溶剂向水的转化

- 东协模组化建筑推动PVA需求快速成长

- 亚洲轻量化汽车胶合剂市场受益于聚氨酯分散体

- 新兴市场监管趋严

- 市场限制

- 热阻差距限制了其在高温应用领域的渗透

- 在高阶应用的使用有限

- 初始成本和投资高

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 依树脂类型

- 丙烯酸纤维

- 聚醋酸乙烯酯(PVA)乳液

- 乙烯醋酸乙烯酯(EVA)乳液

- 聚氨酯分散体和CR(氯丁橡胶)乳胶

- 其他树脂类型

- 按用途

- 软包装

- 胶带标籤

- 纸张加工与印刷艺术

- 层压板和薄膜结构

- 地板和地毯

- 书籍装订和出版

- 不织布和卫生用品

- 其他的

- 按最终用户产业

- 建筑/施工

- 纸、纸板和包装

- 木工和细木工

- 运输

- 卫生保健

- 电气和电子

- 其他最终用户产业

- 按基材

- 纸和纸板

- 塑胶薄膜

- 木材/复合材料

- 金属

- 玻璃和陶瓷

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略性倡议(併购、合资、业务扩张)

- 市占率分析

- 公司简介

- 3M

- Arkema

- Ashland

- Avery Dennison Corporation

- Benson Polymers Pvt Ltd.

- DIC CORPORATION

- Dow

- Dymax

- Evonik Industries AG

- HB Fuller Company

- Henkel AG & Co. KGaA

- Jowat SE

- MAPEI SpA

- Parker Hannifin Corp

- Pidilite Industries Ltd.

- PPG Industries, Inc.

- Sika AG

- Soudal Group

- Wacker Chemie AG

第七章 市场机会与未来展望

The Water-borne Adhesives Market size is estimated at USD 8.57 billion in 2025, and is expected to reach USD 11.49 billion by 2030, at a CAGR of 6.03% during the forecast period (2025-2030).

The water-borne adhesives market is growing as manufacturers accelerate the shift from solvent-based to water-based chemistries to comply with tightening global VOC rules and meet brand-owner sustainability targets. Growth momentum is reinforced by fast-expanding e-commerce packaging volumes, automotive lightweighting, and modular construction, each of which demands high-performance yet low-emission bonding systems. Regulatory convergence, especially Europe's VOC Solvents Emissions Directive and the Ecodesign for Sustainable Products Regulation, has made water-based chemistries a de facto license to operate, prompting multinationals to re-engineer portfolios while opening technology-transfer opportunities in emerging markets.

Global Water-borne Adhesives Market Trends and Insights

E-commerce-Led Boom in Corrugated Packaging in North America

Explosive online retail sales mean corrugated shippers now use seven times more adhesive per dollar transacted than traditional retail. Brand owners have tightened "ship-in-own-container" requirements, pushing converters to adopt fast-setting water-based grades such as H.B. Fuller's Advantra series that survive multi-node logistics while meeting curbside-recyclability guidelines. Automated case-sealing lines further amplify demand for clean-running, low-viscosity formulations compatible with high-speed applicators. These factors collectively lift the water-borne adhesives market as converters specify eco-compliant chemistries to secure contracts with omnichannel retailers.

VOC-Reduction Mandates Accelerating Solvent-to-Water Conversion in Europe

The EU VOC Solvents Emissions Directive caps industrial emissions so rigorously that water-borne systems have become standard in automotive trim, flooring and facade panels. Recent European Coatings Show demonstrations of bio-based PU dispersions highlighted equal or superior shear strength versus solvent counterparts, eroding legacy performance objections and consolidating the regulatory-driven shift. Early movers such as Arkema report a 5.1% volume lift in industrial grades after launching new acrylic water-borne binders tailored for low-carbon packaging.

Heat-Resistance Gap Limits Penetration into High-Temperature Applications

Continuous exposure beyond 150 °C challenges most water-borne networks. 3M's Fastbond 1000NF illustrates progress-delivering GREENGUARD-certified bonds that tolerate cyclical peaks-but heavy-duty engines, baking-oven panels and under-hood linings remain dominated by solvent systems. Bridging this thermal delta will require novel silicone-hybrid lattices now in early R&D pipelines; until then, market penetration into these niches stays capped.

Other drivers and restraints analyzed in the detailed report include:

- ASEAN Modular Construction Driving Fast-Setting PVA Demand

- Light-Weight Automotive Bonding Boosting PU Dispersions in Asia

- Higher Initial Cost and Investment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic emulsions held 38% of water-borne adhesives market share in 2024 thanks to versatility and low cost. Polyvinyl acetate remains the workhorse for wood bonding, yet rising indoor-air standards are steering contractors toward formaldehyde-free acrylics. Polyurethane dispersions, although contributing a modest slice of 2024 volume, are advancing at a 6.55% CAGR because they pair high peel strength with flexibility-attributes critical in lithium-ion battery packs and retort-pouch laminates.

The acrylic bloc faces margin pressure from propylene and acrylic-acid feedstock swings, nudging suppliers to integrate bio-acrylate routes or by-product streams. Chloroprene dispersions and niche hybrids serve metal furniture, footwear and mining belts where oil-resistance is non-negotiable, but remain volume-constrained. Overall, formulators that balance price-sensitive acrylic offerings with high-value PU portfolios will capture multi-tier growth.

Flexible packaging generated 40% of water-borne adhesives market size in 2024, driven by pouch, sachet and mailer conversions for omnichannel retail. Yet multi-layer lamination is the fastest-advancing cell at 7.23% CAGR as brand owners seek high-barrier designs combining PET, aluminum oxide and bio-PLA films. Water-based two-component systems now enable more than 65 N/15 mm bond strength, matching solvent-polyurethane predecessors while ensuring food-contact compliance.

Tapes, labels and graphic arts supply chains adopt dispersion-based PSAs that meet automated application speeds without stringing. Book-binding and paper-converting segments respond to lower-energy hot-cure cycles offered by new vinyl-acetate-ethylene copolymers. As e-commerce accelerates, corrugated-case adhesives with immediate tack yet fiber-tear substrate failure gain prominence, expanding total addressable demand.

The Water-Borne Adhesives Market Report Segments the Industry by Resin Type (Acrylics, Polyvinyl Acetate Emulsion, and More), Application (Flexible Packaging, Tapes and Labels, and More), End-User Industry (Building and Construction, Paper, Board, and More), Substrate (Paper and Paperboard, Metals, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 40% revenue leadership in 2024 reflects its unrivaled manufacturing depth, robust construction pipeline and accelerating electric-vehicle production. China's Tier-2 cities drive panel adhesive uptake, while India's infrastructure push anchors volume gains. The region's 6.89% CAGR also stems from regulatory tightening in Japan and South Korea, which incentivizes solvent-free chemistries through tax breaks and green-procurement lists.

North America ranks second, buoyed by e-commerce packaging and automotive lightweighting. The United States continues to mandate lower VOC limits in consumer products, expanding the water-borne adhesives market, whereas Canada's energy-efficiency codes spur adoption in residential retrofit insulation. Mexico's maquiladora corridors increasingly specify water-based formulations to service OEM export requirements.

Europe exerts outsized technology influence through stringent directives. Germany's auto interiors, France's flexible food packaging and the UK's timber-frame housing sectors collectively lift continental demand. Eastern European converters, supported by EU cohesion funds, upgrade to dispersion lines, eroding solvent share faster than originally forecast.

South America offers a mixed outlook: Brazil's construction recovery and agribusiness packaging needs push modest demand growth, aided by Henkel's new innovation hub in Jundiai. Argentina maintains smaller but specialized appetites in flexible food wraps. Middle East and Africa remain nascent yet promising; Saudi giga-projects and South African retail logistics are starting to specify water-based grades to meet imported-goods standards.

- 3M

- Arkema

- Ashland

- Avery Dennison Corporation

- Benson Polymers Pvt Ltd.

- DIC CORPORATION

- Dow

- Dymax

- Evonik Industries AG

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Jowat SE

- MAPEI S.p.A.

- Parker Hannifin Corp

- Pidilite Industries Ltd.

- PPG Industries, Inc.

- Sika AG

- Soudal Group

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce-Led Boom in Corrugated Packaging in North America

- 4.2.2 VOC-Reduction Mandates Accelerating Solvent-to-Water Conversion in Europe

- 4.2.3 ASEAN Modular Construction Driving Fast-Setting PVA Demand

- 4.2.4 Light-weight Automotive Bonding Boosting PU Dispersions in Asia

- 4.2.5 Regulatory Push in Emerging Markets

- 4.3 Market Restraints

- 4.3.1 Heat-Resistance Gap Limits Penetration into High-Temperature Applications

- 4.3.2 Limited Usage in High-end Applications

- 4.3.3 Higher Initial Cost and Investment

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Resin Type

- 5.1.1 Acrylics

- 5.1.2 Polyvinyl Acetate (PVA) Emulsion

- 5.1.3 Ethylene Vinyl Acetate (EVA) Emulsion

- 5.1.4 Polyurethane Dispersions and CR (Chloroprene Rubber) Latex

- 5.1.5 Other Resin Types

- 5.2 By Application

- 5.2.1 Flexible Packaging

- 5.2.2 Tapes and Labels

- 5.2.3 Paper Converting and Graphic Arts

- 5.2.4 Laminating and Filmic Structures

- 5.2.5 Flooring and Carpeting

- 5.2.6 Bookbinding and Publishing

- 5.2.7 Non-woven and Hygiene Products

- 5.2.8 Others

- 5.3 By End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Paper, Board, and Packaging

- 5.3.3 Woodworking and Joinery

- 5.3.4 Transportation

- 5.3.5 Healthcare

- 5.3.6 Electrical and Electronics

- 5.3.7 Other End-user Industries

- 5.4 By Substrate

- 5.4.1 Paper and Paperboard

- 5.4.2 Plastics and Films

- 5.4.3 Wood and Composites

- 5.4.4 Metals

- 5.4.5 Glass and Ceramics

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, JVs, Expansions)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Ashland

- 6.4.4 Avery Dennison Corporation

- 6.4.5 Benson Polymers Pvt Ltd.

- 6.4.6 DIC CORPORATION

- 6.4.7 Dow

- 6.4.8 Dymax

- 6.4.9 Evonik Industries AG

- 6.4.10 H.B. Fuller Company

- 6.4.11 Henkel AG & Co. KGaA

- 6.4.12 Jowat SE

- 6.4.13 MAPEI S.p.A.

- 6.4.14 Parker Hannifin Corp

- 6.4.15 Pidilite Industries Ltd.

- 6.4.16 PPG Industries, Inc.

- 6.4.17 Sika AG

- 6.4.18 Soudal Group

- 6.4.19 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Rising Demand for Sustainable and Eco-Friendly Products