|

市场调查报告书

商品编码

1773338

BOPET 包装薄膜市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测BOPET Packaging Films Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

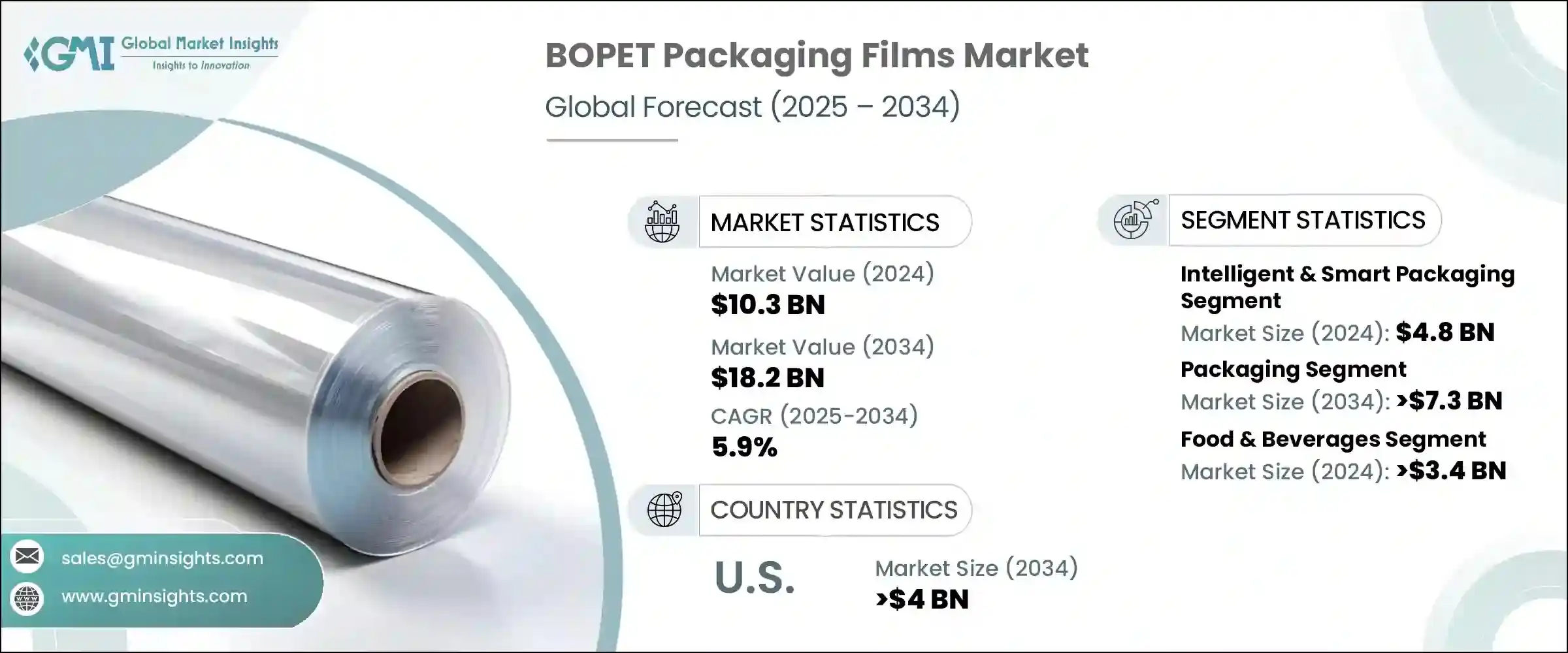

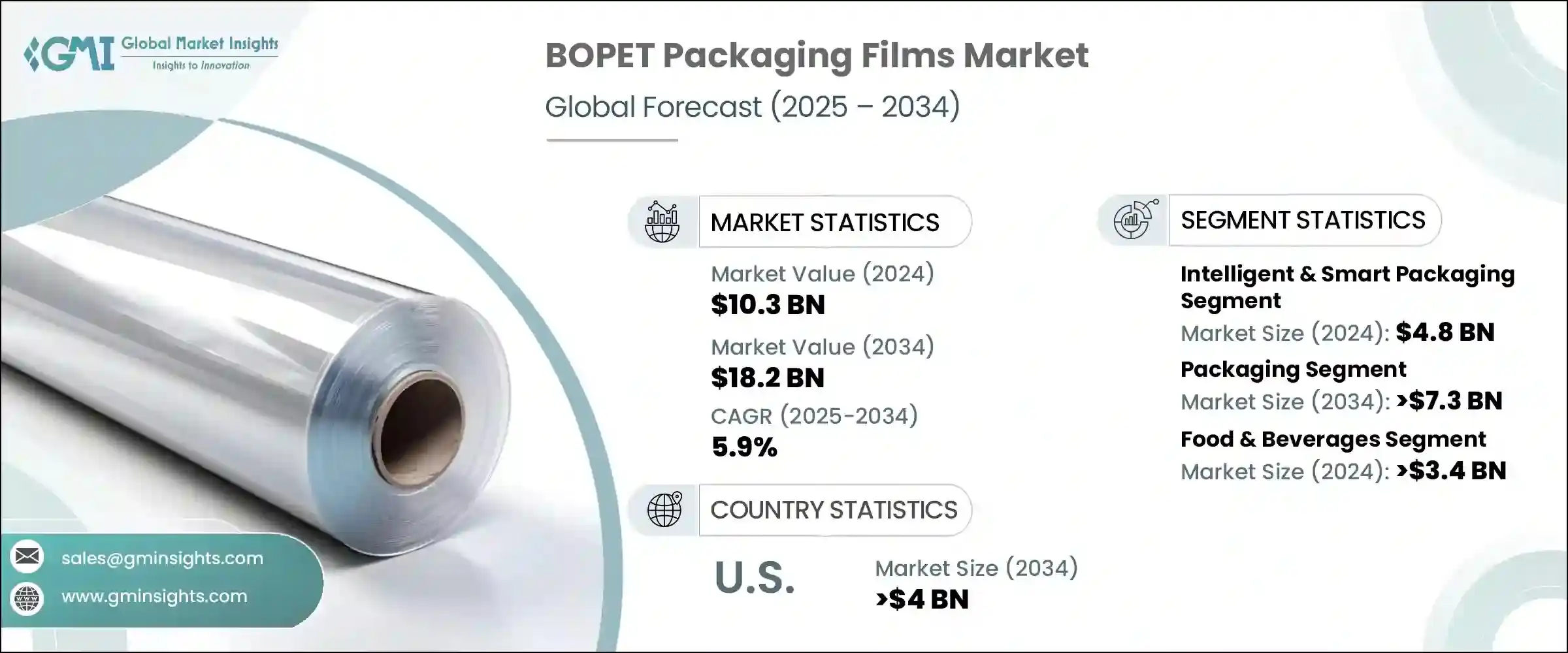

2024年,全球BOPET包装薄膜市场规模达103亿美元,预计到2034年将以5.9%的复合年增长率成长,达到182亿美元。这项成长主要得益于电商平台和「最后一公里」配送系统的快速发展,以及更严格的永续发展要求和推广环保包装材料的法规。该市场面临国际贸易紧张局势的挑战,尤其是川普政府推出的报復性关税,增加了进口製造业投入的成本。由于该行业的许多主要参与者严重依赖进口原材料,关税迫使製造商要么将增加的成本转嫁给消费者,要么寻找更具成本效益的国内替代品。

儘管面临诸多不利因素,对轻量化、经济高效且柔性包装的需求仍在持续成长。 BOPET 薄膜相较于硬质包装具有显着优势,因为它们能够高度适应不同的产品尺寸,有助于减轻体积重量并优化运输效率。消费者驱动的期望和超本地化配送趋势进一步推动了轻量化包装设计的创新。全球对可回收、防篡改和长保质期包装的需求日益增长,也推动了 BOPET 薄膜在食品、药品、电子和个人护理行业的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 103亿美元 |

| 预测值 | 182亿美元 |

| 复合年增长率 | 5.9% |

随着对兼具耐用性和柔韧性的保护性包装的需求日益增长,BOPET 薄膜的市场持续受到青睐,远超硬质薄膜。这些薄膜尤其因其能够贴合各种产品形状和尺寸而备受青睐,有助于减少运输量,并最终降低物流成本。这一趋势与全球对符合法规和消费者期望的环保包装日益增长的需求相符。

BOPET 薄膜作为智慧和活性包装技术的理想基材,也日益受到青睐。 2024 年,智慧包装市场规模达 48 亿美元。这些创新包装解决方案包含除氧剂、抗菌剂和湿度调节剂等功能性成分,它们与包装内部环境相互作用,以保持产品的新鲜度和安全性。 BOPET 薄膜凭藉其高热稳定性、优异的阻隔性和耐化学性,能够有效支持这些应用。这些特性使其成为食品饮料、医疗保健和化妆品等产品的首选,因为这些行业的产品寿命和完整性至关重要。

预计到2034年,更广泛的包装应用领域将达到73亿美元。 BOPET薄膜凭藉其卓越的机械强度、透明度以及防潮防气性能,在该领域占据主导地位。它们非常适合多层软包装系统,尤其是在製药、食品和个人护理等高性能要求较高的行业。食品安全法规的日益严格、消费者对永续性的意识日益增强以及对可回收解决方案的需求,加速了BOPET材料在初级包装和次级包装中的应用。此外,全球线上零售的扩张也推动了对确保产品安全并延长保质期的包装的需求。

预计2034年,美国BOPET包装薄膜市场规模将达40亿美元。联邦物流、製药、食品和电子等行业的需求持续推动软包装的创新。美国製造商正面临越来越大的压力,需要转向可回收和生物基材料,以满足消费者的期望和永续发展目标。这些不断变化的需求正推动先进解决方案的开发,例如轻质柔性邮寄袋和可回收缓衝包装。像三菱聚酯薄膜有限公司这样的全球製造商正引领业界潮流,打造专为全通路零售模式设计的环保包装,同时兼顾性能和永续性。

全球 BOPET 包装膜市场的主要参与者包括三菱聚酯薄膜有限公司 (Mitsubishi Polyester Film GmbH)、SKC、SRF Limited、Polyplex 和 UFlex Limited。为了巩固市场地位,BOPET 包装膜产业的公司专注于垂直整合、投资永续产品开发以及建立策略合作伙伴关係。领先的公司正在提高产能并本地化供应链,以减少对进口的依赖并减轻关税影响。创新发挥关键作用,研发团队致力于开发可回收、可生物降解且轻质的薄膜解决方案,以满足不断变化的监管要求和消费者需求。公司也与电商和快速消费品品牌结盟,共同开发适合快速交付系统的特殊包装形式。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 食品饮料和製药业的成长

- 在高性能绝缘和层压应用中的使用日益增多

- 对灵活轻量包装解决方案的需求不断增长

- 永续和可回收包装材料激增

- BOPET 薄膜具有优异的阻隔水分和气体性能

- 产业陷阱与挑战

- 多层薄膜结构所带来的回收挑战

- 原物料价格波动(例如 PTA 和 MEG)

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 - 2034 年

- 智慧包装

- 活性包装

第六章:市场估计与预测:按应用,2021 - 2034 年

- 包装

- 工业的

- 电气和电子

- 影像学

- 其他的

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 食品和饮料

- 製药

- 个人护理和化妆品

- 消费性电子产品

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Amcor PLC

- Avery Dennison

- BASF SE

- CCL Industries Inc.

- Checkpoint Systems, Inc

- DuPont Teijin Films

- Klockner Pentaplast

- Sealed Air Corporation

- Sonoco Products Company

- Tetra Pak International SA

The Global BOPET Packaging Films Market was valued at USD 10.3 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 18.2 billion by 2034. This growth is largely fueled by the rapid development of e-commerce platforms and last-mile delivery systems, along with stricter sustainability mandates and regulations promoting eco-friendly packaging materials. The market faces challenges from international trade tensions, particularly the retaliatory tariffs introduced by the Trump administration, which have increased the cost of imported manufacturing inputs. Since many major players in this sector depend heavily on imported raw materials, the tariffs have forced manufacturers to either pass the increased costs on to consumers or find cost-effective domestic alternatives.

Despite these headwinds, the demand for lightweight, cost-effective, and flexible packaging continues to grow. BOPET films offer a distinct advantage over rigid formats, as they are highly adaptable to different product dimensions, helping reduce volumetric weight and optimizing shipping efficiency. Consumer-driven expectations and hyperlocal delivery trends are further encouraging innovation in lightweight packaging design. The expanding global push for recyclable, tamper-evident, and extended-shelf-life packaging is also pushing the use of BOPET films across food, pharmaceuticals, electronics, and personal care industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.3 billion |

| Forecast Value | $18.2 billion |

| CAGR | 5.9% |

The growing need for protective packaging that combines durability with flexibility continues to favor BOPET film formats over rigid alternatives. These films are especially valued for their ability to conform to various product shapes and sizes, which helps in reducing shipping volumes and, ultimately, logistics costs. This trend is in line with the increasing global demand for environmentally friendly packaging that meets both regulatory and consumer expectations.

BOPET films are also gaining popularity as ideal substrates for intelligent and active packaging technologies. In 2024, the smart packaging segment reached USD 4.8 billion. These innovative packaging solutions include functional components such as oxygen scavengers, antimicrobial agents, and moisture regulators, which interact with the internal package environment to preserve product freshness and safety. BOPET films support these applications effectively due to their high thermal stability, excellent barrier resistance, and chemical durability. These qualities make them a preferred choice for sectors such as food and beverage, healthcare, and cosmetics, where product longevity and integrity are critical.

The broader packaging application segment is forecasted to reach USD 7.3 billion by 2034. Within this space, BOPET films dominate due to their superior mechanical strength, transparency, and moisture and gas barrier capabilities. They are highly suitable for multilayer and flexible packaging systems, especially in industries demanding high performance, such as pharmaceuticals, food, and personal care. Stricter food safety laws, growing consumer awareness regarding sustainability, and the need for recyclable solutions have accelerated the use of BOPET materials in both primary and secondary packaging. Additionally, the expansion of global online retail is boosting demand for packaging that ensures product security and extends shelf life.

United States BOPET Packaging Films Market is projected to reach USD 4 billion by 2034. Demand from sectors such as federal logistics, pharmaceuticals, food, and electronics continue to drive innovation in flexible packaging. US manufacturers are under increasing pressure to shift toward recyclable and bio-based materials to align with consumer expectations and sustainability goals. These evolving demands are inspiring the development of advanced solutions such as lightweight flexible mailers and recyclable cushioning formats. Manufacturers like Mitsubishi Polyester Film GmbH worldwide are leading the charge in creating eco-friendly packaging designed for omnichannel retail models while balancing performance and sustainability.

Key players in the Global BOPET Packaging Films Market include Mitsubishi Polyester Film GmbH, SKC, SRF Limited, Polyplex, and UFlex Limited. To strengthen their market foothold, companies in the BOPET packaging films industry focus on vertical integration, investment in sustainable product development, and strategic partnerships. Leading firms are ramping up production capacities and localizing supply chains to reduce dependency on imports and mitigate tariff impacts. Innovation plays a key role, with R&D teams developing recyclable, biodegradable, and lightweight film solutions to meet shifting regulatory requirements and consumer demands. Companies are also forming alliances with e-commerce and FMCG brands to co-develop specialized packaging formats tailored for fast-moving delivery systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growth in food & beverage and pharmaceutical industries

- 3.3.1.2 Increasing use in high-performance insulation and lamination applications

- 3.3.1.3 Rising demand for flexible and lightweight packaging solutions

- 3.3.1.4 Surge in sustainable and recyclable packaging materials

- 3.3.1.5 Excellent barrier properties of BOPET films against moisture and gases

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Recycling challenges due to multi-layer film structures

- 3.3.2.2 Volatility in raw material prices (e.g., PTA and MEG)

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market estimates & forecast, By Type, 2021 - 2034 (USD Billion)

- 5.1 Intelligent & smart packaging

- 5.2 Active packaging

Chapter 6 Market estimates & forecast, By Application, 2021 - 2034 (USD Billion)

- 6.1 Packaging

- 6.2 Industrial

- 6.3 Electrical and electronics

- 6.4 Imaging

- 6.5 Others

Chapter 7 Market estimates & forecast, By End Use, 2021 - 2034 (USD Billion)

- 7.1 Food & beverages

- 7.2 Pharmaceuticals

- 7.3 Personal care & cosmetics

- 7.4 Consumer electronics

- 7.5 Others

Chapter 8 Market estimates and forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor PLC

- 9.2 Avery Dennison

- 9.3 BASF SE

- 9.4 CCL Industries Inc.

- 9.5 Checkpoint Systems, Inc

- 9.6 DuPont Teijin Films

- 9.7 Klockner Pentaplast

- 9.8 Sealed Air Corporation

- 9.9 Sonoco Products Company

- 9.10 Tetra Pak International S.A.