|

市场调查报告书

商品编码

1773344

编码、标籤和检测包装设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Coding, Labelling and Inspection Packaging Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

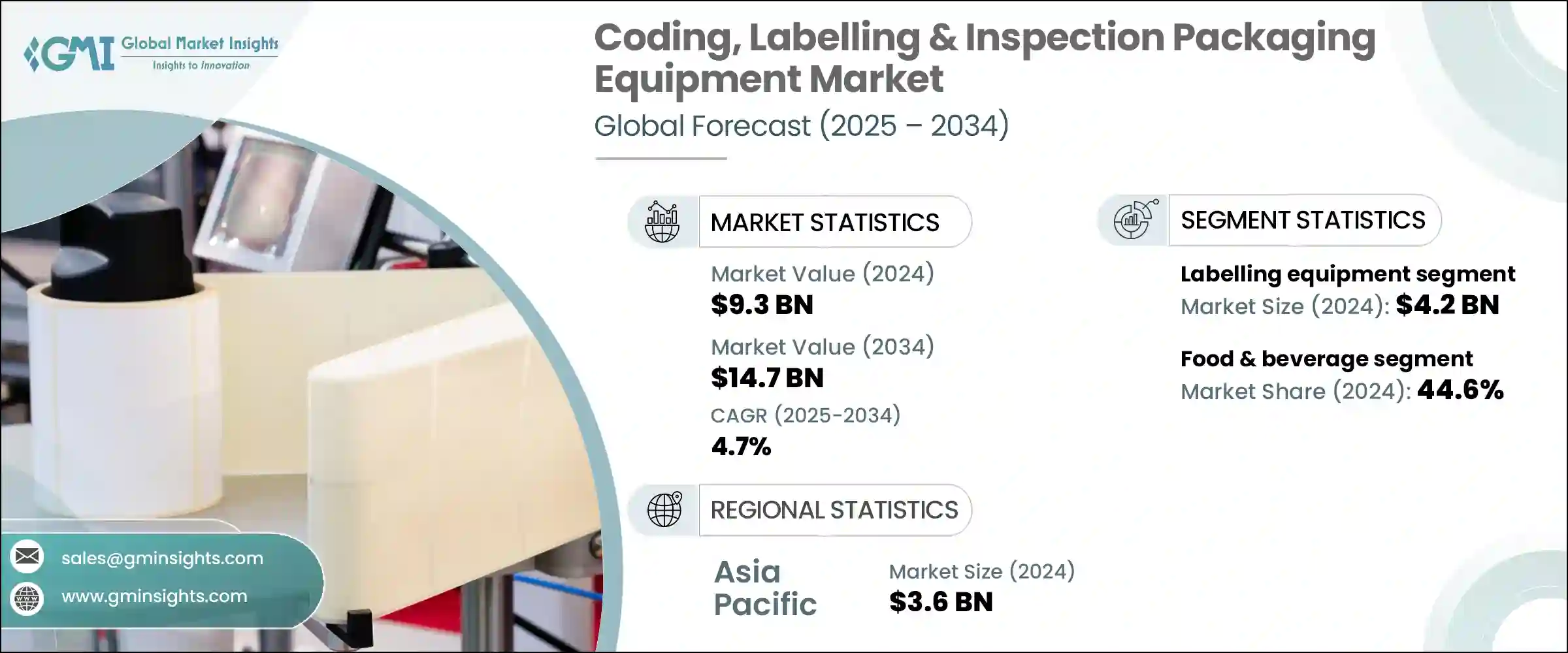

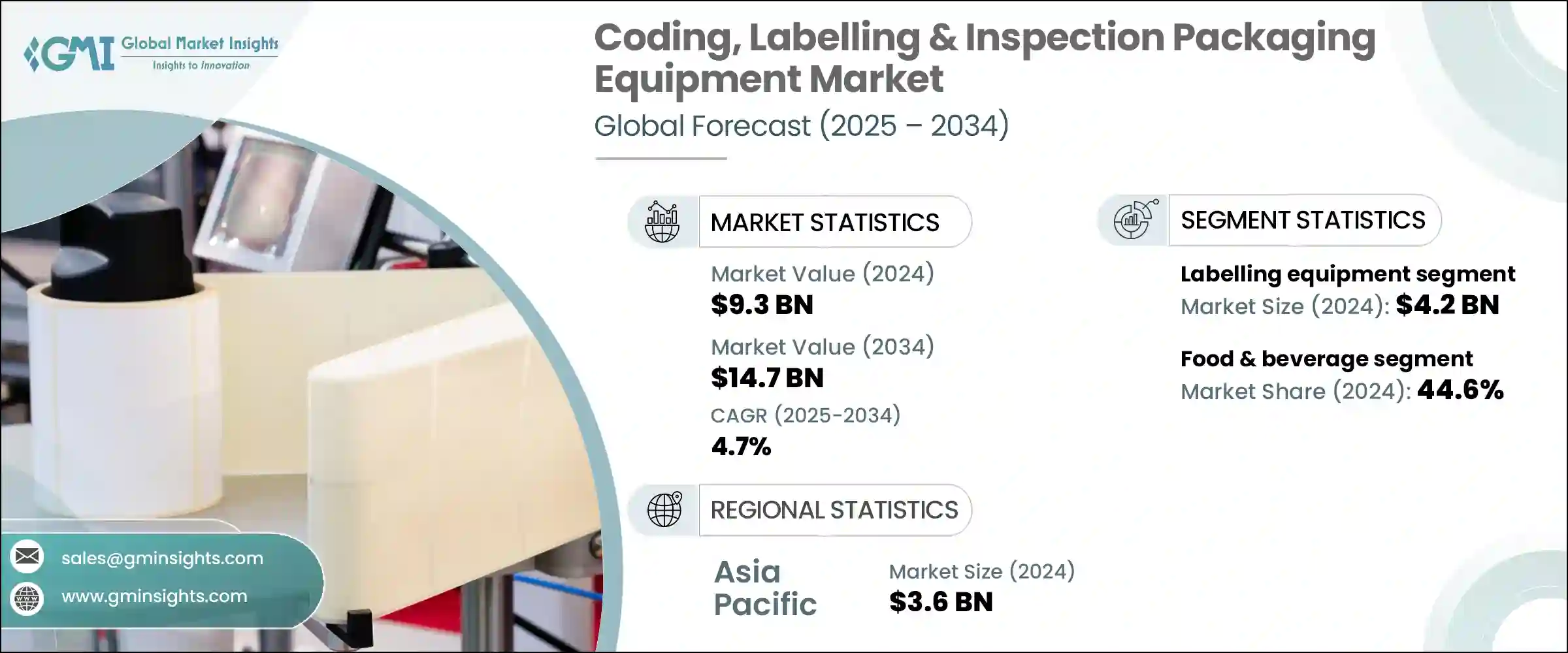

2024 年全球编码、标籤和检测包装设备市场价值为 93 亿美元,预计到 2034 年将以 4.7% 的复合年增长率增长,达到 147 亿美元。这些系统是製药、消费品、化妆品、食品饮料等行业的重要组成部分,支援包装和供应链流程。编码和标籤系统可生产耐用、高品质的标籤,不仅确保符合全球各种监管标准,还能提升品牌形象和顾客信任。可追溯性仍然是一个关键因素,可帮助製造商有效地管理产品召回并监控批次资讯。同时,配备先进摄影机的侦测设备可检查包装、密封和印刷代码中的缺陷,以维护产品的完整性。物联网整合、工业 4.0 功能和机器学习等创新正在显着提高检测精度和营运效率。

市场上有许多全球参与者,提供根据特定行业需求客製化且可扩展的设备。这些公司正积极扩展其产品组合,推出模组化平台,以适应不同的产品尺寸、生产速度和监管要求。製造商专注于寻求能够与现有自动化基础设施无缝整合的解决方案,从而提高灵活性,并减少设备升级或规格变更期间的停机时间。许多参与者也利用智慧技术(例如人工智慧驱动的检测、基于云端的资料分析和即时监控系统)来提高整个供应链的准确性、效率和可追溯性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 93亿美元 |

| 预测值 | 147亿美元 |

| 复合年增长率 | 4.7% |

2024年,标籤设备市场规模达42亿美元。标籤透过传达价格、数量和品质等关键讯息,在产品可见性和消费者决策中发挥至关重要的作用。随着各行各业致力于加强库存管理、验证产品真伪并提升客户参与度,对自动化和智慧标籤解决方案的需求日益增长。製药、个人护理和食品等行业是标籤设备的主要驱动力,推动创新技术的采用。

食品饮料业占比44.6%,2024年市场规模达41亿美元。消费者对透明度、可追溯性和严格安全法规合规性的需求日益增长,这促使食品製造商大力投资高精度标籤系统,例如环绕式贴标机和贴纸贴标机。北美和欧洲等地区的监管要求正促使企业采用能够在不影响合规性的情况下处理大量生产的先进解决方案。

2024年,美国编码、标籤和检测包装设备市场占据64%的市场。美国市场的成长受到严格的标籤法规和大规模生产营运的推动。食品、製药和物流等关键产业越来越依赖先进的标籤和检测系统来简化其生产和分销工作流程。

编码、标籤和检测包装设备市场的领先公司包括多米诺 (Domino)、莱宾格 (Leibinger)、马肯依玛士 (Markem-Imaje)、伟迪捷 (Videojet)、Accutek Packaging Equipment、佐藤 (SATO)、HERMA、日立 IESA、科尔伯 (Korber AGmment、Corberzoan、HERMA、Axini Group、Corberxid Group (Korber AGx)、CKorber 组合、Cpini Group、Cpini Group、Campini Group、CakxA)。为了巩固市场地位,各公司专注于多种策略方针。创新仍然是公司的首要任务,公司在研发方面投入资金,以开发更智慧、更快速、更灵活的设备,并与数位供应链和工业 4.0 技术无缝整合。

企业正透过策略合作、收购和强化售后服务等方式拓展全球业务,以建立更紧密的客户关係并确保长期忠诚度。客製化和模组化设计受到重视,以满足不同行业的特定需求。此外,製造商透过创建节能係统和减少浪费,将永续性放在首位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 食品和饮料行业对标籤设备的需求不断增加

- 电子商务和物流的成长

- 产品认证和防伪需求不断成长

- 产业陷阱与挑战

- 整合复杂性

- 原物料价格波动

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按设备类型,2021 年至 2034 年

- 主要趋势

- 喷码设备

- 喷墨打码机

- 雷射打码机

- 其他的

- 贴标设备

- 压力

- 收缩套标

- 列印并应用

- 其他的

- 检测设备

- 机器视觉系统

- 洩漏检测

- 检重秤

- 金属探测器

- 其他的

第六章:市场估计与预测:依包装类型,2021 年至 2034 年

- 主要趋势

- 基本的

- 次要

- 第三

第七章:市场估计与预测:依营运模式,2021 年至 2034 年

- 主要趋势

- 手动的

- 半自动

- 自动的

第八章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 製药

- 化妆品和个人护理

- 电子产品

- 化学品

- 工业产品

- 其他的

第九章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直销

- 间接销售

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Accutek Packaging Equipment

- CVC Technologies

- Domino

- GEA

- HERMA

- Hitachi IESA

- Korber AG

- Leibinger

- Marchesini Group

- Markem-Imaje

- Paxiom

- Romaco Group

- SATO

- Uhlmann Group

- Videojet

The Global Coding, Labelling and Inspection Packaging Equipment Market was valued at USD 9.3 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 14.7 billion by 2034. These systems are vital components across industries such as pharmaceuticals, consumer goods, cosmetics, and food and beverages, supporting packaging and supply chain processes. Coding and labeling systems produce durable, high-quality labels that not only ensure compliance with diverse regulatory standards worldwide but also enhance brand identity and customer trust. Traceability remains a key factor, helping manufacturers efficiently manage product recalls and monitor batch information. Meanwhile, inspection equipment equipped with advanced cameras checks for defects in packaging, seals, and printed codes to maintain product integrity. Innovations like IoT integration, Industry 4.0 capabilities, and machine learning are significantly enhancing inspection precision and operational efficiency.

The market features numerous global players providing customizable and scalable equipment tailored to specific industry demands. These companies are actively expanding their portfolios with modular platforms that can be adapted to different product sizes, production speeds, and regulatory requirements. Manufacturers are focusing on solutions that can integrate seamlessly with existing automation infrastructures, allowing for greater flexibility and reduced downtime during equipment upgrades or format changes. Many players are also leveraging smart technologies-such as AI-driven inspection, cloud-based data analytics, and real-time monitoring systems-to enhance accuracy, efficiency, and traceability across supply chains.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.3 Billion |

| Forecast Value | $14.7 Billion |

| CAGR | 4.7% |

In 2024, the labeling equipment segment generated USD 4.2 billion. Labeling plays a crucial role in product visibility and consumer decision-making by conveying essential details such as price, quantity, and quality. As industries aim to boost inventory management, verify product authenticity, and improve customer engagement, demand for automated and smart labeling solutions is on the rise. Sectors like pharmaceuticals, personal care, and food are major drivers for labeling equipment, pushing the adoption of innovative technologies.

The food & beverage segment accounted for 44.6% share and generated USD 4.1 billion in 2024. Growing consumer demand for transparency, traceability, and compliance with stringent safety regulations is pushing food manufacturers to invest heavily in high-precision labeling systems like wrap-around and sticker labeling machines. Regulatory requirements in regions such as North America and Europe are motivating companies to adopt advanced solutions capable of handling high-volume production without compromising compliance.

United States Coding, Labelling & Inspection Packaging Equipment Market held a 64% share in 2024. The U.S. market's growth is driven by strict labeling regulations and large-scale manufacturing operations. Key industries, including food, pharmaceuticals, and logistics, increasingly depend on sophisticated labeling and inspection systems to streamline their production and distribution workflows.

Leading companies in the Coding, Labelling & Inspection Packaging Equipment Market include Domino, Leibinger, Markem-Imaje, Videojet, Accutek Packaging Equipment, SATO, HERMA, Hitachi IESA, Korber AG, Romaco Group, Uhlmann Group, CVC Technologies, Marchesini Group, GEA, and Paxiom. To strengthen their market position, companies focus on several strategic approaches. Innovation remains a priority, with investments in R&D to develop smarter, faster, and more flexible equipment that integrates seamlessly with digital supply chains and Industry 4.0 technologies.

Firms are expanding their global footprint through strategic partnerships, acquisitions, and enhanced after-sales services to build closer customer relationships and ensure long-term loyalty. Customization and modular design are emphasized to meet the specific needs of diverse industries. Additionally, manufacturers prioritize sustainability by creating energy-efficient systems and reducing waste.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Packaging type

- 2.2.4 Operation mode

- 2.2.5 End use industry

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for labelling equipment from food & beverages industry

- 3.2.1.2 Growth of e-commerce and logistics

- 3.2.1.3 Rising demand for product authentication & anti-counterfeiting

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Integration complexity

- 3.2.2.2 Fluctuating raw material prices

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 – 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Coding equipment

- 5.2.1 Inkjet coders

- 5.2.2 Laser coders

- 5.2.3 Others

- 5.3 Labeling equipment

- 5.3.1 Pressure-sensitive

- 5.3.2 Shrink sleeve

- 5.3.3 Print and apply

- 5.3.4 Others

- 5.4 Inspection equipment

- 5.4.1 Machine vision systems

- 5.4.2 Leak detection

- 5.4.3 Checkweighers

- 5.4.4 Metal detectors

- 5.4.5 Others

Chapter 6 Market Estimates and Forecast, By Packaging Type, 2021 – 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Primary

- 6.3 Secondary

- 6.4 Tertiary

Chapter 7 Market Estimates and Forecast, By Operation Mode, 2021 – 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Semi-automatic

- 7.4 Automatic

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Pharmaceuticals

- 8.4 Cosmetics & personal care

- 8.5 Electronics

- 8.6 Chemicals

- 8.7 Industrial products

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.1.1 Direct sales

- 9.1.2 Indirect sales

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Accutek Packaging Equipment

- 11.2 CVC Technologies

- 11.3 Domino

- 11.4 GEA

- 11.5 HERMA

- 11.6 Hitachi IESA

- 11.7 Korber AG

- 11.8 Leibinger

- 11.9 Marchesini Group

- 11.10 Markem-Imaje

- 11.11 Paxiom

- 11.12 Romaco Group

- 11.13 SATO

- 11.14 Uhlmann Group

- 11.15 Videojet