|

市场调查报告书

商品编码

1773368

完整预混料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Complete Premixes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

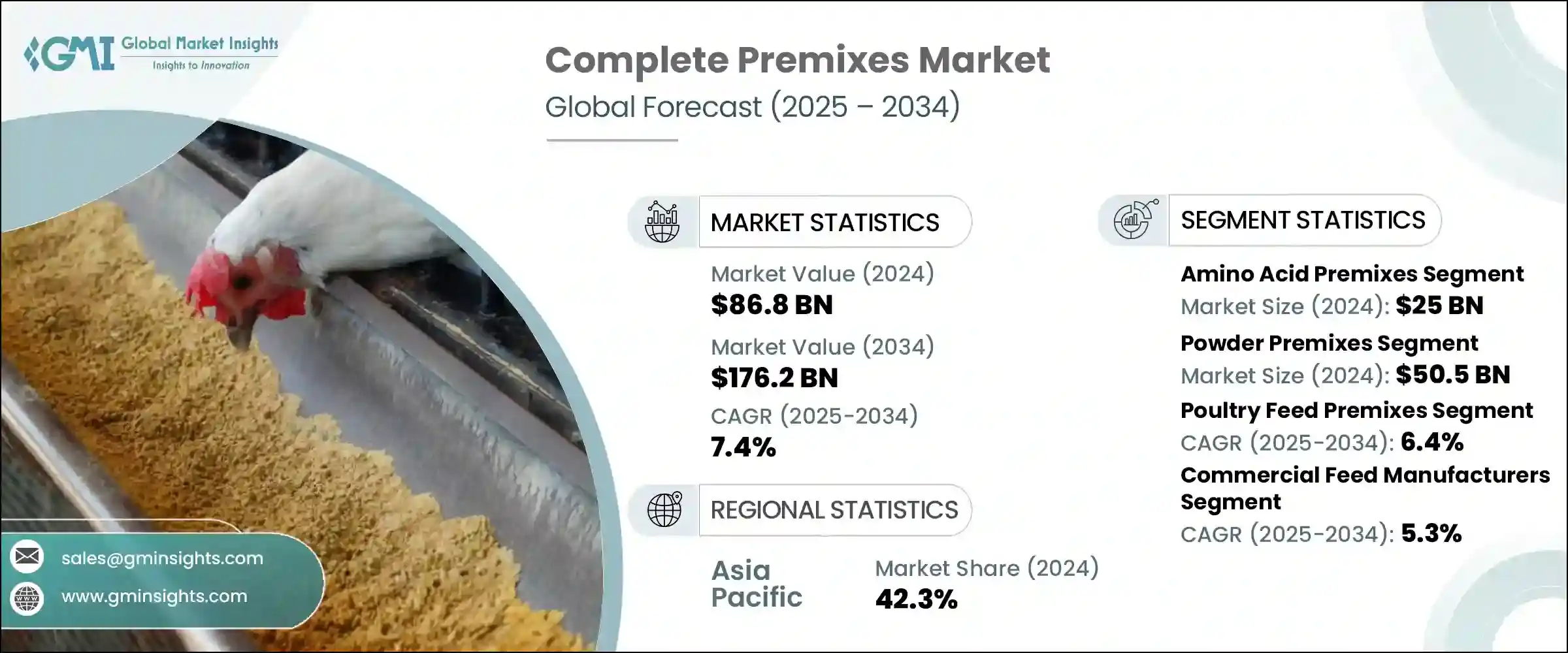

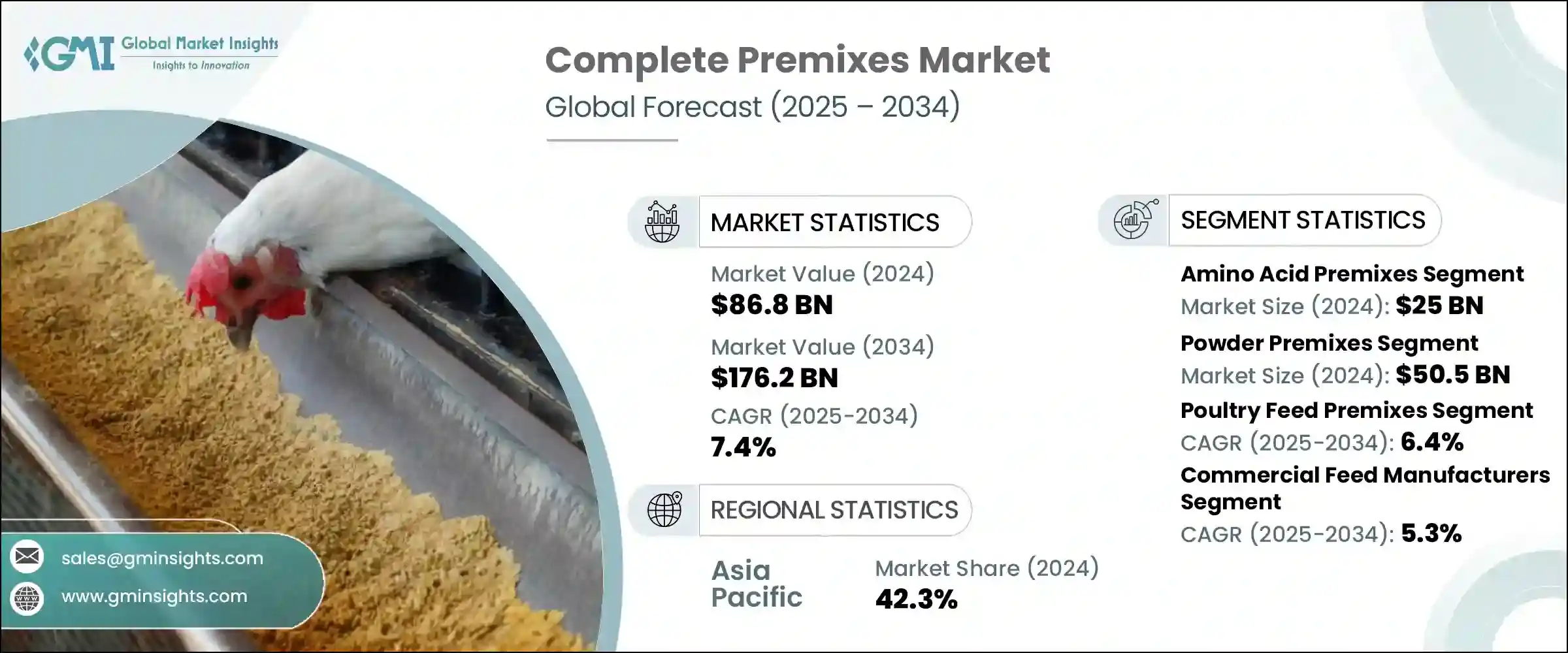

2024年,全球全价预混料市场规模达868亿美元,预计2034年将以7.4%的复合年增长率成长,达到1762亿美元。全价预混料是精心调配的混合料,含有维生素、矿物质、胺基酸、酵素和其他功能性成分等必需营养素,可确保宠物和人类食品的营养成分精准均衡。这些预混料在改善动物健康、促进生长、增强免疫力和提高生产力方面发挥重要作用。此外,它们也有助于解决强化食品体系中的微量营养素缺乏问题。由于技术进步、高蛋白饮食的兴起以及人们对健康和营养的意识不断增强,全球全价预混料市场正在蓬勃发展。

商业化畜牧养殖的兴起、客製化宠物营养需求的不断增长以及发展中国家食品强化计画的实施,推动了市场的成长机会。此外,对有机、专用和非基因改造预混料(包括药物混合料)的需求也不断增长。由于城镇化和营养计画对健康食品产业的支持,亚太、非洲和拉丁美洲等新兴市场的需求正在不断增长。预计在整个预混料行业配方和自动化创新的推动下,市场将实现长期成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 868亿美元 |

| 预测值 | 1762亿美元 |

| 复合年增长率 | 7.4% |

2024年,胺基酸预混料市场占28.8%的市场份额,价值250亿美元。由于对赖氨酸、蛋氨酸和苏氨酸等必需氨基酸的需求不断增长,该市场将继续占据主导地位。这些氨基酸用于家禽和猪饲料中,以提高生长率和饲料转换率。非必需胺基酸也因其在支持代谢过程中的作用而越来越受欢迎。农业领域对蛋白质平衡和精准营养的日益关注,促进了该市场的扩张。

2024年,粉末预混料市场以58.1%的市占率领先市场,价值达505亿美元。粉末预混料因其保质期长、运输便捷、配料精准和成本效益高而备受青睐。它们广泛应用于牲畜饲料、宠物食品和人类营养,特别用于干饲料和速食配方。粉末预混料也相容于批量混合系统,使其成为商业饲料製造商和农场混合作业的理想选择。

2024年,亚太地区全功能预混料市场占据42.3%的市占率。该地区畜牧业的蓬勃发展、对强化营养产品的需求以及政府支持的旨在改善食品安全和饲料效率的项目,是推动市场成长的关键因素。此外,可支配收入的提高、人口的增长以及水产养殖和宠物食品的日益普及等因素,也推动了食品和饲料行业对高品质功能性预混料的需求。

Nutreco NV、帝斯曼-芬美意、嘉吉公司、巴斯夫和阿彻丹尼尔斯米德兰公司 (ADM) 等公司凭藉创新和分销引领市场。他们持续投入研发,并建立强大的全球分销管道,巩固了在全价预混料市场的地位。为了巩固市场地位,全价预混料产业的领先公司专注于多种策略,包括与关键供应商建立策略合作伙伴关係、加强研发力度以打造客製化和有机预混料,以及透过收购和合併扩大地域覆盖范围。他们还透过非基因改造和药物混合等专业解决方案来增强产品供应。生产流程的自动化和智慧混合技术的引入进一步帮助企业简化营运并提高效率。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 维生素预混料

- 脂溶性与水溶性

- 矿物质预混料

- 宏观与微观矿物分割

- 螯合物与无机物形式

- 氨基酸预混料

- 必需胺基酸与非必需胺基酸

- 完整的维生素矿物质预混料

- 定製配方与标准配方

- 特种预混料

- 有机预混料

- 非基因改造预混料

- 药物预混料

- 效能增强预混料

第六章:市场估计与预测:依形式,2021 - 2034 年

- 主要趋势

- 粉末预混料

- 液体预混料

- 颗粒预混料

- 颗粒状预混料

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 家禽饲料预混料

- 猪饲料预混料

- 反刍动物饲料预混料

- 水产养殖饲料预混料

- 宠物食品预混料

- 其他应用

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 商业饲料製造商

- 畜牧业整合商

- 农场搅拌机

- 宠物食品製造商

- 特种饲料生产商

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- DSM-Firmenich

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Nutreco NV

- BASF SE

- Glanbia Nutritionals

- Alltech Inc.

- Kemin Industries

- Biomin Holding GmbH

- Lallemand Inc.

The Global Complete Premixes Market was valued at USD 86.8 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 176.2 billion by 2034. Complete premixes are meticulously blended mixtures containing essential nutrients such as vitamins, minerals, amino acids, enzymes, and other functional ingredients that ensure precise and uniform nutrition in both pet and human foods. These premixes play a significant role in improving animal health, supporting growth, enhancing immunity, and boosting productivity. Additionally, they help address micronutrient deficiencies in fortified food systems. The market for complete premixes is gaining momentum globally due to advancements in technology, a rise in protein-rich diets, and increased awareness surrounding health and nutrition.

Growth opportunities in the market are being driven by the rise of commercial livestock farming, the growing demand for customized pet nutrition, and food fortification initiatives in developing nations. There is also an increasing demand for organic, specialized, and non-GMO premixes, including medicated blends. Emerging markets in regions such as Asia-Pacific, Africa, and Latin America are seeing rising demand due to urbanization and nutritional initiatives supporting the health food sector. The market is expected to experience long-term growth fueled by innovations in formulation and automation within the complete premixes industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $86.8 Billion |

| Forecast Value | $176.2 Billion |

| CAGR | 7.4% |

The amino acid premixes segment held a 28.8% share in 2024, valued at USD 25 billion. This segment continues to dominate due to the rising need for essential amino acids, such as lysine, methionine, and threonine, used in poultry and swine feeds to improve growth and feed conversion rates. Non-essential amino acids are also gaining popularity for their role in supporting metabolic processes. The increasing focus on protein balance and precision nutrition within the agricultural sector has contributed to the segment's expansion.

The powder premixes segment led the market with a 58.1% share in 2024, valued at USD 50.5 billion. Powdered premixes are highly favored due to their long shelf life, ease of transportation, precise dosing, and cost-effectiveness. They are extensively used in livestock feed, pet foods, and human nutrition, particularly in dry feed and instant food formulations. Powdered premixes are also compatible with bulk mixing systems, making them ideal for commercial feed manufacturers and on-farm mixing operations.

Asia-Pacific Complete Premixes Market held a 42.3% share in 2024. The region's growing livestock sector, demand for fortified nutrition products, and government-backed programs aimed at improving food security and feed efficiency are key factors driving the market's growth. Additionally, factors such as rising disposable incomes, an expanding population, and the increasing popularity of aquaculture and pet foods contribute to the demand for high-quality functional premixes in both the food and feed sectors.

Companies like Nutreco N.V., DSM-Firmenich, Cargill Incorporated, BASF SE, and Archer Daniels Midland Company (ADM) lead the market through innovation and distribution. Their continued investment in research and development, along with the establishment of strong global distribution channels, has helped solidify their presence in the complete premixes market. To strengthen their market positions, leading companies in the complete premixes industry focus on a variety of strategies. These include strategic partnerships with key suppliers, increasing their R&D efforts to create customized and organic premixes, and expanding their geographic reach through acquisitions and mergers. They are also enhancing product offerings with specialized solutions such as non-GMO and medicated blends. Automation of production processes and the introduction of smart blending technologies further help companies streamline operations and improve efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Form

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Vitamin premixes

- 5.2.1 Fat-soluble vs water-soluble

- 5.3 Mineral premixes

- 5.3.1 Macro vs micro mineral segmentation

- 5.3.2 Chelated vs inorganic forms

- 5.4 Amino acid premixes

- 5.4.1 Essential vs non-essential amino acids

- 5.5 Complete vitamin-mineral premixes

- 5.5.1 Customized vs standard formulations

- 5.6 Specialty premixes

- 5.6.1 Organic premixes

- 5.6.2 Non-GMO premixes

- 5.6.3 Medicated premixes

- 5.6.4 Performance enhancement premixes

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder premixes

- 6.3 Liquid premixes

- 6.4 Granular premixes

- 6.5 Pelletized premixes

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Poultry feed premixes

- 7.3 Swine feed premixes

- 7.4 Ruminant feed premixes

- 7.5 Aquaculture feed premixes

- 7.6 Pet food premixes

- 7.7 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Commercial feed manufacturers

- 8.3 Livestock integrators

- 8.4 On-farm mixers

- 8.5 Pet food manufacturers

- 8.6 Specialty feed producers

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.3.7 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 DSM-Firmenich

- 10.2 Cargill, Incorporated

- 10.3 Archer Daniels Midland Company (ADM)

- 10.4 Nutreco N.V.

- 10.5 BASF SE

- 10.6 Glanbia Nutritionals

- 10.7 Alltech Inc.

- 10.8 Kemin Industries

- 10.9 Biomin Holding GmbH

- 10.10 Lallemand Inc.