|

市场调查报告书

商品编码

1773376

自动胶带应用系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automated Tape Application Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

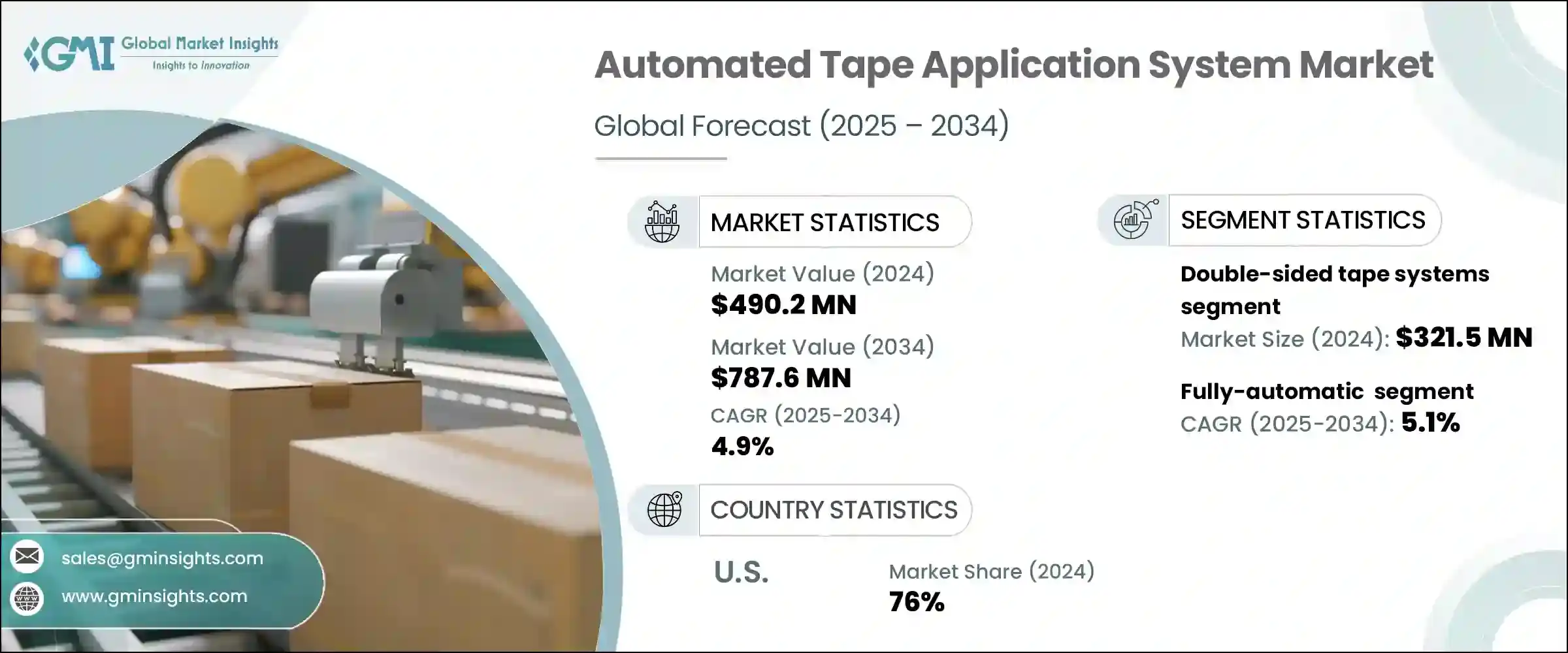

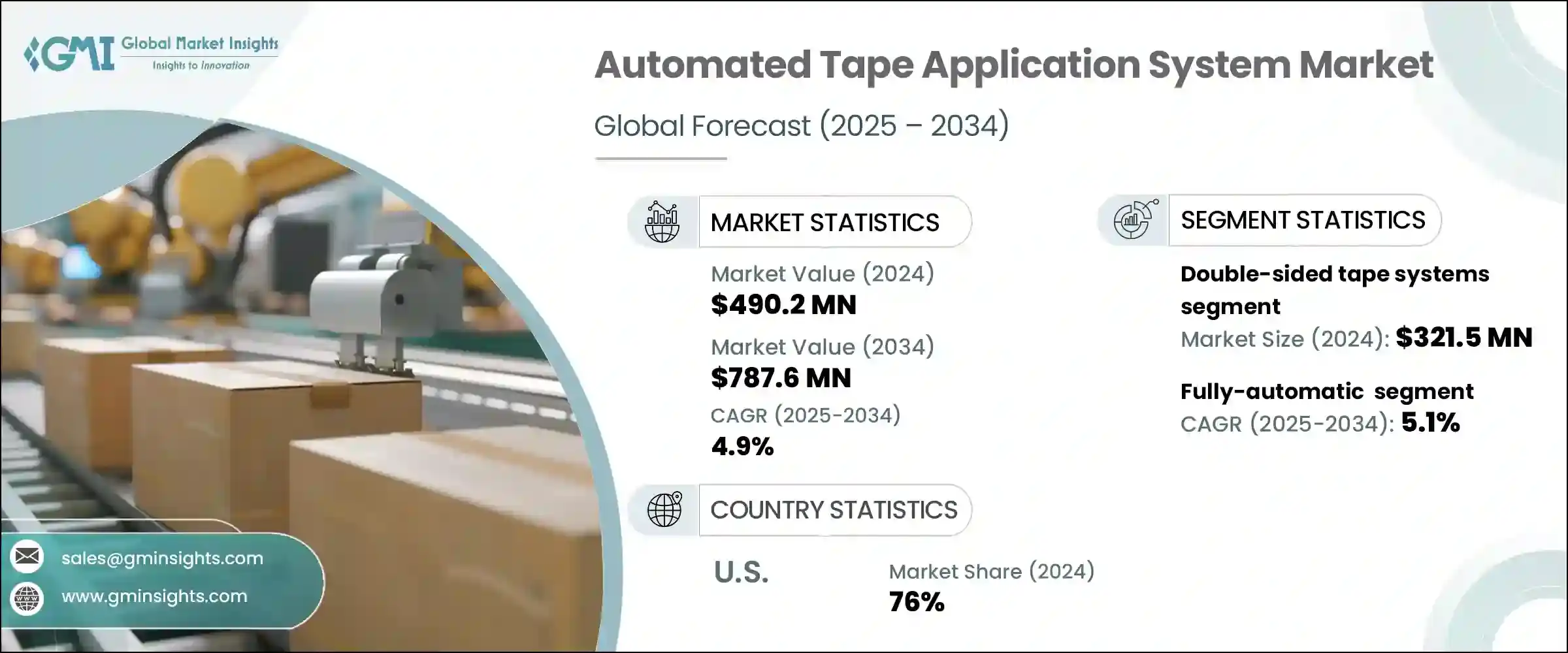

2024年,全球自动胶带应用系统市场规模达4.902亿美元,预计2034年将以4.9%的复合年增长率成长,达到7.876亿美元。该市场的成长主要得益于电子商务产业快速成长所推动的包装流程自动化程度的提升。随着对更快、更有效率包装解决方案的需求日益增长,企业越来越多地转向自动化系统。自动胶带应用系统在简化包装流程方面发挥着至关重要的作用,它能够提供可靠、一致的黏合效果,同时最大限度地减少对人工的需求。此外,这些系统还有助于减少胶带浪费和能源消耗,从而节省成本,提高生产力和永续性。

全自动配送中心的日益普及,尤其是在大型电商平台中,大大推动了全球自动胶带应用系统的普及。这些中心利用尖端机器人技术、人工智慧和机器视觉技术,旨在优化包装和物流的各个环节。随着电商公司寻求更快、更有效率的订单履行,对自动化的需求也随之激增,这使得自动胶带应用系统对于简化包装操作至关重要。为了应对这项需求激增,胶带应用系统製造商正在大力投资,开发更先进、更快速、更可靠的解决方案。这些投资不仅提高了系统性能,还降低了营运成本和能耗。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.902亿美元 |

| 预测值 | 7.876亿美元 |

| 复合年增长率 | 4.9% |

2024年,双面胶带系统细分市场产值达3.215亿美元,预计2025-2034年复合年增长率为5.3%。由于航太、建筑和消费电子等行业对高性能黏合和洁净表面的需求,该细分市场引领市场。双面胶带系统在需要直接、持久黏合的组装应用中具有优势,可消除可见的胶带痕迹。这些系统随着技术进步而不断发展,包括能够使用客製化胶带送料系统和自动化品质检测,从而提高了灵活性和可靠性。

全自动胶带应用系统市场在2024年占据59%的市场份额,预计在2025年至2034年期间的复合年增长率为5.1%。全自动系统尤其受汽车、电子和包装等需要高吞吐量、高精度和低干预的行业的青睐。这些系统利用整合机器人技术、机器视觉和基于人工智慧的控制技术,在确保品质稳定的同时最大限度地减少停机时间。工业4.0技术(包括即时监控和预测性维护)的日益普及,透过提高生产力和减少营运效率低下,进一步推动了这一趋势。

2024年,美国自动胶带应用系统市场占76%的市场份额,产值达9,820万美元。这一成长主要得益于製造业、汽车业、包装业和电子商务等各行各业对自动化解决方案的广泛采用。随着对更有效率、更快速、更可靠的胶带应用设备的需求不断增长,自动化系统市场持续扩张,尤其是在大量包装和组装作业领域。

自动胶带应用系统市场的主要参与者包括 Ambica Pharma Machines、APR Solutions、Cyklop、Daap Machinery、东莞科琪自动化设备、Global Packaging Automation、Intec Automation、Kylin Machines、Robo Tape、Robus India、Rocket Industrial、Smart Tec Automation、Straub Design Company Automation。自动胶带应用系统市场的公司正专注于各种策略以巩固其市场地位。这些策略包括大力投资研发,以提高产品的精度、效率和多功能性。公司也在探索合作伙伴关係和协作,以扩大其产品组合併拓展新的客户群。自动化和智慧技术(例如机器人、人工智慧和机器视觉)的整合是许多参与者提高系统可靠性和性能策略的核心。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 电子商务和包装自动化的兴起

- 製造业和工业自动化的成长

- 产业陷阱与挑战

- 初始投资成本高

- 整合复杂性

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 监管格局

- 标准和合规要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- Company market share analysis

- By region

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 单面胶带系统

- 双面胶带系统

第六章:市场估计与预测:依自动化水平,2021 - 2034 年

- 主要趋势

- 全自动

- 半自动

第七章:市场估计与预测:依包装类型,2021 - 2034 年

- 主要趋势

- 纸箱

- 瓦楞纸箱

- 外送袋

- 其他的

第八章:市场估计与预测:按产量,2021 - 2034 年

- 主要趋势

- 高达 1000 箱/小时

- 1000箱/小时至5000箱/小时

- 每小时5000箱以上

第九章:市场估计与预测:依最终用途产业,2021 - 2034 年

- 主要趋势

- 电子商务及配送中心

- 零售和消费品

- 食品和饮料

- 製药和医疗

- 物流与仓储

- 其他(电子、电器等)

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- Ambica Pharma Machines

- APR Solutions

- Cyklop

- Daap Machinery

- Dongguan KEQI automation equipment

- Global Packaging Automation

- Intec Automation

- Kylin Machines

- Robo Tape

- Robus India

- Rocket Industrial

- Smart Tec Automation

- Straub Design Company

- Vulkan Technic

- Wayne Automation

The Global Automated Tape Application Systems Market was valued at USD 490.2 million in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 787.6 million by 2034. This market is expanding primarily due to the rise in automation in packing processes, driven by the rapid growth of the e-commerce industry. As the demand for faster, more efficient packaging solutions intensifies, businesses are increasingly turning to automated systems. Automated tape application systems play a crucial role in streamlining packaging by providing reliable, consistent adhesion while minimizing the need for manual labor. Additionally, these systems contribute to cost savings in terms of reduced tape waste and energy consumption, enhancing both productivity and sustainability.

The growing presence of fully automated fulfillment centers, particularly among major e-commerce players, is significantly boosting the global adoption of automated tape application systems. These centers, which leverage cutting-edge robotics, artificial intelligence, and machine vision, are designed to optimize every aspect of packaging and logistics. As e-commerce companies seek faster and more efficient order fulfillment, the demand for automation has skyrocketed, making automated tape application systems crucial for streamlining packing operations. In response to this surge, manufacturers of tape application systems are making significant investments in developing more advanced, faster, and more reliable solutions. These investments are not only improving system performance but also reducing operational costs and energy consumption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $490.2 Million |

| Forecast Value | $787.6 Million |

| CAGR | 4.9% |

In 2024, the double-sided tape systems segment generated USD 321.5 million and is expected to grow at a CAGR of 5.3% during 2025-2034. This segment leads the market due to the demand from industries such as aerospace, construction, and consumer electronics, which require high-performance adhesion and clean finishes. Double-sided tape systems offer an advantage in assembly applications where direct, durable bonds are needed, eliminating visible tape lines. These systems continue to evolve with technological improvements, including the ability to utilize custom tape feed systems and automated quality inspections, increasing both flexibility and reliability.

The fully automatic tape application systems segment held 59% share in 2024 and is projected to grow at a CAGR of 5.1% between 2025 and 2034. Fully automated systems are particularly preferred in industries that require high throughput, precision, and minimal intervention, such as automotive, electronics, and packaging. These systems leverage integrated robotics, machine vision, and AI-based controls to ensure consistent quality while minimizing downtime. The growing adoption of Industry 4.0 technologies, including real-time monitoring and predictive maintenance, is further fueling this trend by improving productivity and reducing operational inefficiencies.

United States Automated Tape Application Systems Market held a 76% share in 2024, generating USD 98.2 million. This growth is largely driven by the widespread adoption of automated solutions across various sectors, including manufacturing, automotive, packaging, and e-commerce. As demand for more efficient, faster, and reliable tape application equipment increases, the market for automated systems continues to expand, particularly in high-volume packaging and assembly operations.

Key players in the Automated Tape Application Systems Market include Ambica Pharma Machines, APR Solutions, Cyklop, Daap Machinery, Dongguan KEQI Automation Equipment, Global Packaging Automation, Intec Automation, Kylin Machines, Robo Tape, Robus India, Rocket Industrial, Smart Tec Automation, Straub Design Company, Vulkan Technic, and Wayne Automation. Companies in the automated tape application systems market are focusing on various strategies to strengthen their market position. These include investing heavily in research and development to enhance the precision, efficiency, and versatility of their products. Companies are also exploring partnerships and collaborations to expand their product portfolios and reach new customer segments. Automation and integration of smart technologies, such as robotics, AI, and machine vision, are central to many players' strategies to improve the reliability and performance of their systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Automation Level

- 2.2.4 Packaging Type

- 2.2.5 Output Capacity

- 2.2.6 End Use Industry

- 2.2.7 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in E-commerce and Packaging Automation

- 3.2.1.2 Growth in Manufacturing and Industrial Automation

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Initial Investment Costs

- 3.2.2.2 Integration Complexity

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.1.1 Company market share analysis

- 4.1.2 By region

- 4.1.2.1 North America

- 4.1.2.2 Europe

- 4.1.2.3 Asia Pacific

- 4.1.2.4 Latin America

- 4.1.2.5 MEA

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New Product Launches

- 4.5.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Million, Thousand Units)

- 5.1 Key trends

- 5.2 Single-sided tape systems

- 5.3 Double-sided tape systems

Chapter 6 Market Estimates & Forecast, By Automation Level, 2021 - 2034 ($Million, Thousand Units)

- 6.1 Key trends

- 6.2 Fully automatic

- 6.3 Semi-automatic

Chapter 7 Market Estimates & Forecast, By Packaging Type, 2021 - 2034 ($Million, Thousand Units)

- 7.1 Key trends

- 7.2 Cardboard boxes

- 7.3 Corrugated boxes

- 7.4 Delivery bags

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Output Capacity, 2021 - 2034 ($Million, Thousand Units)

- 8.1 Key trends

- 8.2 Up to 1000 cartons/hour

- 8.3 1000 cartons/hour to 5,000 cartons/hour

- 8.4 above 5,000 cartons/hour

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Million, Thousand Units)

- 9.1 Key trends

- 9.2 E-commerce & fulfillment centers

- 9.3 Retail & consumer goods

- 9.4 Food & beverage

- 9.5 Pharmaceutical & medical

- 9.6 Logistics & warehousing

- 9.7 Others( electronics & appliances, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Million, Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Million, Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Ambica Pharma Machines

- 12.2 APR Solutions

- 12.3 Cyklop

- 12.4 Daap Machinery

- 12.5 Dongguan KEQI automation equipment

- 12.6 Global Packaging Automation

- 12.7 Intec Automation

- 12.8 Kylin Machines

- 12.9 Robo Tape

- 12.10 Robus India

- 12.11 Rocket Industrial

- 12.12 Smart Tec Automation

- 12.13 Straub Design Company

- 12.14 Vulkan Technic

- 12.15 Wayne Automation