|

市场调查报告书

商品编码

1773379

生物基电池市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Bio Based Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

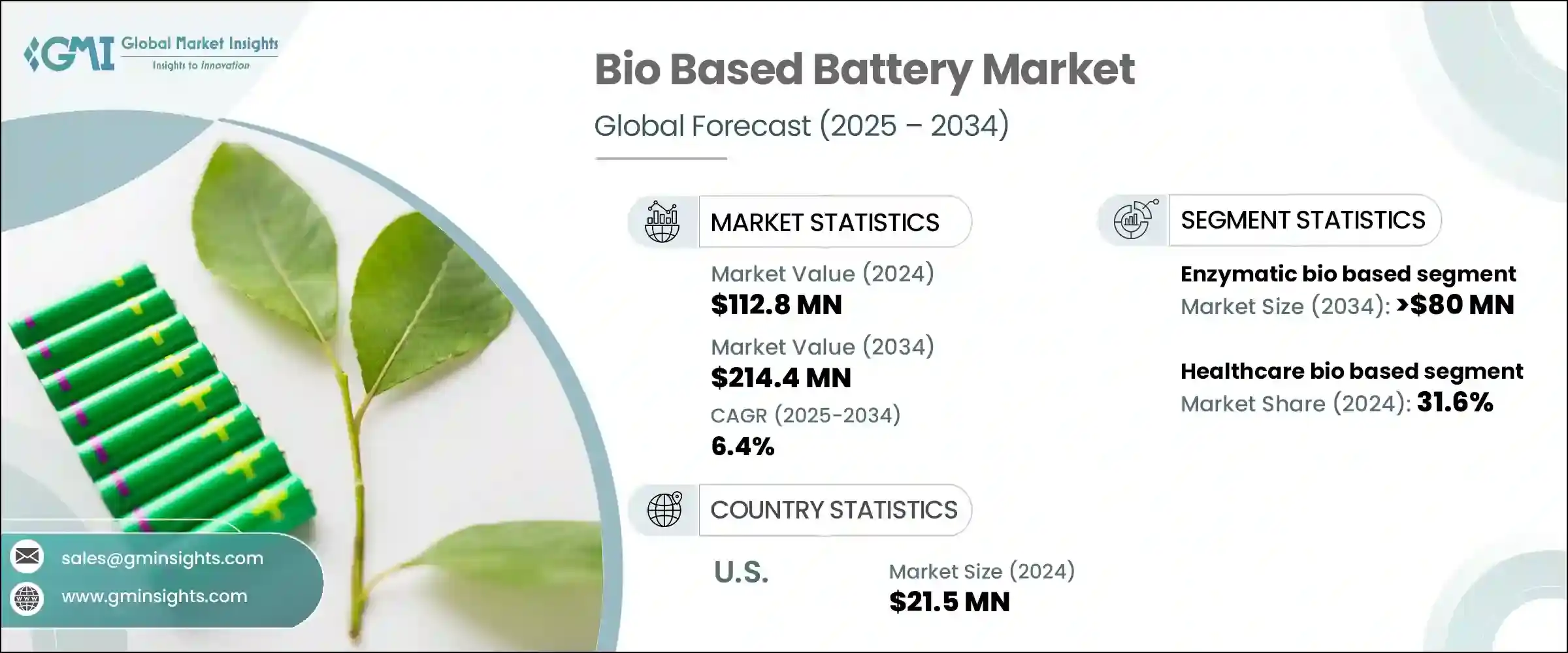

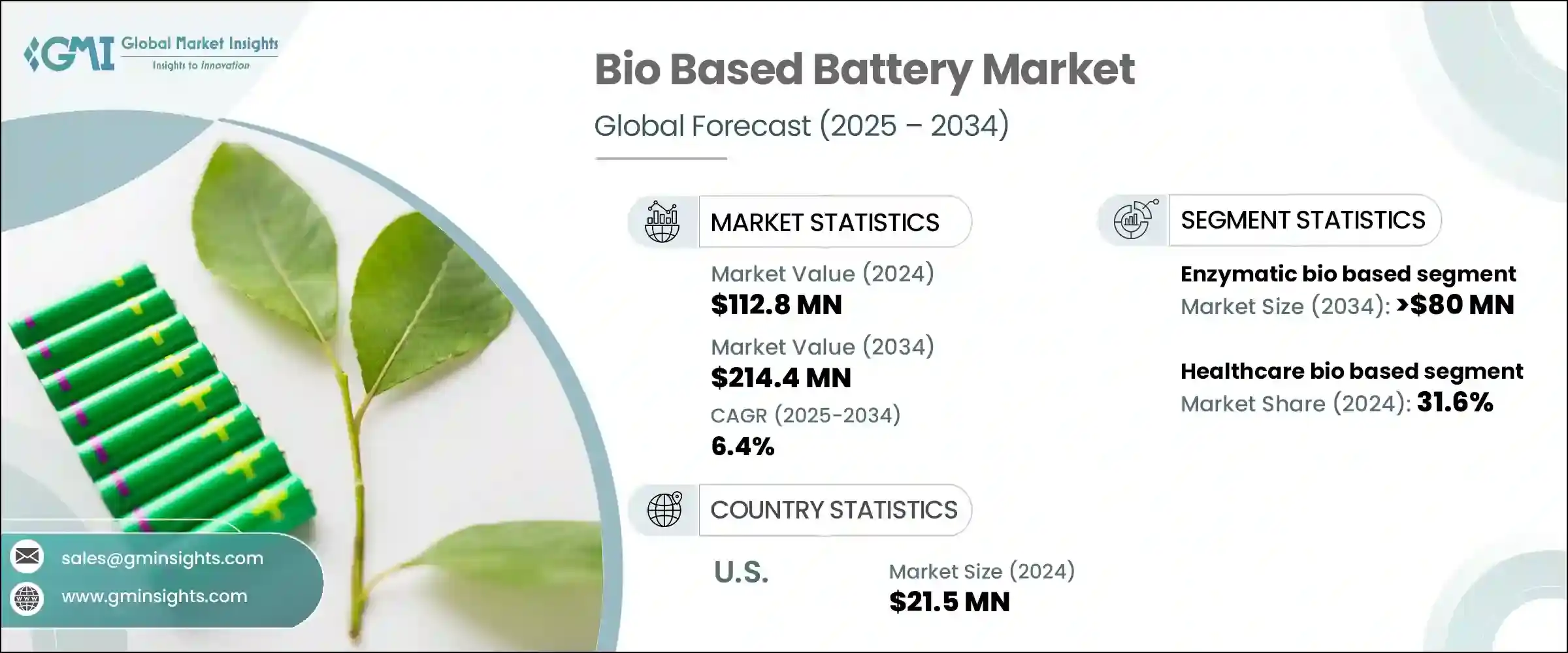

2024年,全球生物基电池市场规模达1.128亿美元,预估年复合成长率为6.4%,到2034年将达2.144亿美元。锂、钴和镍等关键金属的成本上升和供应有限,促使电池製造商重新思考传统化学工艺,并投资于可再生和可生物降解材料。生物基电池因其环保特性、更安全的化学特性以及在生产和处置过程中增强永续性的潜力,提供了极具吸引力的价值主张。这些特性与各行各业日益重视减少生态足迹的趋势相契合。

随着人们对传统电池有害废物处理的担忧日益加剧,监管机构正加强对永续性的关注,推动製造商寻求更环保的替代方案。推动这一转变的关键监管变化之一是实施延伸生产者责任政策,该政策要求製造商管理其产品的生命週期。这些不断发展的合规规范迫使生产商采用循环经济模式,鼓励使用可回收和天然来源的材料。因此,对于那些希望在保持功能和性能的同时向清洁能源转型的行业来说,生物基电池正逐渐成为可行的解决方案。生物基组件越来越多地融入柔性、便携式和可穿戴电子产品中,这也推动了市场的成长——这些领域需要无毒、紧凑且高性能的能源。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.128亿美元 |

| 预测值 | 2.144亿美元 |

| 复合年增长率 | 6.4% |

酵素生物基电池领域正在快速发展,预计到2034年其市场规模将超过8,000万美元。由于酵素技术的创新以及奈米材料增强电极的引入,这些电池的效率和能量密度显着提高,正受到业界的关注。目前,重点正转向提升这些电池的结构完整性和使用寿命,以支援其在不同平台上的应用。开发人员优先考虑设计的适应性和材料创新,这反过来又拓宽了其在下一代能源系统中的部署范围。随着酵素电池的不断发展,预计它们将成为全球生物基能源生态系统扩张的关键贡献者。

在应用方面,医疗保健产业占据了相当大的市场需求份额,2024 年将达到 31.6%。生物基电池正越来越多地被应用于医疗器械,这得益于镁、锌和生物聚合物等材料,这些材料能够安全且灵活地整合到可穿戴和植入式技术中。这些材料有助于创建生物相容性的能源解决方案,为低压医疗设备供电,而不会将有害残留物引入人体或环境。这一趋势反映了医疗保健领域正朝着永续创新的方向转变,这些创新旨在提高患者安全性,同时减少对环境的影响。

美国在生物基电池技术发展中仍扮演关键角色。 2024年,美国生物基电池市场规模将达到2,150万美元,高于2023年的2,060万美元及2022年的1,960万美元。推动这一成长趋势的动力源于新创公司和研究机构不断增加的投资,这些机构正在探索可生物降解化合物和替代电极材料的使用。这些努力旨在最大限度地减少对稀土元素的依赖,并引入更具韧性、更环保的储能係统。地方措施也受到政府主导的清洁技术创新和绿色製造项目的影响,这使得美国在全球向永续电池解决方案转型的过程中处于领先地位。

预计到2034年,北美生物基电池市场的复合年增长率将达到5.8%。该地区对能源基础设施脱碳和推广再生能源技术的坚定承诺,正在推动可生物降解储能设备的普及。扶持性政策加上积极的研发资金投入,正在为生物基电池的广泛市场应用奠定基础。消费性电子产品和能源管理系统对可扩展清洁能源解决方案的需求尤其强劲。北美对环境问责的推动,为创新者创造了部署先进电池系统的机会,这些系统符合面向未来、气候适应性强的目标。

全球生物基电池市场的竞争格局由众多技术供应商和储能先锋共同塑造。顶尖公司高度重视利用再生能源优化电池架构,同时确保高效能和可扩展性。他们最新的产品线专为整合到紧凑灵活的系统中而设计,旨在满足产业向低功耗、永续设备转型的需求。先进的绝缘技术、可降解组件和灵活的模组化设计等特性是其策略的核心,使其始终处于下一代电池创新的前沿。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 酵素

- 糖

- 微生物

- 其他的

第六章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 卫生保健

- 消费性电子产品

- 电动车

- 固定式储能

- 物联网设备和感测器

- 其他的

第七章:市场规模及预测:依销售管道,2021 - 2034 年

- 主要趋势

- 在线的

- 经销商

- 零售

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 法国

- 英国

- 波兰

- 义大利

- 西班牙

- 奥地利

- 德国

- 瑞典

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 菲律宾

- 日本

- 韩国

- 澳洲

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 伊朗

- 阿联酋

- 奈及利亚

- 南非

- 拉丁美洲

- 阿根廷

- 智利

- 巴西

第九章:公司简介

- BeFC

- CarbonScape Ltd.

- CMBlu Energy AG

- Contemporary Amperex Technology Co., Limited

- Greenvolt Group

- Hitachi High-Tech Corporation

- Indi Energy

- KEMIWATT

- Kiverdi, Inc.

- LG Communication Center, HSAD

- Ligna Energy

- Nanjing CBAK New Energy Technology, Co., Ltd.

- Nexeon Ltd.

- Nexus Solar Energy

- Panasonic Energy Co., Ltd.

- Saft

The Global Bio Based Battery Market was valued at USD 112.8 million in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 214.4 million by 2034. The rising costs and limited availability of critical metals like lithium, cobalt, and nickel are prompting battery manufacturers to rethink conventional chemistries and invest in renewable and biodegradable materials. Bio-based batteries offer a compelling value proposition due to their environmentally friendly nature, safer chemical profiles, and potential for enhanced sustainability in production and disposal. These attributes align well with the growing emphasis on reducing ecological footprints across multiple sectors.

As concerns intensify regarding hazardous waste disposal from traditional batteries, regulatory bodies are tightening their focus on sustainability, pushing manufacturers toward greener alternatives. One of the key regulatory shifts driving this transformation is the implementation of extended producer responsibility policies, which place the onus on manufacturers to manage the lifecycle of their products. These evolving compliance norms are compelling producers to adopt circular economic models, encouraging the use of recyclable and naturally sourced materials. Consequently, bio-based batteries are emerging as a viable solution for sectors aiming to transition toward cleaner energy while maintaining functionality and performance. The market's growth is also supported by the increasing integration of bio-based components into flexible, portable, and wearable electronics-segments that demand non-toxic, compact, and high-performing energy sources.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $112.8 Million |

| Forecast Value | $214.4 Million |

| CAGR | 6.4% |

The enzymatic bio-based battery segment is experiencing rapid advancements and is anticipated to surpass USD 80 million by 2034. These batteries are garnering industry attention due to innovations in enzyme technology and the incorporation of nanomaterial-enhanced electrodes, which significantly improve efficiency and energy density. The focus is now shifting toward improving the structural integrity and lifespan of these batteries to support their application across diverse platforms. Developers are prioritizing design adaptability and material innovation, which in turn is broadening the scope for deployment in next-generation energy systems. As enzymatic batteries continue to evolve, they are expected to become a key contributor to the expansion of the global bio-based energy ecosystem.

In terms of application, the healthcare industry accounts for a significant portion of market demand, holding a 31.6% share in 2024. Bio-based batteries are increasingly being tailored for use in medical devices, benefiting from materials such as magnesium, zinc, and biopolymers that support safe and flexible integration into wearable and implantable technologies. These materials allow for the creation of biocompatible energy solutions that can power low-voltage medical equipment without introducing harmful residues into the body or environment. The trend reflects a broader shift in healthcare toward sustainable innovations that improve patient safety while reducing environmental impact.

The United States remains a critical player in the development of bio-based battery technologies. The market in the country reached USD 21.5 million in 2024, up from USD 20.6 million in 2023 and USD 19.6 million in 2022. The upward trajectory is being driven by rising investments from startups and research entities that are exploring the use of biodegradable compounds and alternative electrode materials. These efforts are aimed at minimizing dependence on rare earth elements and introducing more resilient, eco-conscious energy storage systems. Local initiatives are also being shaped by government-led programs focused on clean technology innovation and green manufacturing, positioning the U.S. as a frontrunner in the global shift toward sustainable battery solutions.

Across North America, the market for bio-based batteries is set to expand at a CAGR of 5.8% through 2034. A strong regional commitment to decarbonizing energy infrastructure and promoting renewable technologies is encouraging the adoption of biodegradable energy storage devices. Supportive policies, combined with active funding for research and development, are laying the groundwork for widespread market acceptance. The demand is particularly strong in consumer electronics and energy management systems that require scalable and clean energy solutions. North America's push for environmental accountability is creating opportunities for innovators to deploy advanced battery systems that align with future-ready, climate-resilient goals.

The competitive landscape of the global bio-based battery market is shaped by a mix of technology providers and energy storage pioneers. The top firms are heavily focused on optimizing battery architecture using renewable inputs while ensuring high performance and scalability. Their latest product lines are engineered for integration into compact, flexible systems and are designed to meet the needs of industries transitioning to low-power, sustainable devices. Features such as advanced insulation, degradable components, and modular design flexibility are central to their strategies, positioning them at the forefront of next-gen battery innovation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Enzymatic

- 5.3 Sugar

- 5.4 Microbial

- 5.5 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Healthcare

- 6.3 Consumer electronics

- 6.4 Electric vehicles

- 6.5 Stationary energy storage

- 6.6 IoT devices & sensors

- 6.7 Others

Chapter 7 Market Size and Forecast, By Sales Channel, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Online

- 7.3 Dealer

- 7.4 Retail

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 France

- 8.3.2 UK

- 8.3.3 Poland

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Germany

- 8.3.8 Sweden

- 8.3.9 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Philippines

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Australia

- 8.4.7 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 Iran

- 8.5.3 UAE

- 8.5.4 Nigeria

- 8.5.5 South Africa

- 8.6 Latin America

- 8.6.1 Argentina

- 8.6.2 Chile

- 8.6.3 Brazil

Chapter 9 Company Profiles

- 9.1 BeFC

- 9.2 CarbonScape Ltd.

- 9.3 CMBlu Energy AG

- 9.4 Contemporary Amperex Technology Co., Limited

- 9.5 Greenvolt Group

- 9.6 Hitachi High-Tech Corporation

- 9.7 Indi Energy

- 9.8 KEMIWATT

- 9.9 Kiverdi, Inc.

- 9.10 LG Communication Center, HSAD

- 9.11 Ligna Energy

- 9.12 Nanjing CBAK New Energy Technology, Co., Ltd.

- 9.13 Nexeon Ltd.

- 9.14 Nexus Solar Energy

- 9.15 Panasonic Energy Co., Ltd.

- 9.16 Saft