|

市场调查报告书

商品编码

1773401

产后益生菌补充剂市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Postnatal Probiotic Supplements Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

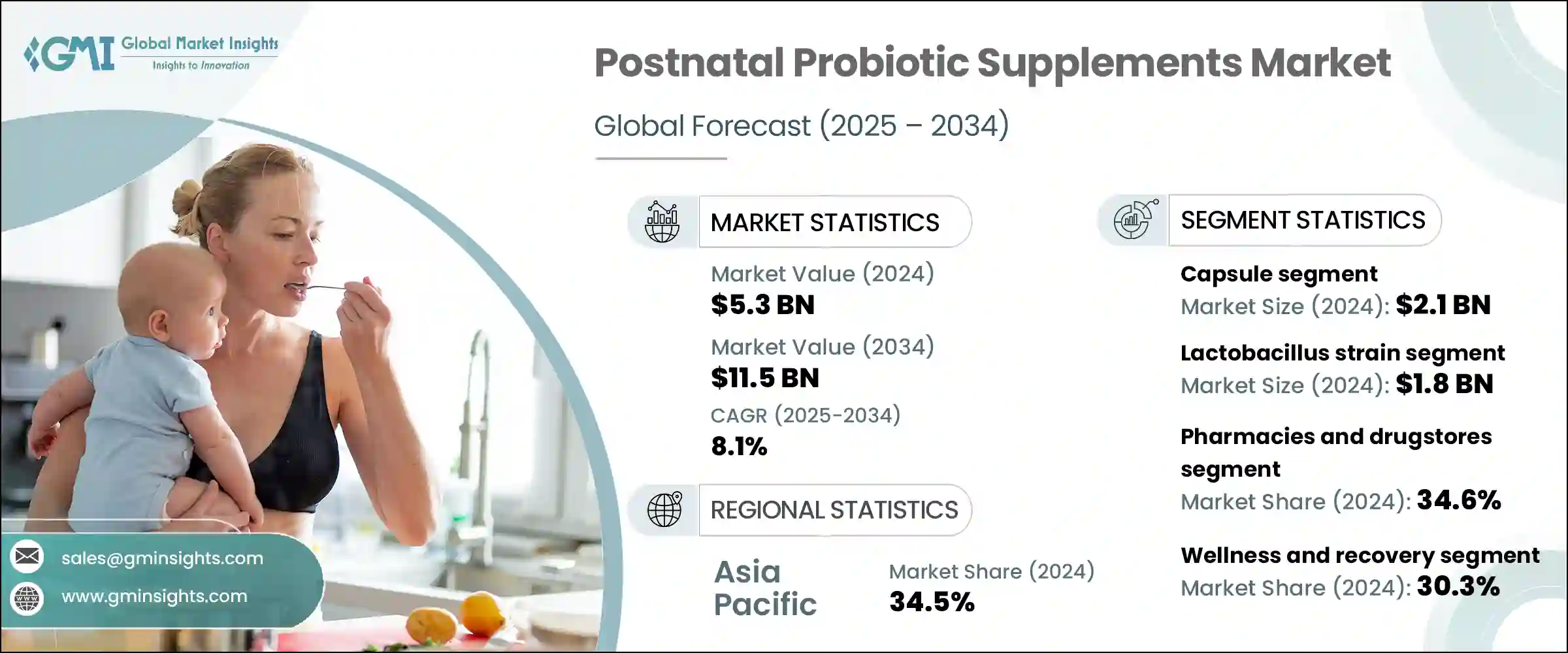

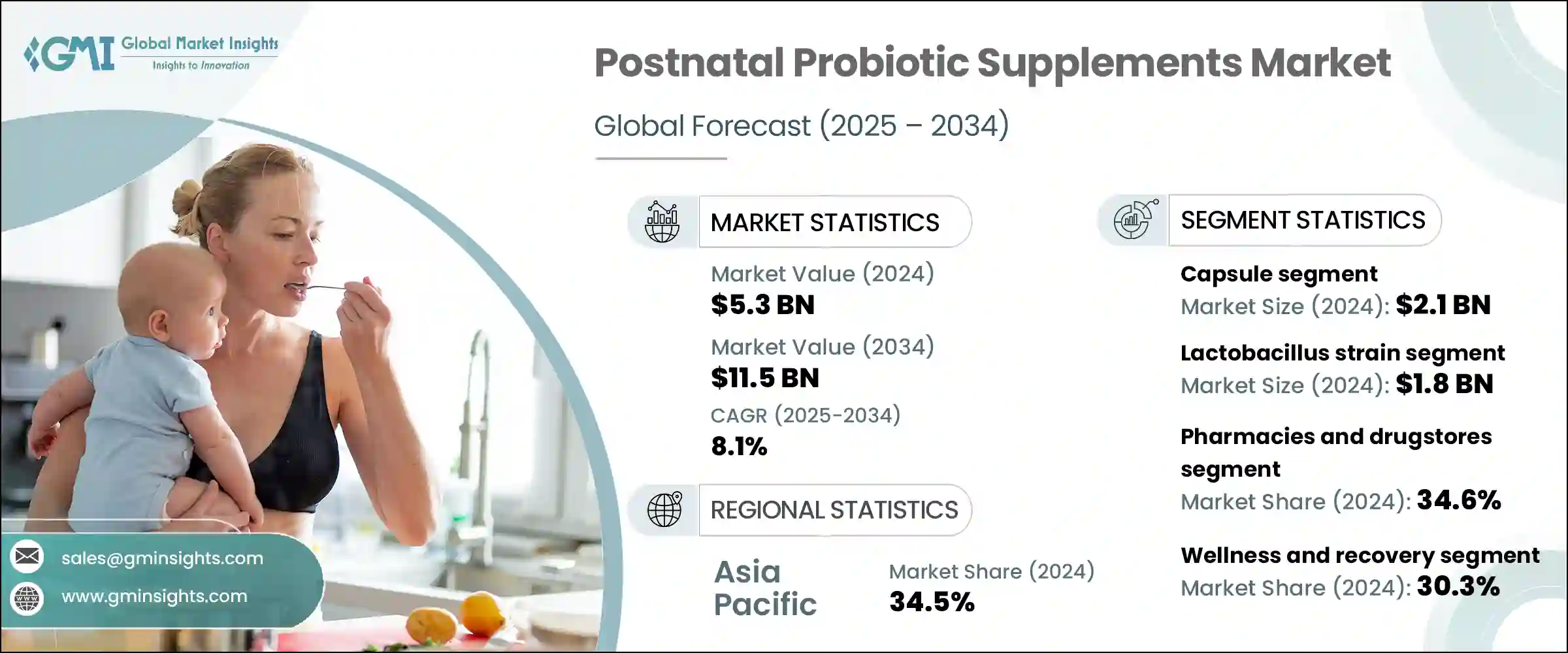

2024年,全球产后益生菌补充剂市场价值为53亿美元,预计到2034年将以8.1%的复合年增长率成长,达到115亿美元。这些补充剂配方含有多种有益菌种,主要来自乳酸桿菌和双歧桿菌,有助于维持产后健康。它们有助于恢復肠道平衡,增强免疫反应,预防乳腺炎等感染,并促进情绪和消化系统健康。

消费者对产后自然和功能性恢復方案的兴趣日益浓厚,是推动成长的关键因素。随着线上和零售通路的扩张,人们对孕产妇护理的认识不断提高,也刺激了需求。此外,生育率高且孕产妇保健计画可近性不断提高的新兴经济体也带来了强劲的扩张机会。对个人化配方和经临床验证的多菌株解决方案的需求正在进一步塑造产品格局。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 53亿美元 |

| 预测值 | 115亿美元 |

| 复合年增长率 | 8.1% |

随着越来越多的医疗保健专业人士认可这些产品,以及各大品牌持续投资扩大其产品组合,市场必将加速创新并得到更广泛的应用。特定菌株益处的临床验证正在提升信任度和需求,促使各公司推出针对产后需求(例如荷尔蒙平衡、消化支持和免疫功能)的针对性配方。

生物技术公司与学术机构之间日益增长的研究合作也推动了基于科学研究成果的产品开发。同时,零售通路的扩大,尤其是透过数位平台,使全球新手妈妈更容易获得这些补充剂。随着宣传活动和教育推广的加强,产后益生菌补充剂的采用率预计将大幅提升,使其成为现代孕产妇保健习惯的核心组成部分。

胶囊市场占39.3%的市占率,2024年销售额达21亿美元。其主导地位源自于其易用性、长期保质期、精准剂量以及与多菌株配方的兼容性。胶囊尤其受到产后消费者的欢迎,因为它们可以随餐或空腹服用,而且可靠性高。临床机构和药局也青睐胶囊给药方式,这增强了胶囊的可靠性和市场接受度。许多市场领先的配方都包含关键的菌株,可以有效促进产后母亲的肠道和免疫健康。

2024年,乳酸桿菌菌株市占比34.3%,价值18亿美元。这些菌株,尤其是像嗜酸乳桿菌、唾液乳桿菌和鼠李糖乳桿菌这样经过深入研究的菌株,因其耐酸性、强大的肠道定植能力以及已被证实的产后健康益处而备受青睐。它们在减轻发炎、改善消化功能和减少常见产后问题方面发挥着至关重要的作用,使其成为大多数针对新妈妈的高端配方奶粉的首选。

2024年,亚太地区产后益生菌补充剂市场占有34.5%的份额。由于产后恢復意识高涨以及功能性营养解决方案的使用日益增多,该地区各国继续占据主导地位。以产后復原为中心的文化习俗也为益生菌产品的推广创造了有利条件,这些产品有助于消化和免疫。透过药局、线上平台和健康商店购买益生菌补充剂的管道日益普及,进一步推动了这一成长。

利洁时集团 (Reckitt Benckiser Group plc)、达能公司 (Danone SA)、雅培实验室 (Abbott Laboratories)、雀巢公司 (Nestle SA) 和 BioGaia AB 等知名公司透过推出客製化产品和提升消费者参与度,推动了该地区的分销和创新。产后益生菌领域的领先品牌专注于个人化产品开发、菌株特异性研究以及与医疗保健专业人士的合作,以巩固其市场地位。为了维持竞争力,各公司正在加大研发投入,开发经临床验证的多菌株配方,以解决免疫力和肠道健康等产后问题。许多公司也正在扩大其电商业务和直销管道,以扩大覆盖范围。透过育儿平台、社群媒体和健康领域影响力人士进行策略性行销,有助于教育和吸引新用户。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 胶囊

- 粉末

- 软糖

- 液体

- 其他(软胶囊、小袋)

第六章:市场估计与预测:按益生菌菌株,2021 - 2034 年

- 主要趋势

- 乳酸桿菌属

- 鼠李糖乳桿菌

- 唾液乳酸桿菌

- 嗜酸乳桿菌

- 8.2 双歧桿菌种类

- 长双歧桿菌

- 乳酸双歧桿菌

- 多菌株配方

- 新兴菌株

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 网路零售

- 药局和药局

- 超市和大卖场

- 保健品专卖店

- 医疗保健设施

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 消化健康支持

- 增强免疫系统

- 情绪和心理健康支持

- 乳腺炎的预防和治疗

- 整体健康和康復

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Abbott Laboratories

- BioGaia AB

- Danone SA

- Nestle SA

- Bayer AG

- Reckitt Benckiser Group plc

- DuPont Nutrition & Biosciences

The Global Postnatal Probiotic Supplements Market was valued at USD 5.3 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 11.5 billion by 2034. These supplements are formulated with beneficial strains of bacteria, primarily from the Lactobacillus and Bifidobacterium families, to support postpartum wellness. They aid in restoring gut balance, enhancing immune response, preventing infections such as mastitis, and contributing to emotional and digestive well-being.

Rising consumer interest in natural and functional recovery options after childbirth is a key factor fueling growth. Growing awareness around maternal care, supported by increasing online and retail distribution, is also amplifying demand. In addition, emerging economies with high birth rates and improving access to maternal health programs present strong expansion opportunities. The need for personalized formulations and clinically validated, multi-strain solutions is further shaping the product landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 8.1% |

The market is set for accelerated innovation and broader adoption as more healthcare professionals endorse these products, and major brands continue to invest in expanding their portfolios. Clinical validation of strain-specific benefits is driving greater trust and demand, prompting companies to introduce targeted formulations tailored to postpartum needs such as hormonal balance, digestive support, and immune function.

Increasing research collaborations between biotech firms and academic institutions are also fueling product development rooted in science-backed outcomes. Simultaneously, expanding retail availability, especially through digital platforms, makes these supplements more accessible to new mothers globally. As awareness campaigns and educational outreach strengthen, the adoption of postnatal probiotic supplements is expected to rise significantly, turning them into a core component of modern maternal health routines.

The capsules segment held a 39.3% share and generated USD 2.1 billion in 2024. Their dominance is tied to ease of use, long shelf stability, precise dosing, and compatibility with multi-strain formulations. Capsules are particularly popular with postpartum consumers due to their ability to be taken with or without meals and their perceived reliability. Clinical settings and pharmacies also favor capsule delivery, which adds to their strong credibility and uptake. Many market-leading formulations include key bacterial strains that address gut and immune health in mothers following childbirth.

The Lactobacillus strain segment accounted for a 34.3% share in 2024, amounting to USD 1.8 billion. These strains-especially well-researched types like L. acidophilus, L. salivarius, and L. rhamnosus-are prominent due to their acid resistance, strong gut colonization ability, and proven benefits for postnatal health. They play a crucial role in reducing inflammation, improving digestion, and minimizing common postpartum issues, making them a preferred choice in most premium formulations targeting new mothers.

Asia Pacific Postnatal Probiotic Supplements Market held a 34.5% share in 2024. Countries across this region continue to dominate due to high awareness of postnatal recovery and the increasing use of functional nutrition solutions. Cultural practices centered on postpartum healing also create favorable conditions for the adoption of probiotic products that support digestion and immunity. This growth is further supported by growing access to supplements through pharmacies, online platforms, and wellness stores.

Prominent companies like Reckitt Benckiser Group plc, Danone S.A., Abbott Laboratories, Nestle S.A., and BioGaia AB have helped in driving distribution and innovation within the region through tailored product launches and growing consumer engagement. Leading brands in the postnatal probiotic sector are focused on personalized product development, strain-specific research, and partnerships with healthcare professionals to strengthen their market position. To stay competitive, companies are increasing R&D investments to develop clinically proven, multi-strain formulas targeting postpartum concerns like immunity and gut health. Many are also expanding their e-commerce footprint and direct-to-consumer sales to boost reach. Strategic marketing through parenting platforms, social media, and wellness influencers helps educate and attract new users.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Probiotic strain

- 2.2.4 Distribution channel

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Capsules

- 5.3 Powders

- 5.4 Gummies

- 5.5 Liquids

- 5.6 Others (soft gels, sachets)

Chapter 6 Market Estimates and Forecast, By Probiotic Strain, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Lactobacillus species

- 6.2.1 L. rhamnosus

- 6.2.2 L. salivarius

- 6.2.3 L. acidophilus

- 6.3 8.2 Bifidobacterium species

- 6.3.1 B. longum

- 6.3.2 B. lactis

- 6.4 Multi-strain formulations

- 6.5 Emerging strains

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Online retail

- 7.3 Pharmacies and drug stores

- 7.4 Supermarkets and hypermarkets

- 7.5 Specialty health stores

- 7.6 Healthcare facilities

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Digestive health support

- 8.3 Immune system enhancement

- 8.4 Mood and mental health support

- 8.5 Mastitis prevention and treatment

- 8.6 Overall wellness and recovery

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.3.7 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 BioGaia AB

- 10.3 Danone S.A.

- 10.4 Nestle S.A.

- 10.5 Bayer AG

- 10.6 Reckitt Benckiser Group plc

- 10.7 DuPont Nutrition & Biosciences