|

市场调查报告书

商品编码

1773425

钛铝化物 (TiAl) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Titanium Aluminides (TiAl) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

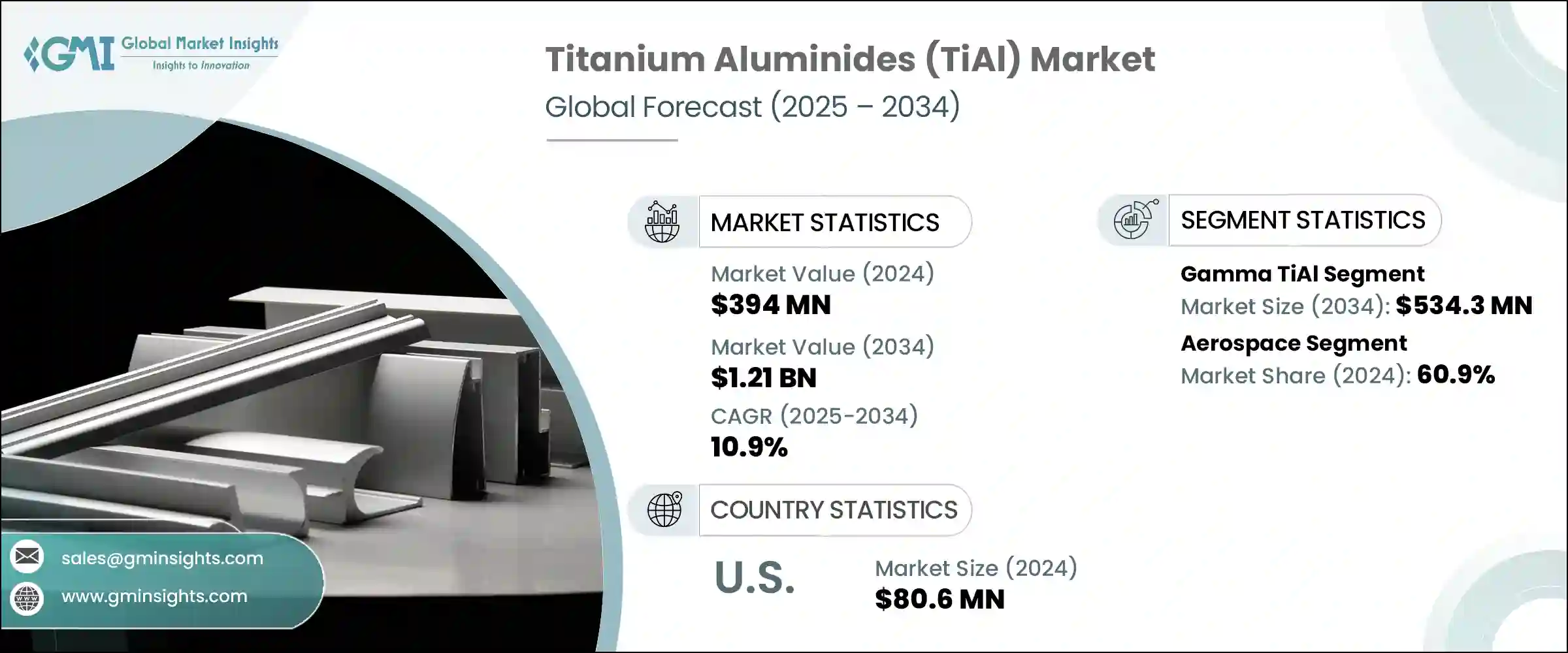

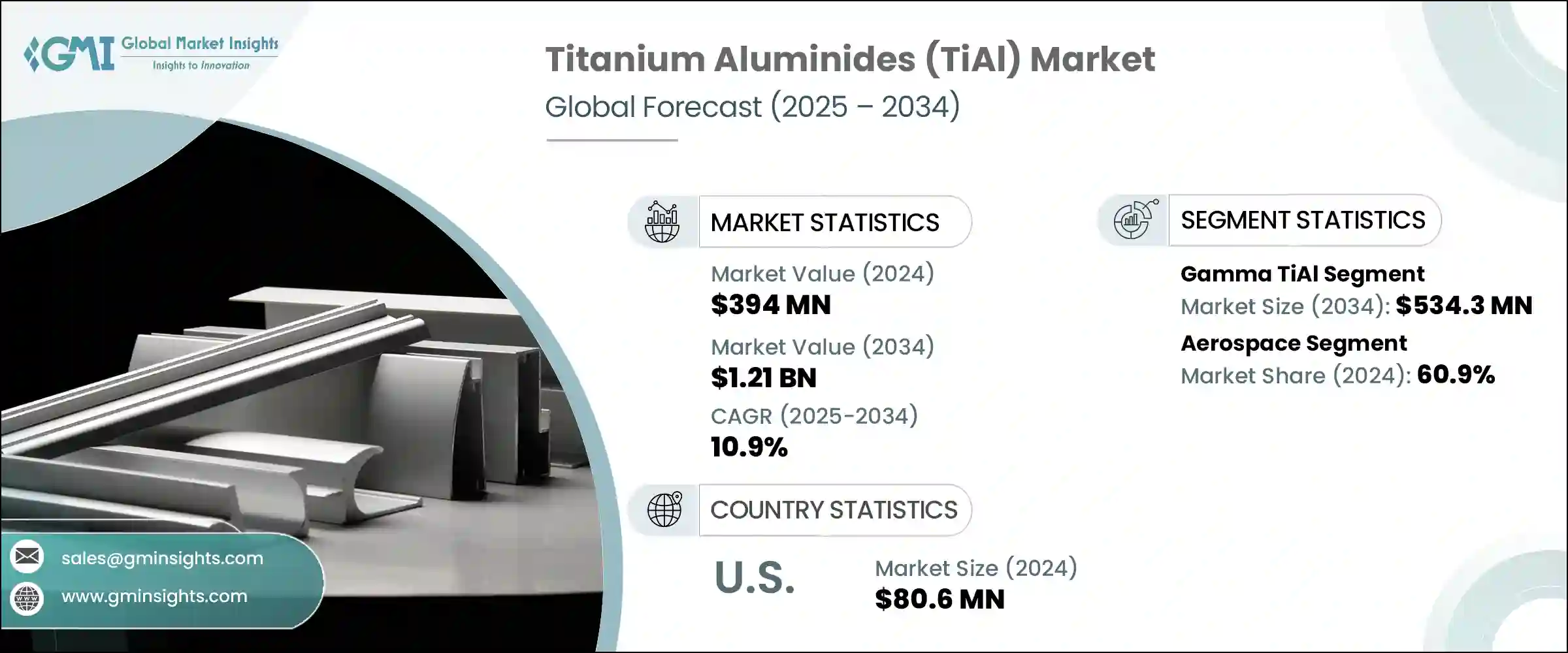

2024年,全球钛铝化物 (TiAl) 市场规模达3.94亿美元,预计到2034年将以10.9%的复合年增长率成长,达到12.1亿美元。钛铝化物卓越的机械性能推动了其需求的成长,尤其是在重量、耐热性和耐用性至关重要的行业。钛铝化物比钢铁等传统材料轻得多,在航太和汽车领域,透过降低整体重量和提高能源效率,展现出显着优势。其卓越的高温性能使其能够承受极端的热应力和机械应力,使其成为飞机引擎零件和高性能汽车零件等应用的理想选择。

对抗氧化、在应力下保持刚度并降低油耗的材料的需求,正在巩固其在先进工程应用中的地位。随着全球国防开支的增加以及汽车製造商转向先进复合材料和更轻的结构,钛铝化物正获得显着发展。包括美国和印度在内的各国国防部门正在加大对技术和材料的投资,以提高性能,而钛铝化物满足了这些发展所要求的高标准,尤其是在喷气涡轮机和下一代推进系统方面。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.94亿美元 |

| 预测值 | 12.1亿美元 |

| 复合年增长率 | 10.9% |

钛铝化物凭藉其低密度、优异的抗蠕变性和出色的高温强度等特性,成为许多高要求领域的顶级材料。钛铝化物能够耐受高温操作条件,并具有极强的抗腐蚀和抗氧化性能,尤其适用于航太结构、涡轮零件以及其他传统合金无法胜任的应用。与传统材料不同,钛铝化物不会为了减轻重量而牺牲强度,这种平衡使其在挑战材料极限的环境中备受青睐。随着全球日益重视交通运输和国防领域的可持续性、轻量化和效率,这些金属间化合物的性能和可靠性将为製造商带来竞争优势。

2024年,γ-钛铝(Gamma TiAl)细分市场产值达1.771亿美元,预计2034年将达到5.343亿美元。这种特殊形态的钛铝化物因其在超过600°C的温度下仍能保持机械完整性并抗氧化而备受青睐。 γ-钛铝合金是镍基高温合金的高性能替代品,特别适用于兼顾强度和重量的领域。由于在热应力下表现出色,这些合金正逐渐取代涡轮引擎关键零件中的传统金属。随着更节能、更轻量化的飞机平台的开发,γ-钛铝在高应力环境中的应用也日益增多,一些主要製造商已将其应用于涡轮叶片零件。

2024年,航太领域占了60.9%的市场。航空引擎及相关零件对轻质耐热材料的持续偏好推动了其广泛应用。钛铝化物目前被用于涡轮叶片和其他经常暴露在高温下的零件,从而减轻了飞机总重量并提高了燃油效率。其高模量、高温强度维持率和较低的热膨胀特性使其成为航太应用的理想选择。随着国防和商用航空领域对引擎性能和排放的更高要求,钛铝化物在材料创新中发挥着至关重要的作用。它们能够在不影响性能的情况下承受恶劣环境,这使得它们在航空部件设计和製造中不可或缺,尤其是在材料故障不容许的情况下。

2024年,美国钛铝化物 (TiAl) 市场产值达8,060万美元。作为全球主要的国防和航太设备出口国之一,美国在采用先进材料以提高飞机效率方面继续保持领先地位。美国国内钛产量一直保持成长,为新机身和引擎产量激增提供所需的原料。轻型、省油飞机型号的大量订单正在影响材料的选择,而钛铝化物与下一代机身中日益普及的碳纤维增强结构具有出色的兼容性。这种相容性支援该材料整合到新设计的平台中,这些平台的设计重点是强度重量比优化和降低燃料消耗。

钛铝化物 (TiAl) 市场表现优异的公司包括 Howmet 航太 Inc.、Precision Castparts Corp、KBM Affilips BV、VSMPO-AVISMA Corporation 和 ATI。这些公司在开发满足多个终端应用领域特定性能要求的先进合金方面处于领先地位。钛铝化物市场的公司正在加强研发力度,以改善合金成分,从而提高热稳定性和可製造性。

各企业正在对先进的铸造、锻造和增材製造技术进行战略投资,以生产机械性能更强的复杂零件。此外,各企业也与航太原始设备製造商 (OEM) 和国防承包商结盟,以确保长期供应合约并简化创新週期。此外,全球市场领导者正在扩大产能并进行垂直整合,以确保原材料供应和品质控制。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场规模及预测:依类型,2021-2034

- 主要趋势

- γ-TiAl

- Alpha2-Ti3Al(α2-Ti3Al)

- 正交 Ti2AlNb(O-Ti2AlNb)

- β型(β-TiAl)

- 其他的

第六章:市场规模及预测:依製造工艺,2021-2034

- 主要趋势

- 锭冶金学

- 真空电弧重熔(VAR)

- 电子束熔炼(EBM)

- 等离子弧熔炼(PAM)

- 真空感应熔炼(VIM)

- 粉末冶金

- 气体雾化

- 等离子旋转电极製程(PREP)

- 机械合金化

- 增材製造

- 粉末床熔合(PBF)

- 直接能量沉积(DED)

- 其他的

- 其他的

第七章:市场规模及预测:依应用,2021-2034

- 主要趋势

- 航太

- 低压涡轮叶片

- 高压压缩机叶片

- 结构部件

- 其他的

- 汽车

- 涡轮增压器叶轮

- 阀门

- 排气系统

- 其他的

- 工业的

- 瓦斯涡轮机

- 化学加工设备

- 其他的

- 医疗的

- 植入物

- 手术器械

- 其他的

- 其他的

第 8 章:市场规模与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 航太与国防

- 商业航空

- 军事航空

- 空间应用

- 汽车

- 搭乘用车

- 商用车

- 赛车和高性能车辆

- 工业的

- 发电

- 化学加工

- 石油和天然气

- 其他的

- 卫生保健

- 骨科植入物

- 牙科应用

- 其他的

- 其他的

第九章:市场规模及预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- ATI

- VSMPO-AVISMA Corporation

- Precision Castparts

- Howmet Aerospace

- KBM Affilips

- GfE Metalle und Materialien

- AMG Advanced Metallurgical Group

- Alcoa Corporation

- Western Superconducting Technologies

- Carpenter Technology Corporation

- American Elements

- Toho Titanium

- Titanium Metals Corporation

- Stanford Advanced Materials

- Aerospace Alloys

- 6K

- Arconic Corporation

- Daido Steel

- Kobe Steel

The Global Titanium Aluminides (TiAl) Market was valued at USD 394 million in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 1.21 billion by 2034. Rising demand is driven by the material's exceptional mechanical properties, especially in industries where weight, heat resistance, and durability are critical. Titanium aluminides are far lighter than conventional materials like steel, offering significant advantages in the aerospace and automotive sectors by reducing overall weight and improving energy efficiency. Their superior high-temperature performance enables them to withstand extreme thermal and mechanical stress, making them ideal for applications like aircraft engine parts and high-performance automotive components.

The need for materials that resist oxidation, maintain stiffness under stress, and lower fuel consumption is reinforcing their position in advanced engineering applications. With global defense spending on the rise and automotive manufacturers turning to advanced composites and lighter structures, titanium aluminides are gaining significant ground. The defense sectors in countries including the U.S. and India are experiencing increased investment in technology and materials to enhance performance, and titanium aluminides meet the high standards demanded by these developments, especially in jet turbines and next-gen propulsion systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $394 Million |

| Forecast Value | $1.21 Billion |

| CAGR | 10.9% |

The properties of titanium aluminides such as low density, excellent creep resistance, and outstanding high-temperature strength, are turning them into top-performing materials in multiple demanding fields. Their ability to endure elevated operating conditions, coupled with high corrosion and oxidation resistance, makes them especially suited for aerospace structures, turbine components, and other applications where conventional alloys fall short. Unlike traditional materials, titanium aluminides do not compromise strength for weight, and that balance makes them highly desirable in environments that push material limits. With a rising global emphasis on sustainability, lightweight, and efficiency in both transportation and defense, the performance and reliability of these intermetallic compounds offer manufacturers a competitive advantage.

In 2024, the Gamma TiAl segment generated USD 177.1 million and is forecasted to reach USD 534.3 million by 2034. This specific form of titanium aluminide is highly sought after for its ability to retain mechanical integrity and resist oxidation at temperatures exceeding 600°C. Gamma TiAl alloys offer a high-performance alternative to nickel-based superalloys, particularly in applications where both strength and weight-saving are essential. These alloys are increasingly replacing traditional metals in critical turbine engine parts due to their impressive stability under thermal stress. The push to develop more energy-efficient and lightweight aircraft platforms has elevated the use of gamma TiAl in high-stress environments, with several major manufacturers incorporating it into turbine blade components.

The aerospace segment held a 60.9% share in 2024. The continued preference for lightweight yet heat-resistant materials in aircraft engines and related components has driven widespread adoption. Titanium aluminides are now being used in turbine blades and other parts that face constant exposure to high temperatures, reducing total aircraft weight and improving fuel efficiency. Their high modulus, strength retention under heat, and lower thermal expansion properties make them ideal for aerospace applications. As the defense and commercial aviation sectors demand higher engine performance and lower emissions, titanium aluminides play a critical role in material innovation. Their capacity to withstand harsh environments without compromising performance makes them indispensable in aviation component design and manufacturing, especially where material failure is not an option.

United States Titanium Aluminides (TiAl) Market generated USD 80.6 million in 2024. As one of the major global exporters of defense and aerospace equipment, the country continues to lead in adopting advanced materials that boost aircraft efficiency. Domestic titanium production has kept pace with demand, supplying the raw materials required for the surge in new airframe and engine production. High-volume orders for lighter, fuel-efficient aircraft models are influencing material choices, and titanium aluminides offer superior compatibility with carbon-fiber-reinforced structures increasingly used in next-gen airframes. This compatibility has supported the material's integration into newly engineered platforms, where design emphasis is placed on strength-to-weight optimization and reduced fuel usage.

The top-performing companies in the Titanium Aluminides (TiAl) Market include Howmet Aerospace Inc., Precision Castparts Corp, KBM Affilips B.V., VSMPO-AVISMA Corporation, and ATI. These players lead in developing advanced alloys tailored to specific performance requirements across multiple end-use sectors. Companies in the titanium aluminides market are intensifying R&D efforts to improve alloy compositions for higher thermal stability and manufacturability.

Strategic investments are being made in advanced casting, forging, and additive manufacturing technologies to produce complex parts with enhanced mechanical performance. Firms are also forming alliances with aerospace OEMs and defense contractors to secure long-term supply contracts and streamline innovation cycles. Additionally, global market leaders are expanding production capacity and vertically integrating to secure raw material supply and ensure quality control.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Manufacturing process

- 2.2.4 Application

- 2.2.5 End use industry

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Type, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Gamma TiAl (γ-TiAl)

- 5.3 Alpha2-Ti3Al (α2-Ti3Al)

- 5.4 Orthorhombic Ti2AlNb (O-Ti2AlNb)

- 5.5 Beta Type (β-TiAl)

- 5.6 Others

Chapter 6 Market Size and Forecast, By Manufacturing Process, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Ingot metallurgy

- 6.2.1 Vacuum arc remelting (VAR)

- 6.2.2 Electron beam melting (EBM)

- 6.2.3 Plasma arc melting (PAM)

- 6.2.4 Vacuum induction melting (VIM)

- 6.3 Powder metallurgy

- 6.3.1 Gas atomization

- 6.3.2 Plasma rotating electrode process (PREP)

- 6.3.3 Mechanical alloying

- 6.4 Additive manufacturing

- 6.4.1 Powder bed fusion (PBF)

- 6.4.2 Direct energy deposition (DED)

- 6.4.3 Others

- 6.5 Others

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Aerospace

- 7.2.1 Low pressure turbine blades

- 7.2.2 High pressure compressor blades

- 7.2.3 Structural components

- 7.2.4 Others

- 7.3 Automotive

- 7.3.1 Turbocharger wheels

- 7.3.2 Valves

- 7.3.3 Exhaust systems

- 7.3.4 Others

- 7.4 Industrial

- 7.4.1 Gas turbines

- 7.4.2 Chemical processing equipment

- 7.4.3 Others

- 7.5 Medical

- 7.5.1 Implants

- 7.5.2 Surgical instruments

- 7.5.3 Others

- 7.6 Others

Chapter 8 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 Aerospace & defense

- 8.2.1 Commercial aviation

- 8.2.2 Military aviation

- 8.2.3 Space applications

- 8.3 Automotive

- 8.3.1 Passenger vehicles

- 8.3.2 Commercial vehicles

- 8.3.3 Racing & high-performance vehicles

- 8.4 Industrial

- 8.4.1 Power generation

- 8.4.2 Chemical processing

- 8.4.3 Oil & gas

- 8.4.4 Others

- 8.5 Healthcare

- 8.5.1 Orthopedic implants

- 8.5.2 Dental applications

- 8.5.3 Others

- 8.6 Others

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 ATI

- 10.2 VSMPO-AVISMA Corporation

- 10.3 Precision Castparts

- 10.4 Howmet Aerospace

- 10.5 KBM Affilips

- 10.6 GfE Metalle und Materialien

- 10.7 AMG Advanced Metallurgical Group

- 10.8 Alcoa Corporation

- 10.9 Western Superconducting Technologies

- 10.10 Carpenter Technology Corporation

- 10.11 American Elements

- 10.12 Toho Titanium

- 10.13 Titanium Metals Corporation

- 10.14 Stanford Advanced Materials

- 10.15 Aerospace Alloys

- 10.16 6K

- 10.17 Arconic Corporation

- 10.18 Daido Steel

- 10.19 Kobe Steel