|

市场调查报告书

商品编码

1766271

高熵合金市场机会、成长动力、产业趋势分析及2025-2034年预测High Entropy Alloy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

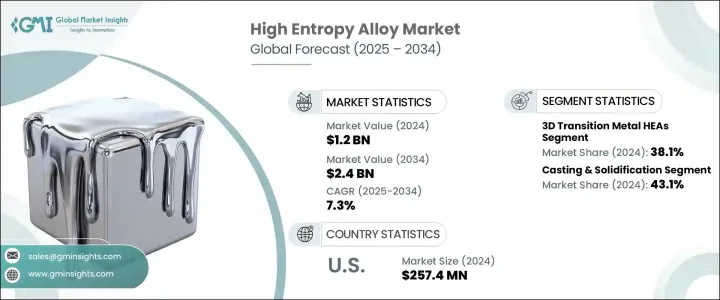

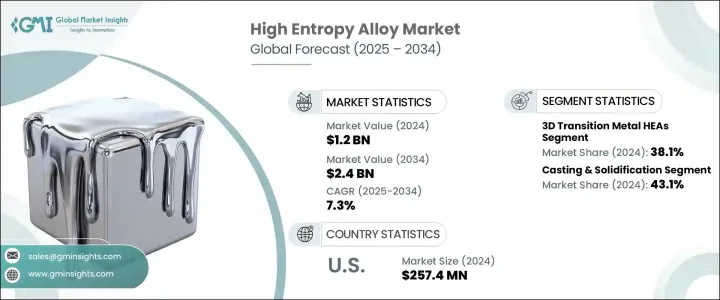

2024年,全球高熵合金市场规模达12亿美元,预估年复合成长率为7.3%,2034年将达24亿美元。这类合金由五种或五种以上主要元素以近乎等比例混合而成,具有独特的机械强度、耐腐蚀性和热稳定性。它们日益普及源于其性能优势,优于传统合金,尤其是在需要耐磨、耐热和结构疲劳性能的环境中。随着製造商不断探索提高材料耐久性、减轻重量和延长零件使用寿命的方法,高熵合金在多个行业中的应用日益广泛。研发投入的激增也推动了高熵合金在各领域的应用。

随着各行各业优先考虑能源效率和长期性能,开发更轻、更坚固、更耐高温的材料至关重要。因此,高熵合金正迅速成为下一代零件製造的关键材料,而先进的材料性能是不可或缺的。这些材料在传统和新兴应用中都展现出巨大的潜力,涵盖从移动出行系统、重型基础设施到高能耗设备部件等各种领域。随着材料创新投资的不断增长以及满足不断变化的性能基准的需求,市场正稳步向广泛的工业应用转变。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12亿美元 |

| 预测值 | 24亿美元 |

| 复合年增长率 | 7.3% |

2024年,按合金类型划分,3D过渡金属高熵合金占据了整体市场份额的38.1%。这些合金通常由铁、镍、钴、铬和锰等元素製成,以其优异的机械弹性、耐腐蚀性和经济可行性而闻名,是各行各业的理想选择。它们与粉末冶金和增材製造工艺的兼容性进一步拓宽了其应用范围。这些方法能够生产复杂的零件并简化原型製作,这对于需要快速开发週期和耐用原型的行业至关重要。此外,这些合金还具有出色的耐辐射性和高导热性,使其适用于暴露在极端温度和工作条件下的系统。

按製造方法划分,铸造和凝固工艺在2024年占据43.1%的市场份额,占据市场主导地位。这种主导地位源自于这些技术的可扩展性和成本效益,尤其是在整合到现有冶金系统中时。该工艺不仅支持大规模生产,还在细化晶粒结构和稳定相态方面发挥至关重要的作用,这对于确保材料在高热应力和机械应力下的长期性能至关重要。儘管粉末冶金和积层製造技术持续受到关注,但铸造仍然是生产具有复杂设计的大块零件最具成本效益的方法。

按性能分类,具有优异机械特性的合金在2024年占据了最大的市场份额。这些性能——例如高抗拉强度、抗衝击性和延展性——使零件能够承受持续的机械负荷而不会发生性能下降。高熵合金独特的原子结构使其具有固溶强化和抗变形能力,因此在需要在循环应力和高强度操作条件下保持结构完整性的应用中被广泛使用。它们能够在保持性能的同时减轻零件重量,这有助于製造商满足严格的监管和安全标准。

在应用方面,结构合金在2024年占据了最大的市场。由于其抗疲劳性和机械稳定性,这些合金经常被选用于必须承受高负荷或在高应力环境下工作的部件。这些材料的多相结构增强了韧性,有助于防止在高衝击使用过程中发生故障。因此,这些合金在各种高负载应用中,在註重耐用性、结构耐久性和长使用寿命的系统中越来越受欢迎。

从终端应用产业来看,航太和国防在2024年引领全球市场。这一主导地位反映了该行业对兼具轻量化、高机械强度和耐热性的材料的持续需求。在快速变化的热环境中运行的部件需要增强的抗氧化和抗蠕变性能,而这些合金恰好能够满足这些要求。它们在恶劣条件下久经考验的可靠性,将继续推动该领域的投资和创新,尤其是在关键任务系统领域。

从区域来看,美国在2024年的市值达到2.574亿美元,领先北美。美国在联邦政府资助的研究计画方面拥有坚实的基础,而航太、国防、能源和汽车产业的需求不断增长,推动了高熵合金的广泛应用。这些产业严重依赖在机械和热负荷下性能稳定的材料,这使得高熵合金成为先进製造业的战略资产。

全球高熵合金市场的竞争格局略显分散,多家厂商占据细分市场。各公司专注于专有合金配方、新一代加工技术以及严格的行业品质标准,以保持领先地位。创新、客製化和材料性能仍然是影响整个产业竞争定位的核心因素。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计资料(HS 编码)註:以上贸易统计资料仅针对主要国家提供。

- 主要出口国

- 主要进口国

- 衝击力

- 成长动力

- 航太和国防领域对轻质高强度材料的需求不断增长

- 增加对核反应器和储能应用先进材料的投资

- 由于热稳定性和耐腐蚀性,电动车零件的应用不断扩大

- 产业陷阱与挑战

- 由于合金成分复杂且加工技术专业,生产成本高

- 商业规模生产基础设施和供应链整合的可用性有限

- 各行业缺乏测试和性能指标的标准化

- 市场机会

- 成长动力

- 利润率分析

- 製造流程分析

- 铸造与凝固

- 粉末冶金

- 增材製造

- 机械合金化

- 其他製造方法

- 技术进步与创新

- 监管格局

- 材料测试标准

- 行业特定的认证要求

- 环境法规

- 先进材料的进出口法规

- 成长潜力分析

- 2021-2034年价格分析(美元/吨)

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略框架

- 併购

- 合资与合作

- 新产品开发

- 扩张策略

- 竞争基准测试

- 供应商格局

- 竞争定位矩阵

- 战略仪表板

- 专利分析与创新评估

- 研发强度分析

第五章:市场估计与预测:按合金类型,2021-2034 年

- 主要趋势

- 3d过渡金属HEA

- CoCrFeMnNi(康托合金)

- 钴铬铁镍

- 钴铬铁镍锰

- 其他的

- 难熔金属高熵合金

- 铌钼钽钨

- 钌铌钽钨

- 铪铌钽钛锆

- 其他的

- 轻金属高熵合金

- 铝镁锂钙锌

- 铝锂镁钪钛

- 其他的

- 含铝HEA

- 铝钴铬铁镍

- 铝钴铬铜铁镍

- 其他的

- 贵金属HEA

- 含稀土元素的高熵合金

- 其他的

第六章:市场估计与预测:依製造方法,2021-2034 年

- 主要趋势

- 铸造与凝固

- 电弧熔炼

- 感应熔炼

- 真空感应熔炼

- 粉末冶金

- 气体雾化

- 机械合金化

- 放电等离子烧结

- 热等静压

- 其他的

- 增材製造

- 选择性雷射融化

- 电子束熔炼

- 直接能量沉积

- 其他的

- 薄膜沉积

- 磁控溅射

- 物理气相沉积

- 其他的

第七章:市场估计与预测:依物业类型,2021-2034 年

- 主要趋势

- 优异的机械性质

- 高强度

- 高硬度

- 高延展性

- 耐磨性

- 其他的

- 热稳定性

- 高温强度

- 抗蠕变性

- 热膨胀控制

- 其他的

- 耐腐蚀和抗氧化

- 耐水性腐蚀

- 抗高温氧化

- 其他的

- 磁性

- 电气性能

- 抗辐射

- 其他的

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 结构应用

- 高温结构件

- 轻质结构部件

- 其他的

- 功能应用

- 磁的

- 电力

- 催化

- 其他的

- 涂层和表面处理

- 耐磨涂层

- 耐腐蚀涂层

- 热障涂层

- 其他的

- 极端环境应用

- 低温

- 高温

- 辐射密集型

- 其他的

- 其他的

第九章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 航太与国防

- 飞机部件

- 推进系统

- 国防装备

- 空间

- 其他的

- 汽车

- 引擎部件

- 排气系统

- 结构部件

- 其他的

- 活力

- 核能

- 化石燃料发电

- 再生能源

- 其他的

- 工业设备

- 切削刀具

- 机械零件

- 其他的

- 电子和半导体

- 化工和石化

- 医疗保健

- 研究与学术

- 其他的

第十章:市场估计与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Alcoa Corporation

- AMETEK Specialty Metal Products

- Aperam SA

- ATI Metals

- Aubert & Duval

- Carpenter Technology Corporation

- Daido Steel

- Eramet Group

- HC Starck GmbH

- Haynes International

- High Entropy Alloys Inc.

- Hitachi Metals

- H?gan?s AB

- IHI Corporation

- Kennametal

- Materion Corporation

- Metalysis

- Nippon Yakin Kogyo

- Oerlikon Metco

- Plansee SE

- Praxair Surface Technologies

- Questek Innovations

- Sandvik AB

- Special Metals Corporation

- VDM Metals GmbH

The Global High Entropy Alloy Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 2.4 billion by 2034. These alloys are composed of five or more principal elements mixed in near-equal ratios, offering a unique combination of mechanical strength, corrosion resistance, and thermal stability. Their growing popularity stems from their performance advantages over conventional alloys, especially in environments that demand resilience to wear, heat, and structural fatigue. This increasing adoption across multiple sectors is backed by a surge in research and development, as manufacturers look for ways to improve material durability, reduce weight, and enhance component longevity.

The focus on developing lighter, stronger, and more temperature-tolerant materials is critical as industries prioritize energy efficiency and long-term performance. As a result, high entropy alloys are quickly becoming essential in next-generation component manufacturing, where advanced material properties are non-negotiable. These materials are showing strong potential in both traditional and emerging applications, ranging from mobility systems and heavy-duty infrastructure to components used in energy-intensive equipment. With growing investment in material innovation and the need to meet evolving performance benchmarks, the market is witnessing a steady shift toward widespread industrial deployment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 7.3% |

In 2024, 3D transition metal high entropy alloys accounted for 38.1% of the overall market share by alloy type. These alloys, typically made using elements such as Fe, Ni, Co, Cr, and Mn, are well-known for their mechanical resilience, corrosion resistance, and economic viability, making them ideal for applications across various industries. Their compatibility with powder metallurgy and additive manufacturing processes further broadens their usability. These methods enable the production of complex parts and streamline prototyping, which is valuable in industries that demand quick development cycles and durable prototypes. Additionally, these alloys exhibit excellent radiation tolerance and high thermal conductivity, making them suitable for systems exposed to extreme temperatures and operating conditions.

By manufacturing method, casting and solidification processes led the market with a 43.1% share in 2024. This dominance is driven by the scalability and cost-efficiency of these techniques, especially when integrated into existing metallurgical systems. The process not only supports mass production but also plays a vital role in refining grain structure and stabilizing phases, which are essential for ensuring long-term material performance under high thermal and mechanical stress. Although powder metallurgy and additive manufacturing continue to gain traction, casting remains the most cost-effective approach for producing bulk components with intricate designs.

When categorized by property, alloys with superior mechanical characteristics held the largest market share in 2024. These properties-such as high tensile strength, impact resistance, and ductility-allow components to endure continuous mechanical loading without degradation. The unique atomic structure of high entropy alloys contributes to their solid-solution strengthening and resistance to deformation, which is why they are heavily used in applications that require structural integrity under cyclic stress and intense operational conditions. Their ability to maintain performance while reducing component weight helps manufacturers meet demanding regulatory and safety standards.

In terms of application, structural uses represented the largest share of the market in 2024. These alloys are frequently chosen for components that must bear significant load or operate in high-stress environments due to their fatigue resistance and mechanical stability. The materials' multi-phase structures offer enhanced toughness, which helps prevent failure during high-impact use. As a result, these alloys are gaining ground in systems designed for durability, structural endurance, and long service life across multiple heavy-use applications.

Looking at end-use industries, aerospace and defense led the global market in 2024. This dominance reflects the sector's ongoing demand for materials that combine lightweight characteristics with high mechanical strength and thermal resistance. Components that operate in rapidly changing thermal environments require enhanced oxidation and creep resistance, which these alloys can provide. Their proven reliability in harsh conditions continues to drive investment and innovation in the sector, particularly for mission-critical systems.

Regionally, the United States recorded a market value of USD 257.4 million in 2024, leading North America. The country's strong foundation in federally funded research programs and the growing demand across aerospace, defense, energy, and automotive industries has driven widespread adoption. These sectors rely heavily on materials that perform consistently under mechanical and thermal loads, making high entropy alloys a strategic asset in advanced manufacturing.

The competitive landscape of the global high entropy alloy market is moderately fragmented, with several players holding niche positions. Companies are focusing on proprietary alloy formulations, next-generation processing techniques, and adherence to strict industry quality standards to stay ahead. Innovation, customization, and material performance remain the core areas influencing competitive positioning across the sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)Note: the above trade statistics will be provided for key countries only.

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Rising demand for lightweight and high-strength materials in aerospace and defense sectors

- 3.4.1.2 Increased investment in advanced materials for nuclear reactor and energy storage applications

- 3.4.1.3 Expanding usage in electric vehicle components due to thermal stability and corrosion resistance

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 High production costs due to complex alloy compositions and specialized processing techniques

- 3.4.2.2 Limited availability of commercial-scale production infrastructure and supply chain integration

- 3.4.2.3 Lack of standardization in testing and performance metrics across industries

- 3.4.3 Market opportunities

- 3.4.1 Growth drivers

- 3.5 Profit margin analysis

- 3.5.1 Manufacturing process analysis

- 3.5.2 Casting & solidification

- 3.5.3 Powder metallurgy

- 3.5.4 Additive manufacturing

- 3.5.5 Mechanical alloying

- 3.5.6 Other manufacturing methods

- 3.6 Technological advancements and innovations

- 3.7 Regulatory landscape

- 3.7.1 Material testing standards

- 3.7.2 Industry-specific certification requirements

- 3.7.3 Environmental regulations

- 3.7.4 Import/export regulations for advanced materials

- 3.8 Growth potential analysis

- 3.9 Pricing analysis (USD/Tons) 2021-2034

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic framework

- 4.3.1 Mergers & acquisition

- 4.3.2 Joint venture & collaborations

- 4.3.3 New product development

- 4.3.4 Expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Vendor landscape

- 4.6 Competitive positioning matrix

- 4.7 Strategic dashboard

- 4.8 Patent analysis & Innovation assessment

- 4.9 Research & Development Intensity Analysis

Chapter 5 Market Estimates and Forecast, By Alloy Type, 2021–2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 3d transition metal HEAs

- 5.2.1 CoCrFeMnNi (cantor alloy)

- 5.2.2 CoCrFeNi

- 5.2.3 CoCrFeNiMn

- 5.2.4 Others

- 5.3 Refractory metal HEAs

- 5.3.1 NbMoTaW

- 5.3.2 VNbMoTaW

- 5.3.3 HfNbTaTiZr

- 5.3.4 Others

- 5.4 Light metal HEAs

- 5.4.1 AlMgLiCaZn

- 5.4.2 AlLiMgScTi

- 5.4.3 Others

- 5.5 Aluminum-containing HEAs

- 5.5.1 AlCoCrFeNi

- 5.5.2 AlCoCrCuFeNi

- 5.5.3 Others

- 5.6 Precious metal HEAs

- 5.7 Rare earth element-containing HEAs

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Manufacturing Method, 2021–2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Casting & solidification

- 6.2.1 Arc melting

- 6.2.2 Induction melting

- 6.2.3 Vacuum induction melting

- 6.3 Powder metallurgy

- 6.3.1 Gas atomization

- 6.3.2 Mechanical alloying

- 6.3.3 Spark plasma sintering

- 6.3.4 Hot isostatic pressing

- 6.3.5 Others

- 6.4 Additive manufacturing

- 6.4.1 Selective laser melting

- 6.4.2 Electron beam melting

- 6.4.3 Direct energy deposition

- 6.4.4 Others

- 6.5 Thin film deposition

- 6.5.1 Magnetron sputtering

- 6.5.2 Physical vapor deposition

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Property, 2021–2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Superior mechanical properties

- 7.2.1 High strength

- 7.2.2 High hardness

- 7.2.3 High ductility

- 7.2.4 Wear resistance

- 7.2.5 Others

- 7.3 Thermal stability

- 7.3.1 High-temperature strength

- 7.3.2 Creep resistance

- 7.3.3 Thermal expansion control

- 7.3.4 Others

- 7.4 Corrosion & oxidation resistance

- 7.4.1 Aqueous corrosion resistance

- 7.4.2 High-temperature oxidation resistance

- 7.4.3 Others

- 7.5 Magnetic properties

- 7.6 Electrical properties

- 7.7 Radiation resistance

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021–2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Structural applications

- 8.2.1 High-temperature structural components

- 8.2.2 Lightweight structural components

- 8.2.3 Others

- 8.3 Functional applications

- 8.3.1 Magnetic

- 8.3.2 Electrical

- 8.3.3 Catalytic

- 8.3.4 Others

- 8.4 Coatings & surface treatments

- 8.4.1 Wear-resistant coatings

- 8.4.2 Corrosion- resistant coatings

- 8.4.3 Thermal barrier coatings

- 8.4.4 Others

- 8.5 Extreme environment applications

- 8.5.1 Cryogenic

- 8.5.2 High temperature

- 8.5.3 Radiation-intensive

- 8.5.4 Others

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By End Use Industry, 2021–2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Aerospace & defense

- 9.2.1 Aircraft components

- 9.2.2 Propulsion systems

- 9.2.3 Defense equipment

- 9.2.4 Space

- 9.2.5 Others

- 9.3 Automotive

- 9.3.1 Engine components

- 9.3.2 Exhaust systems

- 9.3.3 Structural components

- 9.3.4 Others

- 9.4 Energy

- 9.4.1 Nuclear energy

- 9.4.2 Fossil fuel power generation

- 9.4.3 Renewable energy

- 9.4.4 Others

- 9.5 Industrial equipment

- 9.5.1 Cutting tools

- 9.5.2 Machinery components

- 9.5.3 Others

- 9.6 Electronics & semiconductors

- 9.7 Chemical & petrochemical

- 9.8 Medical & healthcare

- 9.9 Research & academia

- 9.10 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021–2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Alcoa Corporation

- 11.2 AMETEK Specialty Metal Products

- 11.3 Aperam S.A.

- 11.4 ATI Metals

- 11.5 Aubert & Duval

- 11.6 Carpenter Technology Corporation

- 11.7 Daido Steel

- 11.8 Eramet Group

- 11.9 H.C. Starck GmbH

- 11.10 Haynes International

- 11.11 High Entropy Alloys Inc.

- 11.12 Hitachi Metals

- 11.13 H?gan?s AB

- 11.14 IHI Corporation

- 11.15 Kennametal

- 11.16 Materion Corporation

- 11.17 Metalysis

- 11.18 Nippon Yakin Kogyo

- 11.19 Oerlikon Metco

- 11.20 Plansee SE

- 11.21 Praxair Surface Technologies

- 11.22 Questek Innovations

- 11.23 Sandvik AB

- 11.24 Special Metals Corporation

- 11.25 VDM Metals GmbH