|

市场调查报告书

商品编码

1630181

高性能合金 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)High Performance Alloys - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

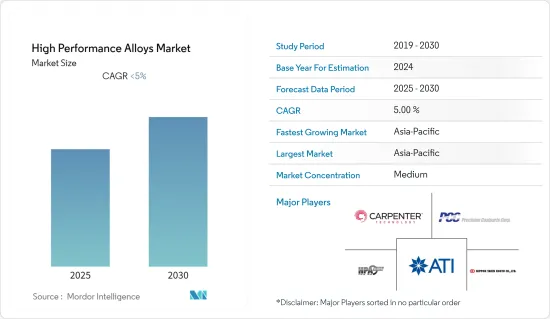

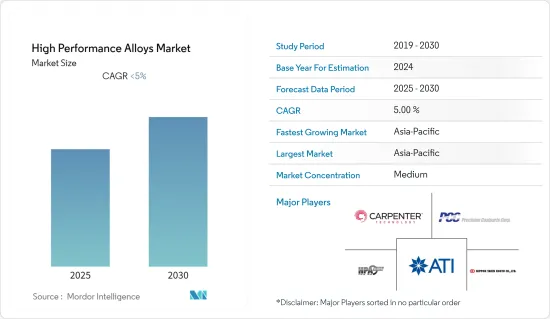

预计预测期内高性能合金市场的复合年增长率将低于5%。

COVID-19 期间,世界各地政府关闭,终端用户营运暂停一段时间。这对航太、电力、石油和天然气产业以及高性能合金市场产生了重大影响。然而,疫情过后,产业将会復苏,市场预计在未来几年将保持成长轨迹。

主要亮点

- 航太业对合金的需求不断增长是推动市场成长的关键因素。

- 然而,原物料价格的波动可能会阻碍市场成长。

- 非铁金属需求的激增可能是市场的机会,因为它们比其他类型的材料具有优势。

- 亚太地区占据最大的市场份额,预计未来几年这一趋势将持续下去。

高性能合金市场趋势

航太业主导市场

- 高性能合金因其高机械强度、高表面稳定性和耐腐蚀性而被广泛应用于航太、石油天然气和汽车等产业。然而,航太业对轻型设备的需求不断增加以及对新一代飞机的需求激增可能会推动市场向前发展。

- 下一代飞机、旋翼机、无人机和飞弹在减重、视觉、热特征、更高的速度和机动性方面将有更严格的要求。这些需求增加了对能够整合这些功能的高性能合金的需求。

- 根据国际航空运输协会(IATA)估计,全球商业航空公司的收入以年度为基础增长近43%,从2021年的4,720亿美元增加到2022年的7,270亿美元。到2023年,预计将产生7,790亿美元的收益。

- 波音《2022-2041年商业展望》预测,到2041年,全球商业航空服务市场,包括航班业务、维护和工程、地面业务、车站业务和货运业务,将达到3.615兆美元。

- 波音《2022-2041年商业展望》也预计,2041年,全球新飞机总出货量将达到41,170架。截至 2019 年,全球飞机持有约为 25,900 架,到 2041 年可能达到 47,080 架。

- 根据经济分析局的数据,2022 年前三季美国航空运输业为经济增加了约 3,520 亿美元。与去年同期相比,这一数字增加了约35%。

- 由于上述原因,航太业预计将在预测期内引领市场。

亚太地区预计需求最高

- 亚太地区是航太、汽车、电气和电子以及许多其他製造业的中心。其中使用了许多高性能合金,增加了所研究市场的需求。

- 在亚太地区,中国、东南亚和南亚的航太市场预计将快速成长,进一步拉动研究市场的需求。根据波音《2022-2041年商业展望》,到2041年,中国将交付8,485架新飞机,市场服务价值将达到5,450亿美元。

- 此外,到 2036 年,印度预计将拥有 4.8 亿航空乘客,预计将超过日本(略低于 2.25 亿)和德国(略高于 2 亿)的总合,到 2038 年,这将需要约 2,380 架新民航机。

- 除此之外,石油和天然气产业也需要高性能合金。高性能合金在高温和机械应力下运作良好,并且在暴露于海水或酸时不会生锈。

- 根据BP《2022年世界能源统计年鑑》,中国将在2021年成为亚太地区最大的石油生产国。中国石油产量逼近2亿吨,与前一年同期比较增加2.5%。同时,中国也将成为该地区最大的天然气生产国,到2021年将占天然气市场的三分之一。同期,中国天然气产量约2,100亿立方公尺。

- 由于该地区在预测期内表现良好,高性能合金市场预计将成长。

高性能合金产业概况

所研究的高性能合金市场在主要企业之间进行了部分整合。主要企业为(排名不分先后):ATI、Precision Castparts Corp.、Nippon Yakin Kogyo、CRS Holdings Inc.、High Performance Alloys, Inc.。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 航太工业对合金的需求增加

- 其他司机

- 抑制因素

- 原物料价格波动

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 基底金属类型

- 铝

- 镍

- 钢

- 镁

- 钛

- 其他的

- 产品类型

- 耐热合金

- 耐腐蚀合金

- 耐磨合金

- 其他的

- 最终用户产业

- 航太

- 电力

- 石油和天然气(包括化学品)

- 电力/电子

- 车

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 欧洲其他地区

- 其他的

- 南美洲

- 中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)分析**/市场排名分析

- 主要企业策略

- 公司简介

- AMG

- ATI

- Corporation VSMPO-AVISMA

- CRS Holdings Inc.

- Fort Wayne Metals Research Products, LLC

- High Performance Alloys, Inc

- Nippon Yakin Kogyo Co., Ltd.

- Precision Castparts Corp

- Stanford Advanced Materials

第七章 市场机会及未来趋势

- 非铁金属需求快速成长

- 其他机会

The High Performance Alloys Market is expected to register a CAGR of less than 5% during the forecast period.

During the COVID-19 period, government lockdowns in many parts of the world caused end-user operations to stop for a while. This had a big effect on the aerospace, power, and oil and gas industries, and so on the high-performance alloys market as well.However, post-pandemic, the industries have recovered, and the market is expected to retain its growth trajectory in the coming years.

Key Highlights

- The aerospace industry's growing need for alloys is the main thing that is making the market studied grow.

- However, fluctuating pricing of raw materials is likely to hinder market growth.

- Nevertheless, the surging demand for non-ferrous metals due to their benefits over other types of materials is likely to act as an opportunity for the market.

- The Asia-Pacific region had the biggest share of the market and is expected to keep doing so during the next few years.

High Performance Alloys Market Trends

Aerospace Industry to Dominate the Market

- High-performance alloys serve various purposes in industries such as aerospace, oil and gas, automotive, and others due to their high mechanical strength, high surface stability, and corrosion resistance. However, the increasing demand for lightweight equipment and the surge in demand for new-generation aircraft in the aerospace industry are likely to drive the market forward.

- Next-generation aircraft, rotorcraft, unmanned aerial vehicles, and missiles will have stricter requirements in terms of lightweight, visual, and thermal signatures, increased speed, and maneuverability. These requirements incite a need for high-performance alloys that can incorporate these functionalities.

- The International Air Transport Association (IATA) estimates that the global revenue for commercial airlines increased by almost 43 percent on an annual basis, from USD 472 billion in 2021 to USD 727 billion in 2022. By 2023, it is anticipated that the revenue will total USD 779 billion.

- Boeing's Commercial Outlook 2022-2041 predicts that by 2041, the global market for commercial aviation services, such as flight operations, maintenance and engineering, ground, station, and cargo operations, will be worth USD 3,615 billion.This is likely to increase demand for the market under consideration in the years to come.

- The Boeing Commercial Outlook 2022-2041 also stated that the total global deliveries of new airplanes are estimated to be 41,170 by 2041. The global airplane fleet amounted to around 25,900 units as of the year 2019, and the fleet number is likely to reach 47,080 units by 2041.

- The Bureau of Economic Analysis said that the air transport industry in the United States added about USD 352 billion to the economy in the first three quarters of 2022. This is about 35% more than the same time period the year before.

- Due to the above reasons, it is expected that the aerospace industry will lead the market during the forecast period.

Asia-Pacific Region to Witness Highest Demand

- The Asia-Pacific region is a center for many types of manufacturing, such as aerospace and automotive, electrical and electronics, and many others.For these things, a lot of high-performance alloys are used, which increases the demand in the studied market.

- In the Asia-Pacific region, the aerospace markets in China, Southeast Asia, and South Asia are expected to grow at a fast rate, which will boost the demand for the studied market even more.By 2041, there will be 8,485 new fleet deliveries in China with a market service value of USD 545 billion, according to the Boeing Commercial Outlook 2022-2041.

- Moreover, India is projected to have 480 million flyers by 2036, which will be more than that of Japan (just under 225 million) and Germany (just over 200 million) combined, and for that to happen, India will need approximately 2,380 new commercial airplanes by 2038, as stated by the Indian Brand Equity Foundation (IBEF).

- Aside from this, high-performance alloys are also needed in the oil and gas industry. They work well at high temperatures and under mechanical stress, and they don't rust when exposed to seawater or acid.

- According to the BP Statistical Review of World Energy 2022, China will be the biggest oil producer in the Asia-Pacific region in 2021. It will produce close to 200 million tons of oil, which is 2.5% more than it did the year before. At the same time, accounting for one-third of the natural gas market in 2021, China was also the region's largest natural gas producer. Around 210 billion cubic meters of natural gas were produced in China overall in that period.

- During the forecast period, the market for high-performance alloys is expected to grow because things are going well in the region.

High Performance Alloys Industry Overview

The high-performance alloys market studied is partially consolidated among the top players. The key players include (in no particular order): ATI, Precision Castparts Corp., Nippon Yakin Kogyo Co., Ltd., CRS Holdings Inc., and High Performance Alloys, Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand of the Alloys in the Aerospace Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Fluctuating Pricing of Raw Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Base Metal Type

- 5.1.1 Aluminum

- 5.1.2 Nickel

- 5.1.3 Steel

- 5.1.4 Magnesium

- 5.1.5 Titanium

- 5.1.6 Other Base Metal Types

- 5.2 Product Type

- 5.2.1 Heat Resistant Alloys

- 5.2.2 Corrosion Resistant Alloys

- 5.2.3 Wear Resistant Alloys

- 5.2.4 Other Product Types

- 5.3 End-user Industry

- 5.3.1 Aerospace

- 5.3.2 Power

- 5.3.3 Oil and Gas (including Chemical)

- 5.3.4 Electrical and Electronics

- 5.3.5 Automotive

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 France

- 5.4.3.3 Germany

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis ** / Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMG

- 6.4.2 ATI

- 6.4.3 Corporation VSMPO-AVISMA

- 6.4.4 CRS Holdings Inc.

- 6.4.5 Fort Wayne Metals Research Products, LLC

- 6.4.6 High Performance Alloys, Inc

- 6.4.7 Nippon Yakin Kogyo Co., Ltd.

- 6.4.8 Precision Castparts Corp

- 6.4.9 Stanford Advanced Materials

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Surging Demand for Non-ferrous Metals

- 7.2 Other Opportunities