|

市场调查报告书

商品编码

1773439

机器人码垛机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Robotic Palletizers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

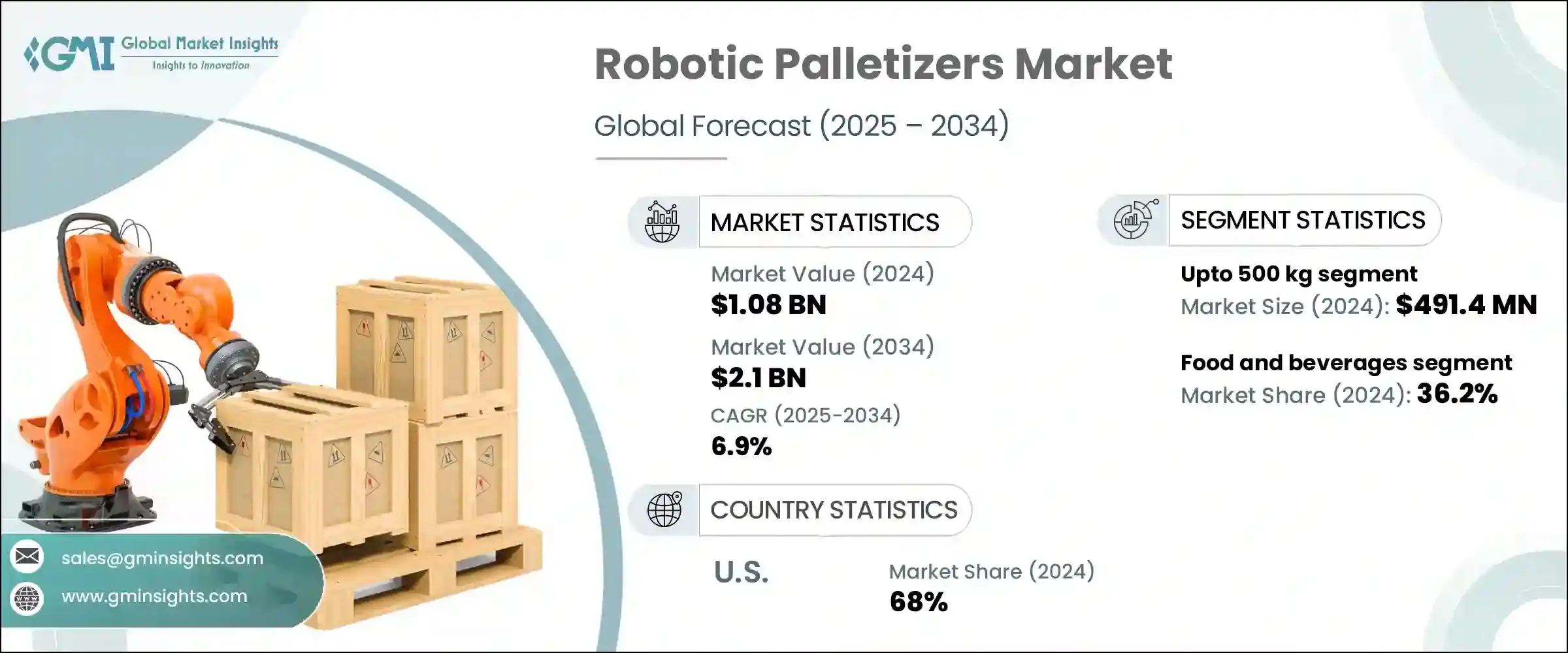

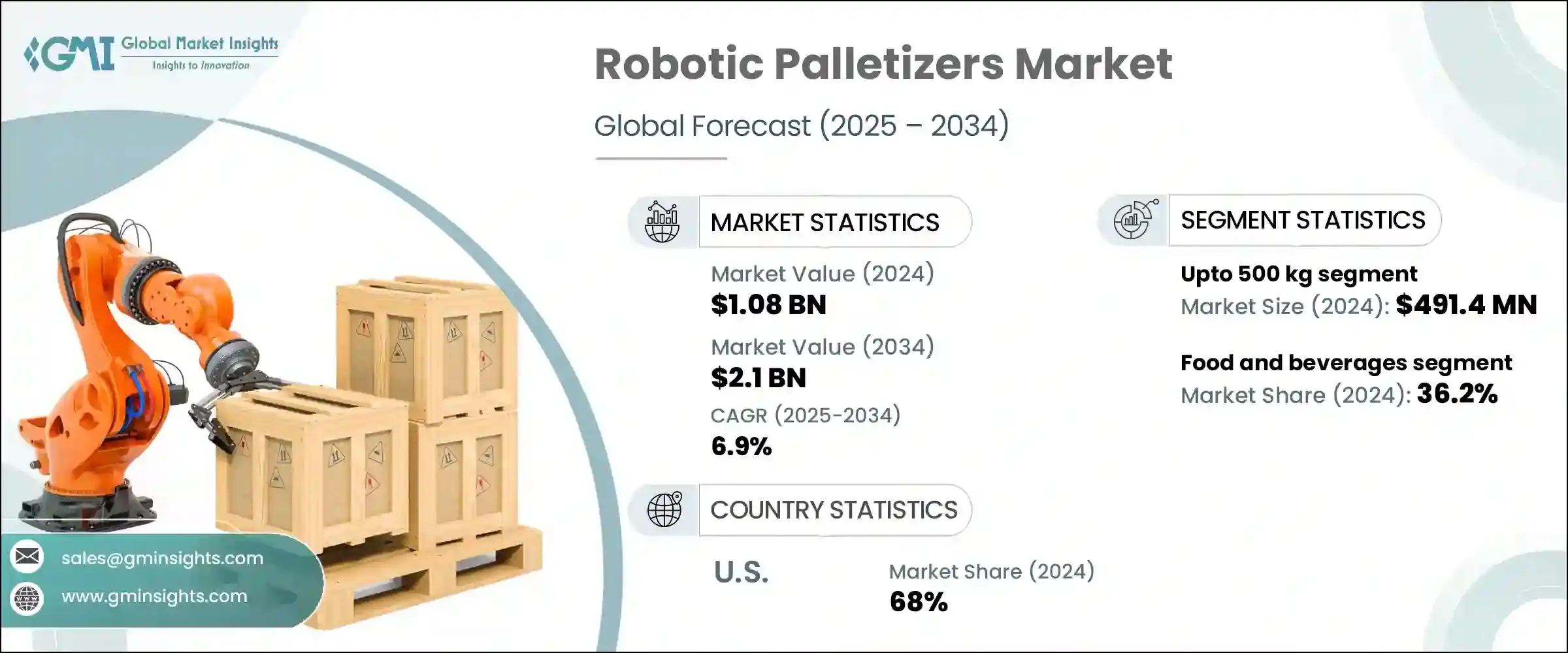

2024年,全球机器人码垛机市场规模达10.8亿美元,预计到2034年将以6.9%的复合年增长率成长,达到21亿美元。各行各业对自动化的需求激增是推动该市场发展的主要因素。机器人码高机旨在实现堆迭和拆垛任务的自动化,从而缩短生产週期、提高产量、减少占地面积并提高成本效益。劳动力短缺加剧、薪资上涨以及对更安全、更有效率的物料搬运的需求是主要的成长动力。透过自动化将货物堆放到托盘上的劳动密集型流程,这些机器人系统减少了对人工的依赖,减少了错误,并透过最大限度地降低事故风险来提高工作场所的安全性。

全球物流的复杂性和电子商务的扩张进一步推动了成长,这两者都要求仓库和配送中心能够有效率地处理各种产品,以便快速处理订单。先进机械手臂和协作机器人等创新技术使机器人码垛机更加灵活,也更容易中小企业使用。儘管机器人码垛机具有许多优势,但由于前期成本高昂、与现有系统的整合复杂、持续的维护和编程费用以及对熟练人员的需求,市场仍面临挑战。儘管如此,持续的技术创新和经济效益正在推动机器人码垛机在自动化製造和供应链环境中的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 10.8亿美元 |

| 预测值 | 21亿美元 |

| 复合年增长率 | 6.9% |

2024年,500公斤以下产品搬运领域创造了4.914亿美元的市场规模。这类机器人专为轻型至中型包装而设计,正经历快速成长,尤其是在电子商务和消费品搬运自动化程度不断提高的背景下。这些机器人码垛机在製药、食品饮料、消费品和其他製造业等行业备受青睐。它们能够处理各种尺寸的纸箱、袋子和箱子,因此用途广泛,在各种码垛应用中需求旺盛。

2024年,食品和饮料行业占据了最大的市场份额,占36.2%。在这个效率、卫生和一致性至关重要的行业中,机器人码垛机已成为不可或缺的一部分。大量生产和快速配送的需求,加上持续的劳动力短缺以及码垛等重复性任务成本的上升,促使企业推行流程自动化。机器人系统不仅提高了营运效率,还减少了人与食品的接触,最大限度地降低了污染风险。此外,专门研发的食品级机器人符合严格的卫生标准,进一步推动了该产业的应用。

2024年,美国机器人码垛机市场占68%的市场。推动这一成长的因素包括供应链日益复杂以及劳动力成本高昂,这使得机器人码垛机成为维持营运连续性的一项切实可行的投资。美国也受益于製造技术的进步和工业4.0计划,从而推动了对机器人码垛解决方案的需求。作为机器人应用的领先国家之一,美国在多个製造环节的机器人密度不断增长,增强了市场发展势头。

在全球机器人码垛机行业竞争的领先公司包括 FANUC 公司、KUKA AG、ABB、霍尼韦尔国际公司、施耐德包装设备公司、Bastian Solutions、Fuji Robotics、Okura LLC、Pasco Systems、Premier Tech、Robotiq、川崎重工业有限公司、KION Group AG、Sidel 和安川电机株式会川会。为加强市场地位,机器人码垛机领域的公司专注于创新,开发能够精确处理各种尺寸和重量产品的高度适应性机器人系统。他们投资研发,以提高自动化效率、易于整合和用户友好的介面。与包装和物流解决方案提供商的策略合作使他们能够提供无缝融入现有供应链的端到端自动化解决方案。公司还透过在地化生产、增强客户服务网络和量身定制的售后支援扩大全球影响力,确保稳固的客户关係。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 自动化需求不断成长

- 机器人技术与人工智慧的进步

- 电子商务和物流的成长

- 产业陷阱与挑战

- 初期投资和安装成本高

- 技术复杂性和对熟练劳动力的需求

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按有效载荷容量,2021 - 2034 年

- 主要趋势

- 最多 500 公斤

- 501-1000公斤

- 1000公斤以上

第六章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 食品和饮料

- 製药

- 化妆品和个人护理

- 电子商务与物流

- 其他的

第七章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- ABB

- Bastian Solutions

- FANUC Corporation

- Fuji Robotics

- Honeywell International Inc

- Kawasaki Heavy Industries Ltd

- KION Group AG

- KUKA AG

- Okura LLC

- Pasco Systems

- Premier Tech

- Robotiq

- Schneider Packaging Equipment Company

- Sidel

- Yaskawa Electric Corporation

The Global Robotic Palletizers Market was valued at USD 1.08 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 2.1 billion by 2034. The surge in automation demand across various sectors is a major factor propelling this market. Robotic palletizers are engineered to automate palletizing and depalletizing tasks, enabling faster cycle times, increased throughput, compact footprints, and cost-efficiency. Rising labor shortages, escalating wages, and the drive for safer, more efficient material handling are primary growth drivers. By automating the labor-intensive process of stacking goods onto pallets, these robotic systems reduce the dependency on manual labor, limit errors, and enhance workplace safety by minimizing accident risks.

Growth is further supported by the complexity of global logistics and the expansion of e-commerce, both of which require highly efficient handling of diverse products in warehouses and distribution centers for rapid order processing. Innovations such as advanced robotic arms and the introduction of collaborative robots have made robotic palletizers more versatile and accessible to small and medium-sized businesses alike. Despite their advantages, the market faces challenges due to high upfront costs, integration complexities with existing systems, ongoing maintenance and programming expenses, and the need for skilled personnel. Nevertheless, ongoing technological innovations and economic benefits are driving the adoption of robotic palletizers within automated manufacturing and supply chain environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.08 billion |

| Forecast Value | $2.1 billion |

| CAGR | 6.9% |

The handling products up to 500 kg segment generated USD 491.4 million in 2024. Robots in this category are designed for light to medium-weight packages and are experiencing rapid growth, particularly due to increasing automation in e-commerce and consumer product handling. These robotic palletizers are favored across industries such as pharmaceuticals, food and beverages, consumer goods, and other manufacturing sectors. Their ability to manage varying box sizes, bags, and cases makes them versatile and highly demanded for diverse palletizing applications.

The food & beverages segment held the largest market share in 2024, accounting for 36.2%. Robotic palletizers have become indispensable in this industry where efficiency, hygiene, and consistency are critical. High-volume production and swift distribution demands, combined with persistent labor shortages and rising costs for repetitive tasks like palletizing, push companies to automate processes. Robotic systems not only improve operational efficiency but also reduce human contact with food products, minimizing contamination risks. Additionally, specialized food-grade robots are developed to comply with strict hygiene standards, further driving adoption in this sector.

United States Robotic Palletizers Market held a 68% share in 2024. Factors fueling this growth include increasing supply chain complexity and high labor costs, which make robotic palletizers a practical investment to maintain operational continuity. The U.S. also benefits from advancements in manufacturing technology and Industry 4.0 initiatives, boosting the demand for robotic palletizing solutions. As one of the leaders in robotics adoption, the country exhibits growing robot density across multiple manufacturing processes, enhancing market momentum.

Leading companies competing in the Global Robotic Palletizers Industry include FANUC Corporation, KUKA AG, ABB, Honeywell International Inc, Schneider Packaging Equipment Company, Bastian Solutions, Fuji Robotics, Okura LLC, Pasco Systems, Premier Tech, Robotiq, Kawasaki Heavy Industries Ltd, KION Group AG, Sidel, and Yaskawa Electric Corporation. To strengthen their market presence, companies in the robotic palletizers sector focus on innovation by developing highly adaptable robotic systems capable of handling a wide range of product sizes and weights with precision. They invest in research and development to improve automation efficiency, ease of integration, and user-friendly interfaces. Strategic collaborations with packaging and logistics solution providers allow them to deliver end-to-end automation solutions that fit seamlessly into existing supply chains. Firms also expand their global footprint through localized production, enhanced customer service networks, and tailored after-sales support, ensuring robust client relationships.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Payload Capacity

- 2.2.3 End Use Industry

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for automation

- 3.2.1.2 Advancements in robotic technology and AI

- 3.2.1.3 Growth of e-commerce and logistics

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and installation costs

- 3.2.2.2 Technical complexity and need for skilled labor

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Payload Capacity, 2021 - 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 Upto 500 kg

- 5.3 501-1000 kg

- 5.4 Above 1000 kg

Chapter 6 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Food and beverages

- 6.3 Pharmaceuticals

- 6.4 Cosmetics and personal care

- 6.5 E-commerce and logistics

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Bastian Solutions

- 8.3 FANUC Corporation

- 8.4 Fuji Robotics

- 8.5 Honeywell International Inc

- 8.6 Kawasaki Heavy Industries Ltd

- 8.7 KION Group AG

- 8.8 KUKA AG

- 8.9 Okura LLC

- 8.10 Pasco Systems

- 8.11 Premier Tech

- 8.12 Robotiq

- 8.13 Schneider Packaging Equipment Company

- 8.14 Sidel

- 8.15 Yaskawa Electric Corporation