|

市场调查报告书

商品编码

1773443

气垫包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Air Cushion Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

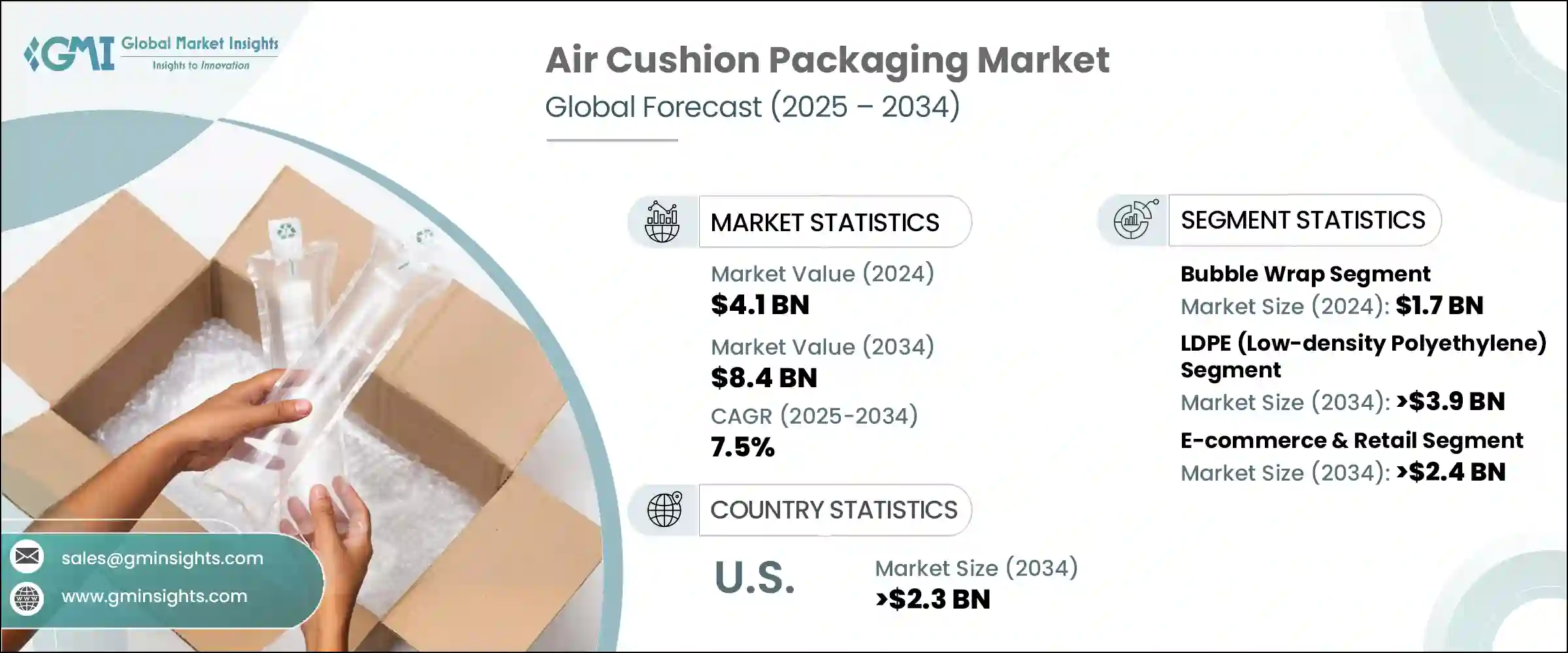

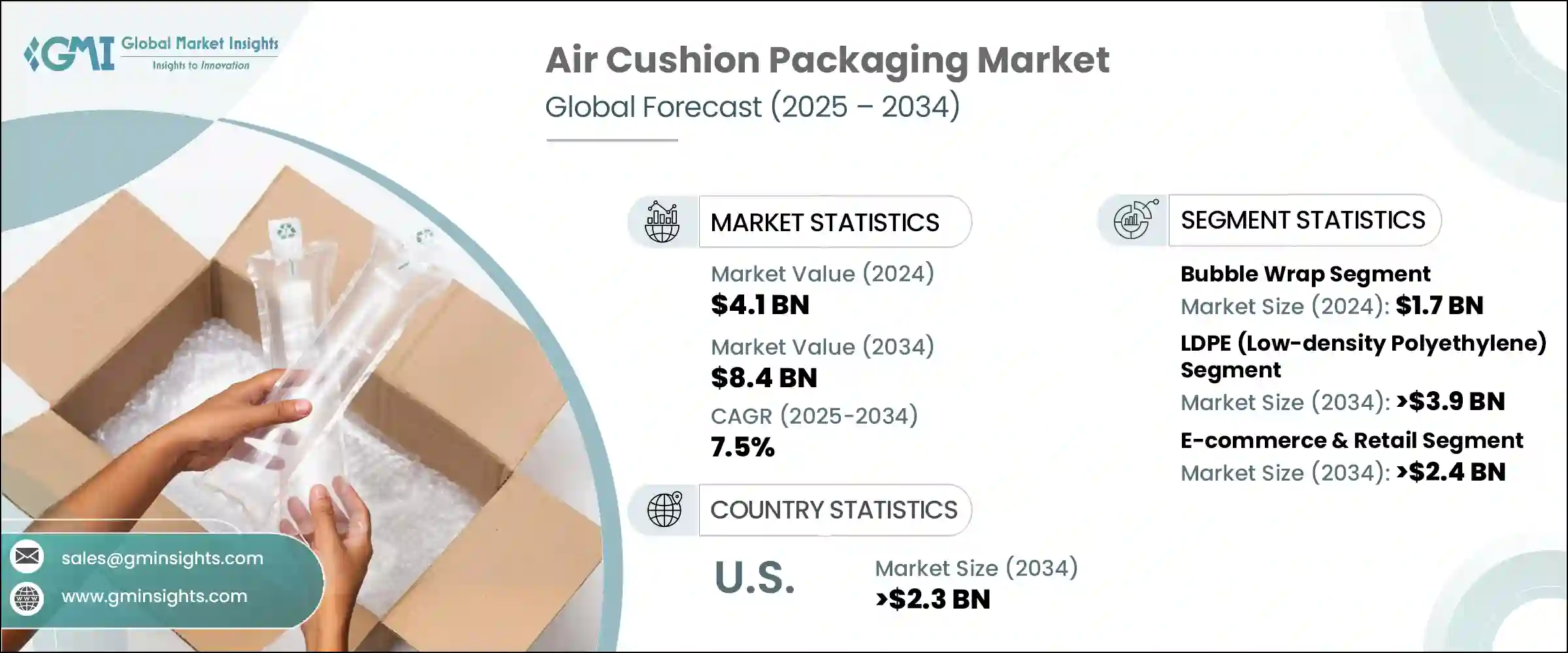

2024年,全球气垫包装市场规模达41亿美元,预计2034年将以7.5%的复合年增长率成长,达到84亿美元。这一成长主要得益于电子商务和「最后一公里」配送系统的快速扩张,以及强有力的永续发展要求和对环保包装的日益重视。随着全球零售业转向更快的配送速度和更大的包裹运输量,对保护性、适应性强且轻量化包装的需求日益增长。

柔性气垫包装满足了这一需求,它提供了一种多功能的解决方案,可以保护各种形状和尺寸的产品,同时最大限度地减轻运输重量。这种高效的包装有助于降低成本,并符合针对过度包装浪费和碳排放的不断变化的环境法规。随着全球各大品牌纷纷适应新的物流和监管要求,灵活、可扩展且可回收的包装形式的重要性日益凸显,使得气垫包装日益不可或缺。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 41亿美元 |

| 预测值 | 84亿美元 |

| 复合年增长率 | 7.5% |

先前贸易政策引发的关税驱动供应链中断,迫使美国气垫包装产业的製造商重新思考采购策略。由于依赖进口原料,由于关税上调导致投入价格上涨,生产成本如今面临压力。国内采购替代方案正变得越来越有吸引力,但必须保持成本竞争力。

儘管面临这些挑战,由于柔性保护性包装的适应性强且能够降低体积运输成本,其需求仍在不断增长。与硬质包装不同,气垫包装能够适应各种形状和尺寸的产品,同时在运输过程中保持产品的完整性。为了满足中小企业和直销品牌的需求,供应商现在提供小批量客製化包装,交货时间更短,并辅以自动化、数位印刷和模组化机械设备。这些创新正在重塑包装生产线,使其优先考虑产品上市速度和消费者个人化需求。

2024年,气泡膜市场规模达17亿美元。气泡膜以其缓衝性能和保护易碎物品免受衝击的能力而闻名,广泛应用于电子商务、电子产品和玻璃相关行业。其灵活性和易用性使其成为包装各种形状产品的理想选择,确保运输和储存过程中的安全。可生物降解和可回收气泡膜的最新进展,正在帮助品牌在不牺牲性能的情况下达到永续发展的标准。这种转变正在提升气泡膜在市场上的相关性,尤其是在环保因素成为关键购买因素的当下。

到2034年,低密度聚乙烯(LDPE)市场规模预计将达到39亿美元。低密度聚乙烯因其强度高、柔韧性好、重量轻而被广泛用于气垫包装。 LDPE具有良好的减震性能,并在广泛的温度范围内保持保护性能,因此非常适合用于气垫包装和气泡膜的生产。它与自动化包装生产线和封口设备的兼容性提高了配送中心的效率,而其可回收性则有助于实现永续发展目标。儘管LDPE不如HDPE耐用,但对于注重轻量化保护和成本效益的应用而言,它仍然是首选。 LDPE泡棉包装还能优异地保护不规则形状的物品,进一步增强了其在物流网络中的实用性。

预计到2034年,美国气垫包装市场规模将达23亿美元。该市场已发展成熟,但仍在快速发展,电子商务、电子产品、食品和医药分销领域涌现出新的需求驱动力。随着消费者预期的转变和监管审查的加强,轻量化、可持续包装的创新变得至关重要。许多公司正在转向可回收和可堆肥的包装,包括纸质气垫和植物性气垫。为此,PAC Worldwide、Pregis和Sealed Air等主要产业参与者正在推出与全通路物流模式相契合的环保解决方案。这些发展反映出业界正在更广泛地转向营运敏捷性、永续性以及针对动态零售生态系统的客製化解决方案。

为全球气垫包装市场竞争实力做出贡献的知名公司包括 FROMM Packaging Systems Inc.、Advanced Protective Packaging Ltd.、Sealed Air Corporation、Smurfit Kappa Group 和 Pregis LLC。这些公司透过创新、策略联盟和永续设计领导力持续塑造市场格局。气垫包装领域的公司正在利用多种策略来巩固其市场地位。

研发工作重点在于开发可回收、生物基且轻量化的替代品,以符合永续发展目标并降低运输成本。领先的企业正在采用自动化和数位客製化技术,以满足中小企业和D2C品牌青睐的短版多品种包装形式的需求。此外,全球企业正在扩大生产布局并实现供应链本地化,以避免关税相关的成本波动。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 电子商务和包裹运输的成长

- 成本效益和轻量性

- 对永续包装解决方案的需求不断增长

- 增强对易碎货物的保护

- 易于取得和应用

- 产业陷阱与挑战

- 聚苯乙烯填料的环境问题

- 与自动包装系统不相容

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依材料类型,2021 年至 2034 年

- LDPE(低密度聚乙烯)

- HDPE(高密度聚乙烯)

- 其他的

第六章:市场估计与预测:依产品类型,2021 年至 2034 年

- 气泡膜

- 气枕

- 充气气囊

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 电子商务与零售

- 食品和饮料

- 製药和医疗保健

- 消费者

- 汽车和工业

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Advanced Protective Packaging Ltd.

- Amcor plc

- AptarGroup, Inc.

- DS Smith Plc

- FROMM Packaging Systems Inc.

- Huhtamaki Oyj

- Mondi Flexible Packaging

- Mondi Group

- Pregis LLC

- ProAmpac LLC

- Rengo Co., Ltd.

- Schur Flexibles Group

- Sealed Air Corporation

- Smurfit Kappa Group

- Sonoco Products Company

- Storopack Hans Reichenecker GmbH

- Toray Plastics (America), Inc.

- Winpak Ltd.

The Global Air Cushion Packaging Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 8.4 billion by 2034. This growth is being fueled by the rapid expansion of e-commerce and last-mile delivery systems, coupled with strong sustainability mandates and increased focus on eco-conscious packaging. As global retail shifts toward faster fulfillment and higher volume parcel shipments, the need for protective, adaptable, and lightweight packaging is intensifying.

Flexible air cushions meet this demand by offering a versatile solution that can protect a wide range of product shapes and sizes while minimizing shipping weight. This efficiency contributes to cost reductions and aligns with evolving environmental regulations that target excessive packaging waste and carbon emissions. As brands across the globe adapt to new logistical and regulatory demands, the importance of flexible, scalable, and recyclable packaging formats continues to grow, making air cushion packaging increasingly indispensable.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $8.4 Billion |

| CAGR | 7.5% |

Tariff-driven supply chain disruptions sparked by prior trade policies have pushed manufacturers in the U.S. air cushion packaging industry to rethink sourcing strategies. With a reliance on imported raw materials, production costs are now under pressure, as higher tariffs raise input prices. Domestic sourcing alternatives are becoming more attractive, although they must remain cost competitive.

Despite these challenges, demand for flexible protective packaging is rising thanks to its adaptability and ability to reduce volumetric shipping costs. Unlike rigid formats, air cushions accommodate various product shapes and sizes while maintaining product integrity in transit. To cater to SMEs and direct-to-consumer brands, suppliers are now providing low-volume custom packaging with shorter lead times, supported by automation, digital printing, and modular machinery. These innovations are reshaping packaging lines to prioritize speed-to-market and consumer personalization.

The bubble wrap segment accounted for USD 1.7 billion in 2024. Known for its cushioning properties and ability to shield fragile items from impact, bubble wrap is widely used in e-commerce, electronics, and glass-related industries. Its flexibility and ease of use make it ideal for wrapping products of varying shapes, ensuring safety during transport and storage. Recent advancements in biodegradable and recyclable bubble wrap are helping brands meet sustainability benchmarks without sacrificing performance. This shift is enhancing the relevance of bubble wrap in the market, particularly as environmental considerations become a key purchasing factor.

By 2034, the LDPE segment is expected to reach USD 3.9 billion. Low-density polyethylene is widely chosen for air cushion packaging due to its strength, flexibility, and low weight. LDPE's ability to absorb shocks and maintain protective performance across a wide temperature range makes it suitable for air pillows and bubble wrap production. Its compatibility with automated packing lines and sealing equipment adds efficiency to fulfillment centers, while its recyclability supports sustainability goals. Though it lacks the higher durability of HDPE, LDPE remains the preferred option for applications prioritizing lightweight protection and cost-efficiency. Foam wraps made from LDPE also excel in protecting irregularly shaped items, further enhancing their utility across logistics networks.

U.S. Air Cushion Packaging Market is expected to reach USD 2.3 billion by 2034. The segment is mature yet evolving rapidly, with new demand drivers emerging from e-commerce, electronics, food, and pharmaceutical distribution. Innovation in lightweight, sustainable packaging has become critical as consumer expectations shift and regulatory scrutiny increases. Many companies are now transitioning to recyclable and compostable packaging, including paper cushions and plant-based air pillows. In response, major industry players like PAC Worldwide, Pregis, and Sealed Air are introducing eco-conscious solutions that align with omnichannel logistics models. These developments reflect a broader industry pivot toward operational agility, sustainability, and tailored solutions for dynamic retail ecosystems.

Prominent companies contributing to the competitive strength of the Global Air Cushion Packaging Market include FROMM Packaging Systems Inc., Advanced Protective Packaging Ltd., Sealed Air Corporation, Smurfit Kappa Group, and Pregis LLC. These players continue to shape the market landscape through innovation, strategic alliances, and sustainable design leadership. Companies operating in the air cushion packaging space are leveraging several strategies to cement their market presence.

A major focus lies on R&D efforts to develop recyclable, bio-based, and lightweight alternatives that align with sustainability goals and reduce shipping costs. Leading firms are adopting automation and digital customization technologies to meet demand for short-run, high-mix packaging formats favored by SMEs and D2C brands. In addition, global players are expanding their manufacturing footprints and localizing supply chains to avoid tariff-related cost fluctuations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growth in e-commerce and parcel shipping

- 3.3.1.2 Cost-effectiveness and lightweight nature

- 3.3.1.3 Rising demand for sustainable packaging solutions

- 3.3.1.4 Increased protection for fragile goods

- 3.3.1.5 Easy availability and application

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Environmental concerns with polystyrene-based fill

- 3.3.2.2 Incompatibility with automated packing systems

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Material Type, 2021 – 2034 (USD Million and Units)

- 5.1 LDPE (low-density polyethylene)

- 5.2 HDPE (high-density polyethylene)

- 5.3 Others

Chapter 6 Market estimates & forecast, By Product Type, 2021 – 2034 (USD Billion and Units)

- 6.1 Bubble wrap

- 6.2 Air pillows

- 6.3 Inflatable air bags

Chapter 7 Market estimates & forecast, By End Use, 2021 – 2034 (USD Billion and Units)

- 7.1 E-commerce & retail

- 7.2 Food & beverages

- 7.3 Pharmaceuticals & healthcare

- 7.4 Consumer

- 7.5 Automotive & industrial

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion and Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Advanced Protective Packaging Ltd.

- 9.2 Amcor plc

- 9.3 AptarGroup, Inc.

- 9.4 DS Smith Plc

- 9.5 FROMM Packaging Systems Inc.

- 9.6 Huhtamaki Oyj

- 9.7 Mondi Flexible Packaging

- 9.8 Mondi Group

- 9.9 Pregis LLC

- 9.10 ProAmpac LLC

- 9.11 Rengo Co., Ltd.

- 9.12 Schur Flexibles Group

- 9.13 Sealed Air Corporation

- 9.14 Smurfit Kappa Group

- 9.15 Sonoco Products Company

- 9.16 Storopack Hans Reichenecker GmbH

- 9.17 Toray Plastics (America), Inc.

- 9.18 Winpak Ltd.