|

市场调查报告书

商品编码

1773451

捲叶机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Leaf Rolling Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

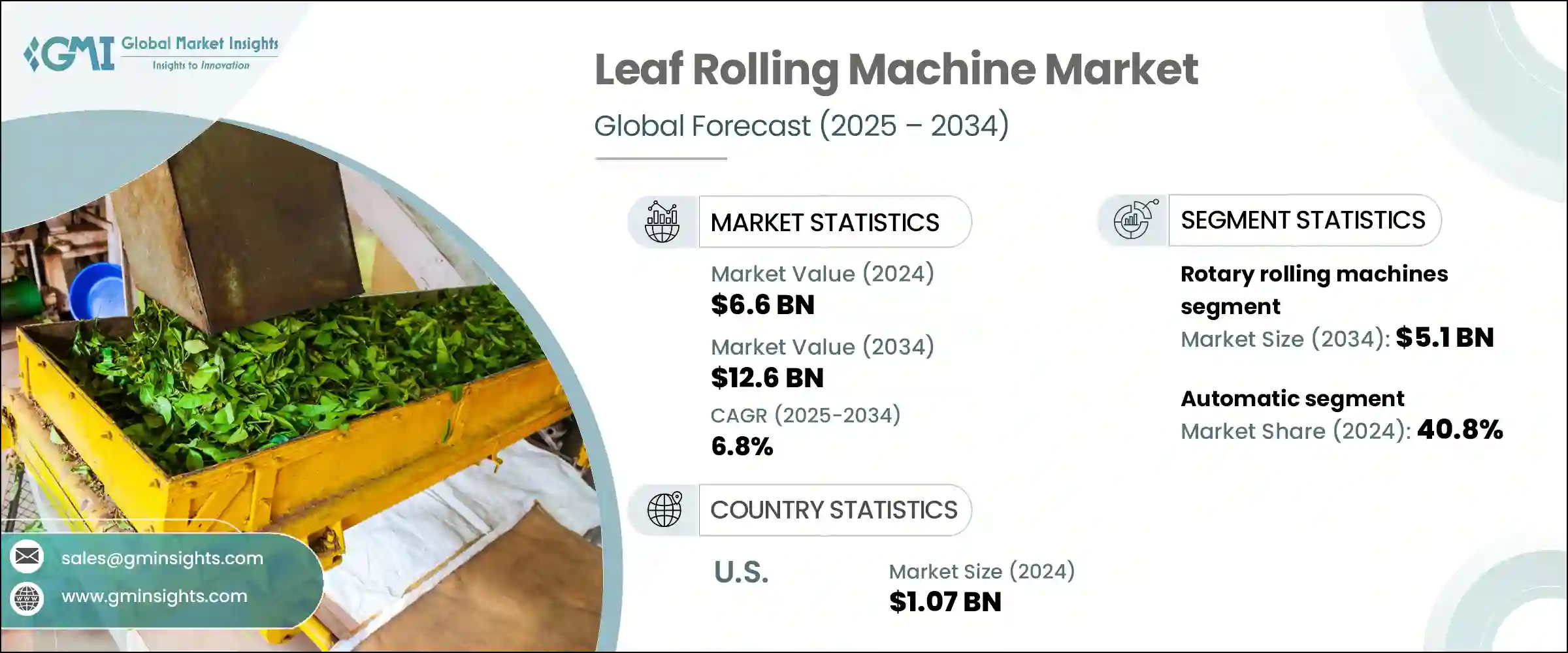

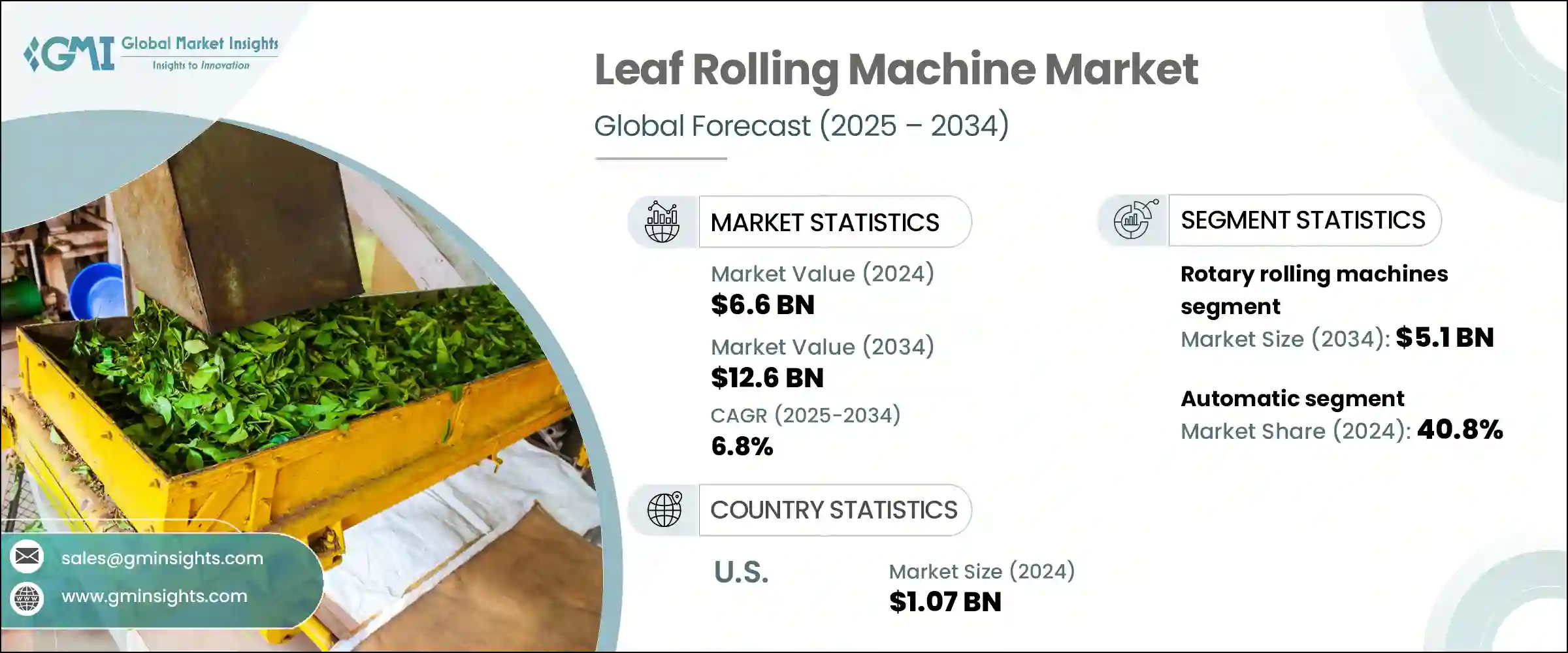

2024年,全球捲叶机市场规模达66亿美元,预计到2034年将以6.8%的复合年增长率成长,达到126亿美元。不断增长的劳动成本和自动化的普及,促使烟草、茶叶和大麻等产业以机械化系统取代手工作业。现代化设施正越来越多地采用OPC UA等工业4.0协议,以实现即时监控和互通性。机械设备与管理系统之间的协调通讯提高了生产可视性并降低了整合成本,这在大批量生产环境中至关重要。配备这些智慧功能的捲叶机可在受监管行业中提供增强的最佳化、可追溯性和品质保证。政府和农业计画正在支持自动化应用,以解决劳动力短缺问题并吸引年轻工人。

机器人技术资助和试点激励等措施正在推动OEM)的创新和规模化发展,包括捲叶机製造商。这些支援性项目正在促进智慧製造工具的快速试验,使原始设备製造商能够将自动化、资料分析和物联网功能整合到捲叶系统中。政府支持的拨款和补贴正在降低创新成本,并降低製造商采用先进机械的风险。因此,企业正在投资模组化设计原型,并在大型和小型农户中启动试点安装。这种外部支援也加快了具有自适应捲叶精度、远端诊断和节能运行等功能的下一代机器的上市时间。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 66亿美元 |

| 预测值 | 126亿美元 |

| 复合年增长率 | 6.8% |

旋转捲烟机在2024年为该领域带来了28亿美元的收入,预计到2034年将达到51亿美元。这些机器专为连续、高通量加工而设计,服务于雪茄、茶叶、大麻捲和草药卷的大型生产商。这些机器在每小时数千台烟叶的生产过程中,仍能确保始终如一的质量,并且无需进行重大改造即可处理各种烟叶材料,从而为製造商提供了营运灵活性和丰厚的投资回报。

2024年,自动化机械市场规模达27亿美元,占40.8%。全自动捲板系统减少了劳动力需求和人为错误,这在薪资成长和劳动力短缺问题严峻的已开发地区尤其重要。这些系统能够生产尺寸、重量和密度均匀的捲板,帮助製造商满足严格的监管和品牌标准。其可扩展性使企业能够适应需求波动,同时又不牺牲一致性。

2024年,美国捲烟机市场规模达10.7亿美元,预计2025年至2034年的复合年增长率将达到6.4%。合法娱乐和医用大麻在30多个州的快速扩张,引发了人们对自动化预捲烟生产设备的浓厚兴趣。获得许可的生产商正在投资全自动机器,以满足GMP标准,减少对劳动力的依赖,并提供品质一致的预包装产品。烟草和新兴草本保健品牌也正在更新生产线,采用整合工业4.0功能的旋转式和自动捲烟机。批次级可追溯性、无尘室相容性和机器人搬运等重点领域正在推动采购决策转向高度数据驱动、技术含量高的机器。

全球捲叶机市场的主要参与者包括:GreenBroz Inc.、福州科士达机械有限公司、湖北品洋科技有限公司、深圳市哈纳科技有限公司、Teamachinerys(ZC Machinery)、STM Canna、泉州市德力农林机械有限公司、泉州市威特茶叶机械有限公司、Haccoand LOM 工业有限公司、法新工业有限公司、机械式工业有限公司、机械式工业有限公司及金融工业有限公司。在这种竞争激烈的情况下,领先的製造商正在强调几项策略倡议。

首先,他们正在大力投资工业4.0集成,例如即时资料平台和OPC UA合规性,以提供先进的可追溯性和品质控制。其次,各公司正在扩展其产品组合,提供可处理多种烟叶类型(烟草、大麻、茶叶)的客製化解决方案,从而为客户提供营运灵活性。第三,各公司正在与农业和政府机构建立合作伙伴关係并获得试点计画资金,以加速自动化应用,并确保在新兴市场取得早期成功。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业影响力量

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按系统

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按机器类型,2021 - 2034 年

- 主要趋势

- 旋转滚压机

- 压轧机

- 泡罩捲绕机

- 模具式滚压机

第六章:市场估计与预测:按烟叶类型,2021 - 2034 年

- 主要趋势

- 烟草

- 大麻或大麻叶

- 茶叶

- 槟榔叶和可食用叶子

- 其他的

第七章:市场估计与预测:依自动化水平,2021 - 2034 年

- 主要趋势

- 自动的

- 半自动

- 手动的

第八章:市场估计与预测:依生产能力,2021 - 2034 年

- 主要趋势

- 低产能(<500 单位/小时)

- 中等产能(501-2,000 单位/小时)

- 高产能(>2,001 单位/小时)

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 工业的

- 商业的

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直销

- 间接销售

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十二章:公司简介

- Fuzhou KeShiDa Machinery Co., Ltd.

- GreenBroz Inc.

- Hangzhou LOM Technology Co., Ltd.

- Hubei Pinyang Technology Co., Ltd.

- Langfang ShengXing Food Machinery Co,.Ltd

- Quanzhou Deli Agroforestrial Machinery Co., Ltd.

- Quanzhou Wit Tea Machinery Co., Ltd.

- Shenzhen Hana-Tech Co., Ltd.

- STM Canna

- Teamachinerys (ZC Machinery)

- Tobacco And Machines

- Zhengzhou Jawo Machinery Co., Ltd.

- Zhengzhou Wenming Machinery Co., Ltd.

The Global Leaf Rolling Machine Market was valued at USD 6.6 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 12.6 billion by 2034. Growing labor costs and the spread of automation are prompting industries like tobacco, tea, and cannabis to replace manual processes with mechanized systems. Modern facilities are increasingly implementing Industry 4.0 protocols such as OPC UA for real-time monitoring and interoperability. Harmonized communication between machinery and management systems improves production visibility and reduces integration costs, crucial in high-volume production environments. Leaf rolling machines equipped with these smart features deliver enhanced optimization, traceability, and quality assurance in regulated sectors. Government and agricultural programs are supporting automation adoption to tackle labor shortages and attract younger workers.

Initiatives such as robotics funding and pilot incentives are driving OEM innovation and scaling, including among makers of leaf rolling machines. These supportive programs are fostering rapid experimentation with intelligent manufacturing tools, enabling OEMs to integrate automation, data analytics, and IoT features into rolling systems. Government-backed grants and subsidies are lowering the cost of innovation and de-risking the adoption of advanced machinery for manufacturers. As a result, companies are investing in prototyping modular designs and launching pilot installations in both large-scale and smallholder operations. This external support is also accelerating time-to-market for next-gen machines with capabilities such as adaptive rolling precision, remote diagnostics, and energy-efficient operation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.6 Billion |

| Forecast Value | $12.6 Billion |

| CAGR | 6.8% |

Rotary rolling machines pulled segment in USD 2.8 billion in revenue in 2024 and are expected to reach USD 5.1 billion by 2034. Designed for continuous, high-throughput processing, they serve large-scale producers of cigars, tea, cannabis pre-rolls, and herbal wraps. These machines ensure consistent quality at thousands of units per hour and can handle diverse leaf materials without needing major modifications, giving manufacturers operational flexibility and strong returns on investment.

The automatic machine segment generated USD 2.7 billion in 2024 and held a 40.8% share. Fully automatic leaf rolling systems reduce labor needs and human error-particularly valuable in developed regions where wage growth and labor shortages are critical issues. These systems produce uniform roll dimensions, weights, and densities, helping manufacturers meet strict regulatory and brand standards. Their scalability enables businesses to adapt to demand fluctuations without sacrificing consistency.

U.S. Leaf Rolling Machine Market was valued at USD 1.07 billion in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2034. The rapid expansion of legal recreational and medical cannabis across more than 30 states has driven strong interest in automated pre-roll production equipment. Licensed producers are investing in fully automatic machines to meet GMP standards, reduce labor dependency, and deliver consistent pre-packaged products. Tobacco and emerging herbal wellness brands are similarly updating production lines with rotary and automatic rollers integrated with Industry 4.0 features. Focus areas such as batch-level traceability, cleanroom compatibility, and robotic handling are shifting procurement decisions toward highly data-driven, technology-rich machinery.

Major players in the Global Leaf Rolling Machine Market include: GreenBroz Inc., Fuzhou KeShiDa Machinery Co., Ltd., Hubei Pinyang Technology Co., Ltd., Shenzhen Hana Tech Co., Ltd., Teamachinerys (ZC Machinery), STM Canna, Quanzhou Deli Agroforestrial Machinery Co., Ltd., Quanzhou Wit Tea Machinery Co., Ltd., Hangzhou LOM Technology Co., Ltd., Langfang ShengXing Food Machinery Co., Ltd., Tobaccoandmachines, Zhengzhou Jawo Machinery Co., Ltd., and Zhengzhou Wenming Machinery Co., Ltd. In this competitive landscape, leading manufacturers are emphasizing several strategic moves.

First, they are investing heavily in Industry 4.0 integration-such as real-time data platforms and OPC UA compliance-to provide advanced traceability and quality control. Second, firms are expanding their portfolios to offer customizable solutions that handle multiple leaf types (tobacco, cannabis, tea), giving customers operational flexibility. Third, companies are securing partnerships and pilot program funding with agricultural and government bodies to accelerate automation adoption and secure early-stage wins in emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Machine Type

- 2.2.2 Leaf Type

- 2.2.3 Automation Level

- 2.2.4 Production Capacity

- 2.2.5 End Use

- 2.2.6 Distribution Channel

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By system

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Rotary Rolling Machines

- 5.3 Compression Rolling Machines

- 5.4 Blister Rolling Machines

- 5.5 Die-Based Rolling Machines

Chapter 6 Market Estimates & Forecast, By Leaf Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Tobacco

- 6.3 Cannabis or Hemp Leaves

- 6.4 Tea Leaves

- 6.5 Betel Leaves & Edible Leaves

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Automation Level, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Automatic

- 7.3 Semi-automatic

- 7.4 Manual

Chapter 8 Market Estimates & Forecast, By Production Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low Capacity (<500 units/hour)

- 8.3 Medium Capacity (501-2,000 units/hour)

- 8.4 High Capacity (>2,001 units/hour)

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Industrial

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct Sales

- 10.3 Indirect Sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 U.K.

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 12.1 Fuzhou KeShiDa Machinery Co., Ltd.

- 12.2 GreenBroz Inc.

- 12.3 Hangzhou LOM Technology Co., Ltd.

- 12.4 Hubei Pinyang Technology Co., Ltd.

- 12.5 Langfang ShengXing Food Machinery Co,.Ltd

- 12.6 Quanzhou Deli Agroforestrial Machinery Co., Ltd.

- 12.7 Quanzhou Wit Tea Machinery Co., Ltd.

- 12.8 Shenzhen Hana-Tech Co., Ltd.

- 12.9 STM Canna

- 12.10 Teamachinerys (ZC Machinery)

- 12.11 Tobacco And Machines

- 12.12 Zhengzhou Jawo Machinery Co., Ltd.

- 12.13 Zhengzhou Wenming Machinery Co., Ltd.