|

市场调查报告书

商品编码

1773458

射频测试设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测RF Test Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

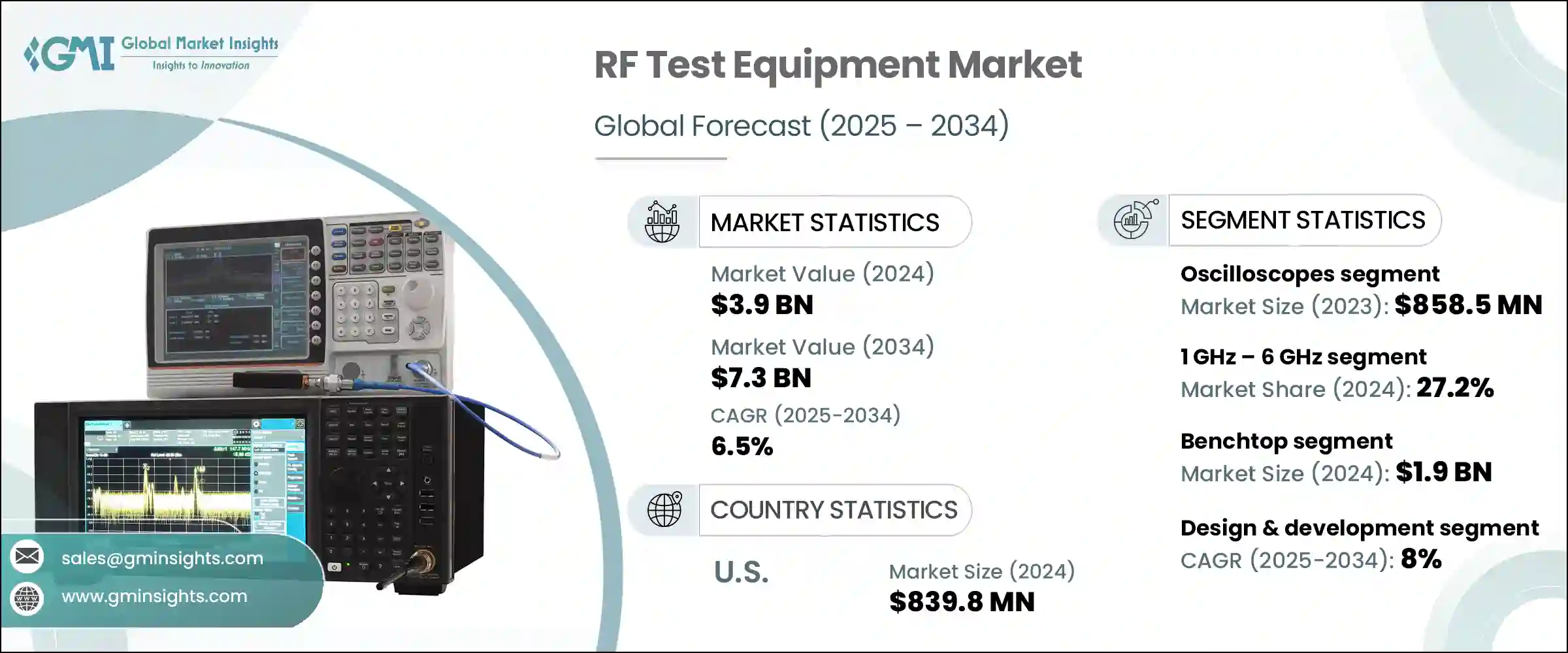

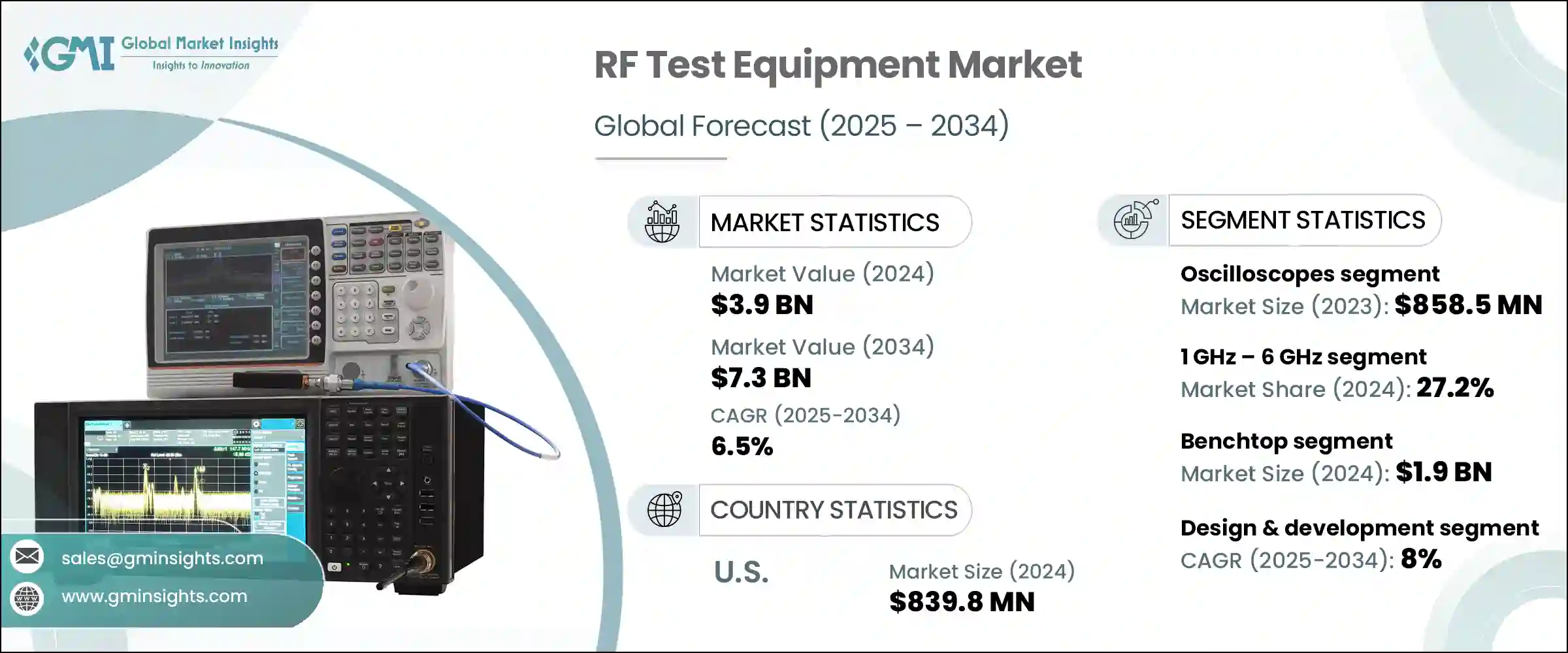

2024年,全球射频测试设备市场规模达39亿美元,预计2034年将以6.5%的复合年增长率成长,达到73亿美元。现代无线通讯技术日益复杂,对射频测试设备市场的成长影响巨大。随着各行各业逐渐转向5G、毫米波应用和物联网 (IoT),对精准、多频段测试解决方案的需求持续激增。如今,法规遵循、性能验证和互通性验证已成为电信、国防、汽车和工业自动化领域不可或缺的要求。

随着越来越多的设备实现无线连接并在拥挤的射频环境中运行,对精密测试设备的需求对于品质保证、频谱效率和安全合规性至关重要。射频测试解决方案也在不断发展,以适应超高频测试,从而推动了研发实验室和关键任务工程环境的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 39亿美元 |

| 预测值 | 73亿美元 |

| 复合年增长率 | 6.5% |

地缘政治发展在塑造全球射频测试设备格局方面发挥了显着作用。贸易政策和关税,尤其是近几届美国政府实施的政策,增加了关键零件和设备的进口成本,显着影响了生产成本和全球供应链。

5G 基础设施的快速发展已成为射频测试设备需求成长的最强大加速器之一。这些下一代通讯系统采用了波束成形、大规模 MIMO 和毫米波传输等高度复杂的技术,所有这些技术都需要进行精密的验证。精确的射频测试对于测量性能指标、验证标准合规性以及确保跨全球频段和设备供应商的兼容性至关重要。

此外,随着 5G 生态系统扩展到智慧城市、自动驾驶和远距医疗等新领域,射频测试设备仍然是确保在日益密集的无线环境中正常运作的基础。物联网解决方案在医疗保健、製造、汽车和智慧家庭领域的激增,进一步增加了射频测试的复杂性。基于 Wi-Fi、LoRa、Zigbee 和蓝牙运行的设备不仅需要验证其协议合规性,还需要验证其在频宽拥塞环境中的共存性和抗干扰能力。

2023年,示波器市场规模达8.585亿美元。这些仪器对于即时可视化和分析电讯号至关重要。随着数位电路、射频系统和电力电子技术日益复杂,示波器在需要精细时域测量的应用中变得不可或缺。研发、汽车设计和无线通讯等产业都依赖这些工具来诊断电气行为、排除系统故障以及高精度验证设计完整性。

预计到2024年,针对40 GHz以上频率设计的测试设备将贡献24.8%的市占率。这些超高频工具主要用于尖端领域,包括5G毫米波网路、先进雷达系统、太空探索和早期太赫兹实验。高风险研发环境中的工程师需要能够支援下一代连接和感测应用的低杂讯、高解析度仪器。儘管这一领域仍是一个新兴领域,但随着研究机构和创新实验室不断推动高频技术的前沿发展,这一领域正获得强劲的关注。

预计2034年,德国射频测试设备市场规模将达3.529亿美元。德国以其卓越的工程技术和工业精度而闻名,这推动了对先进测试工具的需求。工业4.0(包括精密机器人和智慧工厂)的兴起需要可靠的射频测试来实现无缝自动化。德国严格的製造法规,加上对高效电子产品的重视,使其成为持续投资射频测试基础设施的理想中心。强大的国内製造商和广泛的研发业务进一步巩固了德国在全球测试设备领域的重要性。

射频测试设备市场的主要参与者包括 B&K Precision Corporation、Anritsu Corporation 和 AR RF/Microwave Instrumentation,它们都在积极塑造射频验证技术的未来。无线射频测试设备市场的公司正在采取多种策略来增强市场实力并适应不断变化的行业需求。主要重点是透过整合对更高频率、更宽频宽和多协议环境的支援来增强产品组合,以跟上 5G、卫星和物联网的发展步伐。

策略性研发投资正在推动人工智慧测试、自动化和云端整合领域的创新。各企业也加强与电信和航太製造商的合作,共同开发针对新兴应用的解决方案。企业正在向高成长地区扩张,并实现生产本地化,以降低关税影响和供应链风险。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 5G网路部署

- 物联网设备的激增

- 汽车和航太技术的进步

- 人工智慧与机器学习的融合

- 软体定义测试设备的出现

- 产业陷阱与挑战

- 先进射频测试设备成本高昂

- 复杂性和快速的技术变化

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 示波器

- 讯号产生器

- 频谱分析仪

- 网路分析仪

- 射频功率计

- 射频合成器

- 其他的

第六章:市场估计与预测:依频率范围,2021-2034 年

- 主要趋势

- 低于1 GHz

- 1 GHz – 6 GHz

- 6 GHz – 18 GHz

- 18 GHz – 40 GHz

- 40 GHz以上

第七章:市场估计与预测:依外形尺寸,2021-2034

- 主要趋势

- 桌上型

- 便携式/手持式

- 模组化的

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 设计与开发

- 製造业

- 安装与维护

- 其他的

第九章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 电信

- 消费性电子产品

- 汽车与运输

- 航太与国防

- 工业的

- 医疗的

- 其他的

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Anritsu Corporation

- AR RF/Microwave Instrumentation

- B&K Precision Corporation

- Berkeley Nucleonics Corporation

- Bird Technologies

- Copper Mountain Technologies

- Giga-tronics Incorporated

- Keysight Technologies

- National Instruments (NI)

- Qorvo

- Rigol Technologies

- Rohde & Schwarz

- Saelig Company, Inc.

- Signal Hound

- Teledyne LeCroy

- Teledyne Technologies Incorporated

- Thorlabs, Inc.

- Vaunix Technology Corporation

- Yokogawa Electric Corporation

The Global RF Test Equipment Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 7.3 billion by 2034. Growth in this sector is being heavily influenced by the rising complexity of modern wireless communication technologies. As industries increasingly shift to 5G, mmWave applications, and the Internet of Things (IoT), the demand for accurate, multi-band testing solutions continues to surge. Regulatory compliance, performance validation, and interoperability verification are now considered non-negotiable requirements across telecommunications, defense, automotive, and industrial automation sectors.

As more devices become wirelessly connected and operate across crowded RF environments, the need for precise test equipment becomes essential for quality assurance, spectrum efficiency, and safety compliance. RF test solutions are also evolving to accommodate ultrahigh-frequency testing, driving demand across R&D labs and mission-critical engineering environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 6.5% |

Geopolitical developments have played a notable role in shaping the global RF test equipment landscape. Trade policies and tariffs, particularly those imposed during recent US administrations, have significantly impacted production costs and global supply chains by increasing import costs on key components and equipment.

The rapid advancement of 5G infrastructure has become one of the most powerful accelerators for RF test equipment demand. These next-generation communication systems utilize highly complex technologies like beamforming, massive MIMO, and mmWave transmissions, all of which require intricate validation. Precise RF testing is necessary to measure performance metrics, verify standard compliance, and guarantee compatibility across global bands and equipment suppliers.

Furthermore, as the 5G ecosystem expands into new domains like smart cities, autonomous mobility, and telemedicine, RF test equipment remains foundational to ensuring functionality across increasingly dense wireless environments. The proliferation of IoT solutions across healthcare, manufacturing, automotive, and smart homes has added another layer of complexity to RF testing. Devices operating on Wi-Fi, LoRa, Zigbee, and Bluetooth need to be validated not only for protocol compliance but also for coexistence and interference resilience in bandwidth-congested environments.

In 2023, the oscilloscope segment generated USD 858.5 million. These instruments are essential for visualizing and analyzing electrical signals in real-time. The rising intricacy of digital circuits, radio-frequency systems, and power electronics has made oscilloscopes indispensable in applications that require fine time-domain measurement. Industries such as R&D, automotive design, and wireless communication rely on these tools for diagnosing electrical behavior, troubleshooting systems, and validating design integrity with high levels of precision.

Test equipment designed for frequencies above the 40 GHz segment is anticipated to contribute a 24.8% share in 2024. These ultrahigh-frequency tools are primarily used in cutting-edge domains including 5G mmWave networks, advanced radar systems, space exploration, and early-stage terahertz experimentation. Engineers in high-stakes R&D environments demand low-noise, high-resolution instrumentation that can support next-generation connectivity and sensing applications. Though still an emerging segment, this category is gaining strong traction with research institutions and innovation labs pushing the frontiers of high-frequency technology.

Germany RF Test Equipment Market is forecasted to hit USD 352.9 million by 2034. The country's reputation for engineering excellence and industrial precision fuels the demand for advanced testing tools. The rise of Industry 4.0, including precision robotics and smart factories, requires reliable RF testing for seamless automation. Germany's rigorous manufacturing regulations, coupled with its focus on high-efficiency electronics, make it an ideal hub for continuous investment in RF testing infrastructure. The presence of strong domestic manufacturers and extensive R&D operations further reinforces Germany's importance in the global testing equipment landscape.

Key players in the RF Test Equipment Market include B&K Precision Corporation, Anritsu Corporation, and AR RF/Microwave Instrumentation, all of whom are actively shaping the future of RF validation technologies. Companies in the RF test equipment market are adopting several strategies to build market strength and adapt to evolving industry needs. A major focus has been on enhancing product portfolios by integrating support for higher frequencies, wider bandwidths, and multi-protocol environments to keep pace with 5G, satellite, and IoT advancements.

Strategic R&D investments are driving innovation in AI-enabled testing, automation, and cloud integration. Companies are also strengthening partnerships with telecom and aerospace manufacturers to co-develop solutions tailored to emerging applications. Geographic expansion into high-growth regions and localization of production are being pursued to reduce tariff impacts and supply chain risks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 5G network deployment

- 3.7.1.2 Proliferation of IoT devices

- 3.7.1.3 Advancements in automotive and aerospace technologies

- 3.7.1.4 Integration of AI and machine learning

- 3.7.1.5 Emergence of software-defined test equipment

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High cost of advanced RF test equipment

- 3.7.2.2 Complexity and rapid technological changes

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Oscilloscopes

- 5.3 Signal generators

- 5.4 Spectrum analyzers

- 5.5 Network analyzers

- 5.6 RF power meters

- 5.7 RF synthesizers

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Frequency Range, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Less than 1 GHz

- 6.3 1 GHz – 6 GHz

- 6.4 6 GHz – 18 GHz

- 6.5 18 GHz – 40 GHz

- 6.6 Above 40 GHz

Chapter 7 Market Estimates & Forecast, By Form Factor, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Benchtop

- 7.3 Portable/Handheld

- 7.4 Modular

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Design & development

- 8.3 Manufacturing

- 8.4 Installation & maintenance

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 Telecommunications

- 9.3 Consumer electronics

- 9.4 Automotive & transportation

- 9.5 Aerospace & defense

- 9.6 Industrial

- 9.7 Medical

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Anritsu Corporation

- 11.2 AR RF/Microwave Instrumentation

- 11.3 B&K Precision Corporation

- 11.4 Berkeley Nucleonics Corporation

- 11.5 Bird Technologies

- 11.6 Copper Mountain Technologies

- 11.7 Giga-tronics Incorporated

- 11.8 Keysight Technologies

- 11.9 National Instruments (NI)

- 11.10 Qorvo

- 11.11 Rigol Technologies

- 11.12 Rohde & Schwarz

- 11.13 Saelig Company, Inc.

- 11.14 Signal Hound

- 11.15 Teledyne LeCroy

- 11.16 Teledyne Technologies Incorporated

- 11.17 Thorlabs, Inc.

- 11.18 Vaunix Technology Corporation

- 11.19 Yokogawa Electric Corporation