|

市场调查报告书

商品编码

1836514

无线射频测试设备:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)RF Test Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

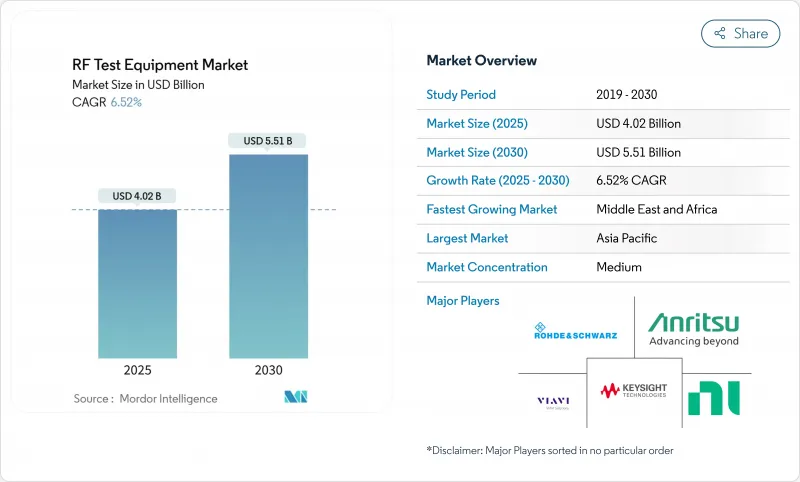

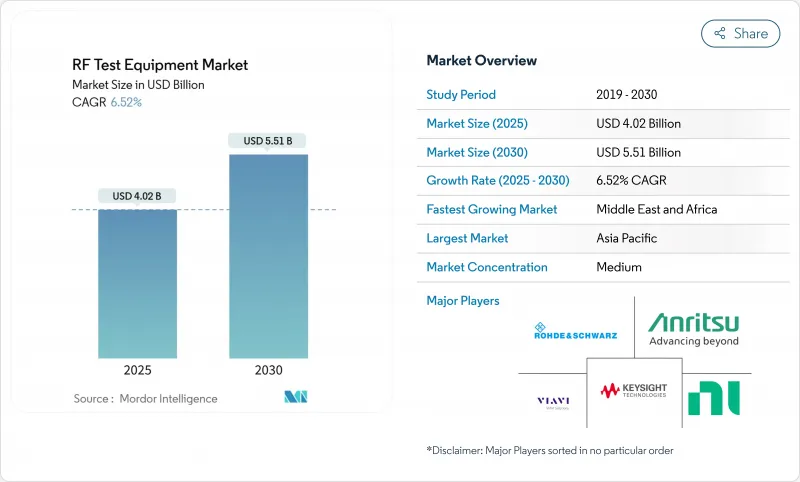

预计射频测试设备市场规模在 2025 年将达到 40.2 亿美元,在 2030 年将达到 55.1 亿美元,2025 年至 2030 年的复合年增长率为 6.52%。

5G 毫米波链路的普及、向软体定义实验室的转变以及不断增长的雷达和卫星项目,将支撑到2024年稳定的需求。硅基氮化镓功率元件的整合提升了扩大机的性能上限,而模组化平台则缩短了设定时间和营运成本。亚太地区的供应商继续扩大国内网路和出口合约的产量,而北美实验室则优先考虑云端连接自动化,以应对工程人员短缺。以思博伦通讯两次竞标标为例,产业整合正在加剧,并正朝着承包硬体和软体生态系统的方向转变,这些生态系统正随着3GPP标准的发布而不断发展。

全球射频测试设备市场趋势与洞察

需要 24GHz 以上检验的 mmWave 5G 部署激增

24 至 39 GHz 的 5G 商业部署需要无线电暗室、相位阵列波束检验和宽频频道模拟。是德科技报告称,其集生成、分析和衰落于一体的整合平台将测试週期缩短了 40%,并降低了研发中心的校准开销。美国、韩国和德国的网路营运商已经批量订购 32 和 64 通道分析仪,以便在密集的城市部署之前检验波束控制演算法。随着毫米波小型基地台密度的增加,服务实验室从单机频谱扫描转向自动化云链路工作流程,可以在一夜之间完成数百个参数检查。这种趋势推动了射频测试设备市场向模组化、富含 FPGA 的收发器发展,这些收发器能够提供每通道 2 GHz 的瞬时频宽。

东亚地区MIMO基地台快速成长

中国和日本正竞相在大都会地区部署64T64R射频,迫切需要能够同时测试数十条射频链路的设备。一份RF Globalnet简报预测,2024年全球将新建或升级940万个基地台,其中许多将采用大规模MIMO阵列。相位杂讯可实现单次无线特性分析,将塔侧服务时间缩短一半。东亚OEM厂商进一步推动了对PXIe刀片组的需求,随着3GPP版本的持续演进,工程师可以将其与软体一起重复使用。向灵活产能的转变支撑了生产线和现场服务供应商射频测试设备市场的持续成长。

ETSI 和 3GPP 标准的快速发展导致过时

3GPP Release 18 于 2024 年 6 月冻结,Release 19 计画于 2025 年底发布。每个週期都会引入新的空中介面功能,这些功能无法在传统测试仪上轻鬆仿真,因此必须提前更换设备或进行昂贵的 FPGA 升级。面临多标准认证的实验室必须同时维护 NR、LTE 和 Wi-Fi 测试平台,这会导致营运预算激增。虽然模组化设计可以降低部分风险,但韧体授权费用和再培训成本仍然抑制着射频测试设备市场的支出。

报告中分析的其他驱动因素和限制因素

- 德国和日本的汽车雷达/ADAS测试卫星

- LEO卫星群建设加速Ka波段测试

- 40GHz以上尺寸的散热挑战

細項分析

模组化GP仪器占据了这一层级射频测试设备市场的最大份额,到2024年将占据35%的收益,这得益于寻求可配置系统并随着3GPP版本发展的企业。它们的表现优于传统的机架式分析仪,复合年增长率高达8.5%。 PXIe和AXIe刀片采用脚本化FPGA。美国国家仪器公司的PXIe-5842向量讯号收发器提供2 GHz频宽,连续覆盖范围高达54 GHz,可在单一插槽中实现统一的生成和分析。租赁GP模式也得到了发展,尤其是在拉丁美洲,透过提供高级功能的订阅访问,无需资产摊销,以满足紧张的资本预算。半导体ATE虽然由于模组化工作台上分立通道数量的增加而导致市场份额略有下降,但对于大批量射频设备製造商来说仍然至关重要。

传统的通用仪器对于精密测量和需要绝对精度的政府实验室来说仍然至关重要。但随着软体更新解锁了新的调变格式,各公司开始转向以卡片为基础的架构,以避免堆高机式更新。供应商蓝图进一步强化了这种转变,建议容器化的微服务,让工程师可以按需下载测试专用程式。这种势头表明,模组化仍将是保持整个射频测试设备市场竞争力的关键。

桌上型电脑机型在2024年将维持45%的市场份额,这得益于其无与伦比的动态范围和低相位杂讯,这对于研发和校准至关重要。然而,模组化底盘的复合年增长率最高,达到9.2%,随着服务团队采用可扩展的通道数和小尺寸机箱,对射频测试设备市场的整体成长做出了重大贡献。是德科技将于2025年推出紧凑型54 GHz信号产生器和合成器,显示该公司在保持性能的同时,正在努力缩小传统机箱的尺寸。

凭藉高效 GaN PA 级的整合和改进的热路由,手持式分析仪现已支援在屋顶、石油平台和防御靶场的安装和维护。由于 40 GHz 以上频段的散热问题,其应用范围有限,但现场工作人员对其电池供电的频谱和云端同步记录功能非常欣赏,这些功能可以加速故障排除。随着网路密集化和卫星闸道的普及,射频测试设备市场越来越注重在精确度和移动性之间取得平衡,导致顶级供应商的产品策略趋于趋同。

区域分析

2024年,亚太地区将占全球销售额的39%,充分彰显其在射频测试设备市场的主导地位。中国的自力更生政策使其国内工具链焕发了活力,而日本和韩国则在雷达和半导体调查方法处于领先地位。高通、中国行动和小米使用骁龙X75展示了8.5 Gbps 5G Advanced毫米波测试平台,凸显了该地区在扩增实境检验领域的领导地位。 300毫米晶圆厂的投资有所回升,台湾和中国当地的代工厂也扩大了高频量产测试仪的生产。

北美按以金额为准排名第二。美国实验室迅速采用云端连接工作台来减轻射频专家的压力,而13亿美元的国防预算分配给无人机系统对抗计划,增加了对能够即时威胁识别的宽频分析仪的需求。加拿大的卫星网关建设进一步推动了Ka波段测试的预订量。欧洲在汽车雷达方面的专业知识(例如德国)以及北欧地区严重的人才短缺,导致复杂的一致性任务活性化外包给第三方实验室。

中东和非洲市场儘管规模较小,但复合年增长率最高,达8.7%。沙乌地阿拉伯计画在2030年发展350亿美元的太空经济,催生了对Ka波段有效载荷和地面段检验的需求。阿联酋的火星和小行星带探测任务加速了频道模拟器的采购。在南美洲,巴西通讯业者选择短期租赁来进行700 MHz频谱重耕计划,这为射频测试设备市场的供应商创造了一种自适应的市场进入模式,呈现出明显的租赁偏好。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 毫米波 5G 部署快速成长,需要 24GHz 以上频段检验

- 东亚大规模MIMO基地台部署

- 德国和日本的汽车雷达/ADAS测试需求

- 透过建构卫星低卫星群加速Ka波段测试

- 微型物联网晶片组协助手持式射频分析仪

- 美国转向软体定义、云端连线实验室的转变

- 市场限制

- 由于 ETSI 和 3GPP 标准的快速发展而过时

- 40 GHz以上尺寸的散热挑战

- 北欧射频测试工程师短缺

- 拉丁美洲的高资本投资与租赁偏好

- 价值/供应链分析

- 监管或技术格局

- 五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 投资分析

- 宏观经济因素的影响

第五章市场规模及成长预测(金额)

- 按类型

- 模组化GP设备

- 常规GP测量仪

- 半导体ATE

- 租赁全科医生

- 其他类型

- 外形规格

- 桌上型

- 可携式的

- 模组化的

- 按频率范围

- 低于1 GHz

- 1-6 GHz

- 6 GHz以上

- 按组件

- 射频分析仪

- 射频振盪器

- 射频合成器

- 射频放大器

- 射频探测器

- 其他组件

- 按最终用户产业

- 通讯

- 航太/国防

- 消费性电子产品

- 车

- 半导体製造

- 卫生保健

- 工业和物联网

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 瑞典

- 挪威

- 其他欧洲国家

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Keysight Technologies Inc.

- Rohde & Schwarz GmbH & Co. KG

- Anritsu Corporation

- Viavi Solutions Inc.

- Yokogawa Electric Corporation

- Tektronix Inc.

- Teledyne Technologies Inc.

- National Instruments Corporation

- Fortive Corp.(Fluke)

- Teradyne Inc.

- Chroma ATE Inc.

- EXFO Inc.

- Cobham Ltd.

- TESSCO Technologies Inc.

- Advantest Corporation

- LitePoint Corporation

- Spirent Communications plc

- RIGOL Technologies Inc.

- Aim-TTi(Thurlby Thandar Instruments)

- Boonton Electronics

- SIGLENT Technologies

- GW Instek

- PMK Messtechnik

- Picotest Corp.

- B&K Precision Corporation

- TestEquity LLC

- Copper Mountain Technologies

- Giga-tronics Inc.

- Empirix Inc.

第七章 市场机会与未来展望

The RF test equipment market size was valued at USD 4.02 billion in 2025 and is forecast to reach USD 5.51 billion by 2030, registering a 6.52% CAGR over 2025-2030.

Uptake of 5G millimeter-wave links, the migration toward software-defined laboratories, and escalating radar and satellite programs all supported steady demand through 2024. Integration of GaN-on-Si power devices raised performance ceilings for amplifiers, while modular platforms compressed set-up times and operating costs. Asia-Pacific suppliers continued to scale output for domestic networks and export contracts, whereas North American laboratories prioritized cloud-connected automation to counter rising engineering labor shortages. Intensifying consolidation-highlighted by two separate bids for Spirent Communications-signalled an industry pivot toward turnkey hardware-software ecosystems that can evolve with 3GPP releases.

Global RF Test Equipment Market Trends and Insights

Surge in mmWave 5G Roll-outs Requiring >24 GHz Validation

Commercial roll-outs of 5G at 24-39 GHz demanded over-the-air chambers, phased-array beam verification, and wideband channel emulation. Keysight reported that integrated platforms combining generation, analysis, and fading cut test cycles by up to 40% and trimmed calibration overhead in research and development centers. Network operators in the United States, South Korea, and Germany placed bulk orders for 32- and 64-channel analyzers to validate beam-steering algorithms before dense-urban deployment. As mmWave small-cell density climbed, service labs shifted from single-box spectrum scans to automated, cloud-linked workflows that can sequence hundreds of parametric checks overnight. The trend pushed the RF test equipment market toward modular, FPGA-rich transceivers capable of 2 GHz instantaneous bandwidth per channel.

Proliferation of Massive-MIMO Base Stations in East Asia

China's and Japan's race to blanket metro areas with 64T64R radios created immediate needs for instruments that test dozens of RF chains concurrently. A 2024 RF Globalnet briefing cited 9.4 million new or upgraded sites worldwide, many of which employed massive-MIMO arrays. Multi-port vector signal analyzers with synchronized phase noise tracking enabled over-the-air characterization in a single pass, halving tower-side service times. East Asian OEMs further drove demand for PXIe blade sets that engineers can repurpose through software as 3GPP releases evolve. The swing toward flexible capacity underpinned the sustained growth of the RF test equipment market across production lines and field-service providers.

Rapidly Evolving ETSI and 3GPP Standards Creating Obsolescence

Release 18 of 3GPP entered freeze in June 2024, with Release 19 scheduled for late 2025. Each cycle introduced new air-interface features that legacy test sets could not easily emulate, forcing premature replacement or costly FPGA upgrades. Laboratories facing multi-standard certification workloads had to keep parallel benches for NR, LTE, and Wi-Fi, inflating operational budgets. While modular designs mitigated some risk, firmware licensing fees and retraining still curbed spending momentum within the RF test equipment market.

Other drivers and restraints analyzed in the detailed report include:

- Automotive RADAR/ADAS Test Demand Across Germany and Japan

- Satellite LEO Constellation Build-outs Driving Ka-Band Tests

- Form-factor Heat-Dissipation Challenges >40 GHz

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Modular GP instruments captured 35% of 2024 revenue as organizations sought configurable systems that evolve with 3GPP releases, accounting for the largest slice of the RF test equipment market size at this layer. Their 8.5% CAGR outlook outpaced traditional rack-mount analyzers, which ceded ground to PXIe and AXIe blades housing scripted FPGAs. National Instruments' PXIe-5842 vector signal transceiver delivered continuous coverage to 54 GHz with 2 GHz bandwidth, enabling unified generation and analysis in one slot. Rental GP models also grew where capital budgets were tight, especially in Latin America, offering subscription access to advanced capability without depreciating assets. Semiconductor ATE stayed essential for high-volume RF device makers, though its share narrowed modestly as discrete-channel counts rose on modular benches.

Conventional general-purpose instruments remained vital for precision metrology and government labs requiring absolute accuracy. Yet as software updates unlocked new modulation formats, enterprises gravitated toward card-based architectures that avoided forklift refreshes. Vendor roadmaps hinted at containerized microservices that would let engineers download test personalities on demand, further reinforcing the shift. This momentum suggests modularity will stay central to maintaining competitiveness across the broader RF test equipment market.

Benchtop units retained a 45% share in 2024, underpinned by unmatched dynamic range and low phase noise-qualities indispensable for research and development and calibration. Nevertheless, modular chassis logged the fastest 9.2% CAGR as service teams embraced scalable channel counts and smaller footprints, contributing measurably to overall RF test equipment market growth. Keysight's 2025 release of compact 54 GHz signal generators and synthesizers illustrated the push to shrink conventional boxes while preserving performance.

Handheld analyzers advanced through the integration of high-efficiency GaN PA stages and improved thermal paths to support installation and maintenance on rooftops, oil platforms, and defense ranges. Although thermal concerns above 40 GHz moderated adoption, field crews valued battery-operated spectrum capture and cloud-sync logs that accelerated troubleshooting. As networks densified and satellite gateways proliferated, the RF test equipment market increasingly balanced precision with mobility, driving converged product strategies among the top suppliers.

The RF Test Equipment Market is Segmented by Product Type (Modular GP Instrumentation, and More), by Form Factor (Benchtop, Portable, and More), by Frequency Range (< 1 GHz, 1 - 6 GHz, and More), by Component (RF Analyzers, RF Oscillators, and More), by End-User Industries (Telecommunication, Aerospace and Defense, and More), and by Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa).

Geography Analysis

Asia-Pacific commanded 39% of global revenue in 2024, underscoring its pre-eminence within the RF test equipment market. China's self-reliance agenda fuelled domestic tool chains, while Japan and South Korea pioneered radar and semiconductor test methodologies. Qualcomm, China Mobile, and Xiaomi demonstrated an 8.5 Gbps 5G Advanced mmWave testbed using the Snapdragon X75, spotlighting regional leadership in extended-reality validation. Heavy investment in 300 mm fabs expanded pull-through for high-frequency production testers across Taiwan and mainland foundries.

North America ranked second by value. U.S. labs rapidly adopted cloud-connected benches to mitigate a tightening pool of RF specialists, and defense allocations of USD 1.3 billion for counter-UAS projects spurred demand for wideband analyzers capable of real-time threat identification. Canada's satellite gateway build-outs further lifted Ka-band test bookings. Europe followed closely, anchored by Germany's automotive radar expertise and the Nordic region's acute talent shortages, which encouraged the outsourcing of complex conformance tasks to third-party labs.

The Middle East and Africa segment, while smaller, posted the fastest 8.7% CAGR. Saudi Arabia's plan to develop a USD 35 billion space economy by 2030 created demand for Ka-band payload and ground-segment validation. The UAE's missions to Mars and the asteroid belts accelerated the procurement of channel emulators. South America exhibited distinct rental preferences as Brazilian carriers opted for short-term leases during 700 MHz refarming projects, shaping adaptive go-to-market models for suppliers within the RF test equipment market.

- Keysight Technologies Inc.

- Rohde & Schwarz GmbH & Co. KG

- Anritsu Corporation

- Viavi Solutions Inc.

- Yokogawa Electric Corporation

- Tektronix Inc.

- Teledyne Technologies Inc.

- National Instruments Corporation

- Fortive Corp. (Fluke)

- Teradyne Inc.

- Chroma ATE Inc.

- EXFO Inc.

- Cobham Ltd.

- TESSCO Technologies Inc.

- Advantest Corporation

- LitePoint Corporation

- Spirent Communications plc

- RIGOL Technologies Inc.

- Aim-TTi (Thurlby Thandar Instruments)

- Boonton Electronics

- SIGLENT Technologies

- GW Instek

- PMK Messtechnik

- Picotest Corp.

- B&K Precision Corporation

- TestEquity LLC

- Copper Mountain Technologies

- Giga-tronics Inc.

- Empirix Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in mmWave 5G Roll-outs Requiring >24 GHz Validation

- 4.2.2 Proliferation of Massive-MIMO Base-Stations in East Asia

- 4.2.3 Automotive RADAR/ADAS Test Demand Across Germany and Japan

- 4.2.4 Satellite LEO Constellation Build-outs Driving Ka-Band Tests

- 4.2.5 Miniaturised IoT Chipsets Boosting Hand-held RF Analyzers

- 4.2.6 Migration to Software-Defined, Cloud-Connected Labs in US

- 4.3 Market Restraints

- 4.3.1 Rapidly Evolving ETSI and 3GPP Standards Creating Obsolescence

- 4.3.2 Form-factor Heat-Dissipation Challenges >40 GHz

- 4.3.3 Skilled RF Test Engineering Talent Shortage in Nordics

- 4.3.4 High Cap-Ex vs. Rental Preference in Latin America

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

- 4.8 Impact of Macroeconomic factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Modular GP Instrumentation

- 5.1.2 Traditional GP Instrumentation

- 5.1.3 Semiconductor ATE

- 5.1.4 Rental GP

- 5.1.5 Other Types

- 5.2 By Form Factor

- 5.2.1 Benchtop

- 5.2.2 Portable

- 5.2.3 Modular

- 5.3 By Frequency Range

- 5.3.1 < 1 GHz

- 5.3.2 1 - 6 GHz

- 5.3.3 > 6 GHz

- 5.4 By Component

- 5.4.1 RF Analyzers

- 5.4.2 RF Oscillators

- 5.4.3 RF Synthesizers

- 5.4.4 RF Amplifiers

- 5.4.5 RF Detectors

- 5.4.6 Other Components

- 5.5 By End-user Industry

- 5.5.1 Telecommunication

- 5.5.2 Aerospace and Defense

- 5.5.3 Consumer Electronics

- 5.5.4 Automotive

- 5.5.5 Semiconductor Manufacturing

- 5.5.6 Healthcare

- 5.5.7 Industrial and IoT

- 5.5.8 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Sweden

- 5.6.3.6 Norway

- 5.6.3.7 Rest of Europe

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 Saudi Arabia

- 5.6.4.1.2 United Arab Emirates

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Rest of Africa

- 5.6.5 Asia-Pacific

- 5.6.5.1 China

- 5.6.5.2 Japan

- 5.6.5.3 India

- 5.6.5.4 South Korea

- 5.6.5.5 Rest of Asia-Pacific

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Keysight Technologies Inc.

- 6.4.2 Rohde & Schwarz GmbH & Co. KG

- 6.4.3 Anritsu Corporation

- 6.4.4 Viavi Solutions Inc.

- 6.4.5 Yokogawa Electric Corporation

- 6.4.6 Tektronix Inc.

- 6.4.7 Teledyne Technologies Inc.

- 6.4.8 National Instruments Corporation

- 6.4.9 Fortive Corp. (Fluke)

- 6.4.10 Teradyne Inc.

- 6.4.11 Chroma ATE Inc.

- 6.4.12 EXFO Inc.

- 6.4.13 Cobham Ltd.

- 6.4.14 TESSCO Technologies Inc.

- 6.4.15 Advantest Corporation

- 6.4.16 LitePoint Corporation

- 6.4.17 Spirent Communications plc

- 6.4.18 RIGOL Technologies Inc.

- 6.4.19 Aim-TTi (Thurlby Thandar Instruments)

- 6.4.20 Boonton Electronics

- 6.4.21 SIGLENT Technologies

- 6.4.22 GW Instek

- 6.4.23 PMK Messtechnik

- 6.4.24 Picotest Corp.

- 6.4.25 B&K Precision Corporation

- 6.4.26 TestEquity LLC

- 6.4.27 Copper Mountain Technologies

- 6.4.28 Giga-tronics Inc.

- 6.4.29 Empirix Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment